Investment themes that are not AI

AI investment themes seem somewhat unspecific. Investors should be concerned about the market concentration of returns in just 7-10 mega cap AI story driven stocks. Here we offer a different vision for consideration – mining and healthcare M&A. We also take a look at what has gone wrong with SPACs (Special Purpose Acquisition Company).

Mining and Healthcare M&A could offer an alternative mechanism for replacing traditional IPO returns. IPO opportunities are relatively thin on the ground compared to 2021.

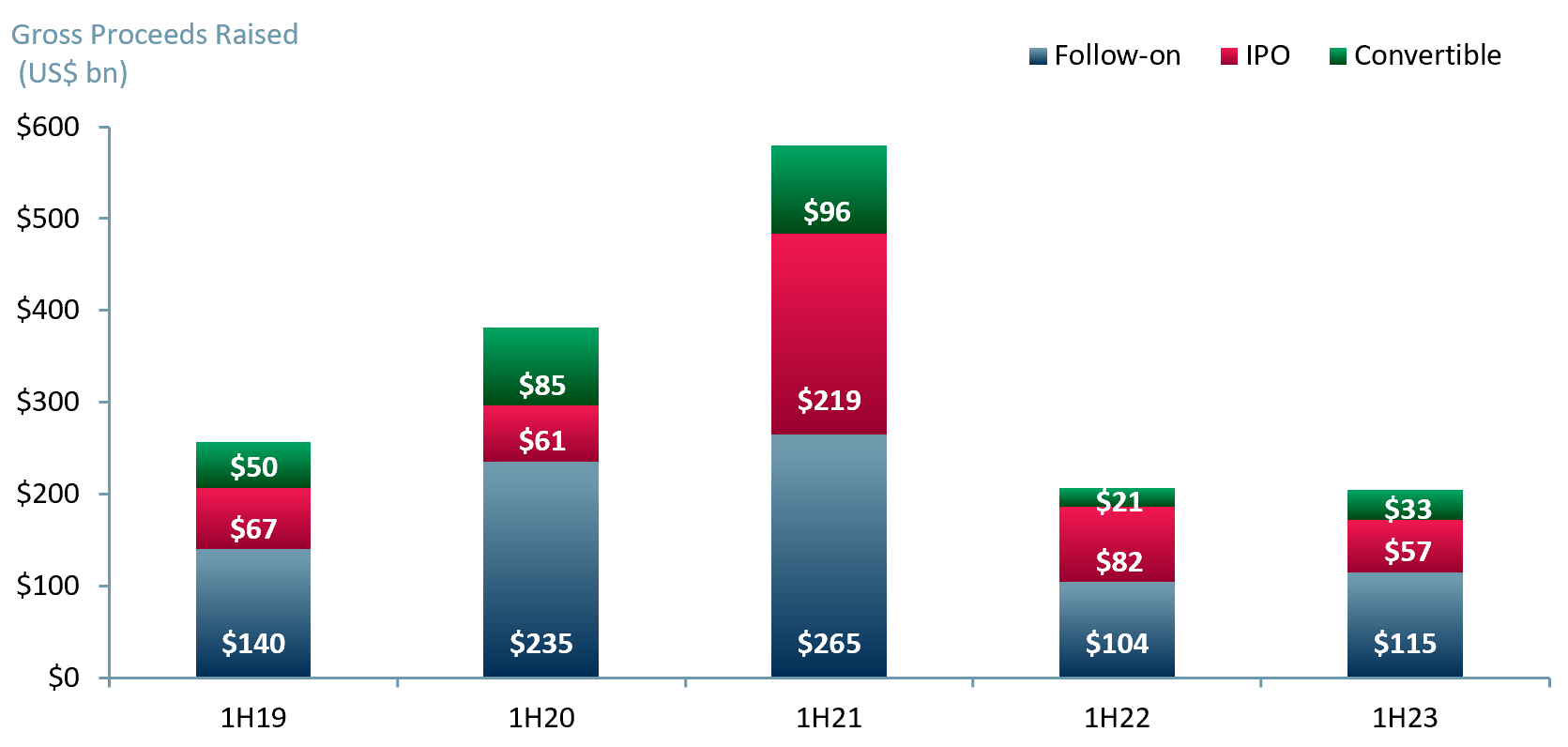

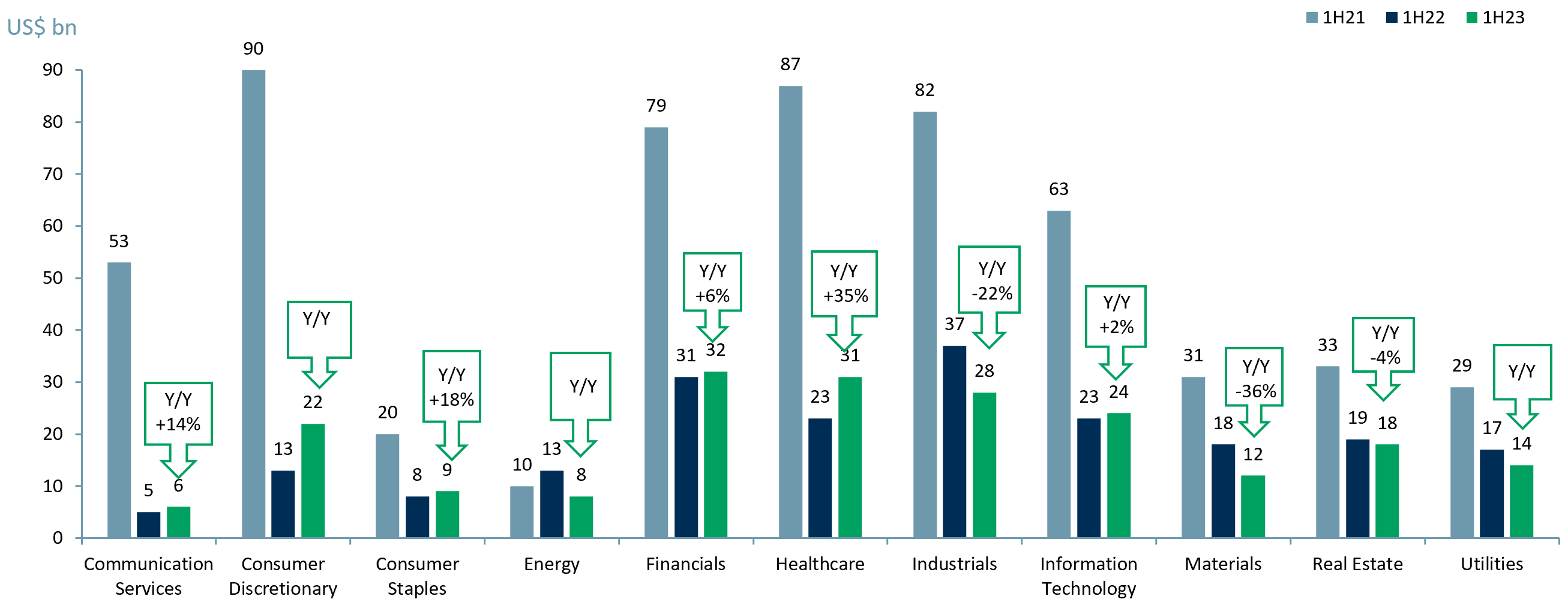

IPOs, and their close relation the SPAC (SPACs were a credible alternative to IPOs until the 2022/23 SPAC implosion), are in relatively short supply so far in 2023. 1H23 mining IPOs are down ~35% year on year. Though healthcare IPOs are up 35% year on year, healthcare IPOs are still only around one third of their 1H21 values by gross proceeds (see exhibit 1 below).

