Is the C-19 vaccine market a solution to HIV?

Researchers from Scripps Research’s Phase 1 human trials uncovered a potential vaccine for HIV in Feb 2021. Could research connections between the C-19 vaccine and HIV pave the way for an HIV vaccine? Will Covid prove to be the unintended economic driver to accelerate HIV vaccine research?

- Scripps Research (CA, USA) and IAVI (International AIDS Vaccine Initiative – NY, USA) found promising blood-test results (currently unpublished) from a Phase 1 human trial on a new HIV vaccine strategy.

- Scripps observed an immune response – rare immune cells required to generate antibodies against fast-mutating viruses were produced in 97% of participants.

- Following decades of setbacks, these results provide a light at the end of the tunnel and also show interesting connections to the C-19 vaccine that could accelerate an HIV vaccine.

- C-19 vaccine efforts are said to have “piggybacked off the clinical, laboratory and biostatistical infrastructure” produced by the HIV Vaccine Trials Network (a US non-profit).

- “If we come up with an HIV vaccine,” William Schief (immunologist at Scripps) says, “I would think the world’s experience with the COVID vaccines might make it easier for us to deploy.”

Vaccines

Vaccines are designed to teach our immune systems to fight off viruses or bacteria. During production certain considerations are made:

- How does the human immune system respond to a particular virus/bacteria (i.e. acquired immunity) – is it able to produce enough antibodies via T or B cells?

- Which section of the population needs the vaccine and why – is there a pandemic, a particular set of social behaviours or a particular region where individuals are prone to the type of virus/bacteria?

- What is the best approach or technology needed to create a vaccine? This depends on the type of virus/bacteria we describe below.

