Sun Machine – the new energy generator

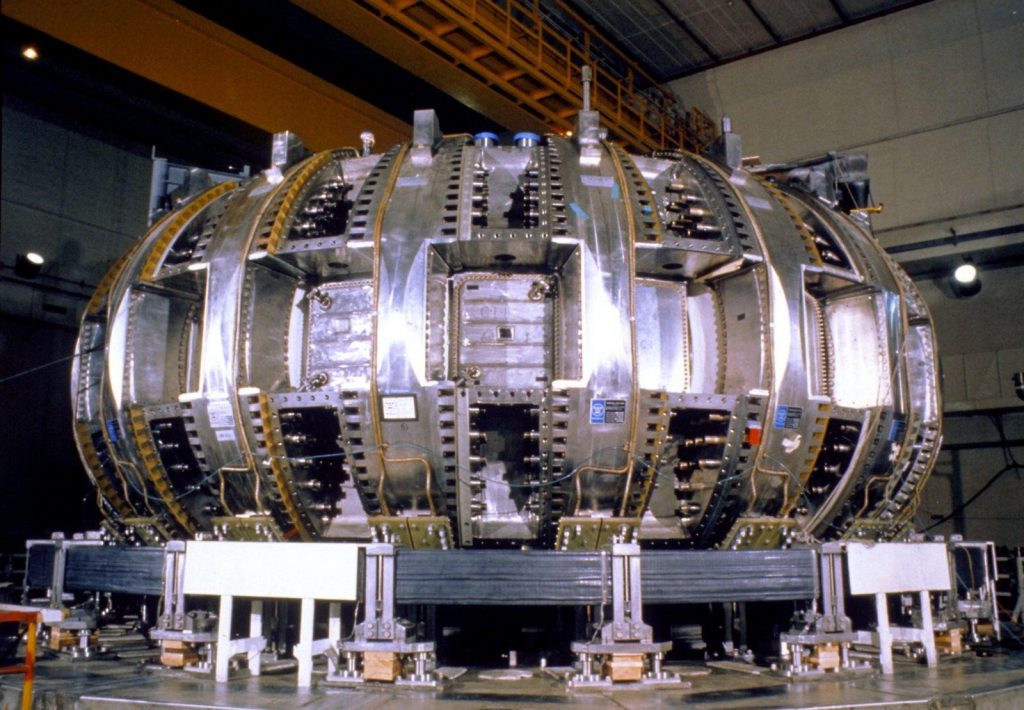

‘Sun Machine’, the world’s largest science project, was born in the 1980s to produce clean energy. Sun Machine’s tokamak can harness nuclear fusion as a power source.

- The International Thermonuclear Experimental Reactor (ITER) project is worth €20bn (£18.2bn). The project is led by a team of engineers, physicists and builders based in Provence, France.

- ITER currently involves 35 countries – among them the UK, EU, US, Russia, China, India and Japan.

- Tim Luce, ITER’s chief scientist, says “Fusion is the power source of the universe.”

- The reactor is also known as a tokamak, a magnetic device which resembles a doughnut in shape, if not effect.

Exhibit 1 – Tokamak

Source: engadget.com

Source: engadget.com

- Fusion occurs when hydrogen fuel is super-heated, so that the protons and electrons of the hydrogen atoms detach and form a swirling mass of hot plasma. The reactor will be able to heat hydrogen plasma to 150m°C (10x hotter than the Sun’s core).

- These nuclear particles will then form helium – releasing large amounts of energy as they do – eventually producing clean energy.

- A project like this takes time – the first ultra-hot plasma is anticipated for 2025. It will take at least another decade before the first viable energy generator is produced.

- The first fusion generators are projected to be fitted into electricity grids by the end of the 21st century.

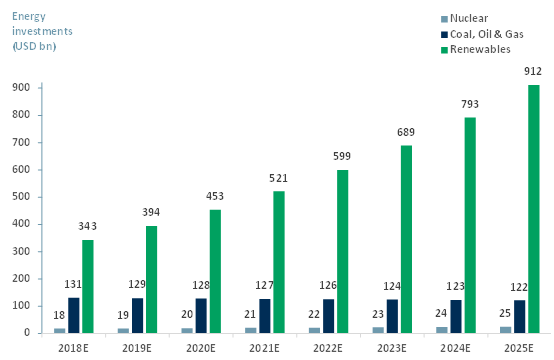

In Exhibit 2 we have charted the projections for the investment in the energy sector by subsector – Nuclear; Coal, Oil and Gas; and Renewables. Based on a 10-years CAGR, Nuclear investments will grow at 5%, Coal, O&G at -1% and Renewables at 15%.

Nuclear energy investment is forecasted to reach $25bn in 2025E, up from $18bn in 2018E, but most of that is fission not fusion.

Exhibit 2 – Global energy investment by subsector, 2018E – 2025E

Sources: ACF Equity Research; IEA

Sources: ACF Equity Research; IEA

While the Sun Machine has taken decades to come to fruition, such is the case with any complex technically challenging project. However, if it is able to deliver what it says it can, would it make sense to increase investments into this project?

Would it be appealing for investors to put all their eggs into one basket, given that they may not be around to see the outcome?

It is a bit of a catch 22.

Climate change is a concern for everyone and the future of the world is not necessarily unknown. We are seeing the effects on the environment on a daily basis.

The mostly probably cause, based upon the current data set, is that humans are causing climate change by releasing carbon back into the atmosphere that was sequestered 300-360m years ago.

It is timely that countries and government pool their resources for renewables R&D and advanced technology. In doing so, perhaps the benefits of the Sun Machine may be observed sooner than we think. That would be exciting.

On the other hand, investors are adverse to nuclear power because of the time scale and costs of such projects. Fusion energy is essentially a threat to the existing energy market. Therefore rather than faster we could expect investment to be slowed if fusion ever looked like an immediate or certainly rapid threat to the current energy complex.

If the subsector worked effectively at scale, it would complete the renewables market and with improvements in large scale gird and transport batteries would essentially render fossil fuels obsolete. The markets and governments are not ready that.

Given the controversy around fusion energy, it has been largely underfunded as illustrated in Exhibit 2. It’s viability still needs to be proven and from the example of the Sun Machine, that could be decades.

We love fusion power and Tokamaks and plasma. But the problem might be that not enough people currently alive care enough. Afterall, almost all of them will be dead by time the first reactor comes on line. That’s a depressing but logical conclusion about long-term projects and humanity.

Author: Renas Sidahmed – Renas is a Staff Analyst and part of the Sales & Strategy team at ACF Equity Research. See Renas’s profile