Lithium structural shortage – the end of mass EVs?

Lithium Carbonate prices are down 70% at ~$25,000/Mt, since the all-time highs of November 2022 and a surplus is evident so far in 2023 – China ended cash EV subsidies for households and there is temporary surplus of lithium-ion batteries, leading to product discounting. Nevertheless, lithium (Li) is still in short supply by any other measure.

Not enough lithium is extracted from mines to meet increasing expected demand. The time horizon for lithium mining production growth falls somewhat short of future demand growth expectations. Without structural change, Inevitably, lithium prices will increase. The electric vehicle (EV) industry, which is experiencing accelerated sales growth is increasingly anxious.

Electric vehicle sales in the US, UK, China and South Korea continue to increase – growth rates may be variable the structural demand schedule remains in place. The rise in EV sales is driving up demand for lithium.

In addition, there are currently no new significant potential lithium producing mines under development. The demand from the EU in 2023 is expected to increase to 550k Mt/year (2x that of expected capacity to produce lithium).

The shortage of lithium is already impacting several industries – from mining companies who are struggling to meet their quotas, to battery manufacturers who need more raw materials, to electric car companies looking for ways around their limited access to batteries by vertically integrating their business operations (e.g. Tesla (Nasdaq:TSLA, MCAP ~$513bn)).

- Expansion in lithium mining development and exploration is the answer to the lithium shortage (lithium ion battery recycling will make a contribution but it is not the answer to the current shortage).

- European Lithium (FRA:PF8, MCAP ~€87m, ~US$95m) – is focused on developing its mine in Wolfsberg, Austria. It has an estimated capability to mine 10,500 Mt of Li/year as of 2025E – enough to manufacture ~200k EVs (there were ~16.5m EVs sold in 2021).

- Aqua Metals (Nasdaq:AQMS, MCAP ~$88m) has built an alternative recycling facility for non-lithium-ion batteries. AQMs’s AquaRefining process recycles lead-acid batteries by breaking down the batteries into component parts including lead, plastic and acid – these are then separated and processed for reuse.

- Hydrogen cells – While hydrogen fuel cells are being leveraged for trucks and buses, it is does not yet appear practicable technology for the everyday commuter (lack of government funding/backing for mass fuelling high energy consumption infrastructure).

- Solid-state batteries (e.g. NASA project) vs. lithium-ion use solid electrolytes vs. liquid, are considered safer (less volatile at high temperatures) because they use a solid electrolyte vs. liquid. EV manufacturers will see decreased limitations and increase/stretch lithium resources as sold-state batteries come into play.

Why lithium (Li) is so potent for electrical vehicle batteries

Lithium is a chemical element with atomic number 3. It is a soft, silver-white metal that is highly reactive with water and can be found in many natural sources. It is used to make batteries for electric vehicles and portable electronics such as smartphones, laptops and tablets.

Lithium is also used to produce glass and ceramics because it has a low melting point (180°C/356°F) compared to other metals such as sodium ( Na) or potassium (K) which have higher melting points (800°C/1,472°F).

Lithium’s properties make it ideal for use in electric vehicle (EV) batteries. Its high energy density, high reactivity and long lifespan make it ideal for use in EV batteries.

• Lightweight: Lithium is a lightweight metal with a low atomic number, 3, and a high energy density. This makes it an excellent material for use in batteries because it can store large amounts of energy in a small volume, the outcome of which is to enable EVs to travel commercially relevant distances on a single charge.

• Highly reactive: Lithium is highly reactive – when lithium ions in a battery move from the positive electrode (cathode) to the negative electrode (anode) during charging, they release electrons, which can be harnessed as electrical energy. When the battery discharges, the lithium ions move back to the positive electrode, where they are recharged with electrons for the next cycle. The anode is made from graphite. The cathode is made from Lithium carbonate (Li2CO3).

• Long lifespan: Lithium-ion batteries have a relatively long lifespan. Unlike traditional lead-acid batteries, lithium-ion batteries do not suffer from the ‘memory effect’ where the battery loses capacity over time due to incomplete charging and discharging.

• Charging time and power density: Lithium-ion batteries charge more quickly and have a higher power density, which means they can deliver more power per unit of weight compared with lead acid and other battery technologies.

Why is lithium carbonate (Li2CO3) critical in the battery cathode?

Use – Lithium carbonate is an essential component in the production of electric vehicle (EV) batteries. It is a lithium compound that is used to manufacture the cathode, which is the positive electrode in lithium-ion batteries.

