The incorporation of smart technology into agriculture can help farmers manage risk

Nespresso, in partnership with Blue Marble Microinsurance (a UK company), launched a pilot weather index insurance program in 2018 to provide coverage for crop losses due to climate shocks.

The programme assists small and independent farmers in Colombia in the Andes, where they are more likely to experience excessive rainfall and frequent droughts. Droughts damage the coffee bean development and excess rain harms the coffee flowers and prevents them from developing.

Such climatic events can affect the quality and quantity of coffee produced, which in turn means these farmers are forced to find other sources of income.

As a result, Nespresso created its insurance program and in which there are now approximately 2,000 farmers enrolled. The program is run in collaboration with a Colombian insurance company – Seguros Bolivar and supported by Nespresso AAA Sustainable Quality Program.

Coverage in Colombia is provided based on a weather index called CafeSegur. The index uses satellite technology to automatically activate payments to participating farmers should there be a drought or excessive rainfall.

This process speeds up the time it takes for farmers to get compensated and it also helps farmers hold on to, and even expand on, their land.

The weather index insurance started becoming mainstream in the early 2000’s when international financial institutions, such as the World Bank, started launching and encouraging their pilot programs for low income countries. Low income countries are defined as having a GNI – Gross National Income – per capita of $1,035 or less. (The World Bank)

Its predecessor, the index insurance, dates back to 1920 when Indian economist Sukhamoy Chakravarti created an insurance product that was able to pay out claims if the level of rainfall fell below the threshold required for cultivation.

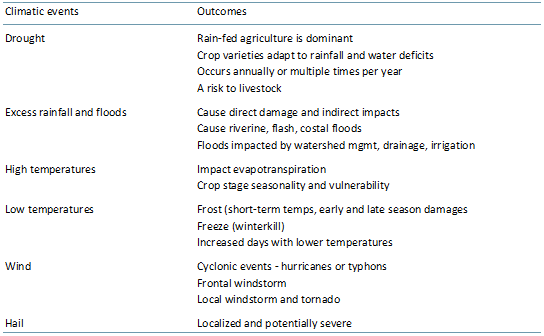

The index has since evolved to include payouts for the following – excessive rainfall, droughts, temperature, earthquakes, wind, livestock mortality and crop yields. These indicators provide a better understanding of the overall agricultural cycle and ensures that farmers get a fair and quick pay out. (IFC)

Exhibit 1 – Agriculture weather related risks

Sources: ACF Equity Research; The World Bank

A policy such as the weather index insurance can help farmers plan ahead and manage risk better in the face of a climate driven crop failure.

In addition, it speaks to the growing industry for smaller companies.

In our view, this could easily become another lucrative niche market for small and mid-cap companies and peak investor interest. It is gaining attention as a sustainable market mechanism to transfer risk in low income countries.

While there are still reservations around the index – including the level of farmer education and awareness, data availability and how the policies are targeted, gender, distribution, capturing the full value chain and establishing a proper regulatory environment – it is another signal that we are entering a new wave of innovation in global agricultural, and with innovation comes value generation.