Iron: 2020’s Strongest Performing Commodity

Iron is on course to average $100/ton in 2020, the first time since 2013. China’s demand for iron ore, used in construction, is driving prices.

Key Points:

- Iron ore is the best-performing major commodity of 2020, up almost up 38%. In contrast, gold is up about 24%.

- On Friday 20th November Iron ore prices were at $129.50/ton, just shy of the year high of $130/ton.

- The increase in prices has generated huge profits for Anglo American (AAL:LSE), BHP (NYSE: BHP) and Vale (NYSE: VALE) as well as other big producers including Rio Tinto (NYSE: RIO) and Fortescue Metals Group (FMG:ASX).

- Two major factors have propelled iron ore higher this year – booming demand for iron ore in China and supply disruptions in Brazil.

- China’s industrial production increased 6.9% y/y in October, while investment in infrastructure rose 7.5%.

2020 has been a challenging year for investors as Covid-19 has swept across the globe. Many investors moved into gold (Ag), the traditional metal investment, causing prices to exceed $2,000/ounce this year.

As a result of Covid, safe haven commodities are the go-to investment. However, industrial metals have also shown substantive price increases, e.g. copper (Cu).

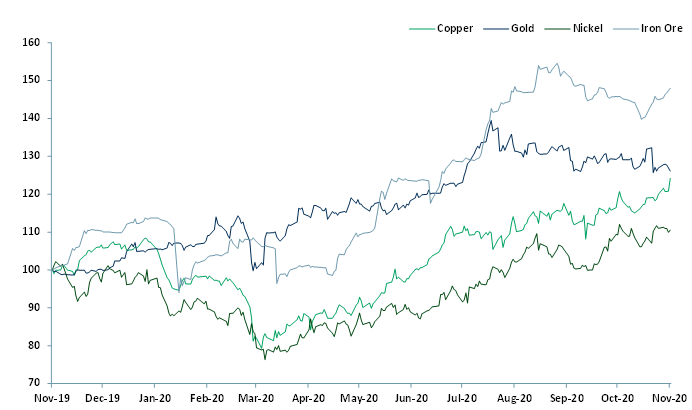

In Exhibit 1 below we show how gold (Ag), iron (Fe), nickel (Ni) and copper (Cu) have changed in price over 12 months, as a price relative. Gold’s 52-week price is volatile, making iron the better investment choice.

Exhibit 1 – Gold, Iron, Nickel and Copper price relative Nov 2019 – Nov 2020

Source: ACF Equity Research

Source: ACF Equity Research

The increase in the iron price is on the back of the surprising pace with which the Chinese government has been able to restart its economy post the Covid crash.

Three out of the top four Iron ore mining companies by mass in 2019 mine out of Australia. Therefore, it is important to watch how the cyclone season in Australia effects exports as any disruptions will boost iron prices.

It is also interesting to observe the pace and efficiency of Vale’s production recovery in the face of Covid. Vale is Brazilian, and the world’s 2nd largest iron ore miner. Because of Vale’s global position in iron ore production, the speed at which Vale can get back to full or near-full production of iron ore, has a supply side influence on iron ore prices.

If the world produces more iron ore, all things equal, the price falls or at least rises less aggressively.

Vale produced 302mt of iron ore in 2019, accounting for 12% of the total global production of 2.5bnt extracted by YE19 (US Geological Survey).

Even if European imports increase to normal levels pre-Covid-19, they only make up a small proportion (10.1%) of total global imports (2018, 155mt). Asia was responsible for ~85% of total global iron ore imports in 2018 at 1.65bnt. Therefore, a recovery in demand from Europe for iron ore is not as important as Asia’s economic recovery so far as iron ore prices.

This leads us to believe that a vaccine rollout in 2021 will not affect the iron price much with Asia, specifically China, already importing more than the previous year.

In the long term, a push to a carbon neutral future will see the demand for the metals Nickel (Ni), Cobalt (Co), Lithium (Li) Manganese (Mg) and Copper (Cu) increase as will demand for many if not all of the 17 rare earth elements (REEs).

We do not envisage this rise in demand for carbon neutral metals reducing the demand for iron ore. The carbon free technology required to power the economy is very metal/mineral intensive.

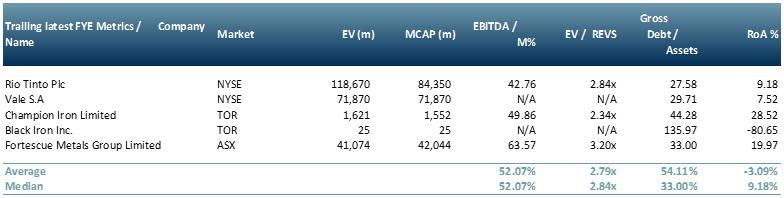

In Exhibit 2 we show a peer group of Iron mining companies – Rio Tinto Plc, Vale S.A., Champion Iron, Black Iron and Fortescue Metals Group.

Exhibit 2 – Extractives company peer group table

Source: ACF Equity Research

Source: ACF Equity Research