Fintech M&A – why it’s on the rise in 2023

Fintech products are heading towards ubiquity across the financial landscape. More and more companies outside traditional financial services are offering financial products to consumers. Although fintech is only at the beginning of its growth trajectory, fintech M&A will be a key player for growth and we expect a rebound in 2023.

- Technology: Large tech companies such as Apple (Nasdaq:AAPL, MCAP~$2.7trn), Alphabet (Nasdaq:GOOG, MCAP~$1.4trn), and Amazon (Nasdaq:AMZN, MCAP~$1trn) have already firmly established a position in the financial services space. Offerings include Apple Pay (mobile payment service), Google Wallet (mobile payment service), and Amazon Pay (online payment processing service).

- Retail: Walmart (NYSE:WMT, MCAP~$412bn) and Target (NYSE:TGT, MCAP~$72bn) have started offering financial products to their customers. Walmart’s MoneyCenter offers digital checking and savings accounts as well as a prepaid debit card (MoneyCard). Target offers a RedCard prepaid debit card.

- Telecom: T-Mobile (Nasdaq:TMUS, MCAP~$173bn) and Verizon (NYSE:VZ, MCAP~$160bn) have entered the financial services space. T-Mobile MONEY offers a mobile-first checking account and Verizon offers mobile banking via 3rd party – Firethorn (a Qualcomm company, Nasdaq:QCOM, MCAP~$120bn).

- Fintech startups: There are many fintech startups that offer a wide range of financial products, from digital wallets (SoFI – Nasdaq:SOFI, MCAP~$5bn), payment apps (Venmo – private) and trading platforms (Robinhood, Nasdaq:HOOD, MCAP~$8bn).

As the line between traditional financial services and other industries becomes increasingly blurred, the fintech space is becoming crowded making is candidate for a consolidation wave. For the more attractive acquisitions we expect significant multiples above the long run average M&A 40% control premium.

ACF’s 2023 fintech assumptions

- Large banks will continue to remain aggressive in acquiring small and niche fintech firms.

- The steep decline in valuations of publicly traded fintech companies will attract M&A interest from buyers.

- There will be more deal-making activity from mature fintech firms that generate free cash flows and have access to borrowing capacity.

What is driving fintech M&A in 2023?

The current high interest rate environment has dried up funding for many fintech companies that remain loss-making. Fintech losses derive from 1) an initial high investment in tech and infrastructure, 2) high costs of customer acquisition underpinned by the rise in marketing and advertising investment required to attract customers, 3) costs involved in meeting regulatory compliance requitements, 4) margins driven lower by competition, 5) scaling challenges.

This reduction in the availability of cheap funding is making fintech operational strategies increasingly difficult to execute over the time scales originally proposed by management teams (they will have to shorten these timescales).

We expect to see more consolidation in fintech in 2023. Leading the trend will be traditional banks which are under pressure to roll out digital channels to counter the threat posed by new fintech startups and as well as big tech. Many large banks are now taking this inorganic route to bolster their digital presence as they perceive that the time available to catch up is running out. The alternative is for traditional banks is technological obsolescence:

- JPMorgan (NYSE:JPM, MCAP~$400bn) acquired wealth management platform Nutmeg (private – UK leader) in 2021 for ~£700m (~$870m).

- UBS (NYSE:UBS, MCAP~$61bn) acquired wealth management provider Wealthfront (private – US) in 2022 for $1.4bn

- Western Alliance Bancorporation (NYSE:WAL, MCAP~$3bn) acquired payments services provider Digital Disbursements (private – US) in 2022 – terms of transaction were not disclosed.

Fintech company valuations peaked in 2021 driven by market FOMO (fear of missing out), but dissipated in 2022. According to Accell (venture investor), fintech valuations fell by 50-75% in 2022. The dramatic decline in the valuations of publicly traded fintech companies will continue to prompt M&A interest from buyers.

Valuations of neobanks, brokers, and the crypto cohort were trading at a median EV/NTM (enterprise value/next 12-months’ revenues) revenue multiple of 1.9x on March 31, 2023, compared with 4.2x in the same period in 2022 (Pitchbook). Other high-growth fintech firms have exhibited similar trends.

(The significance of EV/NTM is that it measures the value of a stock by comparing a company’s enterprise value (MCAP + net debt) to its forecast revenue rather than trailing (historical) revenue. EV/NTM is often used to determine a company’s valuation when a potential acquisition is under consideration.

For younger growth companies it is often a far more useful metric than trailing revenues, which may be insignificant prior to the revenue generation inflexion point. Equally revenues shortly after the inflexion part are often significantly enlarged (young high growth stocks).

The one-year total return of the Global X FinTech ETF (Nasdaq:FINX, MCAP~$400m) was -11.89% as of 9 May 2023. (The FINX provides investors with exposure to companies that are transforming the financial services industry through tech, innovation and disruption.) The negative return of this ETF creates an opportunity for buyers (including private equity firms) looking to take advantage of the depressed valuations.

Although valuations may look depressed relative to prior years, it may also be the case that those seeking to acquire fintechs, consider current valuations to have returned to a fairer level. This is good for investors because it provides an exist opportunity, whilst the higher valuations of prior years’ simply flatter investor portfolios but do not deliver cash returns if these higher valuations are accompanied by low liquidity (as is often the case).