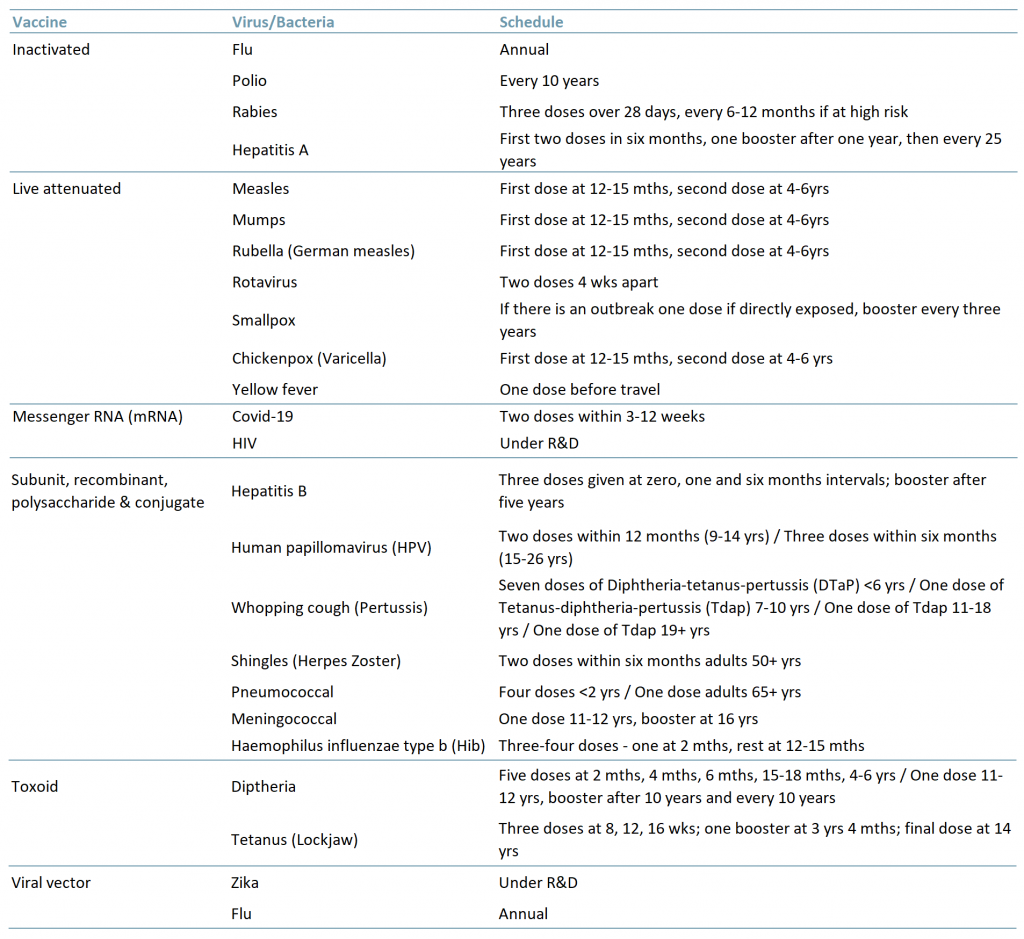

There are six main types of vaccines (Exhibit 1):

- Inactivated – The virus used in the vaccine is inactive or dead. These types of vaccines typically do not provide long-term immunity and require several doses or a refresher program.

- Live attenuated – The virus used in the vaccine is weakened/attenuated but still alive. Therefore, the vaccine is assimilated as if a natural infection and in turn can provide long-lasting immunity with just one or two doses in a lifetime.

- Messenger RNA (mRNA) – The vaccine does not use a live virus but teaches the body how to make a protein that then triggers the immune response (i.e. creation of antibodies) to fight off a virus.

- Subunit, recombinant, polysaccharide & conjugate – These vaccines use specific parts of the virus/bacteria, for example its protein, sugar or capsid (casing). As they are live parts of the virus/bacteria they also provide a long-lasting immune response however, some do require boosters because the virus/bacteria is not used in its entirety.

- Toxoid – As its name suggests, the vaccine uses a toxic protein/molecule of the virus/bacteria. Because it only targets the toxic part of the virus/bacteria and not the entire particle/cell, this too may require boosters.

- Viral vector – The vaccine uses an amended form of a different virus as the vector. Viral vector technology has been used to study the immune response of vaccines for diseases such as Zika, flu and HIV.

Exhibit 1 – Types of vaccines, related virus/bacteria and schedule

Sources: ACF Equity Research Graphics; cdc.org, ngs.uk

Sources: ACF Equity Research Graphics; cdc.org, ngs.uk

The potential for an HIV vaccine

Given the gravity of both Covid-19 and HIV, it seems the natural choice is to use an mRNA vaccine. The vaccine does not use live cells and also does not harm our DNA. In fact, as soon as the vaccine has finished doing what it needs to do, i.e. teaching our immune system to generate a protein/antibody to fight the antigen, the mRNA breaks down and is flushed out of the body within hours. (CDC.gov)

According to the HIV Vaccine Trials Network, C-19 vaccine efforts have piggybacked off the efforts for an HIV vaccine. And of course as a result of the pandemic, the HIV vaccine efforts have been placed on the back burner.

But the pandemic has reminded us that innovation is driven by stress (e.g. medical progression as a result of global or intense modern warfare) – enter in mRNA.

As with any pandemic or outbreak, the expectation is that it is short-lived (though history does not necessarily support this – the Black Death, HIV etc. Once we have a vaccine that works, infection rates contract, survival rates increase (more hospital resources become available again for each infected patient) and finally, diseases are eradicated.

Covid is unprecedented in recent times but it has opened up a vast array of opportunities for companies and investors in the Healthcare industry. We have seen a surge in ‘read-through’ start-ups from telehealth, to cleaning products, to farm robotics (circumventing Covid lockdowns) and of course CBD/THC pharma (and recreational) Cannabis products.

It is inevitable that the C-19 hype will pass and companies solely focused on Covid vaccinations will need to diversify or merge. Economically speaking, diverging into HIV vaccines is an obvious choice and given the similarities of both viruses, the transition is relatively seamless.

However, unlike Covid and though much reduced, there still remains significant stigma around HIV. No one calls their boss to tell him or her they just contracted HIV. In addition, infection rates differ significantly with ~155m Covid cases vs. ~38m HIV cases (36.2m>15yrs old, 1.8m<15yrs) reported globally (UNAIDS, 2019). [In both cases we suggest that many cases go unreported and that the real numbers are at least 20% higher.]

