Lithium extraction – mineral deposits vs. salt brines

Mining lithium comes with its challenges. The transition to net zero continues to gain momentum. This is creating an increase in demand for metals such as lithium (Li), which are a key component in powering the green energy transition. E.g. lithium-ion batteries used to power electric vehicles (EVs) and consumer electronics.

While lithium plays a crucial role in the green energy transition, mining lithium is not as straight forward as some other metals – extraction can have vastly different capital requirements, mining costs and environmental impacts.

In part this variability in lithium mining and extraction costs drives the economics and desire for innovation around the lithium supply chain. Researchers continue to look for alternative battery chemistries and ways to improve lithium-battery recycling.

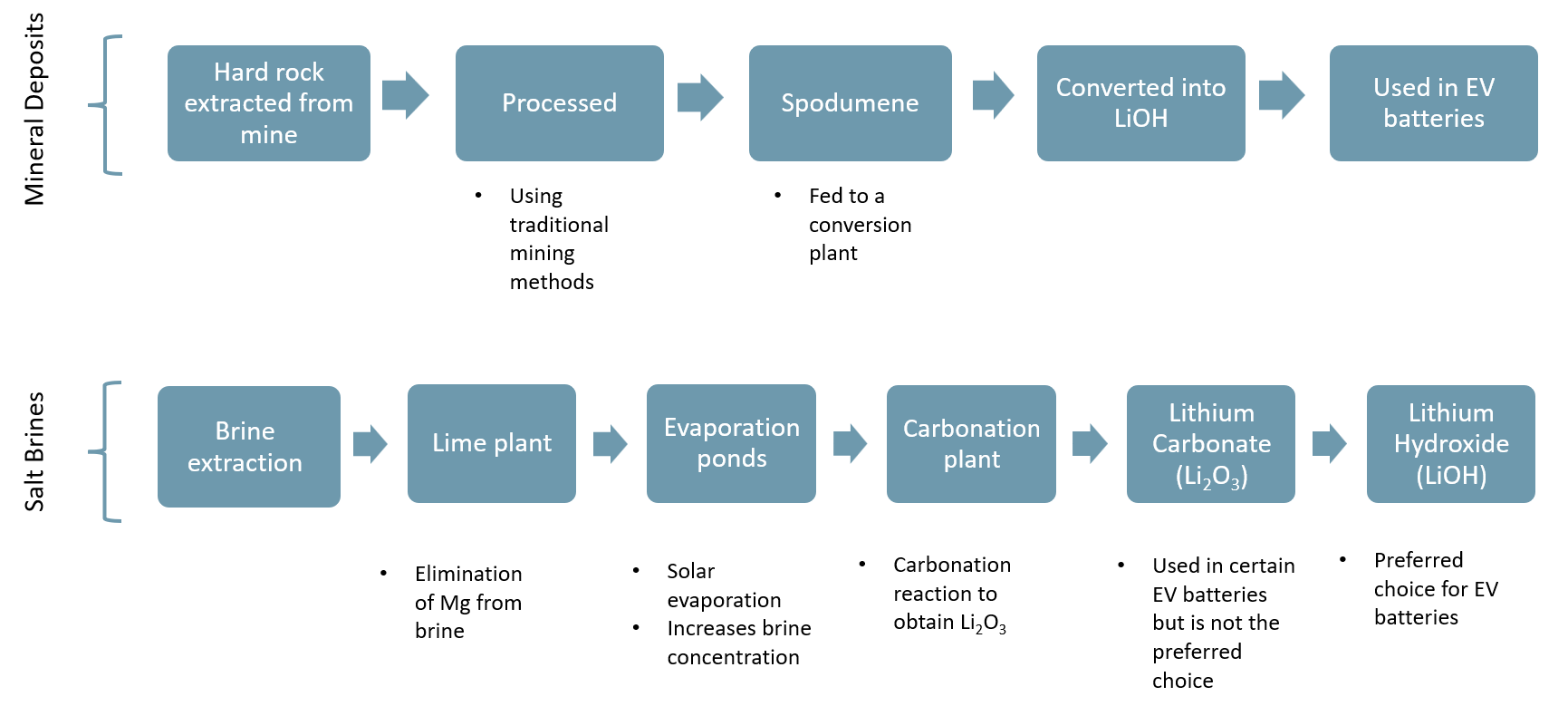

Lithium is extracted from two main sources: mineral deposits (hard rock mining) and salt brines. Below we provide a brief summary of both including the main cons of each.

Mineral deposits (hard rock mining)

- Lithium ore is extracted from rocks, usually pegmatite deposits (coarse-grained igneous rocks with large crystals). The ore is extracted from traditional mining techniques such as open-pit mining. Following a flotation process, lithium concentration increases from ~1% to ~6%.

- The primary output from this hard rock mining is spodumene concentrate. The spodumene concentrate is heated, roasted and then mixed with water to produce lithium hydroxide (LiOH) or lithium carbonate (Li2CO3), which are used in batteries.

- Con: The process is more energy intensive when compared to salt brine lithium extraction and can result in significant amounts of waste rock and tailings.

Salt Brines

- Lithium is extracted from underground brine reservoirs by pumping brine to the surface. These brine reservoirs can be found in areas such as salt flats and dry lakebeds, where water has evaporated over time, leaving behind mineral deposits.

- The primary output from brine extraction is lithium carbonate (Li2CO3). The lithium carbonate is produced once the water has evaporated and the lithium is separated from other salts using chemical reactions, solvent extractions and ion-exchange processes.

