We estimate that the robots and drones market will reach a value of $35.9bn by 2030E

The Financial Times reported recently that Covid-19 has severely impacted the agriculture sector, with farms all over the world faced with fields of fruits and vegetables left unharvested as workers are unable to work due to travel restrictions or coronavirus infections. This has raised investor interest in robotics and automation in the sector.

- According to Dealroom, a company that provides data on innovative tech companies and start-ups, farm robotics and automation sector start-ups have seen a 40% increase in funding since the start of the pandemic.

- UK farmers have ordered 40 farm robots (named Thorvald) from Saga Robotics, a private Norwegian company.

- Thorvald is able to transport crates of produce, weed and harvest strawberries (soft fruits have been notoriously difficult for robots to identify as ripe and then pick without damaging) and can kill mildew with its UV light.

In addition,

- Saga Robotics’ UV technology, known to kill viruses, attracted USD 11m in investment to further its R&D.

- Co-founder of UK start-up Small Robot Company, Sam Watson Jones, reported receiving “constant calls from around the world” as farms continue to face labour shortages.

- As every grower of berries, olives, hazelnuts, etc. faces the same problem – labour shortage – farmers worldwide have shifted their attention and interest in automation and robotics.

- Saga Robotics investor, Alastair Cooper of Agri and Food Tech VC ADM Capital, observes that the entire agriculture cycle from the preparation of soil to harvesting and storage, will be completely transformed over the next 10-20 years.

- Cooper believes “we are at the start of a revolution”.

Over the past few years we have seen major improvements in the development of digital technology, AI and engineering. One area of particular progress and growth are the technologies used to build and program robots.

Robotics and its associated AI software continues to innovate new sectors, either by replacing or for aiding the human workforce.

Most cars production is dominated by robotics and other automations. Robotic surgeons, nurses and cleaners already exist in the healthcare sector. Vision Semicon’s and R-Zero Systems’ UV-C portable sterilising units have already entered the retail sector to some fanfare.

The agriculture sector, which is a $2.4 trillion industry, is picking up speed in adopting more of these technological alternatives like the farm robot Thorvald from Saga Robotics, which ranks among the top ten agricultural robots, and Small Robot Company’ AI products – Wilma, Tom, Dick, and Harry.

What this tells us is that the interest from farmers and investors in farming robots and smart agriculture is growing and it can only be expected to accelerate as a result of Covid-19.

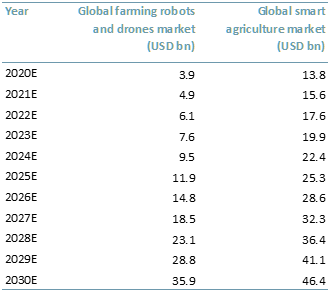

In Exhibit 1 below we present ACF’s 10 year forecasts for the global farming robots & drones market and global smart agriculture market, with a CAGR of 24.7% and 12.9% respectively.

Based on our analysis, we estimate that the robots and drones market will reach a value of $35.9bn by 2030E up from $3.9bn in 2020E. We estimate that the smart agriculture market value will reach $46.4bn by 2030E up from $13.8bn in 2020E.

Exhibit 1 – Global farming robots and smart agriculture markets 10 year forecast, 2020E – 2030E

Sources: ACF Equity Research; BIS Research; Markets and Markets; Research and Markets

Sources: ACF Equity Research; BIS Research; Markets and Markets; Research and Markets

Given these growth rates in the market, there is no surprise we are seeing a surge in demand for robots and automation in most industries followed by a wave of investments as part of a natural chain reaction.

Nevertheless, there is still an education element needed to underpin our forecasts – awareness amongst farmers worldwide might pose some restraints to our market growth forecasts.

As a research house, our bias is toward successful capital investments for all start-ups, as the majority of jobs are created by smaller companies. Education and employment leads to economic and social emancipation, which leads to rises in standards of living and elongated life expectancy.

The “Fast Start Competition”, launched in April 2020 by the UK government and managed by Innovate UK, could potentially be a launching platform for many start-up companies (agri-tech or otherwise).

Nevertheless, initiatives such as “Fast Start Competition” are only a part of the solution and are easily squandered. We believe it is essential for start-ups or any small and mid-cap company to adopt an holistic and strategic approach to their immediate and ongoing funding needs, part of which is for example, an ESG policy

Again, by way of example of the needs for holistic thinking, an ESG policy as part of core business activities is now a common market or opportunity filter for investors and so a requirement for companies.

An ESG policy is crucial in order for small and mid-cap companies to ensure their spot in the global markets and attract or maintain investments, and yet it is still only an element of an holistic strategic approach that is increasingly necessary for success.

Of dwindling value is the adviser education that encourages companies to return to markets and other funders only when they run out of cash and in exchange for a discounted equity offering – this is amateur advice at best, and at worst it is a policy of hope over strategic thinking.