Description – Lithium carbonate in chemistry is classed as an inorganic compound. Li2CO3 is a white powder that is produced by extracting lithium from mineral deposits (brines, ores etc.), and then processed to form lithium carbonate. The lithium carbonate is later combined with other elements, such as cobalt, nickel and aluminium, to form the cathode material in a lithium-ion battery.

Ion movement – The importance of lithium carbonate for EV batteries lies in its ability to facilitate the movement of lithium ions between the cathode and anode during charging and discharging. It provides a stable and reliable source of (lithium) ions, which are essential for the battery’s operation.

High purity level – In addition, lithium carbonate has a high purity level, which is critical for ensuring the quality and performance of the battery. Any impurities in a cathode can cause degradation in the battery’s performance, reducing its energy capacity and lifespan.

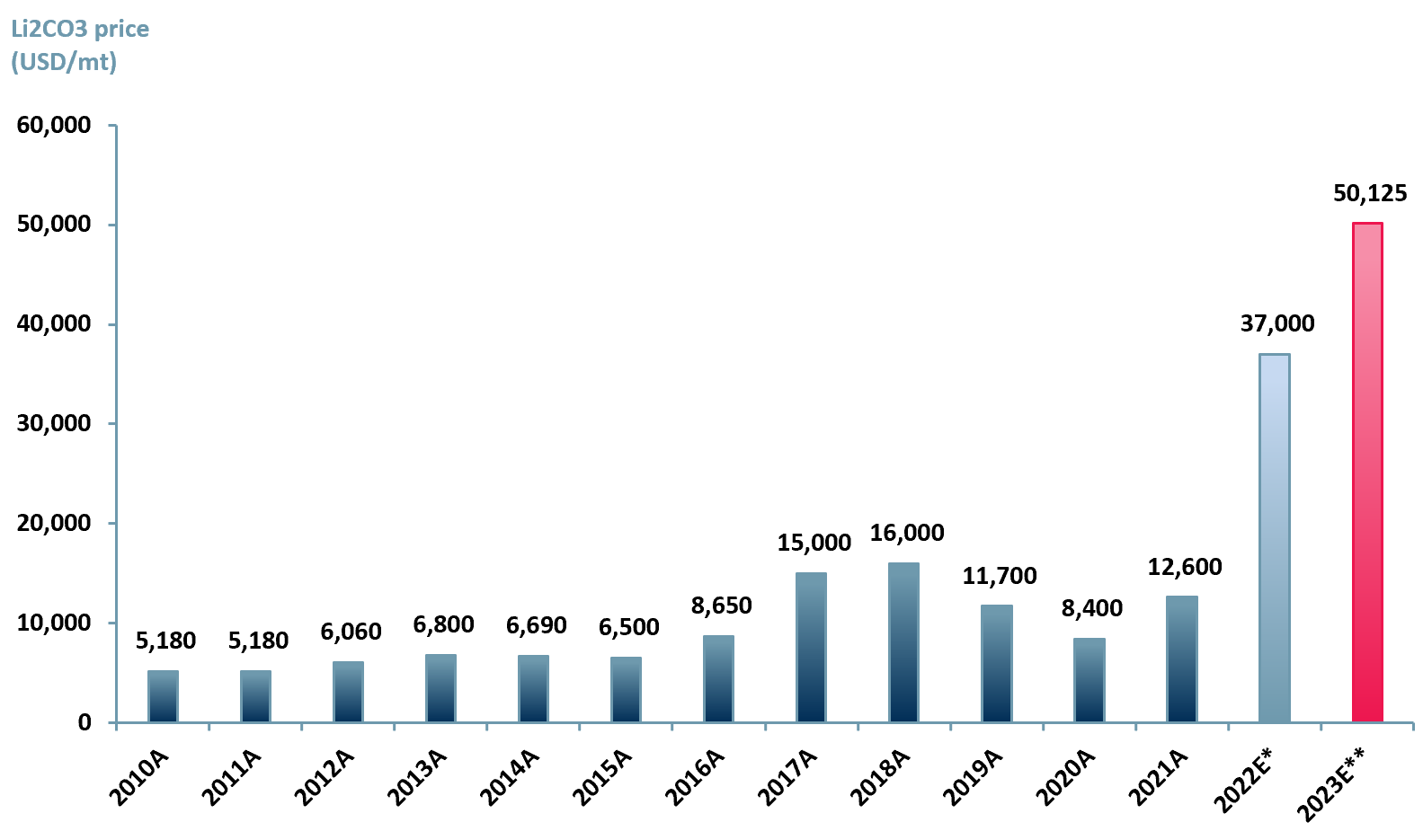

ACF Equity Research current Li2CO3 price forecast

Exhibit 1 – Li2CO3 molecular structure

Sources: Wikipedia.

