Battle for Global Gaming

Amazon (IXIC:AMZN), one of the FANG stocks, announced on 24th September 2020 the launch of its new gaming subscription service, Luna. Amazon is in a battle for a position in the gaming market.

The gaming market is set for accelerated growth over the coming years.

From tech wars to gaming wars, the big tech giants in gaming are the FAMGA – Facebook (IXIC:FB), Apple (IXIC:AAPL), Microsoft (IXIC:MSFT), Alphabet (Google) (IXIC:GOOGL), Amazon (IXIC:AMZN),

The FAMGA are offering gaming across platforms including consoles, PCs, televisions, tablets and smartphones that are also cloud-based service offering games that can be played across

Amazon’s Luna launch is designed to compete with Microsoft’s Xbox Game Pass and Google’s Stadia.

Below are additional notable FAMGA tactical activity in the industry:

- Apple launched a new game subscription service in April 2020, Apple Arcade – a $4.99/mth subscription wherein subscribers get access to more than 100 mostly kid-friendly games.

- Microsoft acquired games developer ZeniMax in Sept. 2020 for $7.5bn.

- Facebook acquired PlayGiga (a Spanish cloud gaming start-up) in Dec. 2019 for €70m. (c.$78m)

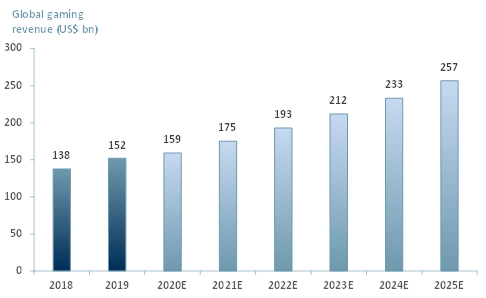

Recent data shows that the global games market is expected in 2020 to generate revenues of $159bn up from $152bn in 2019, a 4.7% increase. See our post 2020 forecasts in Exhibit 1 below.

The growth in the gaming market has been partially Covid-induced. Lockdown measures drove an increase in the number of individuals turning to gaming to fill the void. Lockdowns have lasted long enough to create habit forming behaviours.

In Exhibit 1 below we forecast that the gaming industry will reach $257bn by 2025 based on a CAGR of 10%

Exhibit 1: Global gaming market revenue, 2018 – 2025E

Sources: ACF Equity Research; Newzoo

Sources: ACF Equity Research; Newzoo

We are becoming a digital-centric society. While gaming is not a new phenomenon, Covid has definitely put it back on the map.

Lockdown has forced us all to be heavily reliant on technology and digital avenues in order to have access to basic every day necessities. These avenues are also a source of comfort and entertainment.

It will be no surprise if the gaming industry continues its accelerated growth long after C-19. In turn this suggests game developer start-up opportunities.

Given the UK’s talent pool of creativity in gaming and film (they are increasingly related and interwoven industries), we would look at home for new investment opportunities.

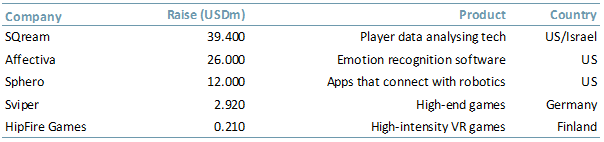

From VR, to technology that can detect a player’s reaction, to kids’ robotics; the list below showcases some noteworthy online gaming start-ups in 2020.

In the list of start-up raises below – Sqream, Affectiva, Shpero, Sviper and HipFire – there are no UK entities, but we are watching out for them and want to know about them this year and in 2021.

Exhibit 2: Global noteworthy gaming start-ups, 2020

Sources: ACF Equity Research; Fingerlakes1

Sources: ACF Equity Research; Fingerlakes1