Oil price breakout winners

The trading range for oil (WTI – West Texas Intermediate) since 6th May 2020 is US$ 38 to 42 bbl. On Monday 23rd November 2020 the oil price broke through its recent resistance line to reach $43 bbl, this oil price breakout saves E&P and Shale and is supported by three vaccine announcements (no more lockdowns) and OPEC discussions on matters that would cut supply.

The excitement is premature. We only need a fall to $35 bbl to trigger a host of potential bankruptcies in E&P and shale. And that can happen as quickly the breakout developed.

On the 2nd November 2020 oil prices (WTI) fell 4% to $36.81 bbl due to lockdown announcements and the turbulence surrounding the US presidential election. As populations begin to feel vaccines will solve the pandemic crisis, they will relax their behaviour. OPEC members will see less of a need to cut production with an end to the pandemic in site. All of which suggests that WTI $43+ is at least as likely to come back as to establish a new higher trading range.

The balance of probabilities is for either an ever growing second wave of Sars-CoV-2 or a third wave before vaccines and anti-Covid measures are so widely available that the pandemic can be declared under control – we think this is another 12 months.

The pressure on E&P and shale producers via volatility in oil prices and trading ranges guaranteeing losses or only just above breakeven levels has dented investor confidence further. Not only this, but institutional fund managers are struggling to find the time necessary to identify the winners and losers in oil – so they are switching to renewables.

E&P and Shale producers are finding it harder than ever to find investment funds to develop and grow their businesses or stay alive through this rough period. Oil is not over for a while, but managements are finding increasingly tough to get seen from amongst the crowd and secure investment funds.

Oil price short run drivers:

- Brent crude futures for January delivery 2021 dropped 3.9% to $36.45/bbl while WTI futures fell 4.4% to $34.21/bbl, representing their lowest levels since May 2020 delivery futures – there is nothing about Monday’s $43 bbl oil price breakout that looks rock solid. $35 bbl oil prices guarantee losses for many E&Ps and for most shale producers.

- Many countries across Europe have reimposed containment measures in an attempt to stem the spread of infection that has escalated over the past few months – vaccine or no vaccine, in practical terms there is no sign of an immediate easing.

- With the infection rates also surging in the US, market sentiment is that they could follow Europe in imposing stricter measures – a move that would further suppress oil demand, in spite of the recent three vaccine announcements.

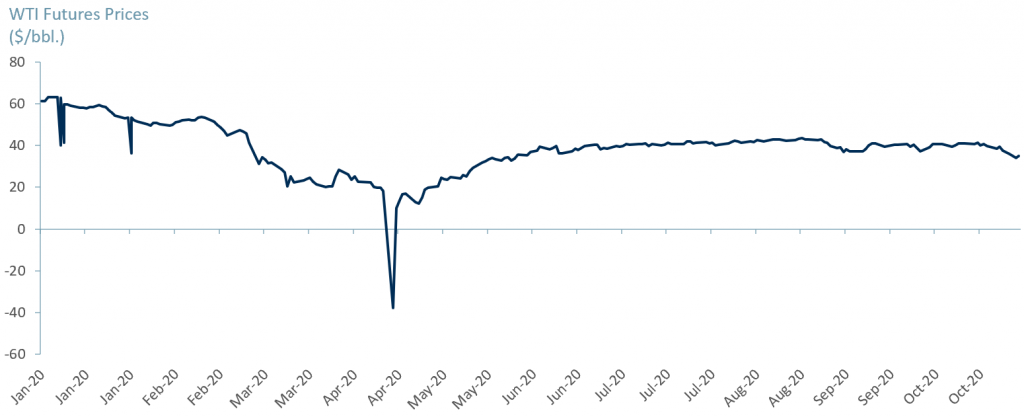

Global WTI oil prices have declined over 42% since January 20 (excluding the negative pricing movement). This follows the widespread Covid-induced containment measures, which saw prices fall to $34.88/bbl in November from $61.33/bbl in January. (refer to Exhibit 1). We are not out of the woods yet.

Exhibit 1 – WTI Crude prices 2020

Sources: ACF Equity Research; Yahoo Finance

Sources: ACF Equity Research; Yahoo Finance

Low oil prices are generally positive for consumers. Sustained low prices could result in huge financial distress for US shale producers that operate at a higher cost to extract ($40 – $90 bbl) compared to their competitors in Saudi Arabia (cost to extract a barrel of oil $3 -$4) and Russia (cost to extract $42 – $44 bbl).

