Seasonal workforce curbs UK cannabis growth?

EU nationals wanting to come to the UK for employment in the agricultural sector, as of 1 Jan 2021 must qualify for a “Skilled Worker” visa and businesses must provide a Sponsor License – as a result the UK has experienced a seasonal worker labour shortage. This has caused an issue for the cannabis sector.

The Seasonal Workers Pilot, started in 2019, has granted 30,000 visas for overseas seasonal workers to work on UK farms in 2021. However, the pilot applies to edible farming only leaving cannabis growers for medicinal use wondering what will happen next.

- The aim of the pilot programme is to help solve the labour shortage brought about as a result of amended immigration policies post-Brexit as well as the Covid-19 pandemic.

- The seasonal agricultural workers scheme hopes to encourage UK farms’ employers to invest and train local workforces, thus deterring UK farmers from relying on overseas labour.

- Seasonal jobs, in fact, are demanding, often piece work or low paid per hour, far from home and do not guarantee an all-year round income therefore making it less attractive for the local workforce.

- Employment and immigration partner at law firm Eversheds Sutherland UK, Audrey Elliott, said the scheme was negatively impacting companies growing sativa (cannabis) plants for pharmaceutical use and those directing research on more disease-resistant and higher yielding crops – as these cannabis crops are not for edible use.

Is the labour shortage a cause for concern for the UK medicinal cannabis industry?

British Sugar, which owns the UK’s largest cannabis glasshouse (18 hectares/45 acres – the size of 34 football pitches) at Wissington in Norfolk, has grown cannabis for epilepsy drugs since 2016. British Sugar has an agreement with GW Pharmaceuticals, which was bought by Jazz Pharmaceuticals (Nasdaq : $JAZZ) in May 21 for ~£5.2bn (US$ 7.2bn).

Even though the UK government granted British Sugar a license to cultivate cannabis, the government continues to face scrutiny as only CBD products are currently legal (even for medicinal use). Notwithstanding these restrictions, the UK medicinal cannabis market is expected to reach ~£929m ($1,293m) by 2024E up from ~£15m ($21m) in 2020A, a 39% increase (Prohibition Partners, 2020).

According to $JAZZ CEO, Chris Tovey, the current labour shortage has not affected Jazz’s business operations [yet], however, it has affected others in the UK medical cannabis industry and may continue to do so.

The UK’s Home Office has so far declared that no changes will be made to the “Skilled Worker” scheme that would include pharmaceutical sativa and that employers will need to focus on training and investing in the local workforce – but is that sustainable? We assess that a) the shortage of overseas seasonable workers has become acute and that b) UK workers simply do not want these jobs, at least not in large enough numbers.

(One of the barriers for UK nationals adopting seasonal work, may well be that so much in the UK economy must now be paid monthly and that missing a monthly payment in the UK leads to a significant change to credit ratings and the ability to get rented accommodation, mortgages etc).

Since the beginning of Covid/Brexit in early 2020, ~1.3m overseas nationals have left the UK.

Even if some companies do not seem to be affected by the agricultural labour shortage, we concluded that change must come either through amendments to the ‘Skilled Worker’ visa conditions to include medical cannabis or the listing rules for medical cannabis companies in the UK must be further simplified.

It would be regretful to see therapeutic cannabis companies trying to find cures for epilepsy, Parkinson’s and more, leave the UK’s shores because it is unable to cater to or for a new growing sector. So far, the signals are positive both in the successful London cannabis IPO market and around other key legislation. Nevertheless, an acceleration would be welcomed.

The UK cannabis market continues to grow

Notwithstanding a temporary shortage of seasonal workers, the global cannabis market is growing as the demand for medicinal cannabis increases due to a patient pool with conditions that marijuana can treat. In the UK, the CBD market is forecasted to reach ~£690m for 21E (Centre for Medicinal Cannabis (CMC)).

Medical marijuana was first legalised in the UK in Nov 2018 after several cases in which children suffering with severe forms of epilepsy were not able to access cannabis-based treatments that could significantly improve their quality of life.

