Telehealth – Google and Amwell ignite a revolution

It is not unreasonable to infer Google views telehealth as a trillion dollar plus market, following Google Cloud’s (NasdaqGS;GOOG) invested US$ 100m in Amwell (NYSE:AMWL).

Telemedicine (or telehealth) is the provision of virtual healthcare services through electronic devices such as smartphones, tablets, or computers.

Key points:

- Google’s investment in telehealth via AMWL was via a private placement, reportedly at the at the IPO price of US$ 18 per share.

- AMWL’s first day of trading was 17 September 2020. As of the date of this blog AMWL’s Mcap is ~US$ 6bn and the 52-week range is $21.34 – 43.75.

- As part of the Google investment Amwell agreed to migrate its servers to Google Cloud and away from Amazon Web Services.to improve Amwell’s and Google’s AI capabilities in telehealth.

- Amwell provides telehealth services in 50 US states to ~2,000 hospitals and 55 health plan partners – equating to >150m patients. AMWL has less than 1,000 employees.

- In 2020/21 Covid-19 caused an increase in the demand for telemedicine.

Amwell in its 3Q20A earnings posted revenues US$ 62.6m, up 80%, vs. 34.7m y/y.

IHS Markit estimated last year that global healthcare spending in 2021 will reach US$ 8.8trn, up 5.8% vs. US$ 8.3trn y/y.

Covid-19 has forced hospitals, clinics, and other medical facilities to cancel non-urgent medical visits (elective services) to make room for Covid-related urgent-care cases. In this way the pandemic expanded the market for alternative healthcare solutions, i.e., telehealth.

Technology leaders Amazon (NasdaqGS:AMZN), Apple (NasdaqGS:AAPL), Microsoft Cloud for Healthcare (NasdaqGS:MSFT) and Google Cloud recognise the opportunity in the telehealth sub-segment of the global healthcare market. These companies assess that they can enter telehealth by leveraging their server and data technologies.

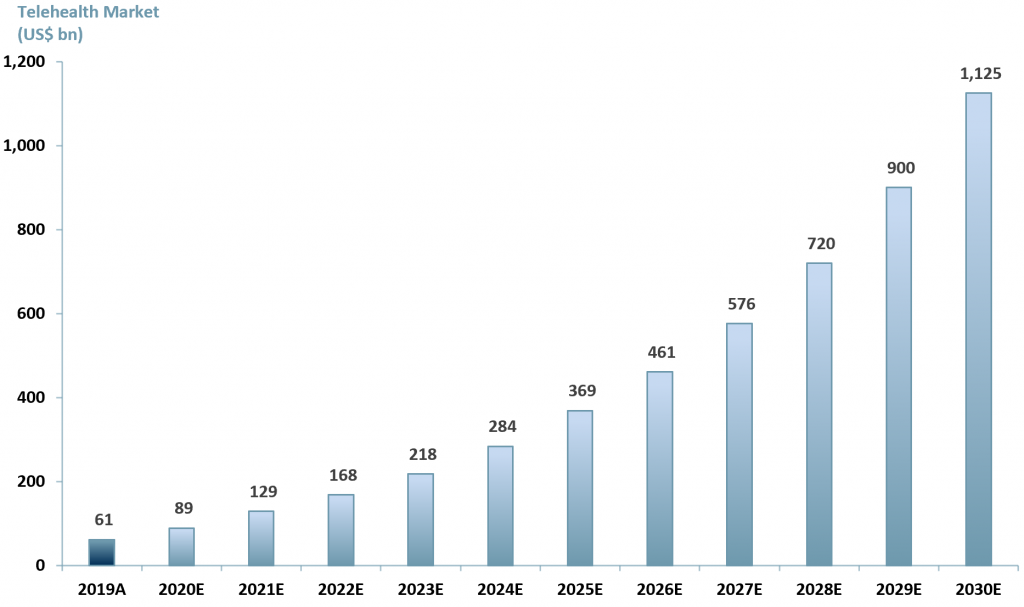

In exhibit 1 ACF Equity Research estimates that the telehealth sub-sector will reach US$ 1.125trn in 2030E, up from US$ 61bn in 2019 – a CAGR of 30%.

ACF Equity Research’s telehealth growth assumptions

We have an aggressively accelerated our growth rate during 2020 and 2021, driven by the effects of the pandemic. We assess the pandemic will drive telehealth adoption to a critical mass point by 2023, which will generate a spur to far broader adoption. We begin to decline our growth rate from 2026 onwards. Our 10-year CAGR is 30.3%.

Our growth forecasts are underpinned by our expectation that work patterns and individual behaviours will undergo permanent change due to the pandemic, e.g., working from home and increased familiarity with online services.

Exhibit 1 – Global Telehealth market, 2019A to 2030E

Sources: ACF Equity Research Estimates; Fortune Business Insights

Sources: ACF Equity Research Estimates; Fortune Business Insights

Prior to the pandemic ACF estimates that the value of the telehealth market grew 10-15% p.a. in hyper-developed markets over the prior 5 years.

One reason for the slower market growth of telehealth prior to the pandemic is that telehealth is eroding hospital revenues and margins. Therefore, hospital groups have been an historical barrier to telehealth adoption, or at least a friction. The pandemic overwhelmed the barrier effect.

Covid forced hospitals and clinics to rapidly implement telehealth / telemedicine technologies to meet the rise in demand for remote patient care relating to non-Covid illnesses.

The issue for hospital groups is that they don’t own the telehealth providers and so they do not control the margins or the revenues associated with these remote healthcare services.

As Covid lingers, according to a study by Deloitte Insights, global doctor virtual visits are expected to increase 5% in 2021, worth at least an extra US$ 25bn, and up from a 1% growth rate in 2019. In OECD countries in 2019, doctor’s visits were estimated to be worth ~US$ 500bn.

Our view is that the use of telemedicine will become as commonplace as the use of the smart phones, upon which telehealth will largely depend for delivery (as opposed to desktop devices/tablets). Patients are likely to demand more convenient and flexible care services – little is more convenient than a smart phone. In addition, patients are seeking more bespoke services…as one size does not fit all.

In the UK, the Covid vaccination process has demonstrated that a more convenient telemedicine driven approach to health is possible.

Though we suspect the current UK vaccination efficiency levels cannot be maintained indefinitely, we forecast that healthcare services in the UK and the US will be held to a higher standard by both politicians and the public.

In reality, ‘fully bespoke’ services in healthcare as in most sectors are still some way off. But creating the impression and experience of something approaching bespoke is reasonably close.

The pandemic has not proved that fully bespoke medicine is inevitable or that it is practical. But is has showed that enormous change in the quality, competence, efficacy, convenience, and cost of healthcare is both necessary and possible.

Expect hospitals and medical services to commence a well organised campaign to persuade us and everyone else that our conclusions are incorrect. Technology, social media, high government deficits, the demands of the developing world and capital markets, support our analysis.

Authors: Renas Sidahmed, Christopher Nicholson, Adeline Bockarie – Renas is a Staff Analyst and part of the Sales & Strategy team, Christopher is founding executive, MD and Head of Research, Adeline is a Junior Staff Analyst at ACF Equity Research. See their profiles here