GameStop – a volatility case study

GameStop’s, (GME:NYSE) will become a case study in the perils of volatility and the role and accessibility of investment research.

GME rallied ~1,700% up from $17.25 on 4th Jan 2021 reaching an intraday high of US $483 and a close of $396 by 28th Jan 2021. Exactly one month later the stock was trading flat again in the $50 range. GameStop is again back in the news.

Little fundamental has changed over this short time frame with respect to GameStop’s future potential value. It is therefore likely that the recent $50 support line was created by investors locked in who got caught out on timing because of the volatility or who believed (correctly as it turns out) that volatility would return to GME’s stock price (and volumes).

- GameStop is a US high street shop that sells games and related electronics. During 2020, the firm was labelled as “failing” after experiencing heavy losses. GME’s business model remains under pressure – most games are bought online, and most game producers want it that way.

- The theatre chain AMC Entertainment, the owner of Odeon Cinemas, Blackberry, Cineworld and Publisher Pearson were also targeted by day traders using a long strategy to create a bear squeeze.

- In response, most financial trading platforms, like UK’s IG, Robinhood, Webull, M1 and E-Trade restricted trading in their retail customers’ accounts.

- Moreover, regulatory bodies in both the US and the UK have been following these trading activities, checking for possible law breaking.

Stock-market timing is an art that not all investors master. Volatility makes market timing far harder and that undermines confidence in the market. Volatility (as opposed to liquidity) repels most retail investors and institutional / professional portfolio managers alike.

Volatility does not help companies raise growth or emergency capital…

Volatility has additional, more insidious effects. Volatility diverts attention away from the actual operational business of the company and associates the company’s brand with the volatility story and not with the product or service story. Share price and volume volatility divert management energy and concentration from running the company.

Volatility is a danger to smaller and mid-cap companies at any level. Extreme or hyper-volatility cannot be managed once it has taken hold of a stock.

But volatility can be guarded against and prevented from spiralling out of control. Volatility usually occurs because of an information vacuum created by lack of accessible third-party best-in-class investment research.

A lack of high quality investment research is often compounded by a management strategy to ‘say nothing’ and hope no one looks when things are tough.

This strategy to ‘keep your head down’ is still propagated by some market advisors. This advice no longer works.

Investors running day trading strategies – professional or retail – want, and search out, exactly this information vacuum so that they can then seed it with rumour and speculation.

The old strategies of ‘hiding’ pre-date the 1990s capital markets environment. Several factors have changed irreversibly since the 1990s – the ubiquity of the internet, the vast global expansion of the middle classes (driven largely by economic growth in India and China), and the adoption of smart phones by 3.5bn people (broadly half the global population above the age of 5).

Like GME, AMC Entertainment Holdings, Inc. (AMC: NYSE), BlackBerry Limited (BB: NYSE), Cineworld Group plc (CINE.L) and publisher Pearson (PSO:NYSE, PSON.L) have unclear growth paths and relatively little long-term shareholder support.

By way of a reminder – compared to the start of 2021, the share price of AMC Entertainment rose nearly 840%, whilst Blackberry’s share price increased 280%.

Over the next decade the future ability of these five companies to raise significant amounts of growth capital seems limited.

Any remaining long-only professional investors in AMC, BB, CINE and PSON will very likely have been unable to resist the opportunity to sell down their holdings, and release ‘captured’ capital that can be put to work elsewhere.

So, whilst we applaud a balancing of the powers between retail and professional investors at one level, we fear the short investors will be proved correct over the longer term with respect to the stocks named in this ACF blog.