Sources: Wikipedia.

We remain bullish about 2023 lithium prices in spite of April lows. ACF’s first ever public estimate is that the price of Li2CO3 will reach ~$47k/mt in 2023. This forecast is based on a conservative low estimate for the CAGR at 26.4%. Though there is significant volatility in metal prices as a general pricing rule, there is a structural shortage of lithium. We expect the structural shortage of lithium to a) exacerbate and b) exist for an extended period of time before market clearing mechanisms take effect.

We expect a) and b) above because 1) it will take automakers years rather than months to fully achieve vertical integration and 2) the average time from resources exploration to production is ~16 years, i.e. even though rising prices for lithium (commodities tend to obey the dynamics of the cobweb pricing model), will drive investment in greater supply, there is a very significant lag time between the investment decision and new production (currently on average at least a decade).

Exhibit 2 – Lithium carbonate price ACF forecast 2023E

Sources: ACF Equity Research; USGS; IMF. Notes: *USGS 2022E estimate, **ACF 2023E

Sources: ACF Equity Research; USGS; IMF. Notes: *USGS 2022E estimate, **ACF 2023E

The lithium shortage and accelerating demand growth

The global shift towards electric vehicles (EVs) has been gaining momentum in recent years, with several countries and automakers (e.g. General Motors (NYSE:GM, MCAP ~$47bn), Ford (NYSE:F, MCAP ~$48bn), Mercedez_Benz (XETRA:MBG.DE, MCAP ~€75bn, $82bn), Volvo (VOLV-B.ST, MCAP ~SEK 428bn, ~$42bn)) setting ambitious targets to phase out traditional fossil-fuel-powered cars by 2040E. However, the widespread adoption of EVs is facing a significant challenge – the shortage of lithium. Lithium production has struggled to keep up with the increasing demand for EVs.

Lithium supply constraints

Geography – One of the main reasons for the lithium shortage is a current geographical constraint – ~2/3 of global lithium production comes from just three countries – Chile, Australia, and Argentina (WEF). These countries have strict regulations on mining and there is a limit to how much lithium can be extracted sustainably.

Reserve economics – In addition, countries that have significant lithium reserves, e.g. Bolivia and Afghanistan, lack both the infrastructure and the conditions to attract investment to exploit the reserves. In short there are a somewhat limited number of mines around the world from which lithium is commercially extracted in high volumes and the conditions to bring on new mines fast do not currently exist.

Supply chain – Another contributor to the lithium shortage is the uneven distribution of lithium-ion battery demand and production. The rise of EVs has led to a surge in demand for lithium-ion batteries, not just in the automotive sector, but also in other industries such as renewable energy storage. As a result, manufacturers are struggling to secure a reliable supply of lithium.

Implications for the autos EV sub-segment

The lithium shortage has significant implications for the EV industry.

-

- Production costs – It is likely to lead to higher prices for EVs, as the cost of producing lithium-ion batteries increases.

- A market clearing mechanism may turn out to be a slow-down in the rate of transition to EVs, as automakers struggle to secure a reliable supply of batteries.

- Environmental impact – It could lead to an increase in the environmental impact of lithium mining, as companies search for new reserves leading to a drive to gain reacceptance of less sustainable extraction methods.

- Cost of capital – If lithium mining environmental impacts are forced to rise this in turn will drive up the cost of capital for such miners because ESG investing criteria increases competition for non-ESG investment dollars. This scenario would contribute to an argument for a downward spiral in lithium production and is an upward futures-curve price driver.

What is the EV industry doing to overcome the structural lithium shortage?

The EV industry is taking several steps to overcome the structural lithium shortage and or to ensure a sustainable supply of lithium for electric vehicle batteries:

- Diversifying: Automakers and battery manufacturers are exploring new sources of lithium, such as brine deposits, which are found in areas like Nevada and the Lithium Triangle in South America. Brine deposits are a lower-cost and more environmentally friendly way of extracting lithium, as opposed to traditional mining methods.

- Recycling: Lithium-ion batteries can be recycled to extract valuable metals such as lithium (Li), cobalt (Co), and nickel (Ni). Recycling can help reduce the demand for newly mined lithium and provide a sustainable source of materials for battery production. However recycling alone will not solve the current structural supply deficit in the face of the currently expected Li demand schedule.

