Rotation back to growth imminent?

Value rotation – If most investors are thinking about AI and innovation, has value rotation happened in this market and are we about to see it move back to growth?

Equity investors currently seem to have one of two highly polarised mindsets – innovation growth, by which we mean just AI, or defensive/value plays.

In our view, there is good evidence that the overall rotation to value (and AI growth) happened. The move back to broader growth opportunities, by which we mean not just 10 AI stocks, is back in clear(ish) view.

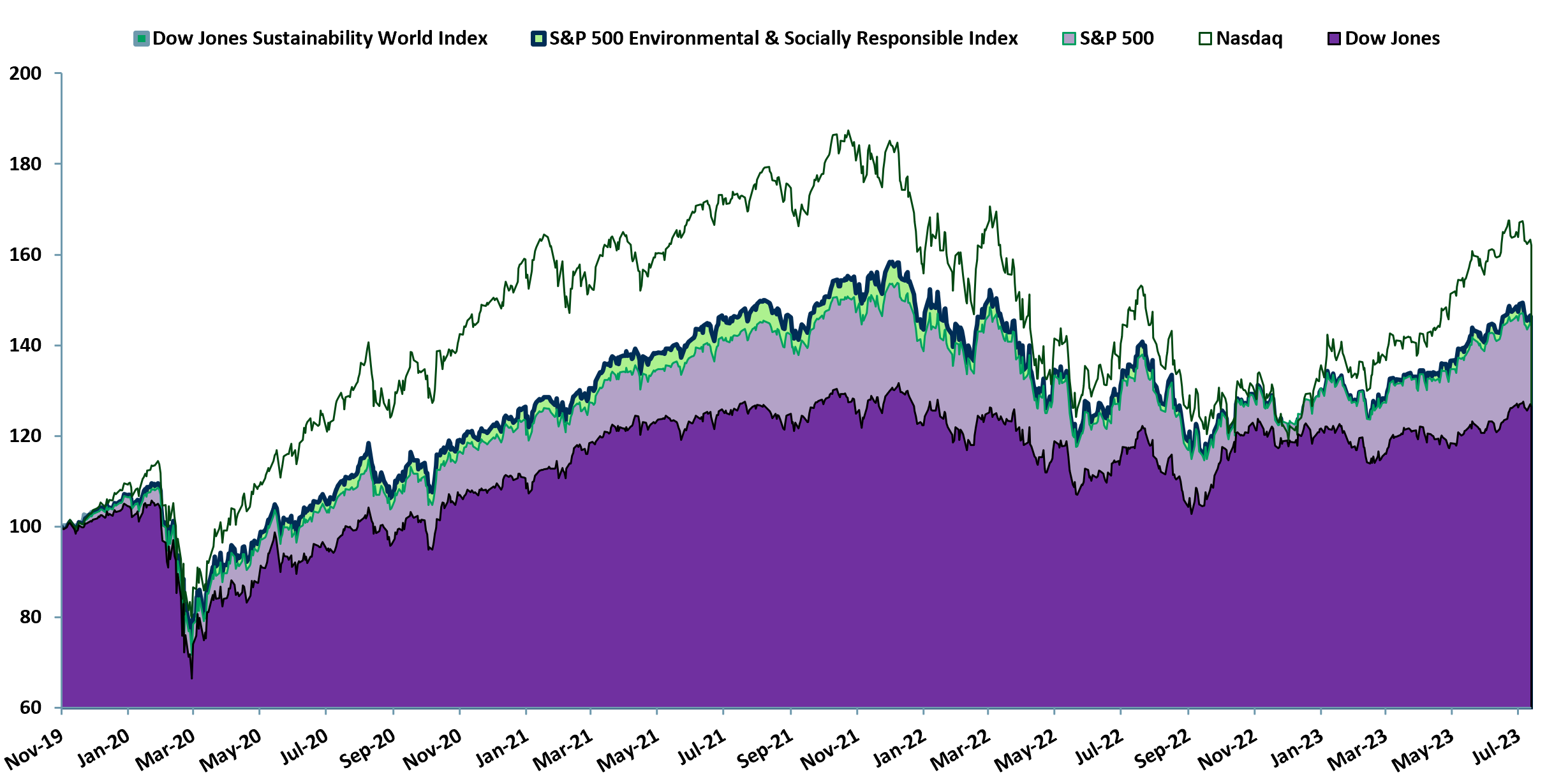

We are using the US S&P 500 ESR and Dow Jones Sustainability World index as proxies to illustrate our ESG/Sustainability index points in this blog. Note that where the US S&P 500 ESR has strong overall performance over the time period late 2019 to early August 2023, the world index does not. The differential may well be down to issues recently highlighted surrounding index construction and verification, or it may not.

First, there is a significant, perhaps extreme, narrowing of the breadth of returns with six of the seven top performing mega-cap stocks driven by AI major initiatives

Second, the comparison between ESG historical and recent performance suggests that after ESG indices rapidly closed the relative returns performance gap with Nasdaq late 2021, an asset allocation switch to AI growth via Nasdaq and to value out of sustainable/ESG began after March 2023, i.e. at the beginning of 2Q23 (see exhibit 1 below).

We infer a rotation in allocation because ESG index constituents significantly underperformed 2Q23 vs. Nasdaq. We view this as indicative of both value rotation and rotation into the top 10 AI stocks (growth allocation). Many ESG stocks are in their innovation growth phase or are R&D plays, but these growth stocks cannot compete with the short run ‘mania’ returns in AI stocks in 2Q23.

