Chinese Recovery Impacts Metals

The Chinese economy grew 4.9% during the third quarter. China’s V-shaped recovery is a sign of a rebound in industrial production and base metals.

- The expansion is lower than market expectations of a 5.2% growth.

- China’s recovery shows a large reversal from the 6.8% contraction seen during the first quarter of this year.

- Data also showed a rebound in industrial production, a 6.9% increase, which is the biggest gain since the pandemic. Retail sales were up 3.3% and auto sales were up 12.8% (which is unlikely to be good for carbon emissions and clear skies).

- While China continues to show a robust economic recovery, the rest of the world is still on a downward trajectory. The IMF forecasts that the global economy will contract by 4.4% in 2020. In spite of vaccine announcement in the week of 7th October, there is some way to go before this makes a difference to economic growth, though global economic sentiment numbers are likely to be on the rise already.

China accounts for at least 50% of the global consumption of aluminium (Al), copper (Cu) and nickel (Ni), and about 48% of zinc (Zn). Based on this, a Chinese recovery will be a driver for base metals.

The 12.8% growth in auto sales is unlikely to be good for carbon emission and clear skies. And in spite of the announcement of a Covid vaccine breakthrough during the week of 7th October, global economic sentiment indices are likely to be already on the rise.

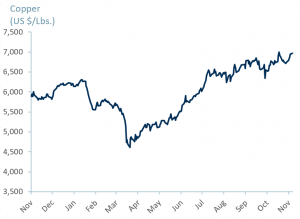

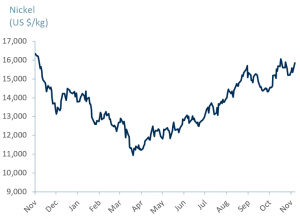

China is nevertheless acting as a forward indicator. With manufacturing and industrial activity opening in China faster than anywhere else, base metals prices have increased from their March lows. We are expecting prices to continue on this trajectory in the mid-term. (see Exhibit 1 – Exhibit 4)

This is welcome news for metals investors looking to protect their portfolios against broader market fluctuations.

However, the recent Covid-driven lockdown measures in Europe and continued global economic downturn will affect Chinese exports.

Although we expect global economic sentiment indicators, such as the PMIs to be on the rise in November, they are forward indicators. Financial markets react to sentiment indicators quickly, the real economy takes a little longer.

Irrespective of our sentiment index expectations, we accept the possibility of a potential lag in global economic growth ex-China. The lag factor is a downside risk that could cause a faltering in base metal prices rises.

A stutter in base metal prices could cause a temporary correction to our overall expectations of continued v-shaped recoveries and expansions in base metal prices. Nevertheless, our overall thesis remains intact – mining is on the up.

| Exhibit 1: Copper Prices, 2019 – 2020 | Exhibit 2: Aluminium Prices, 2019 – 2020 |

Sources: ACF Equity Research, Investing.com

|

Sources: ACF Equity Research, Investing.com

|

| Exhibit 3: Zinc Prices, 2019 – 2020 | Exhibit 4: Nickel Prices, 2019 – 2020 |

Sources: ACF Equity Research, Investing.com |

Sources: ACF Equity Research, Investing.com |

In Exhibit 5, we show our peer group involved at one level of another in the production and supply of Copper, Aluminium, Zinc or Nickel – Amerigo Resources, Nickel Creek Platinum Corp., Solitario Zinc Corp., Century Aluminium Co. and Commercial Metals Co..

Exhibit 5 – Base Metals Peer Group

Source: ACF Equity Research; Notes: FX rates as of 13/11/20: USD/CAD= 1.31

Source: ACF Equity Research; Notes: FX rates as of 13/11/20: USD/CAD= 1.31

Author: Adeline Bockarie – Adeline is a Junior Staff Analyst at ACF Equity Research. See Adeline’s profile