- Innovation: Researchers are exploring alternative battery technologies that use different materials, such as sodium-ion or solid-state batteries. These technologies have the potential to reduce or eliminate the need for lithium in battery production. Our expectation is that there will be place for many of these technologies – Lithium ion batteries may become a premium choice or accessory in EVs or perhaps they will be reserved for utility scale power generation.

- Efficiency: Improving the efficiency of batteries can reduce the amount of lithium needed for each battery pack. For example, some automakers are developing solid-state batteries that offer higher energy density and require less lithium.

- Investing: The EV industry is working with mining companies to ensure that lithium is extracted sustainably, with minimal environmental impact. This includes using renewable energy sources in mining operations, minimizing water usage and reducing waste. ESG miners will attract lower cost capital, allowing them to deliver better returns to investors. In the end, the sector winner is the company with the lowest cost of capital.

The structural lithium shortage is a significant challenge for the EV industry. To overcome this challenge, there needs to be a concerted effort to increase the supply of lithium through sustainable mining practices, investment in new lithium extraction technologies, and the development of alternative battery chemistries that rely less on lithium or that obviate its need.

There is place of all of these solutions alongside a rising lithium carbonate price. In our assessment, structural rising lithium carbonate prices are most likely only a question of degree.

A final thought – Policymakers need to provide support for the development of the EV market, including incentives for EV adoption and investment in EV infrastructure. Only through such efforts can we ensure a smooth transition to a low-carbon transport system that benefits both the environment and society, and therefore of course…investors.

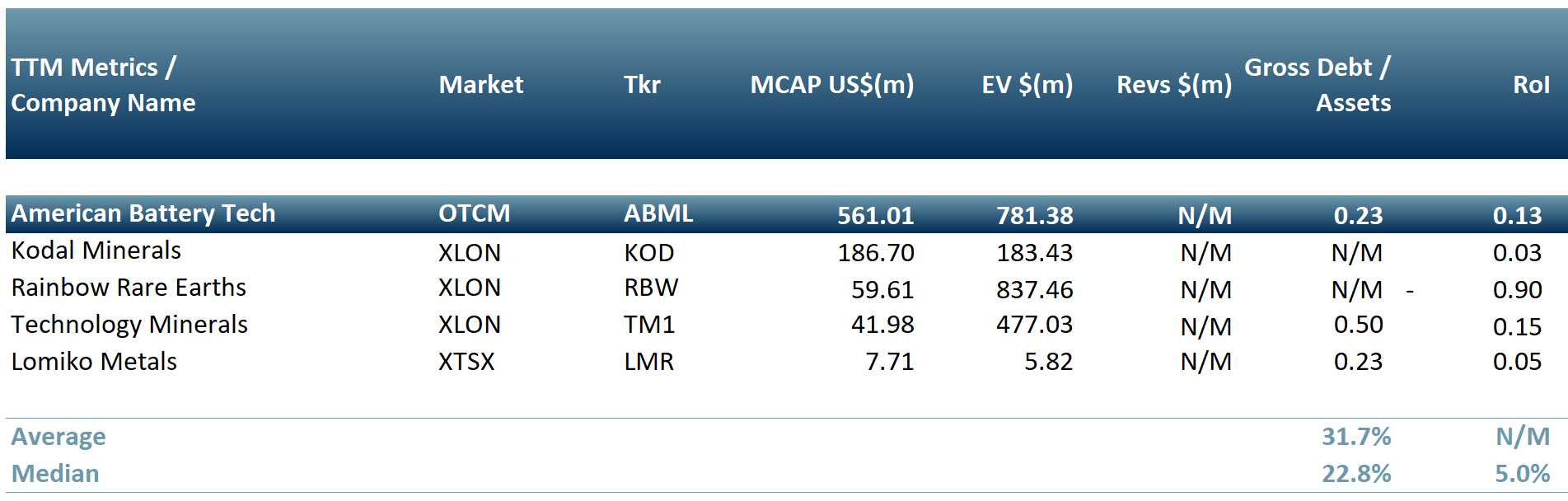

Exhibit 3 – Topical selection of EV and renewable energy supply chain peers

Sources: ACF Equity Research; Refinitiv.

Sources: ACF Equity Research; Refinitiv.

Authors: Renas Sidahmed and Christopher Nicholson – Renas is Head of ESG and a Staff Analyst at ACF Equity Research; Christopher is Head of Research. See their profiles here