Vanadium Flow batteries preferred for long energy storage

Is the future of residential energy efficiency in vanadium flow batteries (VFBs)?

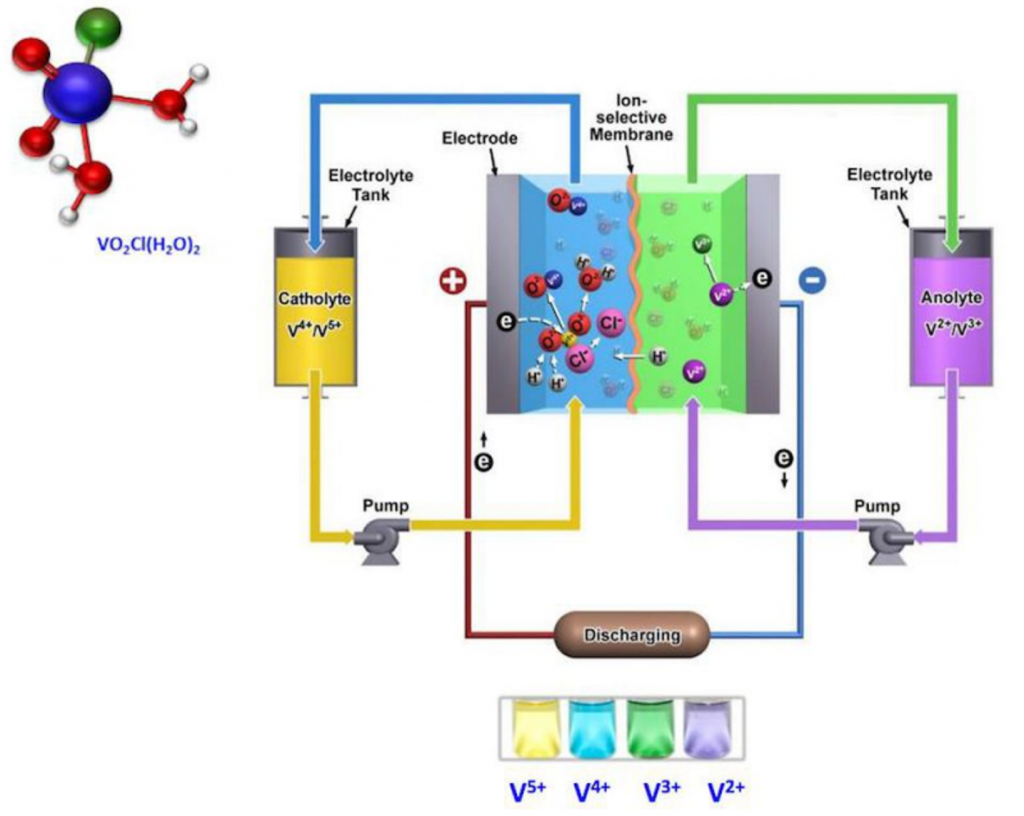

Vanadium flow batteries are rechargeable batteries that use vanadium ions to store energy instead of say Lithium-ion. Vanadium (V) is a hard, grey transition metal that is found in 65 minerals and fossil fuels. Which is to say that whilst native Vanadium is rare, Vanadium compounds are more abundant than Lithium.

Lithium (Li) on the other hand, though also technically relatively abundant, is generally found in very low concentrations, making it costly to extract. Lithium ion batteries also cost more to recycle than VFBs. Lithium batteries are solid, VFBs are liquid (an electrolyte).

Exhibit 1 – Vanadium flow battery (VFBs) are liquid

Source: Forbes

Source: Forbes

The California Energy Commission (CEC) announced a USD 20m program earlier this year, to fund research projects for vanadium flow batteries (VFBs).

- Of the eight awards, Invinity Energy Systems plc (IES:AIM), a UK based VFB producer, obtained funding for four projects to deliver 7.8 megawatt-hours (MWh) of batteries.

- IES was created in April 2020 through a merger between two flow battery industry majors (redTenergy plc and Avalon Battery Corporation).

- VFBs are developed for long-duration energy storage requirements, 10+ hours, for stationary applications (i.e. energy networks) and can last 10-20 years.

- Lithium-ion batteries are too costly to recycle for most applications, VFBs do not suffer the same problem.

Batteries have already begun to shape the future of our transport systems. It is only logical that battery use for energy efficiency in homes is next.

