Vaccine variety is the key to ending pandemics

Valneva, a French vaccine maker intends to raise €85m ahead of its NYSE listing announced in April 2021. Its early-stage vaccine trials are promising 90% effectiveness.

- Valneva ($VLA: FP) is a biotech company based in France. It currently has a ~€1,6bn deal with the UK govt to supply <100m C-19 vaccine shots in 2022.

- Valneva’s vaccine uses the more ‘traditional’ method where the entire inactivated virus is used. This approach is considered more efficient as C-19 variants emerge – as it teaches the immune system to respond to the entire Sars-Cov-2 and not just the spike protein.

- On 05 May 2021, Valneva’s shares rose by ~234% y/y to €12.9 up from €3.9 – its MCAP reached € 1.2bn vs. ~€0.4bn y/y.

- Vaccitech (NasdaqGS: $VACC), the company that owns the technology behind the AstraZeneca ($AZN.L) C-19 vaccine platform, listed on 30 April 2021 and was valued at MCAP US$ 464m (~€380m) – above its March 2021 raise, which valued the company at US$ 425m (€348m).

The valuation of companies such as #Valneva and #Vaccitech is a clear indication that the global Covid-19 vaccine market is growing. In our blog, we forecast that the market will reach US$ XXX by 2030E.

Producing a variety of vaccines for C-19 will help end the current pandemic sooner, indeed without a range of vaccines it may be possible to eliminate or control Covid as new variants continue to emerge. The appropriate approach is to encourage each country to have its own C-19 vaccine. It is not just a matter of economic prosperity – it is a case of risk off setting – vaccines have proven time after time to be cost effective and adequately able to fight off life threatening diseases.

