Productivity vs. Data Privacy

Microsoft rolled out its new 365 Teams feature to track productivity in October 2020. In November Microsoft’s productivity tracking feature was criticised heavily and eventually scaled back in December.

There is a legitimate and not to be underestimated concern about privacy and data collection in vast detail and volume, but there is an equally important need to remain competitive through greater productivity. A lot of one and a lack of the other can both impinge upon our liberties and so our economic success.

How does Microsoft (IXIC:MSFT) Teams collect data:

- Teams collects 74 pieces of granular data including census data, usage data, error-reporting data, and profile data.

- Census data – operating system, device information and user language. You cannot opt out of this option as the data is collected by default.

- Usage data – number of messages, calls, meetings, name of organisation, and tracks where things go wrong in order to improve on the service.

- There is also profile data that is collected – email, profile pic, phone number, and content of meetings, shared files, recording, transcripts, etc that are all stored in the cloud. Microsoft keeps the data until the user stops using Teams or deletes personal data.

- All the data is stored legally, based on the jurisdiction in which the software is offered.

What employers can see:

- Employers have access to 19 different types of user activity data, which allows them to “better understand usage patterns, help make business decision, and inform training and communication efforts” according to Microsoft.

- Administrators can produce reports on how employees use Teams, i.e. if you’ve read messages, how long you spend on audio or video calls, etc. You cannot opt out of this.

Web conferencing tools have been around long before Covid-19 and the inevitable shift for the majority of the workforce to work from home. Data collection is not limited to Microsoft – we see this in the likes of Zoom and Cisco Jabber.

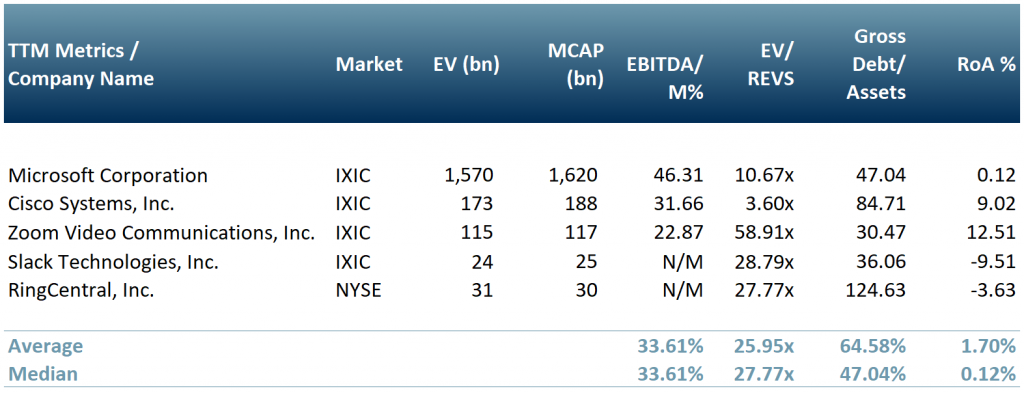

In Exhibit 1 below, we have created a peer group table of the most notable companies that provide web conferencing tools – Microsoft (IXIC:MSFT) Teams; Cisco Systems, Inc. (IXIC:CSCO) which owns Cisco Webex; Zoom Video Communications, Inc. (IXIC:ZM) Zoom; Slack Technologies, Inc. (IXIC:WORK) Slack; RingCentral, Inc. (NYSE:RNG).

Exhibit 1 – Web conferencing tools company peer group table

Source: ACF Equity Research Graphics

Source: ACF Equity Research Graphics

Data collection availability in software technology is nothing new. Nor is it a new phenomenon that companies collect data on their employees.

While data privacy concerns are a legitimate issue, there are many pros – primarily for productivity.

Companies want to measure how their employees are doing and also how productive they are. This is very relevant in developed and super-developed economies, in particular if they want to remain competitive with China and India, the great rapidly growing and highly competitive economies.

There is also a concern as to how constant monitoring may affect employee morale -“Is the Cost of Monitoring Employees at Home Worth the Erosion of Trust?” , however if a company is transparent as to the use of data collected – this could ease legitimate privacy concerns.

