Oil & gas M&A deals 2Q21A ramp up

US oil & gas / shale M&A deals 2Q21A reached >US$ 30bn. The oil & gas M&A cycle ramp up is driven by global players attempting to increase returns and make the industry ESG compliant.

- Oil & gas / shale companies with a MCAP < US $10bn are considered unsustainable in the long term (mostly by investment banks and private equity houses).

- As a result of perceived frailties in small cap oil & gas, large cap oil & gas companies believe they have an opportunity to acquire a roster of oil & gas / shale firms’ assets. This oil majors acquisition strategy started to reveal itself in the 2Q21 M&A oil sector deal numbers.

- Oil & gas / shale acquisitions in 2Q21A reached US$ 33bn – this level of acquisition activity is the highest reported quarterly deal flow since the 2019 US$ 54.4bn M&A deal between Occidental Petroleum (NYSE: OXY) and Anadarko.

Strategy of oil & gas majors driven by current market cycle stage

As the economy recovers from the pandemic, most companies from the oil & gas and shale oil sectors are looking either to invest in low-carbon technologies, or to exit the market while US crude oil prices are high (> US$ 70 bbl) or to ramp up their M&A activities to get bigger.

Still, some oil majors, like ExxonMobil (NYSE: XOM) and Chevron Corporation (NYSE: CVX), have stood clear of the ramp up in oil & gas / shale M&A activity – at least for now.

XOM and CVX are pursuing and ESG compliance strategy rather than go down the oil & gas / shale acquisition route. It is likely that XOM and CVX prefer the risk profile associated with an ESG compliance strategy when compared with the historically fraught oil & gas / shale M&A ramp up route.

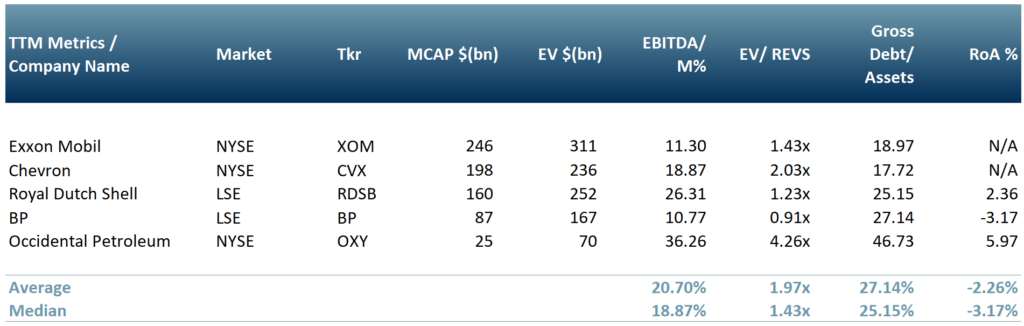

In the exhibit 1 below, we show a peer group of oil & gas majors that represent the scions of the original seven sisters oil & gas majors (and Occidental).

Before the 1973 oil crisis, the original seven sisters oil majors held approximately 85% of world oil reserves. Today, the picture is somewhat different, with an estimated 65% of global reserves held by state owned enterprises.

According to consultancy PFC Energy, public listed companies are thought today to hold less than 7% of global oil & gas reserves.

Exhibit 1 – Peer group – scions of the oil & gas 7 sisters and Occidental

Sources: ACF Equity Research Graphics; Refinitv; Exchange Rate: (Source: XE.com) GBP vs USD: 1.3939

Sources: ACF Equity Research Graphics; Refinitv; Exchange Rate: (Source: XE.com) GBP vs USD: 1.3939

Oil & gas industry response to investor flight

Oil & gas producers have found attracting investment and investors increasingly challenging since perhaps 2018. The reluctance of investors to direct funds towards the oil & gas / shale sectors is not just because of an extended period of $40 bbl oil or a spate of bankruptcies in the shale sector. Investment has also been much harder to come by for the oil & gas sector, because of social drivers.

Investors are increasingly prioritising investments that are social, sustainable and or ESG compliant. The prioritisation of ESG by investors is driving oil & gas companies to invest in energy transition strategies and low-carbon technologies.

The strategic responses of the oil & gas sector to the economic cycle and investor flight that are driving the expansion in M&A activity are rational.

Motive and opportunity for oil & gas M&A growth

The motive – oil and gas sector consolidation should improve margins, thereby improving free cash flow (FCF) and reducing some reliance on capital market funding. At the same time, improved margins may attract some investment back to the oil and gas sector.

The opportunity – in addition, the US shale industry is highly fragmented and under financial pressure. The pressure on the shale industry and its fragmentation presents larger oil & gas sector companies with a temporary opportunity to pick up assets at attractive prices.

Oil & gas sector M&A reaches a new inflexion point?

By May 2021, the total value of mergers and acquisitions for US upstream shale companies reached over US $85bn.

Across the entire oil and gas subsectors (downstream, midstream, oil field services (OFS) and upstream) M&A deal values reached US $141bn by May this year.

These 2021 deal numbers suggest we are on track to beat 2020 total oil and gas sector deal values, the first annual rise since 2018.

In 2020, total oil & gas M&A deal values reached $218bn, down from $347bn in 2019. (Deloitte, 2021). The number of M&A deals in the oil & gas sector also fell over the period with 258 deals in 2020 vs. 433 in 2019.

Exhibit 2 – Historic overview of oil and gas M&A deals globally between 2017-2020

Sources: ACF Equity Research graphic, GlobalData, Deloitte

Sources: ACF Equity Research graphic, GlobalData, Deloitte

How long will the drivers maintain M&A momentum?

We infer some latent demand for M&A oil sector deals is carried over from 2020 to 2021, mainly driven by the economic uncertainty inflicted by the covid pandemic-crisis.

- Oil & gas M&A is again fashionable in 2021 in investment banks and private equity houses.

- There are a lot of shale companies in need of financial assistance.

- ESG is not going away.

We conclude that the current upward M&A oil and gas deals trend will continue into 2022 and perhaps further. Moreover, and like others, we expect oil sector M&A to expand beyond the US shale market.

Authors: Anda Onu and Christopher Nicholson – Anda is part of ACF’s Sales & Strategy team, Christopher is MD and Head of Research at ACF Equity Research. See their profiles here

![Climate change and the [re]emergence of millet Climate change and the [re]emergence of millet](https://acfequityresearch.com/wp-content/webpc-passthru.php?src=https://acfequityresearch.com/wp-content/uploads/2023/08/ACF_Millet-a-new-sustainable-market-_Twitter-470x320.jpg&nocache=1)