DB pension transfers condemned by FCA

The UK’s FCA investigated the DB market in June 2020. Suspicions arose as to the suitability of advice given on DB pension transfers.

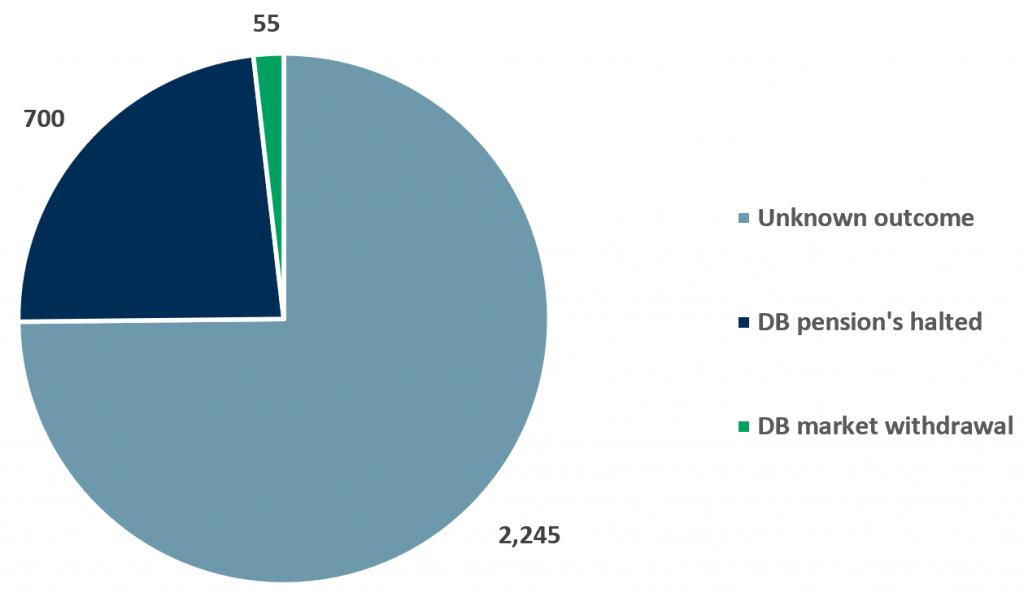

The FCA has combed through the defined benefit market collecting data on over 300 firms. Exhibit 1 illustrates the outcome of these investigations.

As a result of the FCA’s enquiries the following changes have occurred to the DB advice market:

- 55 companies withdrew from the DB market as they did not have adequate indemnity insurance;

- 700 companies halted their DB pension related activities;

- No data provided on the remaining 2,245 companies that were audited – they were neither endorsed nor penalised publicly.

Exhibit 1 – Firms audited by the FCA, June 2020 outcomes

Sources: ACF Equity Research; FTAdviser

The FCA has also witnessed firm owners making structural changes to avoid liabilities and reduce financial resources. These decisions would be detrimental in rectifying poor advice – the FCA has promised to act upon this.

Despite the above, the DB pensions transfer market has seen some improvements. The FCA reported an increase in advice suitability in the 85 most active firms; an increase of 60% in 2018 compared to 47% in 2015.

However, the concern remains that a lot of companies are still failing to collect basic data and information from their customers in order to provide suitable advice.

Christopher Woolard, interim chief executive of the FCA, has condemned the abnormal number of customers advised to transfer out of their Defined Benefit pensions. The FCA is working hard towards improving the quality of advice in the market.

Tideway Investment Group, a UK based firm, is the latest to have been targeted. Following the FCA’s directive, it has had to close all pension related activities – advisory, pipeline businesses and asset retention requirements.

In response, Tideway Investment Group declared that it would concentrate on growing its wealth management business during this time and until the business review has been completed by TLT LLP (a UK law firm).

Tideway is just one of many firms forced to pause defined benefit related business activities.

The FCA’s primary focus is to regulate financial services firms and this is how it acts in practice in the best interests of consumers and retail investors.

Due diligence is an essential part of a company’s core business activities and best practice routines. It should be one of the pillars upon which a company’s business model is built.

So much can go wrong and so quickly that permanently scars the lives of individuals.

Regulations may be lengthy and confusing, therefore it is essential that companies have a dedicated team to oversee these guidelines.

In times of uncertainty, i.e. a pandemic, regulatory requirements are under scrutiny. Companies inevitably look for loopholes and the regulators are inevitably focussed on closing those very same loopholes. The aftermath is usually more regulation rather than less. We envisage the FCA is gearing up to fill loopholes…backed by more legislation.

Companies need to prepare for the inflexibility of regulatory bodies. Being whiter than white makes ever more sense and arguably becomes a requirement to manage costs and risks. Companies and their advisors will need to display ever more evidence of their compliance and good conduct.