Millennials – the new investment prescription

The asset management industry is changing. In 2020 the maturing millennial investor generation created a shift in investment products, funds and tactics.

- The asset management business’ foundation is that the future is somewhat known or at least one can assign a probability to a range of outcomes.

- US-Canadian economist John Kenneth Galbraith says there are two kinds of people that create forecasts – “Those who don’t know and those who don’t know they don’t know.”

- The Economist’s November special report speculates what the future will hold the for the asset management industry. Below are potential changes or extensions of new trends (we add some additional colour):

- By 2030, the industry will consist of a small group of large generalist and dominant fund managers and a bigger group of niche FMs (e.g. ETFs and index-tracking funds). The relevance of niche managers relates to increased longevity of investments due to issues such as climate change.

- Nevertheless, competition will increase between products (if not between asset management companies) as the targeting of funds and the demands of investors continue to bifurcate (or put another way, more niches develop). Evolution shows similar patters but over geological time. A current industry challenge is finding ways for retirees to draw on funds without running out of money too quickly.

- Millennials will demand more tailored products, even though their current share of wealth is small relative to other generations, it is growing. (According to BlackRock ~US $13trn on financial and non-financial assets will be inherited by millennials between 2020-2050.)

- Baby boomers (born between 1946-64) en-masse only had access to mutual funds with relatively high fees or even more expensive personal broker services, most of which disappeared in favour of semi-bespoke funds. In tailoring parlance – something more akin to the ‘stock special’ replaced the fully bespoke product.

- Millennials (born between 1981-96) now have access to tech where they can buy/sell shares at virtually no cost, i.e. via “robo-advisors” ( Please see our blog “The millennial investor boom“

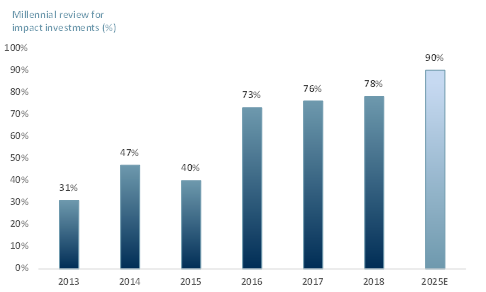

In Exhibit 1 below, we illustrate the increase of high net worth (HNW) millennial investors that are checking/reviewing their portfolios. We forecast that this number will reach 90% by 2025E. Our forecasts are driven by two broad sets of drivers:

1) Technology, policy and education will make it easier and quicker to do and understand.

2) The weighting or mix of the population looking at pensions and pension planning will shift toward the younger generations with differing attitudes, expectations and values.

Exhibit 1 – HNW Millennial review of portfolio 2018

Sources: ACF Equity Research Estimates, ACF Graphics; Bank of America

Sources: ACF Equity Research Estimates, ACF Graphics; Bank of America

- By 2030, ESG will become mainstream and amalgamate into one type of product, probably it will become the standard pension product.

- ESG is showing every sign of becoming a regulatory requirement, at least in Europe, under Mifid II in 2021. We expect major exchanges to follow suit in time.

- Large FMs are already leading the trend and may soon decide to use their voting power to influence firms.

- As a result, the ‘hype’ will fade and the expectation is that the lack of a sustainability or ESG policy will simply preclude firms, larger or small, from accessing capital markets for debt of equity.

- Sustainability and ESG also have the consequence that they make offshoring, where businesses have less control of processes and products, a riskier venture. This is likely to lead to an acceleration of the trend to revert to onshoring rather than offshoring.

- Inevitably, capital markets are the main driver for diversifying risk by geography. – If geographic diversification injects higher risk and so higher costs to access capital, companies will stop geographic production diversification.

- Companies with a lower cost of capital are much more likely to outperform their peers over time.

The asset management industry is changing. The current broker model, in too many cases, is outdated.

The millennial cohort is increasing and they are less interested in the traditional broker model.

Millennials want to fully understand the whole story before making an investment decision. Millennials want to compare the company peers before making an investment decision (this used to be the mantra only of professional investors). Investors, in particular millennials, will expect full transparency.

Nano to mid-caps need to take millennials and their thinking and drivers into consideration when looking for investors. Smaller companies must take their own initiatives and not rely on large fund managers to take the lead or show the way.

In addition, while implementing an ESG policy is currently an initial driving factor of investor interest, making sure that that message is heard is key.

As the investment industry moves towards niche products, smaller companies can get ahead of the curve by having such practices in place now.

Transparency, by instilling a degree of credibility and inviting third party review, helps investors toward the conclusion that companies are candidates for investment.

![Climate change and the [re]emergence of millet Climate change and the [re]emergence of millet](https://acfequityresearch.com/wp-content/webpc-passthru.php?src=https://acfequityresearch.com/wp-content/uploads/2023/08/ACF_Millet-a-new-sustainable-market-_Twitter-470x320.jpg&nocache=1)