Today most ESG indices are, almost by definition, dominated by mid-cap growth stocks. Over the longer term, as these growth companies mature, ESG indices are likely to be dominated by utility type sectors and characteristics.

The exhibit 1 below shows the S&P 500 ESR index (green area, dark blue line) marginally outperforming the S&P 500 and DJI (both shares of purple) since November 2019. ESG stocks began to catch up with Nasdaq (white area, green line) returns in late 2021. However the Nasdaq via AI (growth investing) has been the major beneficiary of fund flows 2Q23.

We expect the heat to come out of AI as it does with all buzz return stories and fund flows to return to ESG/sustainability index constituents. There is early evidence that this is happening. According to Morningstar, European ESG funds attracted US$ 20bn net new money 2Q23 vs. US$ 34bn 1Q23. One explanation for these fund flow numbers is that investment flows were directed towards 10 AI stocks and value investing during 2Q23, post the arrival of ChatGPT on global consciousness.

There is further support for our insight on rotation. Investors cut holdings in 2Q23 in US ESG funds by US$ 635m vs. US$ 5bn in 1Q23. If the fund flows were concentrated at the end of the relevant quarters, then this again points to a pullout from ESG in favour or AI and value stocks at the end of the 1Q23.

There are early signs that funds are coming back to ESG, or at least that the 1Q23 period of dramatic bleed is over.

Exhibit 1 – ESG indices US performance relative to DJ, S&P 500 and Nasdaq Nov-2019 to early Aug 2023

Sources: ACF Equity Research Graphics; S&P Global; Refinitiv; FT; Investing.com.

Sources: ACF Equity Research Graphics; S&P Global; Refinitiv; FT; Investing.com.

