Innovations in Agri-Tech

The UK government created the £70m Agri-Tech Catalyst Fund in 2015 to provide seed-capital for Agri-Tech (agricultural technology) start-ups. The fund and the UK government’s commitment to net zero agriculture is only part of the solution to the growing demand for food.

What is Agri-Tech?

Agricultural Technology (Agri-Tech) uses advanced technology in farming to improve efficiency and profitability. Agri-Tech encompasses an array of technologies, including biotech, photonics, Big Data and the internet of things (IoT).

Investing in these technologies can improve farming though information monitoring, crop development, synthetic fertiliser and pesticide development, analysis and monitoring of the weather, pests, soil and air temperature.

What are the Agri-Tech drivers?

As the global population grows (at a rate of 1.1% p.a.) the demand for food is forecasted to increase by 50% between 2010-2050 (Lexology). In addition, the agricultural sector is responsible for ~30% of global greenhouse gas (GHG) emissions.

The increasing demand for food has created a need for more intensive agricultural practices – in particular a greater need for more effective fertilisers and fertilisation processes but with less arable land available.

Agri-Tech – sustainable agriculture and the use of AI and advanced technology provide solutions to support the increased demand for food – addresses climate change. Agri-Tech also creates opportunities for investment for players wanting to enter the market.

Examples of UK Agri-Tech with a global market solution

- Saturn Bioponics, a UK Agri-Tech company offering sustainable solutions, developed a patented hydroponics platform automatically delivering water and nutrients, eliminating waste and run-off.

- Entocycle, a UK Agri-Tech insect farming company, is developing technology to use insects as animal feed. Insects produce protein more efficiently than farmed animals and uses a fraction of the water and land.

- Light Science Technologies (LST.L), a UK AiM listed Agri-Tech business offering, developing and selling highly innovative light and nutrient management systems for glass house growers and poly tunnel farming (an obvious extension is vertical farming, which is likely, in time, to become another important segment for LST).

What is the UK government’s response to the need for Agri-Tech?

- The UK’s farming sector is the leader in innovation across the UK and Europe. Innovate UK (the agency that provides funding and support for organizations proposing to develop new products and services) has partnered with four centres to create the ‘UK Agri-Tech Innovation Centres’.

- The four UK Agri-Tech Innovation Centres are charged with creating data-driven solutions and technology for the challenges faced in the Agri-food sector. See the Agri-Tech Innovation Centres specific specialisations below:

- Centre for Crop Health and Protection (CHAP) – a network of scientists, farmers, advisors, innovators, and businesses that work together to develop innovative solutions for the market;

- Centre for Innovation Excellence in Livestock (CIEL) – world leading livestock research alliance bringing new technologies into the livestock food supply chain;

- Agricultural Engineering Precision Innovation Centre (Agri-Epi) – promotes the research, development and adoption of precision agriculture and engineering technology;

- Agrimetrics – facilitates the accessing, sharing, managing, and monetising of food, farming and environmental data.

- Other UK funding opportunities and support for Agri-Tech include: Transforming Food Production Challenge (a £90m fund supporting the industry to change food production to net zero by 2040) and the Farming Innovation Programme (supporting Agri-Tech innovation, R&D, and tech development).

Agri-Tech market – are there a wide range of investment plays for exposure in the UK and internationally?

As of Feb 2022, there were 606 Agri-Tech start-ups in the UK, ranging from software solutions to online marketplaces to insect bioconversion (Traxcn). Over the last five years, over 3,000 Agri-Tech start-ups have emerged as investor interest has grown.