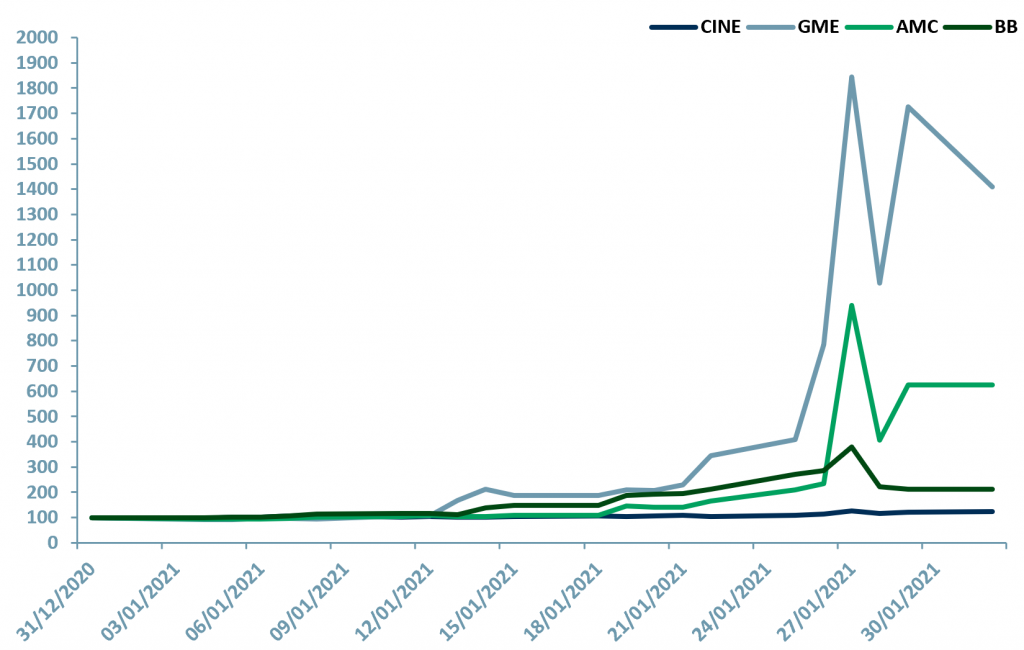

In exhibit 1 below we show a share price relative chart describing the trends between 31st Dec 2020 and 1st Feb 2021 for the five companies we believe face a very challenging future as a result of the GME volatility event.

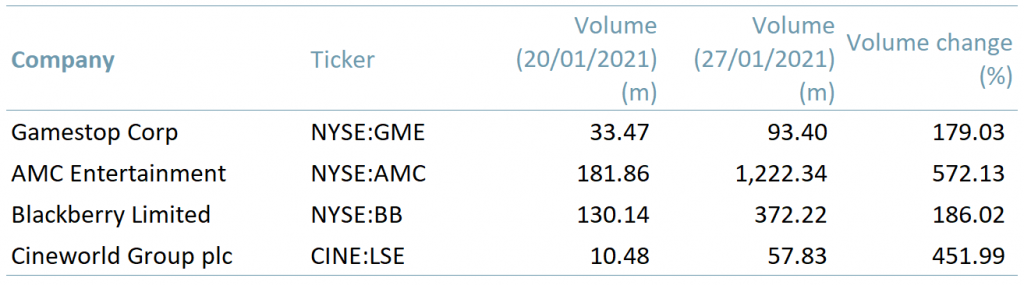

In our exhibit 2 table below, we describe the volatility impact for the same companies (volatility and liquidity should not be confused).

Exhibit 1 – Price relative chart of Cineworld, Gamestop, AMC Entertainment and Blackberry, Jan 2021

Source: ACF Equity Research Graphics

Source: ACF Equity Research Graphics

Exhibit 2 – Changes in trading volume of Cineworld, Gamestop, AMC Entertainment and Blackberry, 20 Jan 2021 – 27 Jan 2021

Source: ACF Equity Research Graphics

Source: ACF Equity Research Graphics

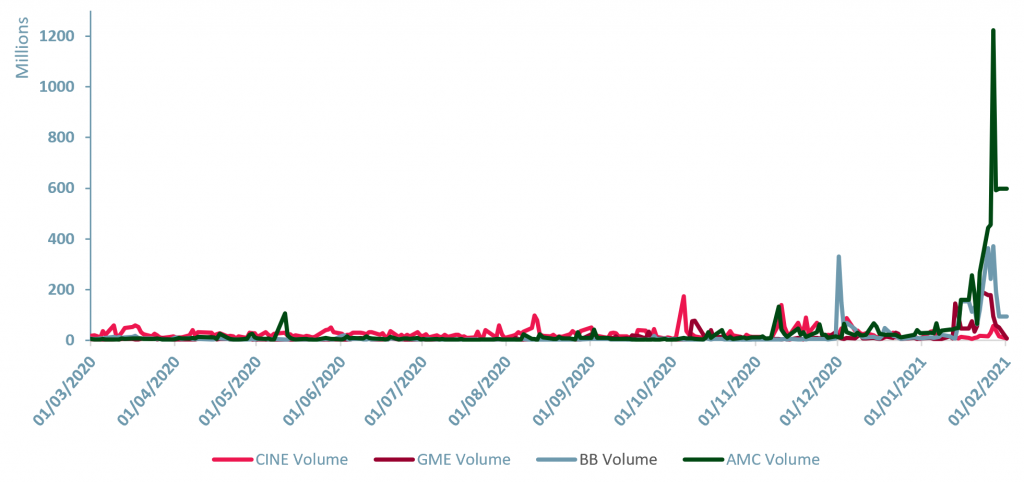

Exhibit 3 – Trading volumes (12 months), CINE, GME, BB, and AMC, BB

Source: ACF Equity research, Yahoo Finance

Source: ACF Equity research, Yahoo Finance

All longer term investors of whatever class (retail to institutional) should have wide access to high quality investment research. Management teams should consider this an essential part of their strategic view of capital markets. The alternative is to rely on tips and speculation.

We believe that the availability of high-quality independent research to retail and professional investors on the same terms is desirable and perhaps crucial. We believe that corporates, especially nano to mid-size corporates, should be thinking about these matters strategically, rather than reactively as they may have been encouraged to do in the past. The rate at which the world changes continues to accelerate and that should, probably, be embraced.

Authors: Christopher Nicholson and Anda Onu. Christopher is a founding executive, MD and Head of Research at ACF Equity Research. Anda is part of ACF’s Sales & Strategy team. See their profiles here