Is ESG driving Renewables?

Luke Oliver, Head of Index Investing Americas at DWS Group (DWS.DE: XETRA), a leading issuer, told CNBC’s ETF Edge in an interview on 14 Sept. 2020 that Environmental, Social and Governmental (ESG) filters as an investment decision factor has “established itself this year”.

It seems “investment has developed a conscience”. It also seems 2020 will mark the inflection point for ESG driven investing.

ETFs (exchange traded funds) are passively rather than actively managed.

An ESG investment strategy refers to a type of investment approach that evaluates a company’s environmental, social, and governance ratings alongside traditional financial metrics (such as net present value, internal rate of return, etc).

ESG-focused ETFs have seen persistent growth in investor inflows this year. We suspect this is due to improved environmental awareness during lockdowns.

Emissions reductions and clean air improvements were noticed by big-city dwellers, in particular, during the Covid-19 stay-at-home restrictions.

Market data shows $19bn flowing into ESG ETFs this year vs. $8bn inflows in 2019, representing 130% y/y growth.

According to DWS Group’s Oliver ESG filtering should not be seen as investors attempting to breach confidence with companies. Neither does it mean that companies have to give up returns or take less risk in order to access ESG funding. It is another way of assessing company value generation and performance.

Investors, and those that influence them, are increasingly interested in sustainability and as leading fund managers such as Blackrock publicly push this trend, others are inevitably following, some above the waterline but many more below it.

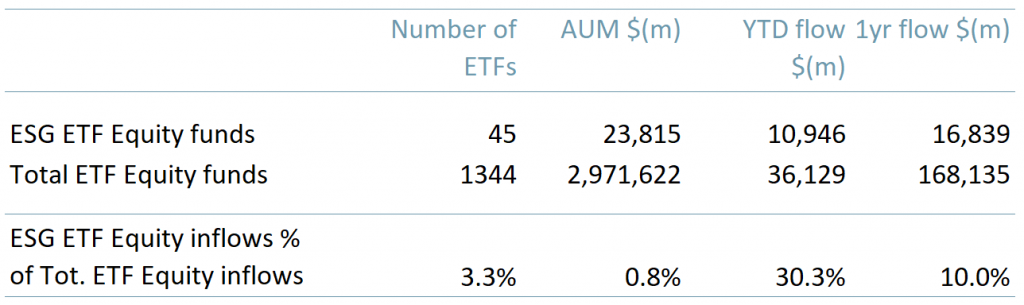

ESG-focused equity ETF fund inflows represented over 30% of total ETF equity fund inflows this year. However, ESG money into ETFs is still relatively insignificant at 0.8% of the total ETF Assets Under Management (AUM), see Exhibit 1 below. What we can see, is where the trend is going – we expect ESG filtered AUM as an investing class to reach $25 trn by YE20.

Exhibit 1 – Funding inflows of ETFs, as of 30/04/2020

Source: ACF Equity Research; Sage; Bloomberg.

Source: ACF Equity Research; Sage; Bloomberg.

Although the concept of ESG investing is not a new one, the ESG ETFs market is still in its infancy in terms of translating interest to actual AUM. Notwithstanding this, our long-term view of an accelerated ESG adoption across all traditional carbon intensive industries – such as coal, oil and gas – still remains intact.

We infer that the renewable energy sector is a direct beneficiary of the growing demand for ESG optics. Investors are starting to direct their portfolios to alternative (i.e. renewable) energy sources – competition for investment within the energy sector is strong.

For example, BP recently announced that it will cut its oil and gas production by 40% over the next 10 years so that it can meet its zero-emissions goal by 2050.

As the momentum for sustainable investment continues to grow, the oil and gas industry (as well as other fossil-fuel intensive industries) should consider the possibility that it will be upended by what is now becoming a low-carbon era.

We have already seen investments into renewable energy companies increase to $6.6bn in 2019 up from $6bn in 2018, an 11% increase (UNEP, Frankfurt School-UNEP Centre, Bloomberg NEF, 2020). Solar and wind accounted for the largest share of total investments at $3.6bn and $2.4bn, respectively.

Carbon is a long way from dead but the change in sentiment towards renewables and ESG is beginning to feel structural – it is always best to plan for the eventuality of a flip, and so be ready for change.

![Climate change and the [re]emergence of millet Climate change and the [re]emergence of millet](https://acfequityresearch.com/wp-content/webpc-passthru.php?src=https://acfequityresearch.com/wp-content/uploads/2023/08/ACF_Millet-a-new-sustainable-market-_Twitter-470x320.jpg&nocache=1)