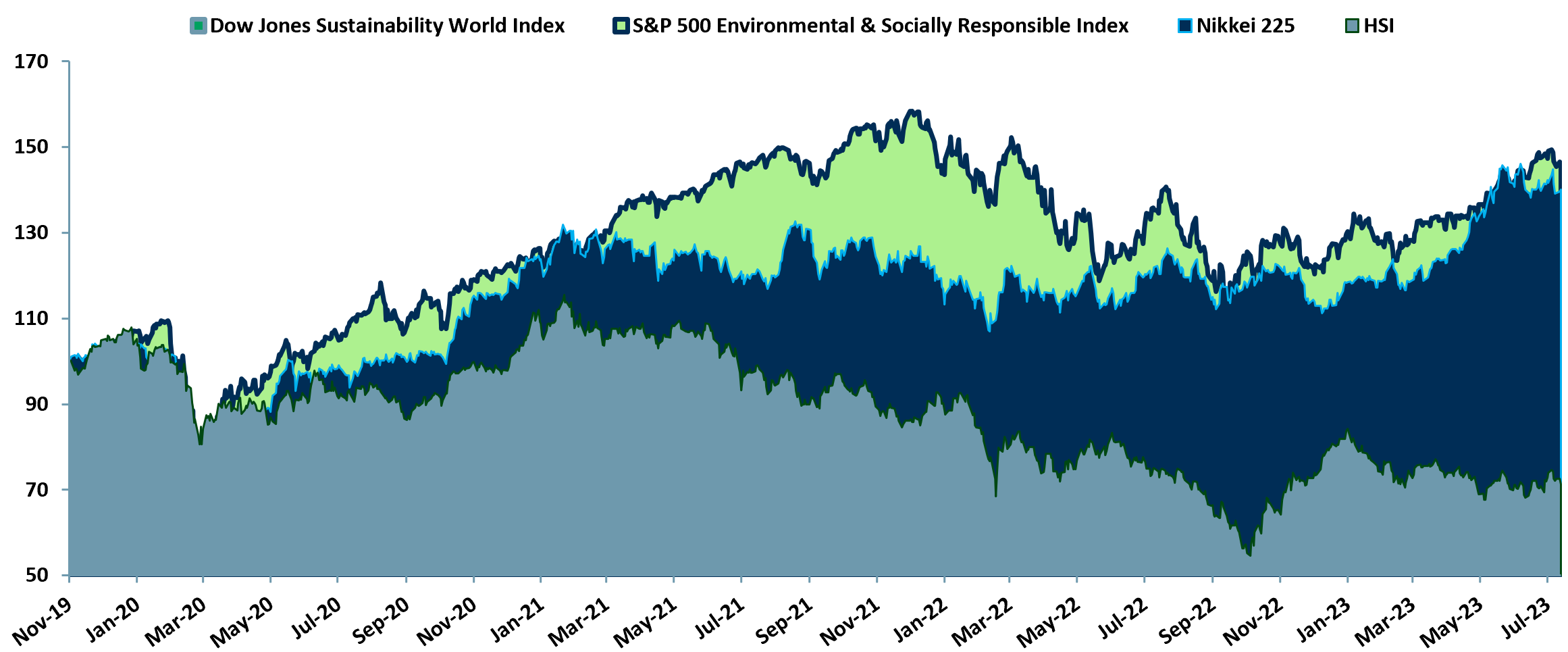

We see similar patterns in Asia (exhibit 2) where the Nikkei 225 relative performance has caught up with the S&P 500 ESR index (green area, dark blue line) 2Q23. The HSI has been somewhat lack lustre due to the economic and political challenges in China however, Europe is different (see exhibit 3 below).

Exhibit 2 – ESG indices US performance relative to DJ, S&P 500 and Nasdaq Nov-2019 to early Aug 2023

Sources: ACF Equity Research Graphics; S&P Global; Refinitiv; FT; Investing.com.

Sources: ACF Equity Research Graphics; S&P Global; Refinitiv; FT; Investing.com.

