Peloton has it right

Peloton – US exercise equipment and media co. – announced on 10 Nov a partnership with Beyoncé. Peloton will create fitness classes for HBCUs.

- Peloton Interactive Inc. (IXIC:PTON) has partnered with Beyoncé to create a series of classes based around Homecoming.

- Homecoming is an annual celebration carried out at historically black colleges and universities (HBCUs) in the US.

- The workout classes will include yoga, meditation, cycling and running.

- Peloton, like other tech companies, is concerned it will be pushed out as the Covid-19 pandemic gets under control via vaccine delivery.

- The expectation is that as people resume normal activities, there will be less of a need for work-from-home technologies.

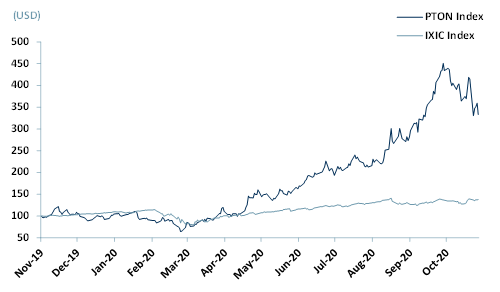

In Exhibit 1 we have charted the share price of Peloton vs. the NASDAQ. The movement over a 12-month period indicates that tech companies such as Peloton are outperforming the NASDAQ.

Exhibit 1 – Peloton vs. NASDAQ (IXIC) share price, 2019-2020

Source: ACF Equity Research graphics

Source: ACF Equity Research graphics

We do not agree that the need for work-from-home will drop off as dramatically as our exhibit 1 chart suggests the markets currently think it will. The software sector growth triggered by Covid will continue even if at a slightly lower rate.

Nevertheless, Peleton’s strategy makes sense in order to capitalise on the opportunity the pandemic has created and retain market share.

In our view, the return to the office will come in four stages and the sector read-through effects are probably counter-intuitive:

- In the short run – people will likely work from home 2-3 days a week and be in the office some of the week – rationally these days are likely to be Monday, Tuesday, Wednesday and or Thursday.

Read-through – positive for central city retail sector and the travel sector.

Driver for chain shops to migrate to local high streets. Extra local trade could encourage and support specialist local independent retailers, if they can compete with the rents extra competition from chains will bring over the mid-term.

- Over the mid-term – companies will examine their need to take on new office space with a different set of calculations and be ever more opposed to signing up long leases.

Read-through – positive driver for the survival of firms that let space like WeWork (though we don’t think WeWork will survive).

Driver to support commercial property sector prices – but change of type of tenant and fit out requirements. Fit out changes are good for the construction sector;

- Over the long-run companies will still want offices but the office capacity requirement will change as essentially only half the office space will be needed, based on rotation of people coming in or out during the week.

Read-through – consumers will have more disposable income in cities as travel costs make up a very significant proportion of disposable income for median wage earners in white collar jobs.

- Culture change – some firms will grow big and never have more than a small office dominated by meeting room space.

Read-through – positive for the travel sector, driver for more international travel to meetings via a diversion of budgets from rental costs to meeting costs.

Peleton’s strategy remains credible in the light of our views on which sectors will benefit from the cultural change the pandemic has accelerated and the sector read-throughs we have identified above.

Affluent artists/millennials have long been partnering with well-known brands – from Kanye and Adidas to Taylor Swift and Unilever’s Cornetto.

It is no surprise that tech companies such as Peloton see this as an opportunity to maintain their ‘relevance’ post-Covid.

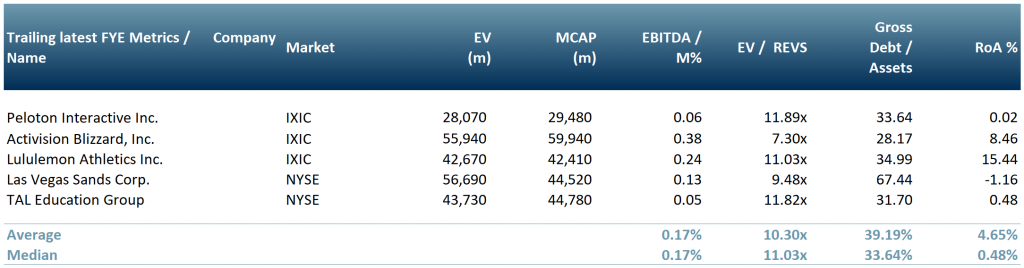

In Exhibit 2, we show our peer group involved at one level or another in software (gaming and educational), sports equipment and apparel and other consumer goods that have become popular during the pandemic.

- Peloton Interactive (exercise equipment and media), Activison Blizzard (gaming), Lululemon Athletics (sports apparel), Las Vegas Sands (gaming/online casino) and TAL Education (online education and training).

Exhibit 2 – Work-from-home products company peer group

Source: ACF Equity Research graphics

Source: ACF Equity Research graphics

Peloton’s audience is strategically targeted. The pandemic also brought the spotlight on the Black Lives Matter (BLM) movement.

Now more than ever, millennials are interested in a cause. They are looking for opportunities that are globally beneficial on multiple levels

Millennials are interested in the environment but also in the well-being of its citizens. This involves basic human rights, work-life balance, diversity and an overarching support from governments.

Partnerships such as the Peloton and Beyoncé one, are a direct reflection of that. In our view, we can expect to see more similar partnerships emerge as the opportunities created by the pandemic.

Ground gained (market share) by particularly successful tech companies will attract competition. The new ground already won needs to be defended and more ground taken – grow or die, that is the nature of business. Peloton’s solution looks timely and on point.

Authors: Renas Sidahmed and Christopher Nicholson – Renas is a Staff Analyst and part of the Sales & Strategy team at ACF Equity Research. Christopher Nicholson – Christopher is a founding executive, MD and Head of Research at ACF Equity Research. See their profiles