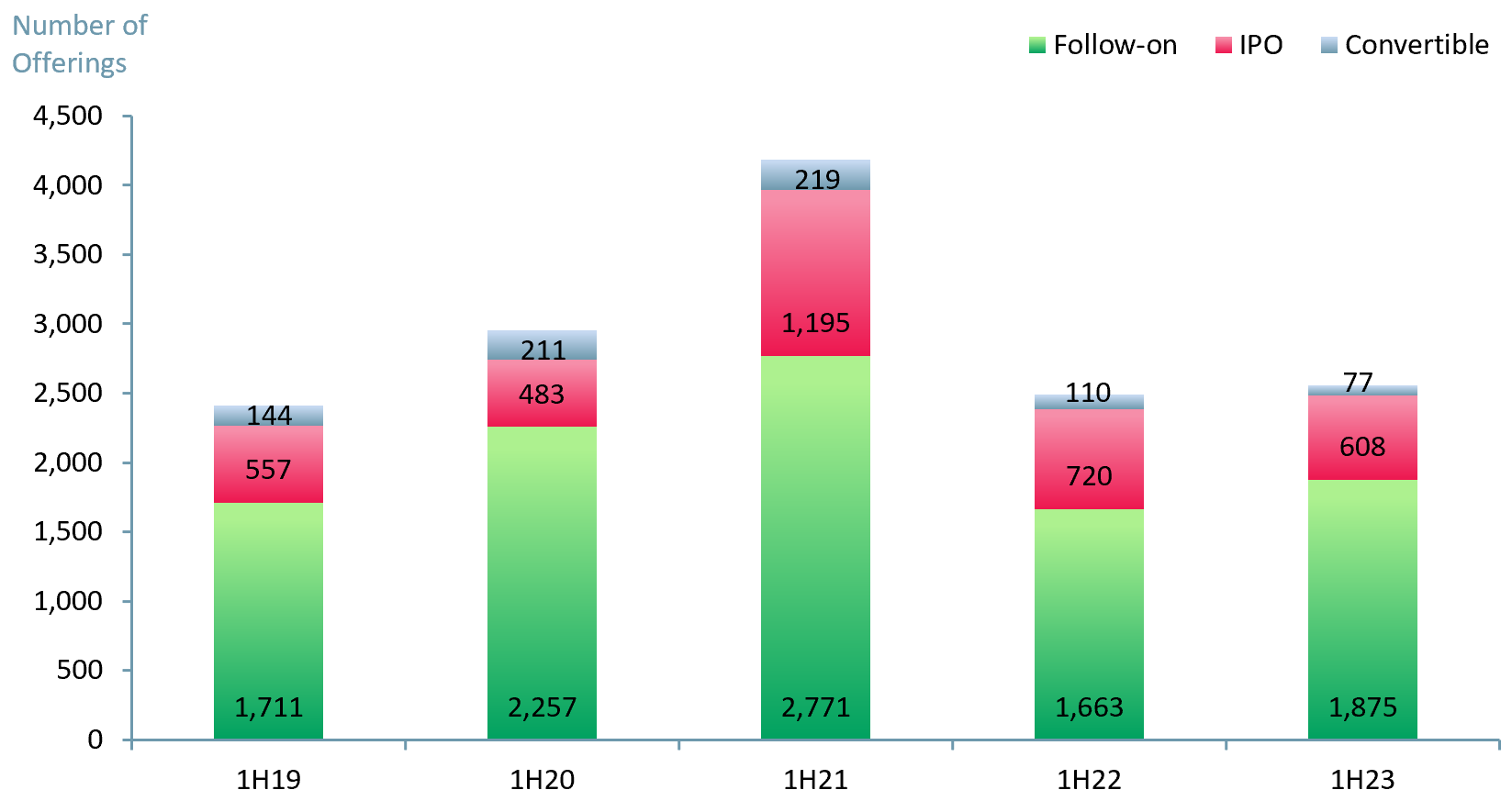

In more general terms, the number of IPOs globally are down ~15% vs.1H22. Numbers of secondary offerings are up around 13% vs. 1H22.

Though secondary offerings globally in 1H23 are slightly ahead of 1H22, they are still only around 40% of their 1H21 gross proceeds values. This 60% fall in US$ amounts raised is before the significant impact of recent inflation is taken into account. We infer one can remove ~20% of the real buying power of 1H23 capital raise values versus 1H20 values. If we do this calculation on the 1H23, secondary capital raises are barely at 35% of their 1H21 real purchasing power levels.

Exhibit 1 – Global capital raised 1H19 to 1H23 by type (Gross US$ bn) IPO, Secondary raise, CLNs

Sources: ACF Equity Research Graphics; S&P Global Market Intelligence. Note: In the exhibit above a follow-on offering is a secondary raise by a public company.

Sources: ACF Equity Research Graphics; S&P Global Market Intelligence. Note: In the exhibit above a follow-on offering is a secondary raise by a public company.

Exhibit 2 – Global capital raise 1H19 to 1H23 by # of transactions and type – IPO, Secondary raise, CLNs

Sources: ACF Equity Research Graphics; S&P Global Market Intelligence. Note: In the exhibit above a follow-on offering is a secondary raise by a public company.

The challenging environment for capital raising generates a lot of cash starved companies in mining and healthcare. Such pressures create and drive M&A opportunities. Nevertheless, premiums have been attractive and in the case of healthcare, even spectacular at times, out shadowing the average 12m expected IPO returns of around 70-80%.

