Diamond market honey trap

Diamond sales data from the US in April suggests that polished diamond demand is likely to remain strong throughout 2021, in spite of diamond retailer Pandora stating that 35% of retail outlets are currently closed due to Covid.

Online polished diamond sales, though growing, only account for around 20% of total market sales, according to Evgeny Agureev, Chief of sales at Russian diamond miner Alrosa PJSC ($ALRS.ME:MCX) (Bloomberg, 2021).

US jewellery Christmas period sales in 2020 delivered mixed data, whilst online sales were up 45%, Mastercard SpendingPulse reported that total US Jewellery sales fell 4.3% y/y. Nevertheless, underlying demand drivers for precious stones and metals have been building rapidly below the surface.

US stimulus payments, low interest rates, less travel and closed restaurants have translated into higher disposable income and pent-up demand appears to be behind a rise in March US jewellery sales, up 106% y/y, according to data from Mastercard SpendingPulse.

Polished diamond market – key dynamics:

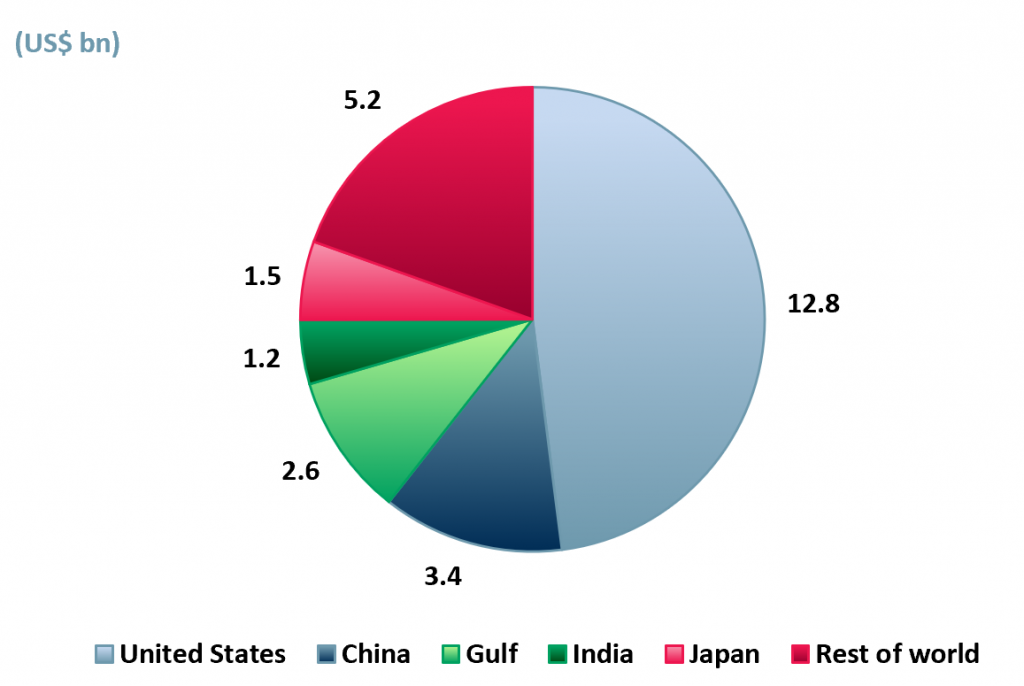

- The demand for polished diamonds is dominated by the two largest polished diamond markets – the US and China. See exhibit 1 below.

- In India, where ~90% of diamonds are cut or polished, companies are so desperate to boost output they are offering 50% pay increases plus perks for skilled cutters and polishers.

- The travel sector, hit by lockdowns, is the diamond, platinum and palladium jewellery industries’ primary competition for disposable income. Those with disposable income, are substituting travel and dining out with jewellery.

Exhibit 1 – Global demand value of polished diamonds by country 2019

Sources: ACF Equity Research Graphics; De Beers Group

Sources: ACF Equity Research Graphics; De Beers Group

Rough diamond market:

The current increased demand expectations for polished diamonds are supported by rough diamond demand data from December 2020.

There are two main market suppliers of rough diamonds – Russian miner, Alrosa PJSC; and UK-based De Beers Group (controlled by Anglo American (AAL:LSE)).

