Is shipping industry Covid paralysis an opportunity for investors?

Lockdown restrictions have closed down ports in China and across the globe, stopping the shipping industry from business as usual.

Deliveries for seasonal goods from developing nations aren’t moving and as many as 1.6m seafarers on 50 thousand tankers and cargo carriers are confined to ships or hotels – unpaid and unable to fly home.

First half 2020 data suggests a 25% fall in shipping activities. An estimated 10% contraction in shipping volumes over the whole of 2020 could result in USD 20-30bn in operating losses for the shipping industry.

The cost to ship goods via bulk cargo carrier fell 43% (indicating a collapse in demand for shipping) as measured by the Baltic Dry Index (BDI).

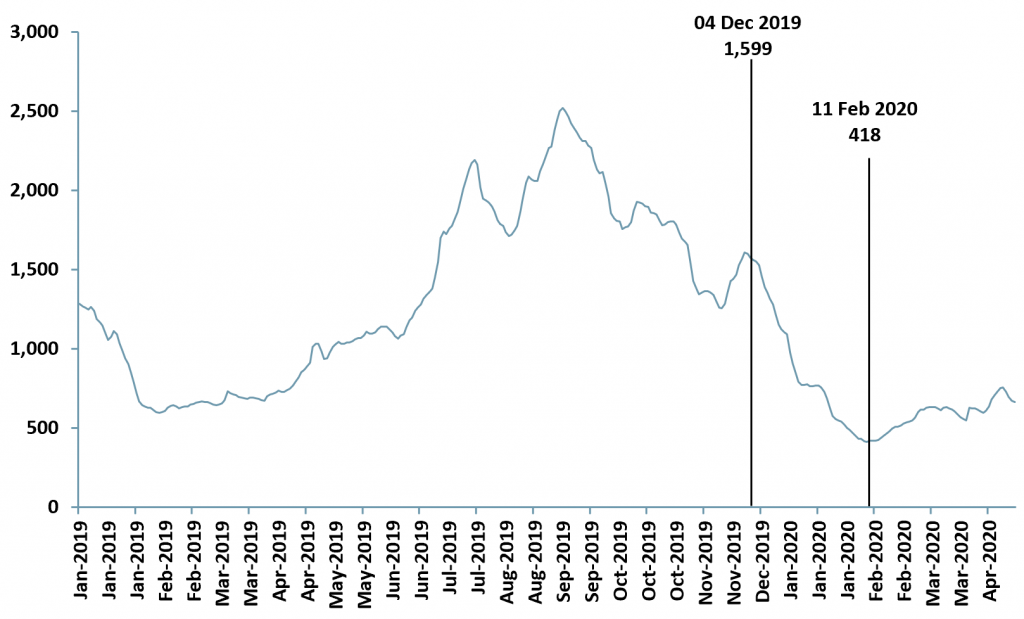

The BDI is also a forward economic indicator and it started its decline after the 3rd December 2019 (exhibit 1), in our view on the back of the fall in Chinese factory production (also Covid driven) and nearly a full quarter before the global capital markets went into free-fall. The index has been back on the rise since 11th February 2020, also ahead of the financial markets free fall event.

Exhibit 1 – Baltic Dry Index 2019A-2020A

Sources: ACF Equity Research Graphics; UK Investing

Sources: ACF Equity Research Graphics; UK Investing

Because the BDI is a forward indicator of economic activity its behaviour since 3rd December 2019, described above, lends weight to our V-shaped capital markets recovery proposition.

The behaviour of the BDI and the woes of the shipping industry also provide two read-throughs for the mining industry.

Due to Covid-19 lockdowns smaller mining companies have either temporarily suspended exploration and production or are trying to maintain operations with skeleton resources and cash expenditure.

Covid-19 restrictions on the shipping industry will prove to be a further hit as even if a mining company is able to continue production, the miner will struggle to get its product to market reliably, certainly in the short term.

Because of a combination of the collapse in demand for bulk carriers driven by Chinese factory closures initially (bulk carriers often only sail when they are full) and now because much of the bulk shipping fleet is going nowhere, shipping mining product to market is firstly, unpredictable and secondly, where or when a shipping run is possible, the cost to ship mining product is rising (according to the BDI).

For investors this means that mining revenues, margins and so cash inflow from operations are more unpredictable over the short-term. Smaller miners needing the oceans to ship product are particularly affected. Miners that do not need to get their product to market via the oceans are in a better relative position.

Our analysis expressed in other notes and blogs suggests capital markets will undergo a V-shaped recovery. If investors believe the BDI is a useful forward indicator for capital markets, which have undergone record falls, and if investors believe that capital markets are a useful forward indicator for the economy…is this a record opportunity for investors?