The challenges of an HIV vaccine

While the difference in the number of cases for both Covid and HIV are staggering, HIV is currently only a quarter of the market size of Covid on a per pop basis. So who decides on the urgency of a vaccine and how?

In developed countries, HIV is considered a ‘young persons’ disease. According to the WHO, 30% of all new HIV infections occur among the younger sexually active generations from the ages of 15-25. In addition, ~26m (68%) of those infected with HIV are accessing antiretroviral therapy (ART) (as of June 2020). ART therapies bring the HIV virus under control within six months.

This tells us two things:

- Calling it a ‘young person’s disease may be an attempt to suggest that the individuals’ immune system is strong enough to withstand the virus, thereby downgrading the importance of a cure or vaccine.

- It may also suggest that both multilaterals and the pharma industry consider that 16% of the population (un.org) is not a significant enough number to warrant a vaccine. This in part is because vaccines remain expensive to develop but the countries (in general) where vaccines may be most needed have relatively low health budgets and low income – meaning low margins for drug

- Access to antiretroviral therapy (ART) as we currently understand it does offer HIV patients longevity. 30 years ago at the start of the epidemic, life expectancy was only 1-2 years, in 1996 a 20-yr old was only expected to live to 39 and by 2011 life expectancy increased to 70 years.

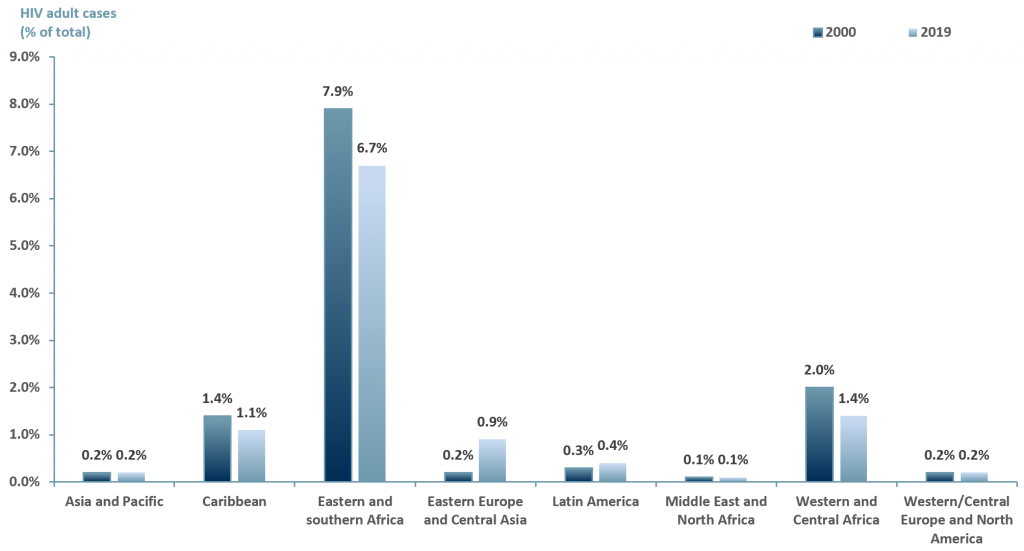

In developing nations the challenges are far greater. Not only is there the stigma, there is also a lack of resources in order to provide individuals with HIV access to ART. Exhibit 2 below highlights the prevalence on HIV by region among adults (>15 yrs old).

Exhibit 2 – HIV cases among adults (>15 years old) by region 2000 and 2019

Sources: ACF Equity Research Graphics; unaids.org

Sources: ACF Equity Research Graphics; unaids.org

Exhibit 2 suggests that over a decade, the number of HIV cases globally has decreased. However, the highest number of cases remain in Africa and the Caribbean, followed by Eastern Europe and Central Asia, Asia-Pacific and finally Western/Central Europe and North America.

The rising global vaccine market

Notwithstanding the stigma around HIV, the global vaccine market, at least in hyper developed countries, remains an attractive investment case.