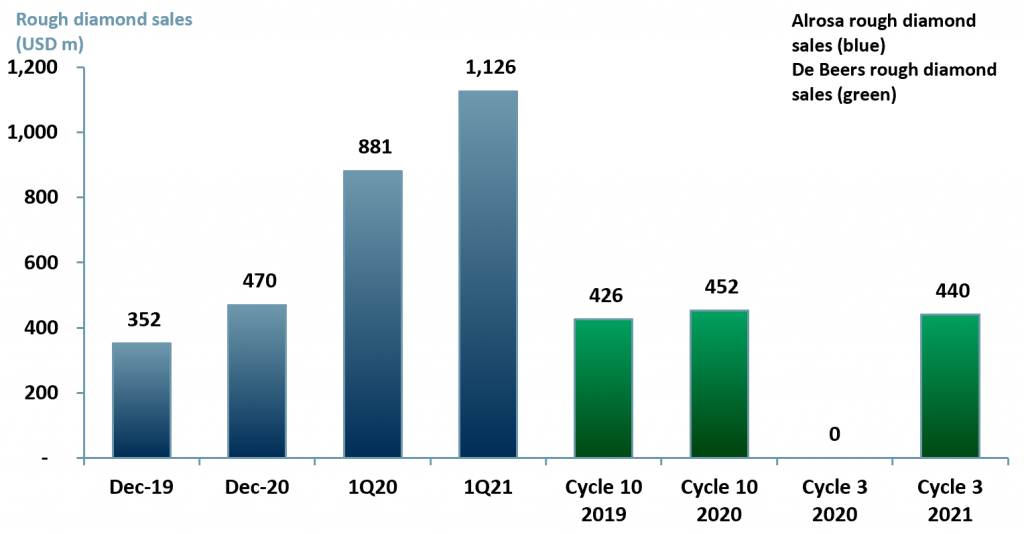

De Beers reported provisional sales in its third cycle of 2021 (out of ten) at US$ 440m, up 440m vs no revenue generated from rough diamond sales in cycle three of 2020. Alrosa reported 1Q21 rough diamond sales at US$ 1,126m, up 245m or 28% vs US$ 881m in y/y (exhibit 2).

Exhibit 2 – Rough diamond sales of Alrosa and De Beers Group 2019 and 2021

Sources: ACF Equity Research Graphics; Company reports

Sources: ACF Equity Research Graphics; Company reports

Both De Beers and Alrosa have increased prices of rough diamonds in 2021 with De Beers increasing prices by ~5-7%. This increase in price has not affected sales which can be seen via cycle one 2021 sales of rough diamonds from De Beers increasing 43.8% from cycle 10 2020. This suggests demand remains well supported.

The secondary market, where those who do not have access to De Beers or Alrosa supplies exchange diamonds, is also showing increased activity. Prices are trading at a ~5% premium to the general market, highlighting the tightness of the market. However, a limit to the premium the secondary market is prepared to pay is created by the knowledge of the rough diamonds market overhang.

A major issue in the rough diamond market is the large stockpiles held by both De Beers and Alrosa – essentially an overhang. Alrosa alone had amassed stockpiles of rough diamonds standing at 12.8m carats at the end of 1Q21.

This poses a problem for both the ‘cartel’ holders of the stockpiles and the wider diamond market. De Beers and Alrosa stock pile diamonds, a rare resource, in order to maximise the value, but there are limits to the profit maximisation effect of this strategy.

The start of 2021 has shown a glimmer of light for the diamond industry that struggled through 2020 with many sector middlemen struggling to turn a profit. The danger understood in the market is that De Beers and Alrosa could, at any point, attempt to profit maximise during a period of high demand and release stock into the market, which could cause some secondary market players and some jewellery companies to go bust.

With covid, closed retail outlets, the usual ‘cartel’ overhang and rising prices backed by pent-up demand rather than a structural change in demand, from an investor point of view, the diamond market looks like a honey trap for the unwary.

Author: Sam Butcher – Sam is a Junior Staff Analyst at ACF Equity Research. See Sam’s profile here