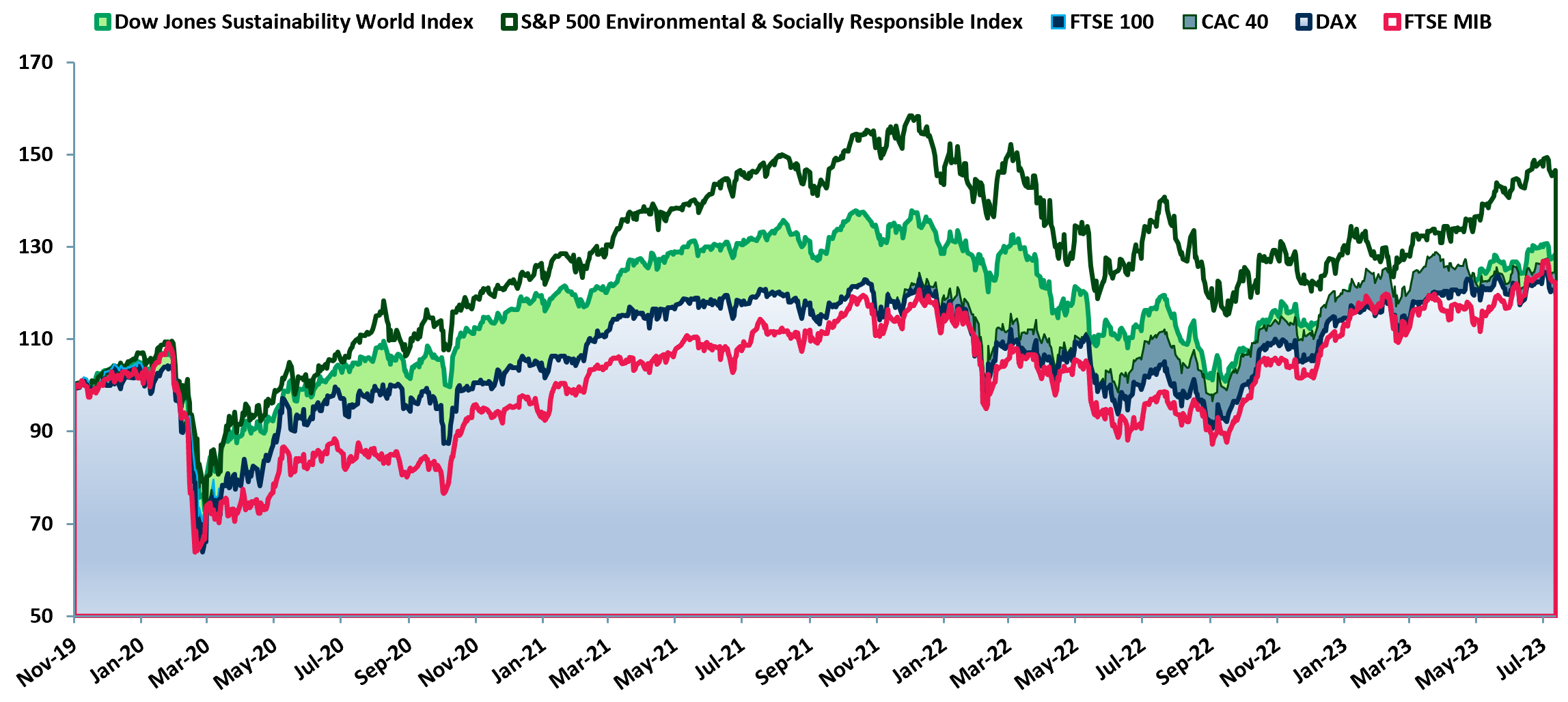

ESG/sustainability stocks in the global and US indices have out-performed key European indexes. ESG and sustainable stocks have performed particularly well against the Italian stock market index, the FTSE MIB 40. This may be related to the economic challenges in Italy and it may possibly suggest that companies with MCAPs below US$ 10bn benefit particularly well from ESG index inclusion. The bottom 20 companies on the FTSE MIB 40 currently have MCAPs less than approximately $10bn.

Exhibit 3 – Relative performance of US and World ESG stocks vs. key European indexes late 2019 to early Aug 2023

Sources: ACF Equity Research Graphics; S&P Global; Refinitiv; FT; Investing.com.

