ESG Indices Outperform

Investor’s growing interest in ESG is driving funds into sustainable investments. Companies must develop sustainable policies now or risk falling behind.

Key Points:

- S&P Global forecasts that assets in sustainable investment products in Europe will reach €7.6trn over the next five years. At this rate they will outnumber ‘conventional’ funds. ACF estimates that global ESG filtered funds will reach $25 trillion by YE20

- A recent report from the Forum for Sustainable and Responsible Investment (US SIF) found US AUMs using sustainable investment strategies expanded by US $17.1trn in 2019, up 42% from US $12trn in 2018.

- ACF’s own analysis shows ESG indices are beginning to outperform non-sustainability indices on a consistent basis over time. For example, the Dow Jones Sustainability World Index has outperformed many of the global major indices (e.g. S&P 500 and Dow Jones) over the past three years.

- S&P’s Global Corporate Sustainability Assessment (CSA) is an annual evaluation of companies with sustainable business practices. Other financial institutions (e.g. Citibank) are carrying out similar analyses.

- S&P’s CSA has been running since 1999 and in 2020 had a record number of participating companies (~1,400 or 40%). Those invited to participate are ~3,500 of the largest companies globally by market cap.

- The survey consists of 2,800 total data points (private and public).

- The CSA looks at a wide variety of data points in assessing a company’s ESG score, ranging from climate strategy to human rights.

- The assessment observes not only the company’s strategy but also how it compares against its peers, how it improves each year, how difficult the targets are to reach and how transparent the company is.

- The newest category for which the CSA is trying to collect a reliable data set, is equal pay. By asking for information from companies on employee pay the CSA aims to create a score on how equal the pay is throughout the company.

- While the ESG scoring process is slow – it requires the submission and assembly of a lot of private data – more companies are taking part each year; ACF expects it to become a significant element of ESG investment filtering within 18 months.

There is a clear trend that sustainable investing is becoming a key focus for many investors. The US SIF estimated that in 2019 33% of total US assets under management used sustainable investment strategies as part of their investment filtering process.

2020’s turbulent year of investing has accelerated the uptake, interest in, and importance of, sustainable investment filtering.

Current data demonstrates sustainable investing is not an overall additional financial burden.