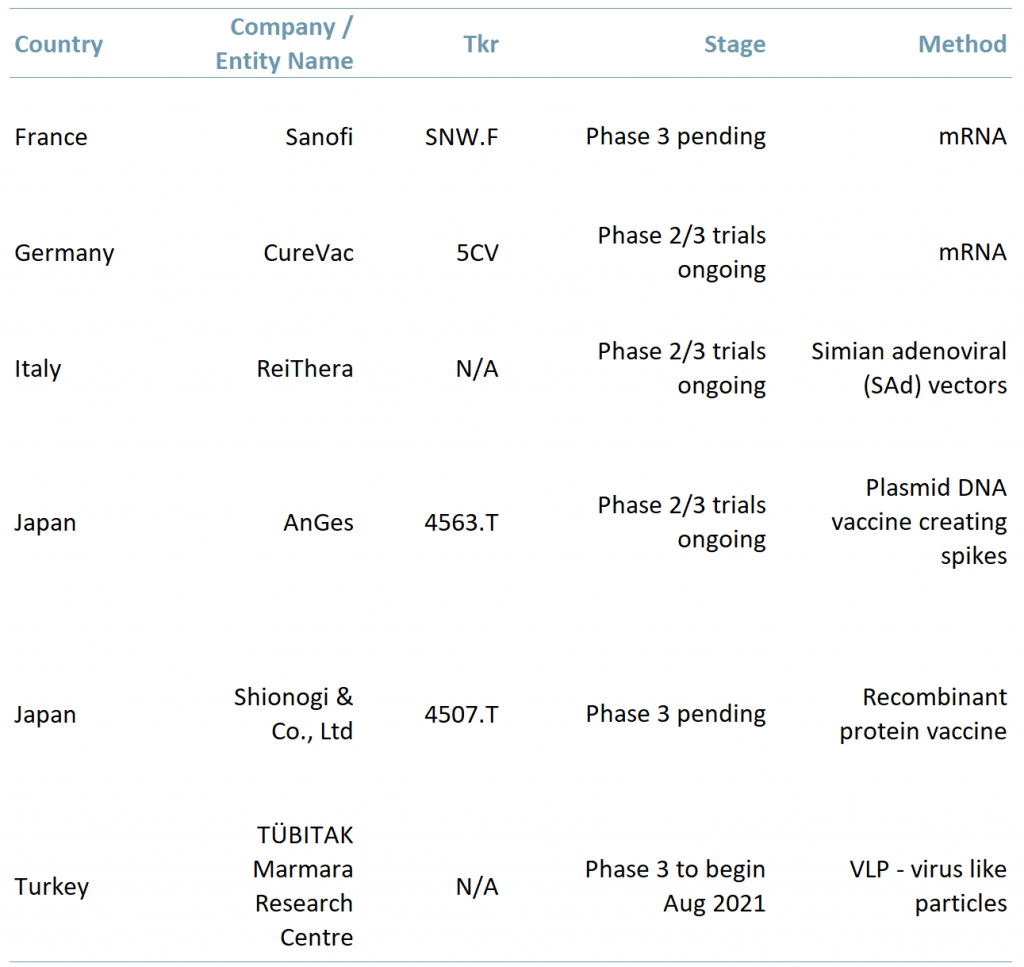

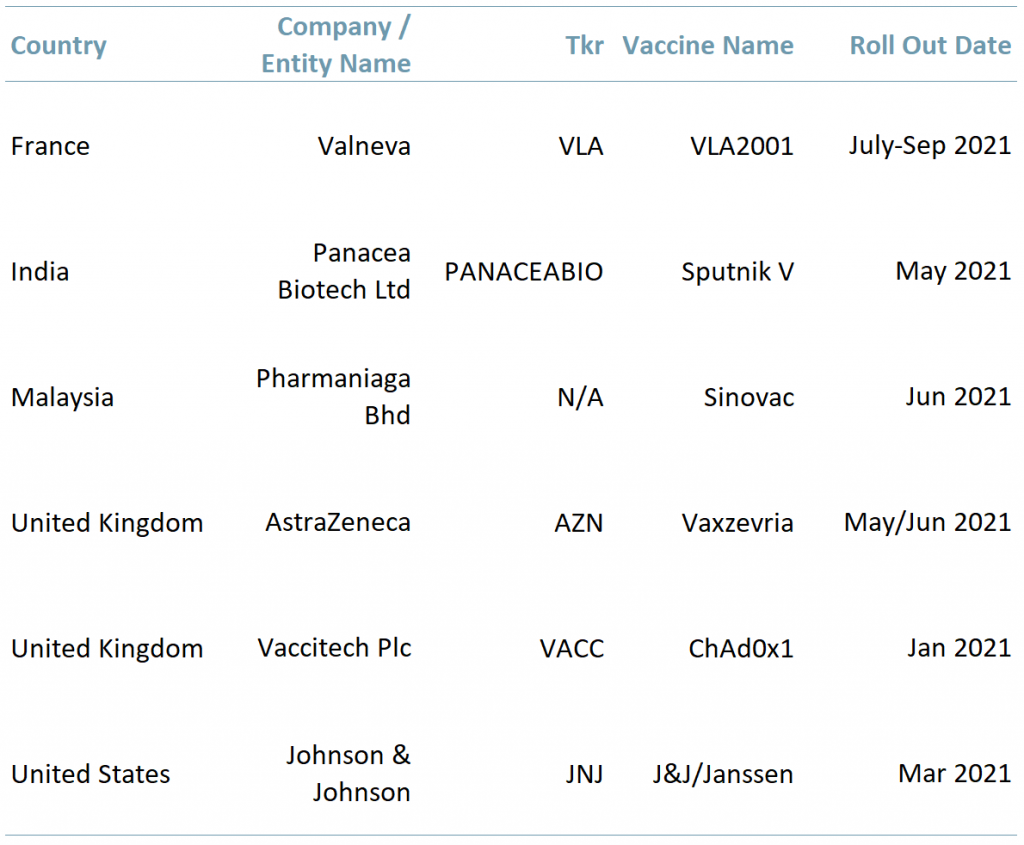

Initially only the US – $PFE & $MRNA and UK – $AZN developed successful vaccines against Covid, however several other countries are now in the Covid vaccination market at either development or approval stages (see exhibits 1 & 2 below).

Exhibit 1 – Countries with vaccines in the development stage

Sources: ACF Equity Research Graphics; Company websites; Daily Sabah.

Sources: ACF Equity Research Graphics; Company websites; Daily Sabah.