In our view, many IPOs have not performed well in 2023. In general, IPOs have been relatively sparse since 2021.

Exhibit 3 – IPO and secondary raises by sector 1H21 to 1H23 (global estimates, US$ bn)

Sources: ACF Equity Research Graphics; S&P Global Market Intelligence.

Sources: ACF Equity Research Graphics; S&P Global Market Intelligence.

Have many IPOs simply migrated to the SPAC market? An alternative proxy for traditional IPOs has been SPACs (Special Purpose Acquisition Company). SPACs are not new and they have continued to reinvent themselves.

SPAC performance in 2023 has been dismal (by and large). Poor SPAC performance has made traditional IPOs look good so far in 2023. SPACs will be back, as they always are, probably in a healthier format, but for now they are not attractive.

One of the issues with SPACs compared with IPOs is that corporates (particularly smaller/junior companies) are using them as fast inexpensive mechanisms to go public in challenging IPO market conditions. In theory SPACs also come with readily available cash, a tempting proposition in current markets. However, in such conditions, the power of negotiation passes ever more firmly to the SPAC promoter.

Since the 3Q22, the changing balance of power that favours the SPAC promoter has led to SPAC offerings becoming more and more dilutive via increasingly exotic structures. This tends to suit the SPAC creators and SPAC IPO investors, but it does not suit investors in the targets during the de-SPAC process (i.e. once the target corporate the SPAC needs has been acquired).

There is also a downside for SPAC promoters. SPACs have become difficult to sell to target companies because of poor performance during the de-SPAC process. As a result there are fewer and fewer SPAC promotions. SPACs cost the promoter considerable sums to set up and they are only profitable for the promoter if a target can be found, typically within a 24-month time limit.

In 2023, falls in valuation of 90% have not been uncommon during the de-SPAC process. Cashless warrants (warrants that grant shares at a discount but that do not generate a capital inflow to the company when exercised) have become a popular SPAC IPO investor incentive. Cashless warrants have done significant damage to the value of many SPAC target companies.

Cashless warrants have helped make SPACs less attractive for target companies, but there is an upside for some. The 90% fall in target company valuations during the de-SPAC step is creating opportunities for investors to pick up de-SPAC stocks cheaply once the cashless warrants have washed through.

Nevertheless, the rebuild of reputation and value in de-SPACs (the SPAC structure sort of melts away and one is left with the newly listed corporate entity that was the SPAC target) is neither straight forward nor fast.

Rebuilding de-SPAC reputation, valuation and investor confidence requires a concerted effort by management teams in combination with the right tools. A coordinated investor relations strategy and quality investment research coverage are key factors to look out for. These tools are particularly effective together but only if management has the ability to deliver on its stated corporate goals. If these elements are in place, bit by bit these SPAC target companies can rebuild their valuations.

Investors would probably be wise to either, accept that a de-SPAC is a longer term rebuild of value, or to choose not to invest in companies using the SPAC process, for now.

Why is mining and healthcare M&A more attractive than IPOs (or AI)? In contrast to IPOs, SPACs and AI returns concentration, mining and healthcare M&A have comparatively attractive properties for investors at this point in the cycle. There are several reasons for this.

First, both sectors look undervalued given the fundamental long-run demand drivers for many metals and the rate of innovation in healthcare. For smaller and mid-cap healthcare companies this is partly because AI driven projects launched a long time before the present AI buzz, are not recognised in valuations.

Second, both sectors are finding it challenging to access the regular injections of capital that they require, making M&A deals more palatable and more likely to close.

Third, management teams on both sides, so acquirer and target, understand that the assets are currently significantly undervalued after years of ‘market neglect’. This leads to both acquirer and target agreeing to somewhat higher M&A premiums (which are justifiable) than the traditional long run 40% premium for control.

From an investment perspective we assess that in the junior/small and mid-cap mining and healthcare sectors there are significantly undervalued assets that are probably ripe for M&A.

Given the level of undervaluation in mining and healthcare, there is merit in assigning time to investigate smaller and mid-cap mining and healthcare M&A opportunities. The premiums paid in M&A transactions in these sectors (well above 40%) are attractive. Investigating M&A opportunities as a replacement for IPOs should be part of a carefully considered exercise in portfolio diversification.

Author: Christopher Nicholson, ACF Equity Research’s Managing Director / Head of Research, was a speaker for the future of US tech for the Financial Times Investors’ Chronicle Future of Private Investing on the 15th of June 2023.