Oil prices (WTI) above $43 bbl provides a temporary safety net for significant numbers of E&P companies and some shale producers.

However, with price volatility over extended periods and oil falling to a recent low of $34.88 per bbl in November 2020, small and mid-cap E&Ps with low cash reserves are struggling.

Therefore, the current price environment is in no way sufficient for a significant amount of E&Ps to generate, or sustain, positive margins that could offset the rising costs associated with operations. Ceteris paribus, we expect a further surge in bankruptcies in the shale and E&P sub-sectors by the end of 2Q21E.

During 2020, about 43 North American E&Ps filed for bankruptcy protection (including Chesapeake Energy Corp. (CHK:NYSE), and Whiting Petroleum Corp (WLL: NYSE)). However, since 2015 the total number of bankruptcies in the sub-sector in North America is 251. We estimate that total debt in the North American E&P sub-segment has reached US$ 275bn up 129% from US$ 120bn YE19A – make no mistake – this will cripple many E&Ps for years to come, if they survive at all.

The trick is to spot the E&Ps that are comfortably profitable at $35 bbl. These companies will reap benefits from the industry fallout and there is still a decade at least of growing petroleum demand and probably another decade of high demand. There are two options for institutional and retail investors alike – spend a lot of time doing a lot of research or read a lot of research.

Institutions are giving up on the time requirements which might, oddly, give retail investors an advantage as long as the companies have high quality research coverage. Filter 1 – no high quality research coverage – stay away – that goes for institutions as much as it does retail investors.

Investment case – with the current oil market conditions (price volatility, pandemic overhangs, less than effective cartels, whose members need cash to fund the pandemic stimuluses) we project oil prices to remain risked to the downside. We are expecting a rise in bankruptcy filings through 2021.

After this ‘great clearance’, that has been running half a decade, the market clearing mechanism will at some point (perhaps by the end of 2021) have left the winners on view. By that time everyone will know who they are and it is always more interesting to travel as an investor than to arrive. Same goes for the companies.

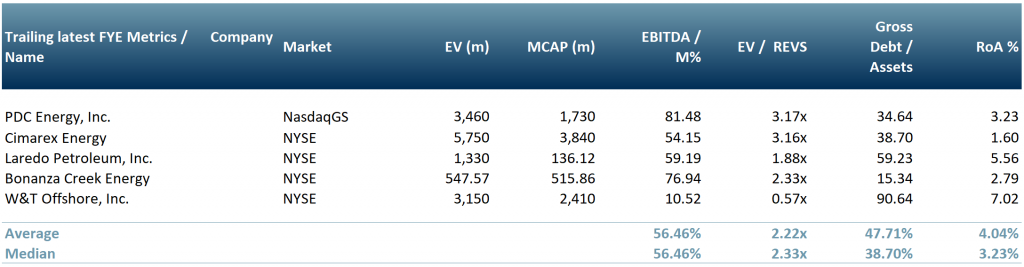

In Exhibit 2 below we show our peer group of North American E&P companies with a break even costs at oil prices below $30/bbl price range.

- PDC Energy (PDCE:NASDAQGS E&P Oil & Gas, Wattenbergy Field, Colorado);

- Cimarex Energy (XEC:NYSE, E&P Oil & Gas, Texas, Oklahoma, New Mexico);

- Laredo Petroleum (LPI:NYSE, E&P Oil & Gas, shale Permian Basin of West Texas;

- Bonanza Creek Energy (BCEI:NYSE, E&P Oil & Gas, Wattenberg Field, Colorado)

- W&T Offshore Inc. (WTI:NASDAQ, E&P Oil & Gas offshore coasts o Louisiana, Texas, Mississippi, and Alabama)

Exhibit 2: E&P candidate winners/survivors list North America cost to extract below US$ 30 bbl

Source: ACF Equity Research

Source: ACF Equity Research

Authors: Adeline Bockarie and Christopher Nicholson – Adeline is a Junior Staff Analyst at ACF Equity Research. Christopher is a founding executive, MD and Head of Research at ACF Equity Research. Click here to see their profiles