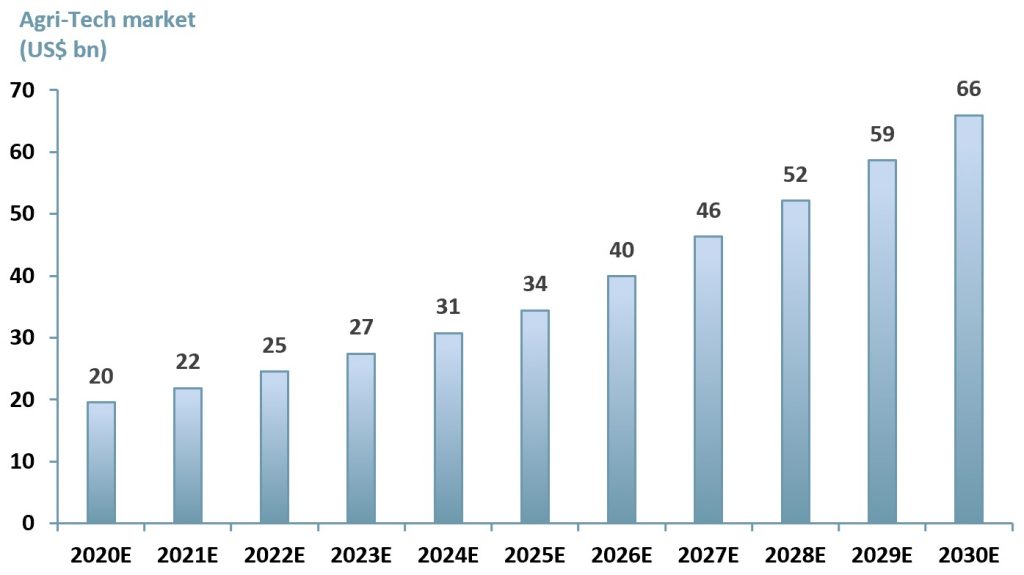

Our forecasts suggests that the global Agri-Tech market will grow at an overall CAGR of 12.9% for the period of 2020A-2030E, reaching a value of $66bn in 2030E up from $20bn in 2020E.

In exhibit 1 below, we forecast the value of the Agri-Tech market using a three-factor growth model.

Exhibit 1 – Global Agri-Tech market forecast 2020E-2030E

Sources: ACF Equity Research Estimates; Globenewswire; Global Banking & Finance Review

Sources: ACF Equity Research Estimates; Globenewswire; Global Banking & Finance Review

Is Agri-Tech in a fight for market share or a dash for growth?

Agri-Tech market growth phase 1 CAGR 12%:

Our model suggests a phase 1 CAGR of 12% for Agri-Tech – the private and public sector are working together to meet the demand of a growing global population.

Increased funds and support will spearhead a popularity in start-ups. While the funding is available, it will still take some time for these ‘innovators’ to trial and test their technologies for more sustainable farming. Therefore, the initial transitory period will include companies and investors experience growing pains.

Agri-Tech market growth phase 2 CAGR 16%:

In phase two, we expect further significant Agri-Tech investment. For example, start-up Circularise uses blockchain to help companies confirm proof of origin. The data details where a product comes from but also if the material is sustainable.

Climate change and sustainability continues to dominate market sentiment. Consumers and stakeholders want companies to take more accountability for their products.

Consumers, as a result, are more likely to purchase products from companies providing clear, detailed and verified origins and logistics chains. This clarity is important as the global demand for food will create an increase in the use of fertiliser solutions and competition for land use.

Agri-Tech market growth phase 3 CAGR 12.5%:

Our CAGR declines to 12.5% as the market begins to mature, competition rises, and government funding is exhausted.

We also expect that sustainable fertiliser solutions will become commonplace in the agricultural sector. Beyond our forecast period we expect the market reverts towards a CAGR equivalent to global GDP development.

In Agri-Tech’s ‘final’ phase we expect the sector to enter the first of several consolidation rounds in a fight for market share.

What is the investor cycle for Agri-Tech?

In very general terms, the dash for growth in the Agri-Tech sector will probably last a decade – after this period of capital growth opportunity for investors, the sector will be become a bid premium play and then an income stream opportunity.