Exhibit 2 – Countries with vaccines in the approval/distribution stage

Sources: ACF Equity Research Graphics; Company websites

Sources: ACF Equity Research Graphics; Company websites

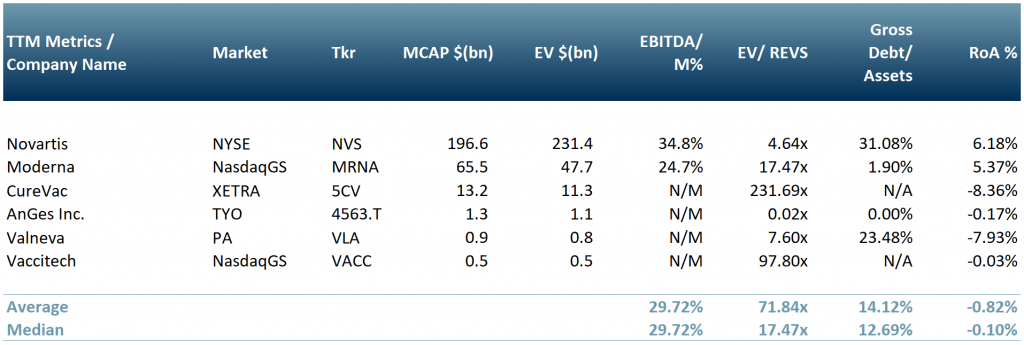

In exhibit 3 below, we show a peer group of some of the key vaccine developers/distributors: Novartis (NYSE: $NVS), Moderna (NasdaqGS: $MRNA), CureVac ($5CV: XETRA), Valneva ($VLA.PA) and Vaccitech (NasdaqGS: $VACC).

*Whilst CureVac’s vaccine is still undergoing clinical trials, it has already signed a deal with $NVS in Mar 2021 for production expected to roll out in the summer of this year.

Exhibit 3 – Peer group of C-19 vaccine developers

Sources: ACF Equity Research Graphics; Yahoo Finance; Bloomberg. Exchange Rate: (Source: XE.com) EUR vs. USD 0.821677 ; JPY vs. USD 0.0091819285;

Sources: ACF Equity Research Graphics; Yahoo Finance; Bloomberg. Exchange Rate: (Source: XE.com) EUR vs. USD 0.821677 ; JPY vs. USD 0.0091819285;

Waiving patents

The global need for Covid vaccines remains paramount, and in response the US has recently proposed to waive patents as a means to speeding control, or eradication, of the virus. Morally the case for waiving patents is self-explanatory. The economic argument is more complex.

At the short-run macro level, stopping the pandemic as soon as possible is an obvious primary priority in order to maintain economic well-being for all.

However, the micro-economic effects may have a long-run macro-economic impact in that companies may (rationally) become far more cautious about assigning valuable capital to solving the next global medical challenge / pandemic. The argument for corporates maintaining substantive margins will also become far more difficult to challenge.

Maintenance of higher margins by companies will, in turn, slow down the rollout of a global solution. A slower or more complex rollout due to higher costs is likely to extend the recovery (recessionary) period experienced by the global economy in the longer run. Higher costs, by slowing rollout, increase the risk of health / economic disasters running out of control for even the hyper-developed economies.

The vaccine roll out to date has been most successful in hyper-developed nations, developing nations continue to lag behind. Part of this observed lag in rollout is because developed nations cannot get access to enough vaccine, largely because they are unable to either afford or manufacture enough or any of the current vaccines, i.e. there is a supply side challenge / opportunity.

So, whilst the patent waiver could imply a reduction in innovation and returns in developed nations and a longer-run micro and macro-economic problem, reaching a compromise could enable the elimination, or at least acceptable control, of Sars-Cov-2 and a global economic recovery in the immediate future.

Maintaining patents

Diverse C-19 vaccines solutions and products would most likely benefit investors, the biotechnology sector, the global economy and the human populous in the following ways:

- Small and mid-cap companies will gain the opportunity to compete against large-caps and secure a place in the global market, smaller companies account for the vast majority of total global employment. Competition lowers costs and brings innovation, which in turn creates solutions and wealth.

- Investors will have a pool of biotech firms to choose from – anything from delivery chain mechanisms to new developing technologies, allowing them to design reduced risk portfolios. Ultimately, capital preservation and growth is the route out of poverty, leading to better education and so better health.

- Though no single sector will, by itself, achieve these goals, it is the marginal or incremental improvements in each sector and across entire economies that will lead to the better outcomes above.

Is there still a market Covid-19 vaccination market opportunity?

The C-19 vaccine development market remains a growth opportunity irrespective of the successful vaccine products from big pharma – e.g. BioNTech (NasdaqGS: $BNTX) / Pfizer (NYSE: $PFE). We see constant and consistent innovation in the Covid vaccine market – companies see opportunities to deliver products that will store for longer at higher temperatures and that have fewer side effects.

While the short-run efficacy of the current crop of Covid vaccines is now reasonably well established (Johns Hopkins Medicine, 2021) the longitudinal efficacy is not yet proven, suggesting there remains space for new vaccine market entrants.

The virus is not going anywhere in the near/medium-term and so the need for more vaccine types and approaches is, we assess, well established.