- Con: The process consumes vast amounts of water, which can be problematic in arid regions where water is scarce. These two conditions can present certain high focus ESG challenges. ESG considerations will only become more important over time.

There is, as the idiom goes, more than one way to skin a cat when it comes to lithium extraction. Nevertheless, mineral deposits (hard rock mining) make up ~60% of the current global mined lithium supply. The market is not expecting this hard rock dominance to change before 2030E (Benchmark Mineral Intelligence). There reasons are as follows:

Greater flexibility: Spodumene concentrate produced from the mining operations can be processed directly into lithium hydroxide (LiOH) or lithium carbonate (Li2CO3). On the other hand, salt brines only produce lithium carbonate. If the end product is to be lithium hydroxide further processing and extra cost is required.

Lithium hydroxide (LiOH) is the preferred ingredient for EV batteries. As such, hard rock operations offer greater flexibility to mining companies and battery-metals producers.

Exhibit 1 – Typical process for mineral deposits (hard rock mining) vs. salt brines

Sources: ACF Equity Research Graphics; Allkem. Note: Mg = magnesium

Sources: ACF Equity Research Graphics; Allkem. Note: Mg = magnesium

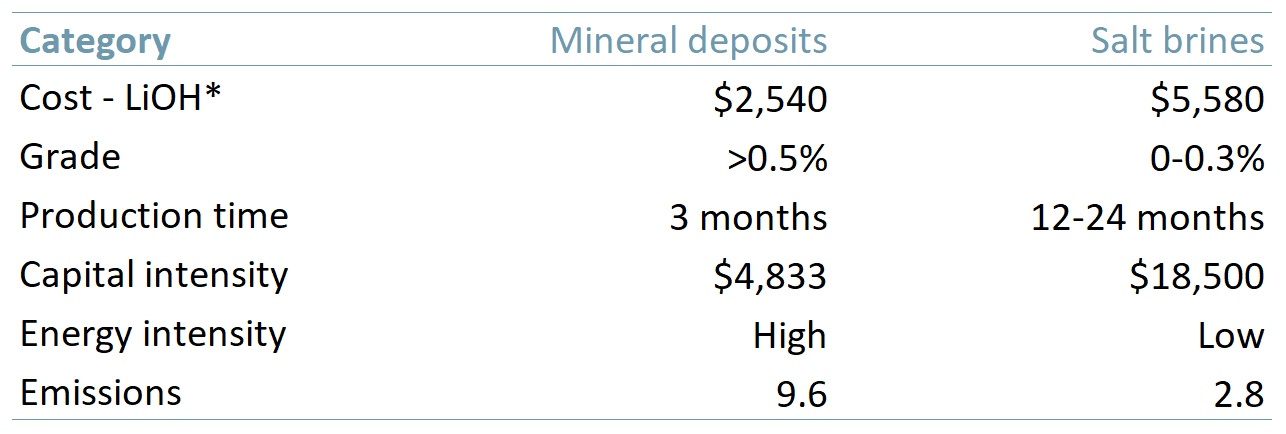

Faster processing time: The bulk of time for brine processing is spent in the evaporation process, slowing down lithium extraction. While the actual processing time may be shorter for mineral deposits, the overall operation (incl. mining and ore treatment) is more complex and energy intensive.

Higher grade: Mineral deposit operations produce higher grade lithium (greater than 0.5%) versus salt brines (between 0-0.3%).

Lower cost: Mineral deposits produce and sell spodumene concentrate as opposed to Li-carbonate or Li-chloride via salt brines, and tend to be less capital intensive and have lower costs of operation. Mineral deposit mine cost structure only considers mining spodumene concentrate, it does not factor in any cost related to its further conversion into lithium chemicals (LiOH or Li2CO3). If this cost is included as part of the cost of extraction and production, then the cost of lithium hard rock mining could be at par or higher than salt brines lithium extraction.

Environmental impact: Mineral deposits are easier to explore, mine and process compared to salt brines, but they may be considered less environmentally friendly (depending on environmental priorities) given their carbon intensive nature. Recall that salt brine lithium extraction requires a lot of water and is often carried out in arid regions (refer to the water-diamond paradox to understand why there can be variation in ESG priorities).

In arid regions water preservation or conservation is arguably a higher local environmental priority than reducing carbon emissions.

According to Benchmark Mineral Intelligence, lithium chemicals derived from mineral deposits such as spodumene can be over three times as carbon-intensive as those derived from salt brine sources.

Exhibit 2 – Mineral deposits (hard rock mining) vs. salt brines

Sources: ACF Equity Research; Li3 Lithium Corp; Bofa Global Research; S&P Global Market Intelligence; IEA.

Sources: ACF Equity Research; Li3 Lithium Corp; Bofa Global Research; S&P Global Market Intelligence; IEA.

The choice between mineral deposits mining and salt brines lithium extraction will depend on a variety of factors, including the location of the deposit, the availability of water and energy resources, and the environmental regulations in place.

In our view, hard rock mineral deposits will play a major role in lithium supply at least until 2023E given that larger percentage of capex (~58% of total) will be spent on bringing hard rock lithium mines online (Li3 Lithium Corp).

Furthermore, mineral deposits have an advantage given their lower capital intensity, faster production time and overall ease of extraction. We would like to emphasize that no deposit is created equal and it is important to assess project specific situations when comparing investment opportunities.