We also expect further acquisitions from mature fintech companies that generate free cash flows and have access to borrowing capacity. Companies like Nuvei (Nasdaq:NVEI, MCAP~$5.6bn) and Marqeta (Nasdaq:MQ, MCAP~$2.4bn) have closed acquisitions in 1Q23A.

Nuvei acquired Paya Holdings (Nasdaq:PAYA, leading US provider of integrated payment and frictionless commerce solutions) for $1.3bn in Feb 2023. Marqeta acquired Power Finance (PFC.NS, provides financial assistance for projects in India) for $275m in Jan 2023.

While deal sizes currently remain modest, the momentum bodes well for fintech M&A in the remainder of 2023.

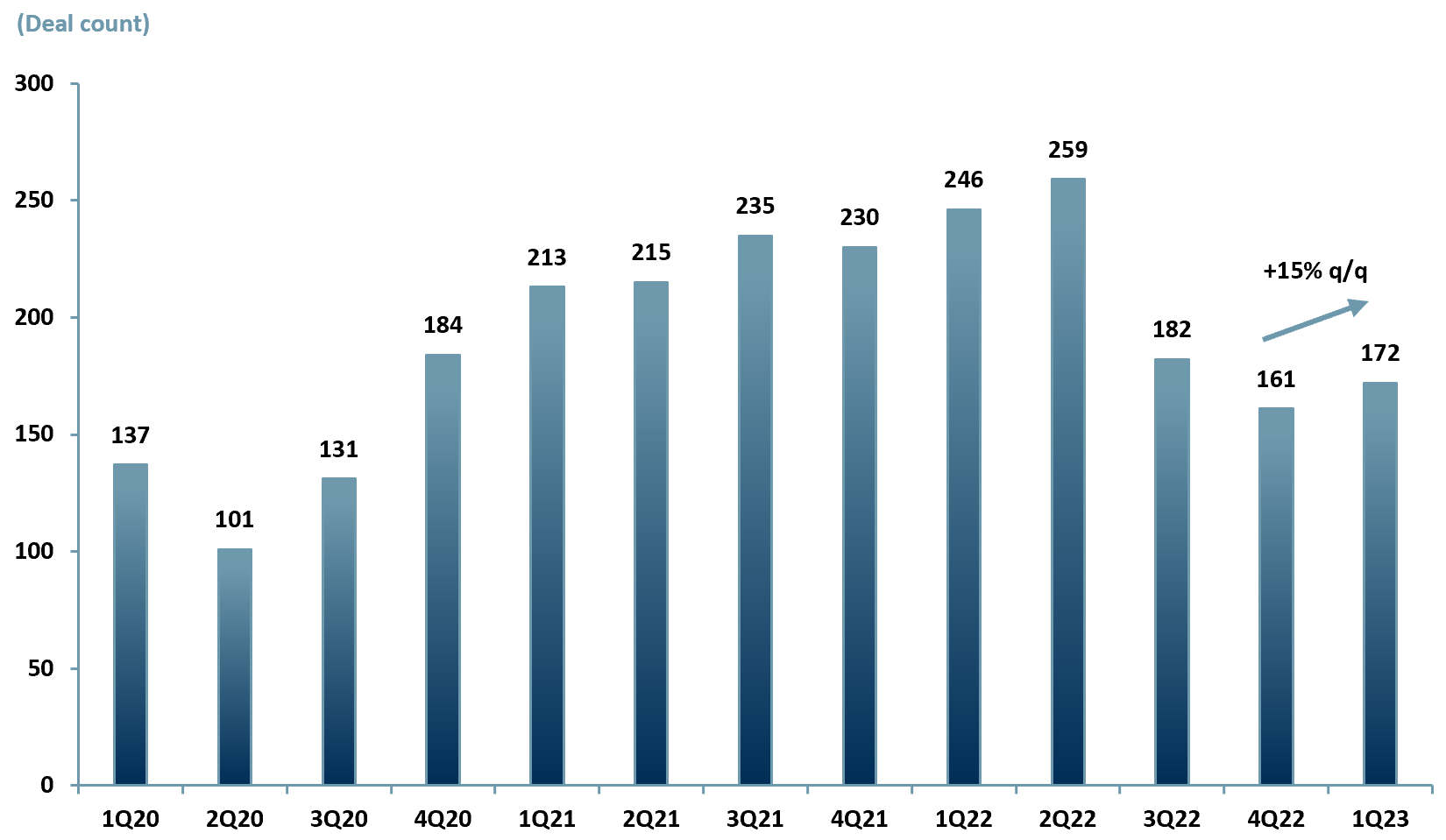

Exhibit 1 – Fintech M&A on the rebound

Sources: ACF Equity Research; CBInsights.

Sources: ACF Equity Research; CBInsights.

Despite an overall optimistic M&A environment for 2023, there remain some concerns that could derail progress. The rising global interest rate environment and geopolitical tensions could play a part in slowing dealmaking by depriving cash generating fintechs and even banks from corralling the necessary firepower or optimizing their of cost of capital.

However, for now, a subdued IPO market and falling valuations have created an opportunity for companies with access to cash and liquidity to invest in deal making. Companies with large balance sheets, private equity with dry powder and traditional financial services companies will be on the lookout for fintech assets at a relative valuation discount in 2023.