Sources: ACF Equity Research Graphics; S&P Global; Refinitiv; FT; Investing.com.

Is timing good for a return to ESG stocks and how are the indices likely to mature?

ESG constituents tend to be involved in innovative/new/renewable energy (not oil and gas) or other emissions reduction and recycling technologies. Many ESG index constituents are associated with huge infrastructure investment.

The characteristics of infrastructure driven growth companies are very high investment requirements, followed by a period of huge and often rapid customer growth. These companies subsequently enter a neo-monopolistic or oligopolistic market dynamic created by very significant capital, regulatory and time barriers to entry.

As such, we expect many of the carbon zero technologies to become more like utilities. At this point ESG investing will be dominated by value stocks – we are not there yet (by some way) but this is the likely cycle.

The de-risking process, which is one of the positive outcomes of ESG policies with metrics, means that companies should not wait for legislation to force their hands. The de-risking process leads to a lower cost of capital, which in turn contributes to higher valuations.

We have observed an extended period of increasing out-performance for ESG indices, at least in Europe. In the US, ESG indices made significant relative performance gains progress vs. Nasdaq from late 2019 until 1Q23. We expect the 2Q23 reversal of some of this ESG stocks’ progress to be reasonably short lived.

We assess that the overall improved relative performance of ESG stocks is related to lower risk profiles delivered by the ESG process and so lower capital costs. There is little doubt that trend investing has also benefitted ESG index stocks. Both drivers have become much weaker in 2Q23, which we expect this to be temporary.

We therefore attribute the recent fairly broad spread ESG stocks underperformance to a broad market rotation out of growth (excepting AI growth stocks) and into value. The rotation to value has been driven by global inflation, commensurate interest rate policy and related growth effects all of which contribute to geopolitical uncertainty (feeding back into more economic uncertainty).

There is now a sense in markets that peak interest rates for the current cycle have either been reached or are one or two steps from peak. This is likely to begin to drive investment managers back into growth ahead of the interest rate curve. There should be plenty of undervalued growth opportunities outside of the main mega-cap plays for a handful of weeks.

If I am thinking about rotation, who benefits most from higher interest rates and do shares need a Fed pause?

ACF’s fundamental and instinctive position is an anti-inflation one ‘at (almost) all costs’. Therefore, prima facie, we assess that a Fed pause is the last thing markets need (even if it might be what they want). We acknowledge all the same that there is a balance to be struck between rate rises and curbing inflation and creating a full blown global recession.

Our assessment is that for the first time in this interest cycle, the central banks might just about be getting ahead of the game. Central bank signalling is just showing signs of working. Now is not quite the time to release the downward pressure on inflation.

The downside with going for balance rather that harsh medicine when fighting inflation is that inflation expectations get baked in and once that happens central bank ability to use policy leavers ‘gently’ gets less and less effective. The short sharp shock seems to us to be the least bad medicine.

We do not envy the position of central banks, which are in a pretty thankless phase. This is because in the end, inflation is politically bad (voters get poorer) but fiscally good for most governments and states.

Inflation suits borrowers rather than lenders (most governments are significant net borrowers). Inflation reduces the real value of the principal borrowed, which rapidly becomes a smaller proportion of income.

Ergo, governments are conflicted at some important levels and even an independent central bank has to take heed of an element of political messaging (if these banks want to maintain their independence).

We suspect that interest rate pressure expectations will be maintained for a month or two more (so expect one or two more rate rises). If supported by positive inflation data (by which we mean lower inflation), interest rates will be on hold for a while to really put a lid on inflation expectations (and so inflation) before some attempt at cutting rates is ‘trialled’ later this year or early 2024.

Author: Christopher Nicholson, ACF Equity Research’s Managing Director / Head of Research, was a speaker for the future of US tech for the Financial Times Investors’ Chronicle Future of Private Investing on the 15th of June 2023.