The future of the fertiliser industry

The fertiliser industry is entering a new era of growth driven by growing food demand and technological innovation.

The fertiliser industry was affected during the pandemic as a result of initial lockdown restrictions – shutting down plants and slowing down shipments.

Supply chains have now stabilised somewhat, but feed stock prices have increased dramatically. The Russia / Ukraine war has accentuated the focus on food production created by climate change and population growth concerns.

Asia-Pacific is the largest fertiliser market globally, accounting for ~60% of the global fertiliser market consumption. Within Asia-Pac, China is the largest single consumer of fertilisers, accounting for ~53% of Asia-Pac consumption in 2019 (Mordor Intelligence).

- As the global population increases (1.1% p.a.), so will the demand for food. Demand driven global food production is forecasted to increase ~70% between 2005 and 2050E in line with an expected global population of 9.1bn by 2025E (FAO).

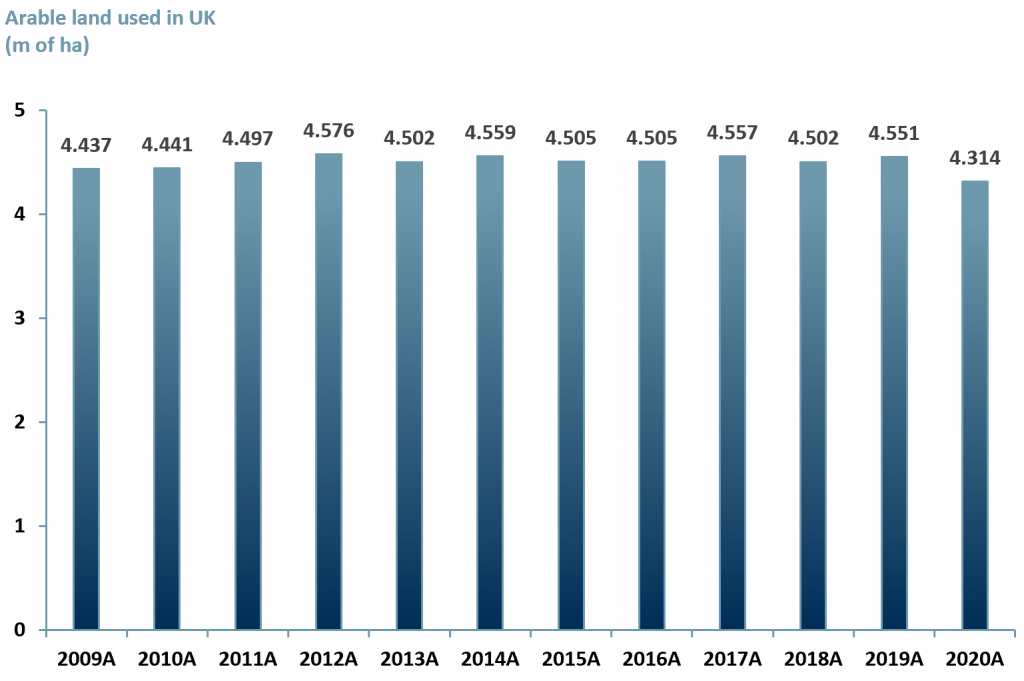

- The amount of arable land is decreasing due to industrialisation and urbanisation. For example, arable land used in the UK was 4.314m ha in 2020A, down from 4.565m ha in 2009A (exhibit 1).

Exhibit 1 – Arable land used in the UK 2009A-2020A

Sources: ACF Equity research graphics; Agriculture in the United Kingdom 2020

Sources: ACF Equity research graphics; Agriculture in the United Kingdom 2020

A need for innovation

Arable land for food production is under further pressure in the UK because one-fifth of agricultural land is deemed to have to be set aside to meet the growing demand for climate mitigation.

There is a direct link between arable land for food production and atmospheric heating. Nitrogen oxide (N2O), from nitrogen fertilisers, is 265x more effective at trapping heat in the atmosphere compared to Carbon Dioxide (CO2).

The Committee on Climate Change (CCC) – the UK governments climate adviser – says that in order to meet the carbon-neutral pledge by 2050, two-thirds of greenhouse gas (GHG) emissions from land must be reduced.

The CCC states that in order to reduce GHG emissions by 64% by 2050E, one-fifth of all arable land is needed to plant trees to absorb carbon out of the atmosphere. This would restore peatlands (i.e., wetlands) and soils and support the capture of CO2 via biomass, referred to as bioenergy with carbon capture and storage (BECCS).

CCC advisers suggest, somewhat counter intuitively, that not only will arable land set-aside reduce GHG emissions, it will also enable land-use priority for food production.

Technological innovations and the need to increase crop yields will be a strong driver for the fertilizer sector. In other words, more food will need to be produced from the same crops using technologically advanced fertilisers in a sustainable way.

Fertiliser companies are already investing in product development:

- Nutrien Ltd. (NYSE:$NTR) purchased Agrosema Commercial Agricola Ltd. in Jan 2020, to expand into the Brazilian agriculture market. Nutrien is a leader in crop inputs and services, helping increase food production sustainably.

- Yara East Africa [subsidiary of Yara International (OTCPK:$YARIY)] developed a micronutrient fertilizer (Yara MiCrop) to improve maize yields in Western Kenya in Aug 2020. Yara MiCrop provides five key nutrients (N-Nitrogen, P-Phosphorus, K-Potassium, S-Sulfur & Zn-Zinc) compared to current programs only offering two (N & P) nutrients.

- The Mosaic Company (NYSE:$MOS) launched the first Diammonium phosphate (DAP) fertilizer in Saudi Arabia in 2017. DAP is a preferred fertilizer because it contains N and P (primary macronutrients).

Technology and innovation are the way forward to fulfilling climate goals and meeting increasing demand for food production.

Cornell University Researchers may have found part of a solution: Adapt-N, a software program helping farmers mitigate environmental impacts by providing real-time data for the application of nitrogen. This allows farmers to understand how much and when to use nitrogen fertilisers, leading to far more efficient use.

Regulation is catching up to the economics

As technology advances in the fertiliser industry, regulation is catching up. Recent key global sustainability developments include:

- 2020 – UK’s Department for Environment, Food & Rural Affairs (DEFRA) launched a consultation on solid urea fertilisers to reduce ammonia emissions. The outcome is still pending but the options are either to ban urea fertilisers, stabilise them or restrict usage to Jan-Mar only.

- 2021 – The US White House outlined its climate goals by signing an executive order ‘The Long-term Strategy of the United States’. The order outlines the goal to reduce GHG emission by ~50% by 2030E, which includes emissions from fertilisers.

- 2021 – EU Carbon Border Adjustment Mechanism (CBAM) supports The European Green Deal. CBAM is a proposed tariff on carbon intensive products. Cardon is currently being phased out to a number of goods, including fertilisers.

We see little alternative to the use of fertilisers to feed our growing global population in the face of land degradation and arable land set-aside policies, global instability, and climate change.

If we are not to add to climate instability in our drive to avoid population and civil instability, then technological innovation in design and application of fertilisers is the way forward.

We assess that the necessary economic drivers are in place for a renaissance in the fertiliser sector, as technological innovation plus demand growth leads to economic growth (value generation). In our view, investors may want to investigate exposure to this sector.