The Hidden Costs of Covid-19

Elective care surgeries since Covid-19 have been cancelled globally. The 45-week backlog for elective procedures that arose in May 2020 lingers.

- A recent study by CovidSurg Collaborative researchers collected data from 359 hospitals across 71 countries.

- The study showed that progressively 28m elective care surgeries had been cancelled globally during the peak (May) of C-19.

- The implication of ACF’s analysis at the high end of our mid-range scenario is that net income losses for the hospital sector could exceed US$ 225bn per calendar month (pcm).

ACF’s low end of its ultra conservative scenario:

- ACF’s analysis suggests the number of cancelled elective surgeries globally is now significantly higher than it was in the CovidSurg May 20 data.

- At the low end or our ultra conservative range, ACF forecasts that total elective care surgeries cancelled at today’s date is in the range 33 to 36m. In our sensitivity analysis we achieve a mid-range forecast of 41 to 45m.

- Our forecasts suggest a pandemic driven global revenue loss to date for hospital elective surgeries of between US$ 247bn and 272bn, and a monthly net income loss rate of US$ 9bn to 13bn globally.

ACF’s low end ultra conservative key assumptions:

- Each additional week of disruption could lead to 2.4m cancellations (CovidSurg data).

- As of May 2020, 38% of cancer elective procedures were postponed or cancelled globally (CovidSurg data).

- To date we assume the C-19 peak range as it effects elective care in the hospital groups sector, is 16 weeks (it is probably above 20) (ACF Estimates)

- We have applied a raw hospital data collection/classification error rate in excess of 15%, and a range spread of 10% based on FX translation, accounting standards variability and other variances. (ACF Estimates)

- We have assumed a global average cost for elective surgeries of US$ 7,500 (ACF Estimates)

- A US National Library of Medicine study observed US hospital groups elective surgery margins of 24% -30%.

- In our ultra conservative scenario, we have forecast a low-end global net income margin for elective surgeries in hospital groups of 15% (ACF Estimates)

Covid-19 infection rates have flared up over the past two months – particularly in Europe and some US States). It is likely that these numbers and their impact will worsen increasing the hospital consolidation wave.

A US National Library of Medicine study observed that the cancellation of elective procedures could result in revenue losses of US $16.3 to $17.7 bn/month. Cancellations would also cause a decrease of $4-5.4bn/m of net income to US hospitals.

As the immediate impact of C-19 begins to fade, the health effects from delayed or lack-of treatment will begin to emerge. This will create an additional burden for patients and healthcare workers.

For patients with chronic conditions such as cancer, deferred treatment will worsen their conditions or lead to death.

Deferred treatment will also increase the costs of treatment in the mid to long term. As of 2019, the average cost of treating a cancer patient ranged between $100k-$150k. This fee could increase by 8% as a result of elective surgery delays (McKinsey, 2020).

In our low case we assume the average cost of elective surgeries globally is US$ 7,500. This leads us to a forecast of lost global revenue of US$ ~62bn per month.

According to King’s College London (Nov 2020), for every month of delayed treatment, a cancer patient’s risk of death increases by 6-13%.

If we extrapolate this across different types of conditions/indications that faced mounting cancellations, the resulting costs could be substantial – financially and physically.

As Covid infection rates continue to rise, we expect this to be the case globally.

On the back of this, the pandemic could well be the catalyst for growth for most companies in the healthcare industry.

Particularly, this could be the panacea for small and mid-cap companies that had to cancel services that otherwise would have been a cash cow for them. Elective care services account for about 50% of revenue for a number of hospitals. (NEJM Catalyst, 2020)

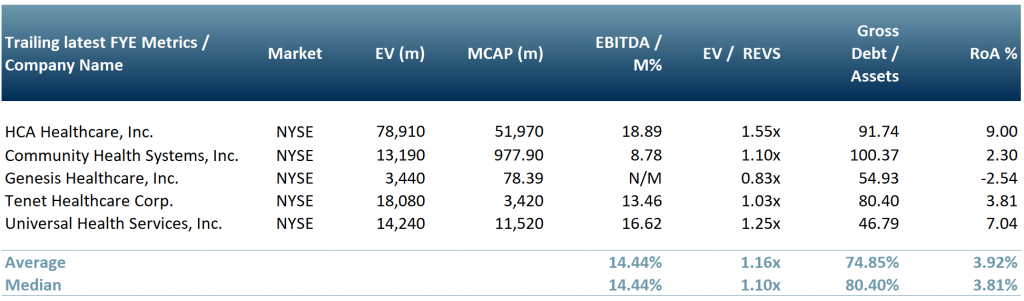

In Exhibit 1, we show our peer group of US hospitals all listed on the NYSE – HCA Healthcare, Community Health Systems, Genesis Healthcare, Tenet Healthcare and Universal Health Services.

Exhibit 1: US Hospitals Peer Group

Source: ACF Equity Research Graphics

Source: ACF Equity Research Graphics

Authors: Adeline Bockarie, Renas Sidahmed, Christopher Nicholson.

Adeline Bockarie – Adeline is a Junior Staff Analyst at ACF Equity Research.

Renas is a Staff Analyst and part of the Sales & Strategy team at ACF Equity Research.

Christopher is a founding executive, MD and Head of Research at ACF Equity Research.