NIH ‘Shark Tank’ Awards – Update?

The National Institutes of Health (NIH) in the US announced in August that it had awarded $248.7m to 7 companies out of 650 applicants in order to accelerate the development of Covid-19 diagnostic tests.

The NIH fund allocation was a follow up to the April 2020 announcement of the $500m ‘Shark Tank’ competition addressed to scientists and investors.

- The “shark tank” initiative is part of a greater Rapid Acceleration of Diagnostics Initiative (RADx), which received a total of $1.5bn in funding from the Federal stimulus package.

- Aim – meet the urgent needs of a vaccine, RADx was set up in only five days of which $500m was allocated to the NIH competition.

- A total of 650 companies applied for the NIH funding pool – of which only seven were selected based on their cutting edge technology, R&D efforts and speed in which they can produce tests.

- Among the contract awardees two are listed (public) – Quidel (QDEL) and Fluidigm (FLDM). The other five winners are private companies – they are Mesa Biotech, Talis Biomedical, Ginkgo Bioworks, Helix OpCo, and Mammoth Biosciences.

- The “shark tank” winners are based in California except for Gingko, which is based in Massachusetts.

- Mammoth claims its gene-editing technology can produce faster results than standard tests.

- Ginkgo and Helix claim their tests can produce results in 24 to 48 hours. Ginkgo and Helix also claim they will be able to produce 50k samples/day by end-Sept and 100k samples/day by year-end.

- However, neither Ginkgo or Helix seems to have published any progress on these claims since joining the winners pack in the “shark tank”, and we are now in October.

- Mesa Biotech claims it can turn results around in 30 minutes and Quidel claims a 15 minute turnaround.

- In July, Forbes and others published an NIH story about a second round of awards. This second round of NIH ‘shark tank’ awards for an additional 20 companies was expected in August.

- There has been no further announcement, we are aware of, regarding the NIH’s second round of awards.

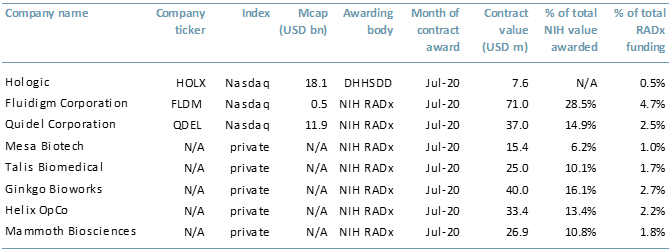

Exhibit 1 below lists the companies by awarding body, total contract value, percent of funding received from the total amount rewarded ($248.7m) and percent of funding received from the federal government ($1.5bn).

Hologic has been included in the list because even though the funding was received from the Department of Health and Human Services and Department of Defense (DHHSDD), it is still part of the $1.5bn RADx stimulus.

Exhibit 1 – Contract awardees for producing Covid-19 tests, 2020

Sources: ACF Equity Research; company websites

Sources: ACF Equity Research; company websites

We have seen names of big pharma giants such as Abbott Laboratories, Becton Dickinson and Roche Holdings thrive in the markets on the back of their advancing technologies for the manufacture of Covid-19 tests.

However, the “shark tank” initiative has provided opportunities for smaller companies to compete in the global markets and against big pharma. Competition is positive, it generates value, innovation and jobs.

The RADx fund offers small and mid-cap medical diagnostics companies an opportunity to scale up, increase brand presence and grow their value.

The NIH award may have given a handful of smaller companies a brand and business leg-up and increased exposure to investors. In our view, there are additional or substitute ways that all smaller companies could improve their profile with retail and institutional investors – one of these is the implementation of an ESG policy. Why is this a solution?

All classes of investors are increasingly inclined to invest in companies that operate sustainably and can account for it – in time we expect it to be ‘mandatory’ for the majority of companies (nano-cap to mega-cap) whether they want public or private investment.

It is usually (though not always) better to be ahead of the curve when it comes to attracting investment funds.