As a result of Covid-19, businesses and individuals have had to scramble to find ways to set up home offices. We assess that working from home is here to stay.

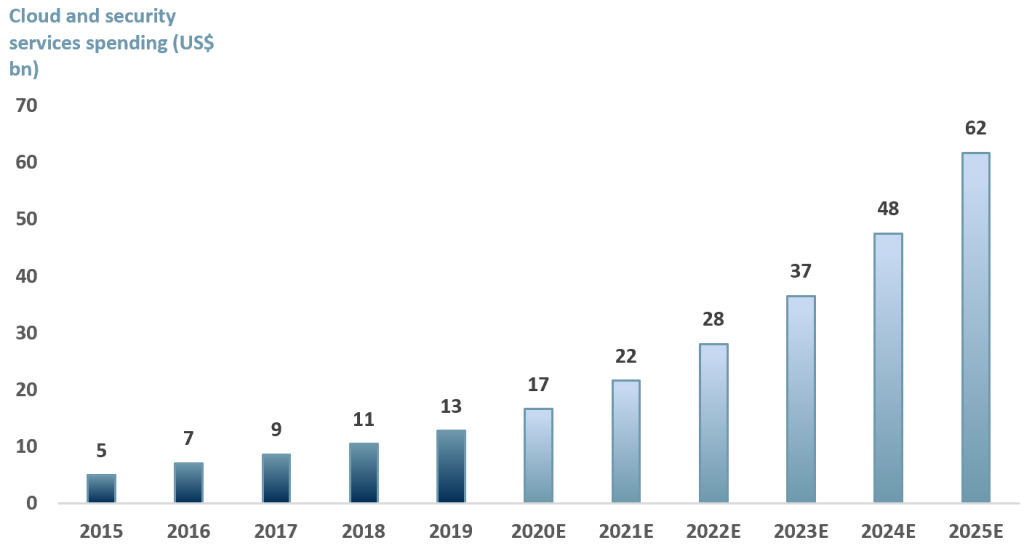

In Exhibit 2 below, we forecast the overall spend of public cloud management and security services, globally.

Based on a CAGR of 30%, we forecast that cloud and security services spending will grow above US$ 60bn in value by 2025E. This is slightly less conservative than the data and forecasts from Gartner. That is because, in our view, remote working will continue at current levels more or less and may even increase in the near-term, given what the world experienced with Covid-19.

In other words, the growth rate for the market for cloud services has accelerated. The acceleration of growth will attract further innovation – and innovation, plus capital, plus labour is the basis for yet further growth – in this segment all three are abundant.

We don’t make our ACF growth assumptions because we are expecting another pandemic, we make them because the pandemic has enabled various mass insights.

The pandemic has disabused many of long held notions and sacred cows related to working from or out of a corporate office (including fears and notions surrounding productivity and home working).

Exhibit 2 – Cloud management and security services spend globally 2015-2025E

Sources: ACF Equity Research Graphics; Gartner

Sources: ACF Equity Research Graphics; Gartner

However, it is all the more important that smaller companies find ways to protect their businesses data as well as their employees.

We argue that it is not so much that your employer is able to gain access to all of this information, though that may well be a legitimate concern for many, it is that individuals outside of your organisation now also have access to this data. The real challenge is the scale and level of detail perhaps not previously envisaged or anticipated by many organisations and individuals.

There are legitimate concerns about this level of data collection from national security to national autonomy, maintaining a free press and individual liberty.

Companies need to maintain the highest level of transparency with employees on what data is collected and how it is being used if they want to reap the rewards from this type of data collection. The downside is lack of cooperation and a breach of trust in the minds of employees. The outcome from lack of trust is invariably that the hoped-for productivity gains never materialise.

The argument remains that data collectors should be paying individuals and companies for the data they collect on them. A policy that set this idea in train might be more effective than any other form of regulation.

However, the counter point remains – how best to get greater competitive productivity and remain competitive in a global environment whilst maintaining quality of life? Not being able to do this is also a threat to a free press, security and democracy and that is a threat to investor returns.