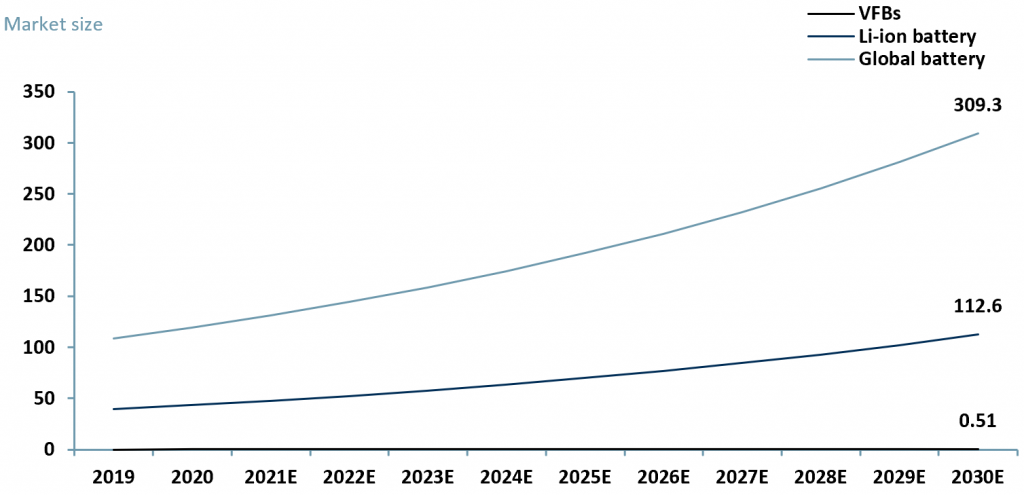

In Exhibit 2, we forecast that the vanadium flow battery (VFB) market will surpass $500m by 2030 up from $200m in 2020. The global batteries market is forecasted to reach ~$310bn by 2030 up from ~$125bn in 2020. Both based on a CAGR of 10%.

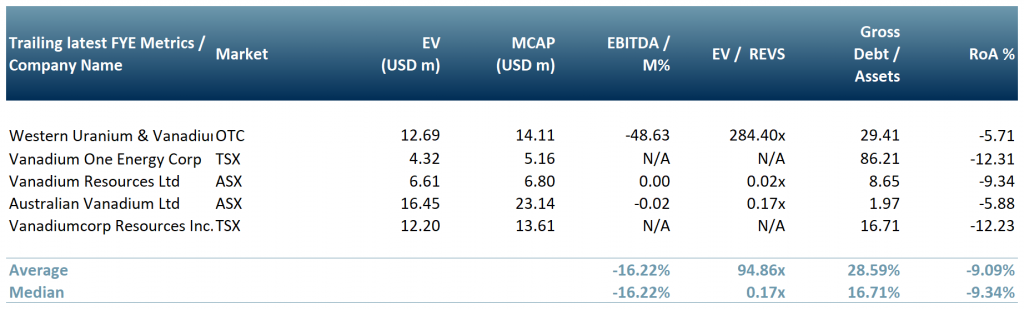

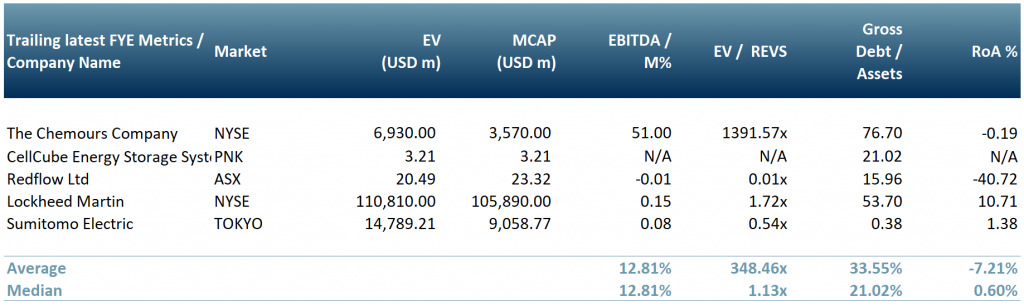

In exhibits 3 and 4 our peer group tables indicate potential read-through stocks with some metrics.

In Exhibit 3, we show our peer group of Vanadium miners, Western Uranium & Vanadium, Vanadium One, Vanadium Resources, Australian Vanadium and Vanadiumcorp.

In Exhibit 4, we show our peer group involved at one level of another in the production and resale of flow batteries using Vanadium or other metals – Chemours, Cellcube Energy, Lockheed Martin (significant investment in flow batteries) and Sumitomo Electric.

Exhibit 2 – Global battery market, 2020 – 2030

Sources: ACF Equity Research; Adroit Market Research; PR Newswire; Allied Market Research; Notes: VFBs = vanadium flow battery; Li-ion = Lithium Ion battery

Sources: ACF Equity Research; Adroit Market Research; PR Newswire; Allied Market Research; Notes: VFBs = vanadium flow battery; Li-ion = Lithium Ion battery

Exhibit 3 – Mining Peer Group – Vanadium (V) mining companies

Source: ACF Equity Research; Notes: FX rates as of 05/11/20: USD/CAD= 1.32, USD/AUD = 1.39

Source: ACF Equity Research; Notes: FX rates as of 05/11/20: USD/CAD= 1.32, USD/AUD = 1.39

Exhibit 4 – Flow Batteries Peer Group

Source: ACF Equity Research; Notes: FX rates as of 05/11/20: USD/CAD= 1.32, USD/AUD = 1.39, USD/JPY = 104.13

Source: ACF Equity Research; Notes: FX rates as of 05/11/20: USD/CAD= 1.32, USD/AUD = 1.39, USD/JPY = 104.13

In addition to homes and the overarching global initiative towards stopping climate change, it would be a natural transition for the battery industry to enter into air transport as well and either compete with or compliment hydrogen fuel technologies for commercial aircraft.

Author: Anda Onu – Anda is part of ACF’s Sales & Strategy team. See Anda’s profile