Cancer testing backlog 2023 – biotech rescue?

There is a new hidden epidemic of missed cancer cases due to the Covid-19 pandemic. Prior to 2020, diagnosis and treatment capabilities as well as cancer survival outcomes had improved. In November 2022 Prof Mark Lawler said to the Guardian Newspaper that he estimated over 1m cancer diagnoses were missed in Europe because of the Covid-19 pandemic.

As a result of Covid, the number of people screened for cancer dropped in the United States – in 2020 an estimated 9.4m missed screening tests.

- The European Cancer Organisation (ECO) estimated that 100m EU individuals missed cancer screening tests in Europe in 2020 and an estimated 1m have undiagnosed cancer. The main drivers were the imposed lockdowns and distancing rules.

- ECO found that different types of cancer screenings decreased more than 40% compared to pre-pandemic period. Cervical cancer screening had the biggest decline at 51.8%, followed by breast cancer screening (46.7%) and colorectal cancer screening (44.9%). (Medicine Maters, 2021)

- In the US, according to the CDC National Breast and Cervical Cancer Early Detection Program, during April 2020 breast cancer screening tests declined by 87% and cervical cancer by 84%. The data was compared to previous 5-year averages. (Medicine Maters, 2021).

Covid changed the priorities of healthcare services, diverting resources. Now, two years on, as healthcare has learned and found ways to manage the pandemic, cancer screening has moved to the forefront.

The American Cancer Society (ACS) launched its Return to Screening initiative in Feb 2021 to bring cancer screening rates back to pre-pandemic levels.

The pandemic has increased the market opportunity for biotechs in the oncology space. Prior to Covid, the prevalent challenge was access to medicines despite advancements in prevention, early detection and treatment. Covid created a new challenge – ability to deliver timely cancer screening, which ultimately increased the number of undiagnosed cases and reduced the availability of treatment options.

The gap created in cancer screening has created a disruption that will have a global knock-on effect for years to come. More initiatives such as the Return to Screening will need to be adopted worldwide. It is not just a need to redirect assets back to cancer it is also about awareness for doctors and suffers alike – early diagnosis is still key to long run successful outcomes for those individuals that develop cancer – that is about recognising symptoms early both for physicians and patients.

The global cancer diagnostics market opportunity

Big pharma and big biotech companies have taken the opportunity to grow their oncology portfolios. The global cancer diagnostics market size is expected to reach US$ 261.34bn by 2027E, up from US$ 137.58bn in 2021A. (Market Watch, 2022)

Treatment of existing (chronic) health conditions has been/was postponed during the coronavirus pandemic. Moreover, screening for potential new health issues such as cancer was also delayed and, inevitably, de-prioritised.

The World Health Organisation (WHO)’s latest Global Pulse Survey on the “continuity of essential health services during C19 pandemic” showed a 5 to 50% “disruption in cancer care” in 4Q21. The survey considered both screening and treatment in countries around the world).

In our assessment the key to early detection for cancer patients is not just to increase the number and regularity of screening tests (so more resources) but to increase the efficiency and effectiveness of the tests themselves. They item is easier to perform, ideally to make them OTC. With an OTC product come inevitable economies of scale (reduction in costs). This is a virtuous circle, with more testing will come a larger addressable market with greater chances of long term cure, this in turn will attract more capital to the section and so more innovation.

Scientists are on track with a solution through the development of new multi-cancer early detection (MCED) tests to detect cancer faster and at earlier stages.

In 2022, the pathfinder study showed that with a blood test the “new MCED tests can detect a common cancer signal from over 50 different types of cancer and predict where the signal has come from in the body.” (ESMO, 2022)

As we described above, biotech companies focused on cancer detection could benefit from both the new cancer screening developments to enlarge the market and make successful outcomes more likely. Biotechs also have an opportunity via the provision of tests. We observe the vertical integration of therapy plus test growing in popularity as a biotech business model.

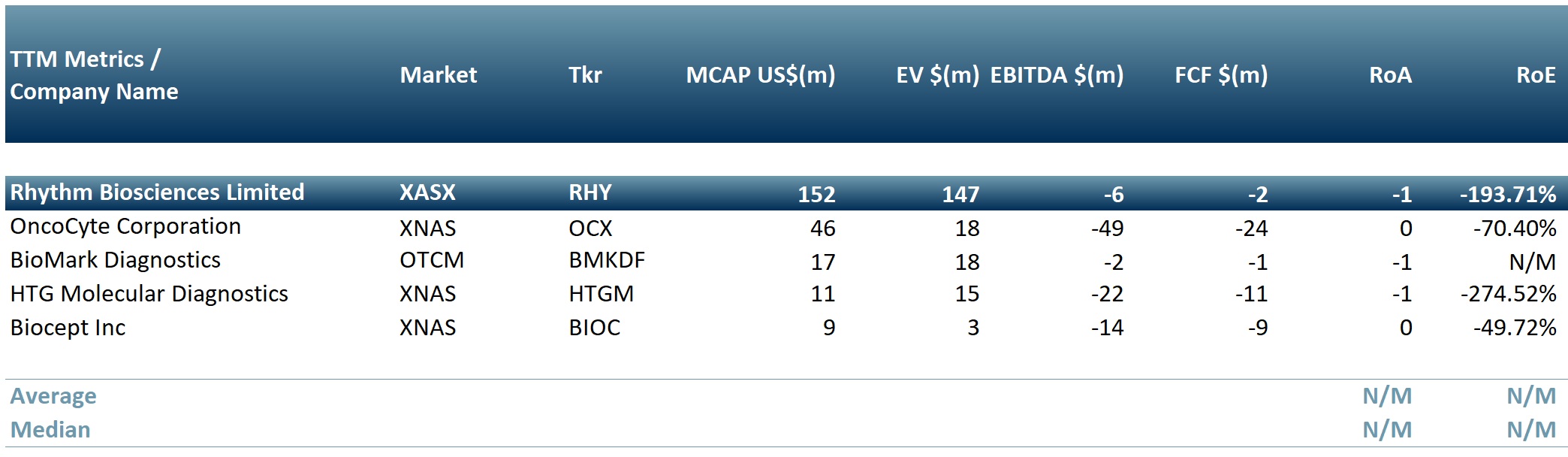

In exhibit 1 we present a peer group table of biotechnology companies that provide cancer screening tests: Rhythm Biosciences Limited (RHY.AX), OncoCyte Corporation (NASDAQ: OCX), BioMark Diagnostics Inc (OTC: BMKDF), Biocept Inc (NASDAQ: BIOC), HTG Molecular Diagnostics Inc (NASDAQ: HTGM)

Exhibit 1. Peer group table of biotech companies producing cancer screening tests

Sources: ACF Equity Research; Refinitiv.

Sources: ACF Equity Research; Refinitiv.