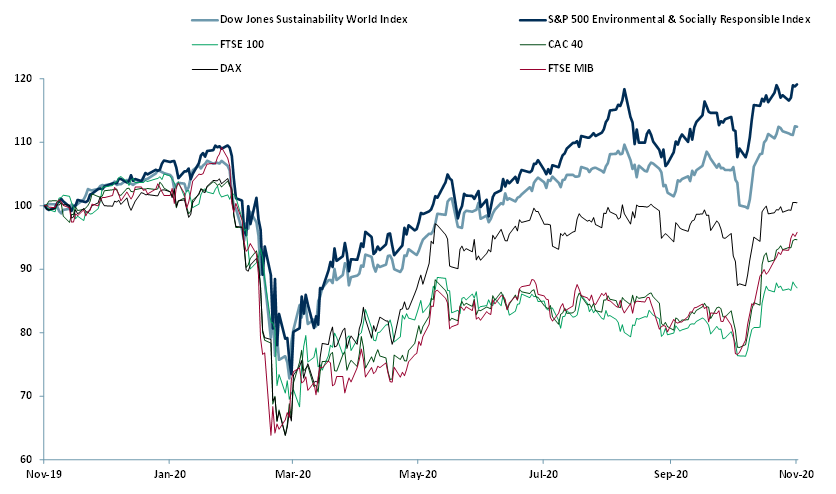

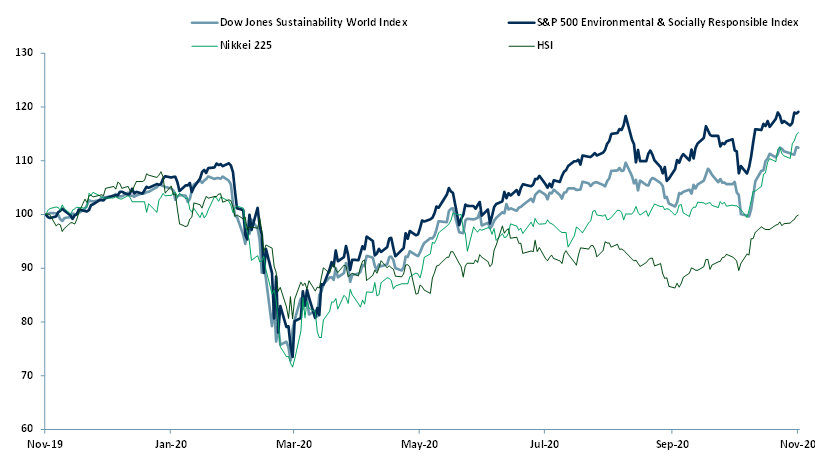

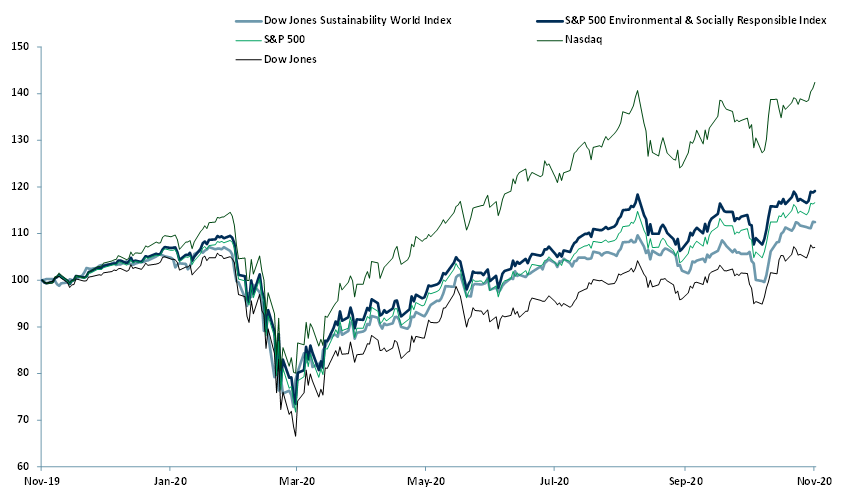

Exhibits 1, 2, and 3 price relative charts below show how major global indices have performed against the Dow Jones Sustainability World Index (W1SG1) and the S&P Environmental & Socially Responsible Index (SPXESRP) over the last 12 months.

The outperformance difference of sustainability (ESG) indices is increasing and in particular, this outperformance is enhanced during periods of crisis and rebound in capital markets. Only the Nasdaq, dominated by the MFANGs -Microsoft (MSFT), Facebook (FB), Amazon (AMZN ), Netflix (NFLX), Alphabet (GOOG), which have been particular and exceptional beneficiaries of the C-19 pandemic, has outperformed sustainability indices this year.

Exhibit 1 – Price relative DJ Sustainability World Index, S&P 500 ES Responsible Index vs. major European indices 2019-20

Source: ACF Equity Research

Source: ACF Equity Research

Exhibit 2 – Price relative Dow Jones Sustainability World Index, S&P 500 ES Responsible Index vs. major Asian indices 2019-20

Source: ACF Equity Research

Source: ACF Equity Research

Exhibit 3 – Price relative DJ Sustainability World Index, S&P 500 ES Responsible Index vs. major US indices 2019-20

Source: ACF Equity Research

Source: ACF Equity Research

The data shows that ESG can be a priority whilst also giving returns to investors that outperform major indices in the long, medium, and short term.

The way in which ESG is measured is also evolving as we have seen from the S&P Corporate Sustainability Assessment (CSA).

We believe that ESG will soon become a pillar of corporate structure and planning. All companies, small cap to large, would therefore benefit from developing their ESG strategies or risk falling behind and missing out on future investors cash or paper support.

There remains an opportunity to get ahead of the curve, but probably not for long. The opportunity to be ‘first’ or even ‘second’ has passed, it is now about being slightly ahead of the coming wave or avoiding the laggard perception.

Building in-depth and transparent policies now will still allow smaller and mid-scale companies to position themselves as forward thinking. Whatever the scale of the company, from our own analysis, it only enhances the investment case and shareholder returns for nano to mid-cap companies if they start the journey sooner rather than later.

Sam Butcher is a Junior Staff Analyst at ACF and Renas Sidahmed is a Staff Analyst and part of the Sales & Strategy team at ACF Equity Research. See their profiles here

![Climate change and the [re]emergence of millet Climate change and the [re]emergence of millet](https://acfequityresearch.com/wp-content/webpc-passthru.php?src=https://acfequityresearch.com/wp-content/uploads/2023/08/ACF_Millet-a-new-sustainable-market-_Twitter-470x320.jpg&nocache=1)