Market opportunities in wearable tech

Wearable technology might well be the answer for false negatives or inconclusive diagnostics tests.

As a result of the Covid-19 pandemic, there is a growing demand for non-invasive accurate diagnostics. This is needed in hospitals as well as in homes.

A critical part of beating the virus is extensive and accurate testing that is trusted by the public and useful to medical systems. This has become increasingly difficult due to some major obstacles:

- The rate of false negatives for RT-PCR (detection of Viral RNA using a reverse transcription polymerase chain reaction) is as high as 29%, according to US data.

- Staff must be trained in order to address challenges presented by false-negative or inconclusive tests.

- Samples must be transported in a timely, efficient and safe manner to centralized laboratory facilities.

- Tests based on antibodies are not as accurate. Antibodies can remain in the blood for some time after exposure. The problem with this outside of Sars-CoV-2 is that it may only reflect prior exposure rather than protective immunity.

- The gap between extensive population testing and a sustained testing approach remains wide.

The need to develop new technologies for diagnosing, monitoring and treating C-19 is crucial. This has sparked interest in consumer-grade wearable technologies and skin-integrated sensor systems.

Wearable Technology

- Devices like Apple Watch (NASDAQ: AAPL) and Fitbit (NASDAQ: FIT) use technology to help the individual detect subtle changes in basic vital signs that are not always apparent to the wearer.

- The downside is that these devices are unable to track Covid symptoms (e.g. coughs or loss of smell and taste) and if they add those facilities, they will eventually need FDA approval.

- For example, the Apple Watch Series 4 has FDA clearance and is able to detect episodic electrocardiography and arrythmia. It then sends a notification to the wearer (who must be above the age of 22).

Skin-Integrated Sensor Systems’ Study

- The system offers devices that can be worn on parts of the body beyond the wrist in the form of a flexible electronic skin (e-skin) or a patch.

- The systems are able to monitor crucial symptoms of Covid – measurements of respiratory biomarkers such as cough frequency/intensity/sound and measurements of blood oxygenation (Fitbit can measure blood oxygenation using light sensors).

- The Biomedical Advanced Research and Development Authority (BARDA) deployed its single-use chest-mounted patch in nursing homes in the summer of 2020.

The expansion for wide scale deployment of such technologies will be accelerated by the need to fight a global second wave of C-19 infections. Even if a vaccine arrives for Christmas, the fiscal and monetary shock that governments have experienced will make them alert to innovations in this area, and so…financially and or regulatorily supportive.

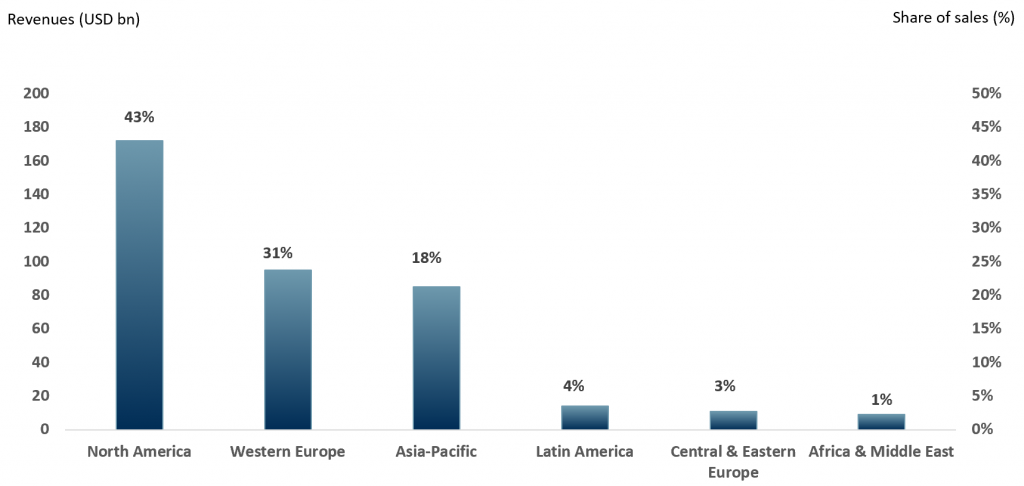

In 2018 (Exhibit 1), the total global medical devices market based on revenues was worth $386bn. North America made up 43% of the total followed by Western Europe at 31%.

Exhibit 1 – Global medical devices revenue & shares of global sales in medical device manufacturing by region, 2018

Sources: ACF Equity Research; McKinsey

Sources: ACF Equity Research; McKinsey

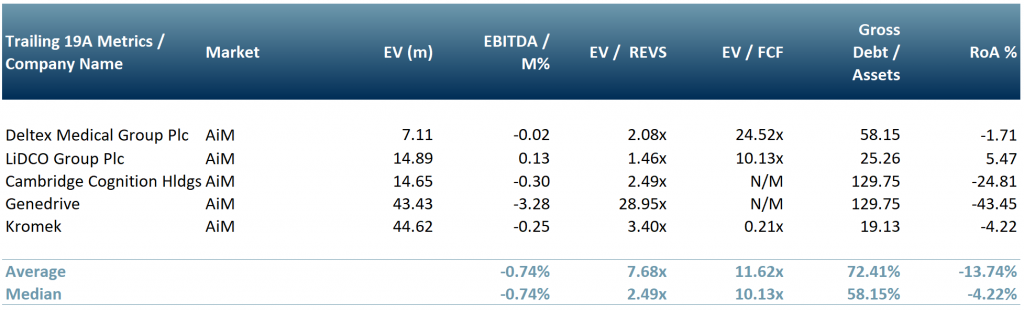

Healthcare companies as illustrated in the Exhibit 2 peer group, are examples of companies that are ahead of the curve in developing and manufacturing these types of technologies.

The EV/REVS average ratio is an indication of the growth potential of this subsector.

Exhibit 2 – Peer group of healthcare technology/devices companies

Source: ACF Equity Research

Source: ACF Equity Research

- Deltex Medical Group (DEMG.L) is a manufacturer of fluid management devices and cardiac monitoring systems used to track blood circulation.

- Lidco (LID.L) is a supplier of non-invasive and minimally invasive hemodynamic equipment used to monitor blood flow and vital organs oxygenation.

- Cambridge Cognition Holdings Plc (COG.L) is a neuroscience technology company that uses digital health solutions to assess cognition for better brain development.

- Genedrive (GDR.L) develops low cost, fast, versatile and user-friendly molecular diagnostic devices used to diagnose infectious diseases and pathogens and for patient genotyping.

- Kromek (KMK.L) supplies Cadmium Zin Telluride (CZT) and scintillation radiation detectors software, components and finished products used for medical imaging allowing for faster scans and early diagnoses.

Device manufacturers at the junior end of markets have struggled to deliver EBITDA positive and net income positive results. There are honourable exceptions such as Lidco (LID.L), but the upside of the pandemic is that we look forward to many more device manufacturers joining the profitability fold. In addition, as companies such as Imagin Medical (PNK: IMEXF) are fully aware – device manufacturers often end up being the acquisition target for larger companies that want to enter their space.

The age of sensors and imaging is upon us. The power of sensors that work and the data they can deliver has entered the popular vernacular. We have Fitbit (NASDAQ: FIT) largely to thank for this, but the smaller UK companies above will all benefit directly or indirectly.

Author: Anne Castagnede – Anne leads the Sales & Strategy Team at ACF Equity Research. See Anne’s profile