The drone industry is taking off

Several trials using drones, or unmanned aerial vehicles (UAV) in logistics have been successfully completed over the past couple of years. Could the drone sector be about to take off?

Key Points:

- Drones were originally designed for the military, but over the past decade the commercial sector has developed and expanded.

- According to Drone Industry Insights, a German research firm, the overall drone market was worth US$ 22.5bn in 2020.

- As regulations begin to loosen, this will expand and drones will become more applicable to a variety of sectors.

A drone would once have been a strange thing to own. Now, with so many brands available in a variety of sizes and prices, they are no longer a niche item with 5m units sold globally in 2020 alone.

UAVs have been growing in popularity amongst hobbyists for the last 5 years. Interest has also grown in the film and photography sectors. However, current legislation is constricting – for example, non-military drone pilots in most countries must be within eyesight of their drone(s) and are not permitted fly drones near people or in built up areas.

Now that drone technology is more advanced, regulators have permitted trials that allow companies to test drones in new areas/sectors and to use automation. Some examples include:

- In the UK, drones have been used to monitor construction sites.

- In China, drones have been used to transport blood samples and supplies between hospitals.

- In Finland, drones have been used to drop off groceries to customers.

- In Rwanda and Ghana, drones have been used to transport medical supplies to rural communities.

- In the US, drones have been used to monitor crops.

Logistics:

The sector in which we see the most potential is in logistics. Drones in logistics could potentially decrease delivery times from days to as little as 30 minutes and completely change the sector over the next 10 years.

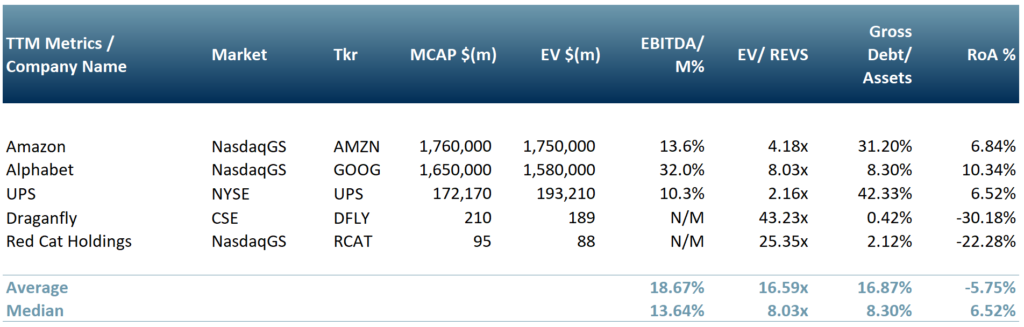

The three largest players in the market are Amazon (NasdaqGS:AMZN), UPS (NYSE:UPS) and Alphabet (NasdaqGS:GOOG).

Amazon has been investigating how it could use drones since 2013, and wants to introduce a service called Amazon Prime Air to deliver small packages in as little as 30 minutes.

- UPS has also been investigating using drones for logistics and has delivered >8,000 lab samples to selected hospitals in the US. UPS used Matternet (private) developed drones to run its 2019 and 2020 tests.

- Alphabet’s subsidiary, Wing, completed over 3,000 deliveries across Canberra, Australia over an 18-month period. Wing is developing its own drones and ran its tests in 2019 and 2020.

- These three companies along with drone manufacturers Draganfly (CSE:DFLY) and Red Cat Holdings (NasdaqCM:RCAT) are included in the peer group in exhibit 1 below.

Exhibit 1 – Peer group of companies in the drone logistics sector

Sources: ACF Equity Research Graphics; Refinitiv

Sources: ACF Equity Research Graphics; Refinitiv

This growth in the drone logistics sector comes at a time when ordering items online has been more popular than ever after Covid-19 forced the closure of stores and restaurants (many of which are likely to remain closed). Global e-commerce sales reached US$ 4,280 bn in 2020, up 28% vs 3,354 in 2019 and the total value of online food delivery market reached US$ 111bn in 2020, up 4% vs 107bn in 2019 (Businesswire, emarketer, 2020).

We infer from the delivery data that the demand growth for ‘rapid delivery’ by drone services remains a vast and attractive market opportunity. We also see significant potential from drone logistics for improved city air quality, reduction in urban congestion and even a cut in the level of fatal road accidents.

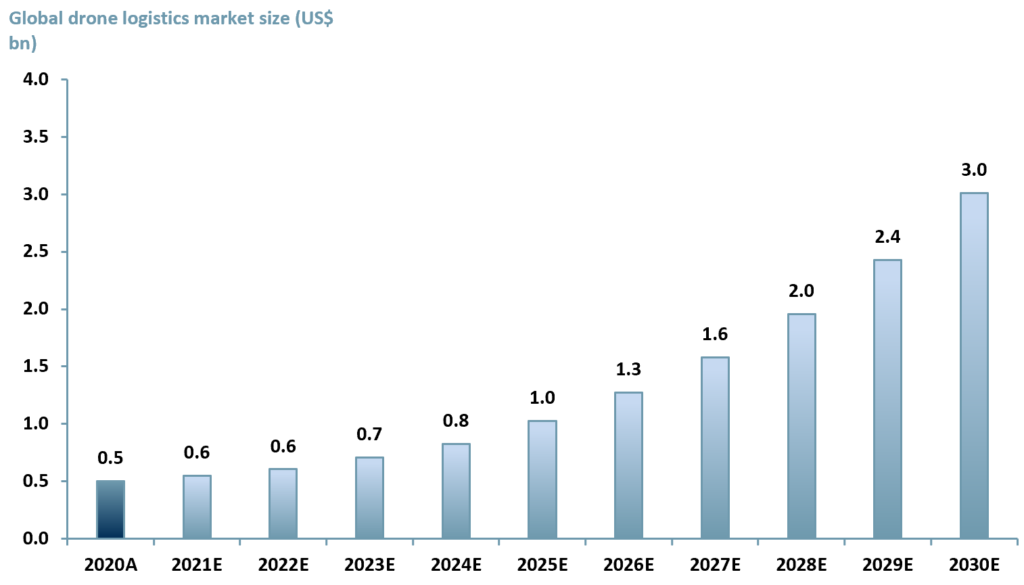

We forecast the drone logistics market will reach US$ 3bn by 2030E, growing at a CAGR of 19.7% over the period. We used an accelerating three factor growth model, with the first phase showing the lowest CAGR of 10% as the technology and regulations remain a limiting factor for growth.

We infer that growth will accelerate over the forecasted period as the technology advances, becomes less expensive, more reliable and is able to pass stringent safety testing.

With the development of drone technology we forsee more supportive regulation for growth in the industry and we predict a CAGR of 24% between 2025 as a result.

Exhibit 2 – Forecast for the drone logistics sector 2020 – 2030

Sources: ACF Equity Research Estimates; Businesswire; Markets &Markets; PR Newswire

Sources: ACF Equity Research Estimates; Businesswire; Markets &Markets; PR Newswire

The trend of shopping online is likely to continue to grow, increasing the demand for ‘rapid delivery’. Urban congestion remains on an upward trajectory globally; air quality has become a top agenda item for politicians thanks to Covid. We view these drivers, if coalesced, as a significant force for rapid change. Imagine the benefits of reducing the volume of delivery vehicles in urban areas.

If both the technology and regulations can develop to support flights in more built-up areas, uptake for drone logistics services could be huge and fast. Drone logistics has the ability to make a transformational change to delivery logistics.

Author: Sam Butcher – Sam is a Junior Staff Analyst at ACF Equity Research. See Sam’s profile