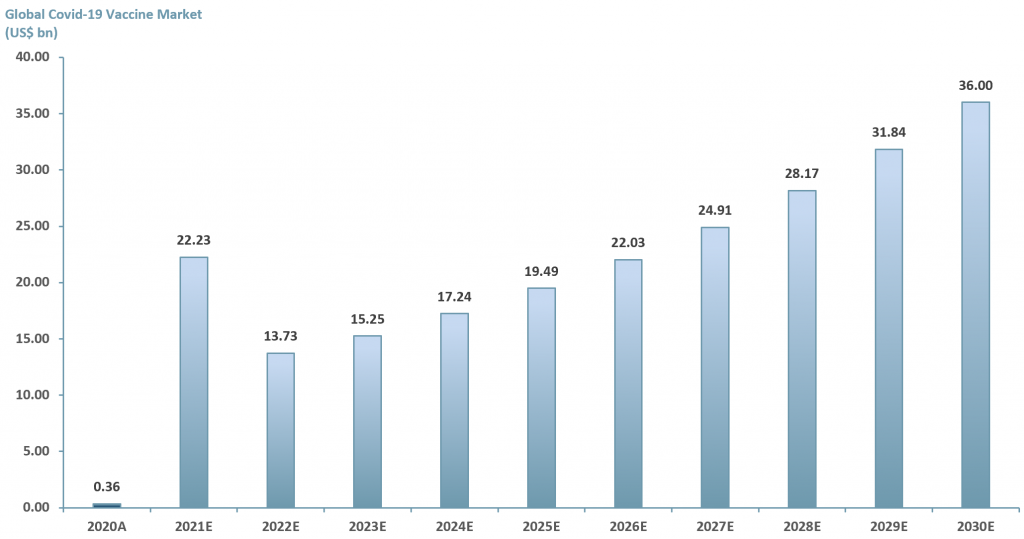

In exhibit 3 below we examine the potential of just one vaccine market – the Covid-19 market. ACF forecasts that the revenue value of the Covid vaccine market will reach >US$ 35bn by 2030E. This forecast is based on an ACF three factor growth model.

Phase 1

2021E: Growth rate 6.147% – ACF’s investment research team forecasts that global Covid vaccine market revenues will grow to over US$ 20bn p.a. YE21E at a growth rate of 6.147%. This is based on a run rate of 1Q21 revenues generated from sales of the Covid-19 vaccine of the big three players: AstraZeneca (NasdaqGS: $AZN), Pfizer (NYSE: $PFE) and Moderna (NasdaqGS: $MRNA).

Phase 2

2022E-2023E: CAGR we have assumed conservatively and that each person requires two shots of a Covid vaccine. We know, however, that this may rise to three, and if the vaccines require remodelling due to variant changes, then the number of vaccine doses per person over time will rise.

Therefore of the global population, estimated at 7.79bn, we assume there is a maximum theoretical market of 15.58bn vaccine shots, again, probably a considerable underestimate as there is a case for three shots and any new variants, if they require new vaccine versions will raise the theoretical number of shots per person. Therefore, our theoretical maximum market size starting point is probably conservative.

We further reduce the market size by assuming that an absolute maximum of 70% of the world’s population will either agree to, or be within reach of, or be old enough for, a vaccination program, within the foreseeable future. Therefore, our total theoretical total market is 11 bn vaccine doses. As of 1Q21 only 4.4% of the global population had been vaccinated for Covid-19 (Our World in Data).

Furthermore, for Phase 2 we have taken the theoretical total market of 10.9 bn vaccine doses less the 5.8bn doses we expect AZN, PFE and MRNA to produce in 2021E, resulting in a market of ~5.1 bn doses over our phase 2 growth (2022 and 2023) which is ~2.6 bn doses/year).

For 2022E revenues are forecasted at ~US$ 14bn, a -38% growth rate compared to 2021E. This is based on the assumption that all 5.8bn vaccine doses will have been administered in 2021E. Our ~US$ 14bn revenues p.a. is our estimated market value of ~2.6 bn doses multiplied by the average price per dose of the big three for 2021E – US$ 5.38/dose.

