The millennial investor boom

Millennial investors, born 1986-91, since Covid struck, have Wall Street taking them seriously. Millennials are the new generation of smartphone day traders.

- Millennials own 7% of the US total wealth (USD 9.1 trillion) compared to the 26% of baby boomers at a similar age (born between 1946-64).

- This wealth is expected to increase as millennials acquire it through savings or inheritances. $1.3trn of investible assets is passed down through generations every five years. Cerulli Associates (a US research company) estimates that millennials will inherit as much as $22trn by 2042.

- Covid may put a dent in this $22trn flow through to millennials via higher taxation, but the overall trend stands.

- Pension policy changes and advancements in technology, are also a driving force for this trend.

Pension policy changes:

- In the 1970’s pension schemes were most commonly of the “defined-benefit” (DB) flavour, which meant that beneficiaries received a fixed income based on their final salary and had no input as to how their funds were invested.

- In the US in 1978 the 401(k) was created. This is a “defined contribution” where the employee contributes to their pension plan and the employer matches the contribution.

- Assets under the 401(k) have largely exceeded those under the DB as of 1995.

Advancements in technology:

- Electronic trading is now cheaper and easier. The cost of investing $100 on an exchange has decreased to less than a thousandth of a penny today compared to $6 in 1975.

- In 2019 Charles Schwab (SCHW: NYSE), E*Trade (a subsidiary of Morgan Stanley (MS: NYSE) as of Feb. 2020), Fidelity and TD Ameritrade (AMTD: IXIC) cut commissions to zero following in the footsteps of “Robo-Advisor” Robinhood.

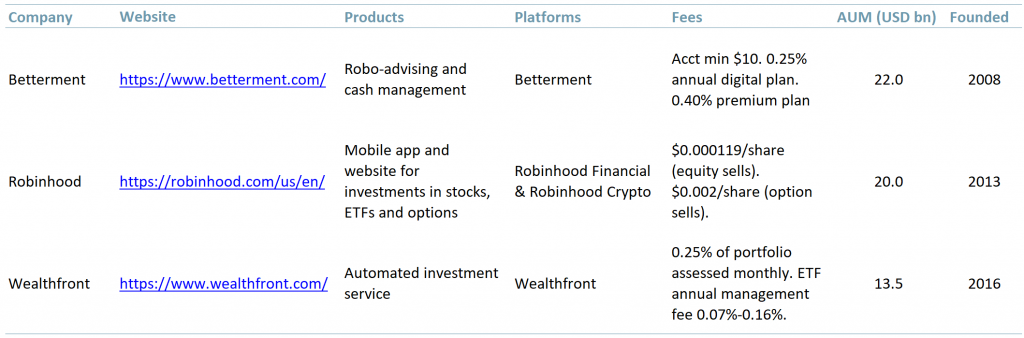

- “Robo-Advisers” (digital trading platforms that allocate assets across low-cost index funds based on age and risk-preference, for a low fee) are becoming increasingly popular. These include Robinhood, Betterment and Wealthfront (Exhibit 1).

Exhibit 1 – Select US Robo-Advisers

Source: ACF Equity Research

Source: ACF Equity Research

There is a new generation of investors emerging.

Millennials have cash, ambition and drive. They are willing to put their money where their mouth is, and they coming to prominence.

Millennials are eager to invest, but it is about investing appropriately and with purpose. It is not just about making a ‘quick buck’. It is about making an investment that is ethically and morally valuable.

These investors are trading on the basis of company information that is publicly available. This means that businesses need to make sure that the ‘right’ story is told in order to increase investor interest.

Telling the right story must be done more than once and consistently. Consistent story telling is only consistently effective via a third party. For corporates this means through financial markets research that is distributed on the right platforms to the right audiences/investors. In the small and mid-cap markets this approach attracts supportive investors and thereby creates opportunities for small and mid-cap companies.

It is not sufficient to simply post financials or RNSs linked to financials. Millennials are going to want to know the whole story. They are looking for the nuances that turn these companies into investment opportunities. And if you do not tick their initial boxes, it is already over.

Millennials may be young investors, but they are coming to power and influence – are Wall Street, London, other major exchanges and their listed companies ready for them?