For 2023E the growth rate is based on a historical average of 11% annual growth in value (capturing wealth effects, education and vaccine innovation) plus the rate at which infectious diseases are expected to rise annually – 0.06%. Revenues forecasted at ~US$ 15bn.

Phase 3

2024E-2030E: A CAGR of 13.06% is used to project the growth of the Covid-19 vaccine market through to 2030E. We have taken a midpoint from various consensus forecasts and added the additional growth rate for infectious diseases (13%+0.06%).

Exhibit 3 – Global Covid-19 vaccine market forecast 2020A-2030E

Source: ACF Equity Research Estimates; Fortune Business Insight; Market Insight Solutions; BIS Research; Zion Market; Medical News Today

Source: ACF Equity Research Estimates; Fortune Business Insight; Market Insight Solutions; BIS Research; Zion Market; Medical News Today

Vaccines are cost effective and very powerful. We know this from experience. Therefore, the obvious choice is to continue to invest in vaccine R&D to find long-term solutions to viral and bacterial infections. For bacteria, vaccination may offer an alternative strategy to antibiotics, an avenue that is, in practice, fast approaching exhaustion (unless there is further large-scale antibiotic research).

As a result of the Covid-19 pandemic, companies and entire sectors have had to pool resources in the fight to eradicate SARS-CoV-2. Companies and sectors have diversified or pivoted their business operations both to take advantage of the market opportunity and to meet the societal and economic challenges of the pandemic.

But what will happen after Covid? How will the companies in our peer group continue to deliver FCF, EVA and superior returns for an extended period via their vaccine business units?

An obvious choice for a few is to focus on the HIV market. Given the similarities between the two, both are caused by RNA viruses and are candidates for mRNA vaccines, the opportunity is there ‘for the taking’.

As of May 2020, there were 23 companies working on a C-19 vaccine (MarketWatch) and that number is expected to grow. C-19 variants will continue to appear and better vaccines with fewer uncomfortable side-effects can gain market share, but there probably is not room for more than 5-10 providers globally at any one time. Companies working on C-19 vaccines that do not make it into the top 5-10 by sales will more than likely have to pivot and either leave the vaccine market or focus on producing vaccines for different viral conditions.

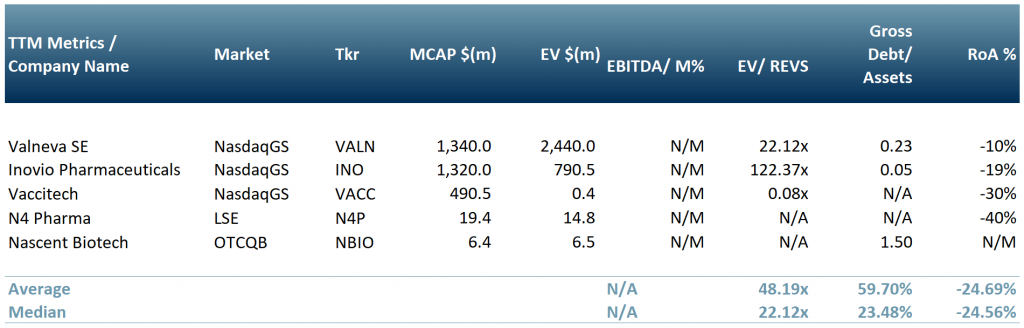

In exhibit 4, we show a peer group of five companies that are involved in producing, or are working towards, a vaccine or solution for Covid-19. Vaccitech Plc (IXIC:$VACC); Nascent Biotech (OTCQB:$NBIO) – its human anti-vimentin MAb may also block SARS-Cov-2 (SARS2) entry into cells; N4 Pharma Plc ($N4P.L) – silica nanoparticle vaccine delivery technology; Valneva SE (NasdaqGS:$VALN) and Inovio Pharmaceuticals, Inc. (NasdaqGS:$INO).

Exhibit 4 – Peer group of companies involved in producing a Covid-19 vaccine

Exchange rates: (Source: XE.com) GBP vs USD 1.4025766 Source: ACF Equity Research; Refinitiv.

Exchange rates: (Source: XE.com) GBP vs USD 1.4025766 Source: ACF Equity Research; Refinitiv.