However, even after legalisation, access to medical marijuana in the UK is limited. Only a specialised doctor (e.g. neurologists or paediatricians listed on the General Medical Council’s specialist registrar) can prescribe medical marijuana when the patient cannot be treated by traditional licensed products.

Attitudes in the UK are changing. There is indication of a strong change in the attitude or older more conservative generations towards the use of medical cannabis. A survey by rehab4addiction released 22 Oct 2018, recorded ~80% of adults over 60 in the UK are of the view that a GP (general practitioner) should prescribe medical marijuana.

While THC is not on the menu yet, the CBD industry is thriving and therapeutic cannabis farms across the country are growing rapidly. Below are three examples of farms that are pushing the cannabis agenda to make it more accessible.

Hilltop Leaf Ltd – is a private medicinal cannabis cultivation and extraction company based in Scotland, founded in 2019. Hilltop hosts an 11,000m2 greenhouse facility built within Dumfries and Galloway. Its first commercial product is under cultivation, with flowers expected by the end of 2021. Hilltop aims to supply cannabinoid oils, APIs (Active Pharmaceutical Ingredient) and medicinal products to the UK and Europe.

Sativa Wellness Group (CSE : $SWEL) – is a vertically integrated life sciences company based in Somerset (and Canada) founded in 2011 that produces and distributes CBD products. In 2019, $SWEL built a 300k ft2 (7.5 acres) cannabis greenhouse in the West Country – with the aim to grow cannabis higher in THC for use in medicinal products.

Bridge Farm Group – is a plant nursery established in 1988 based in Spalding, Lincolnshire. Bridge began growing hemp for CBD and THC (medicinal) when it was acquired by Sundial Growers Inc (Nasdaq : $SNDL) in Jul 2019 – as of May 2020 it has been spun back out. Bridge’s facility is 1.5mft2 and will increase to 3.5mft2 by YE21 – making it one of the largest, fully automated growing facilities in Europe.

In addition to the pre-existing cannabis farms in the UK, since the beginning of 2021 the UK has seen an increase in medicinal cannabis companies listing on the LSE. These companies are looking to capture the nascent EU cannabis market.

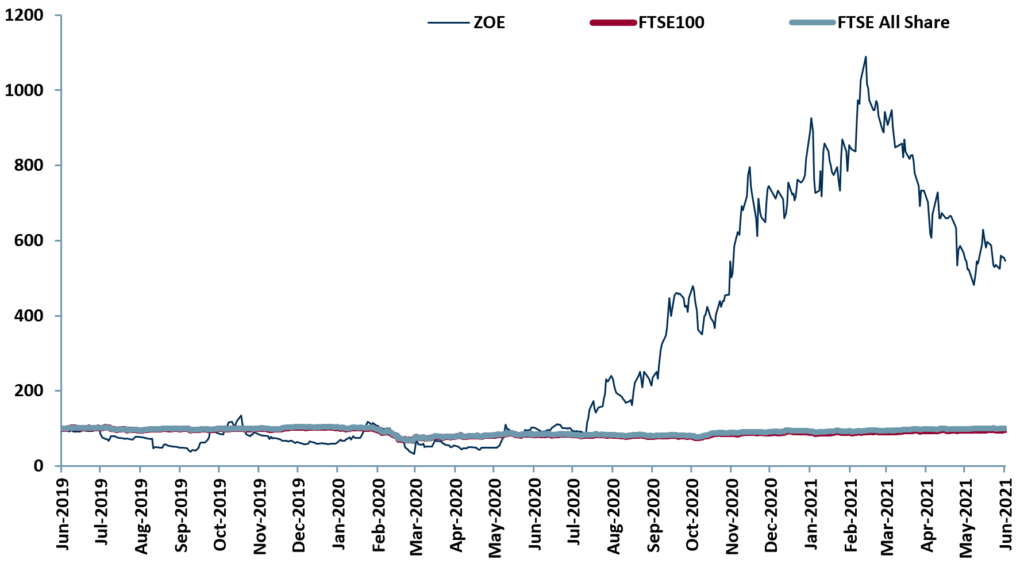

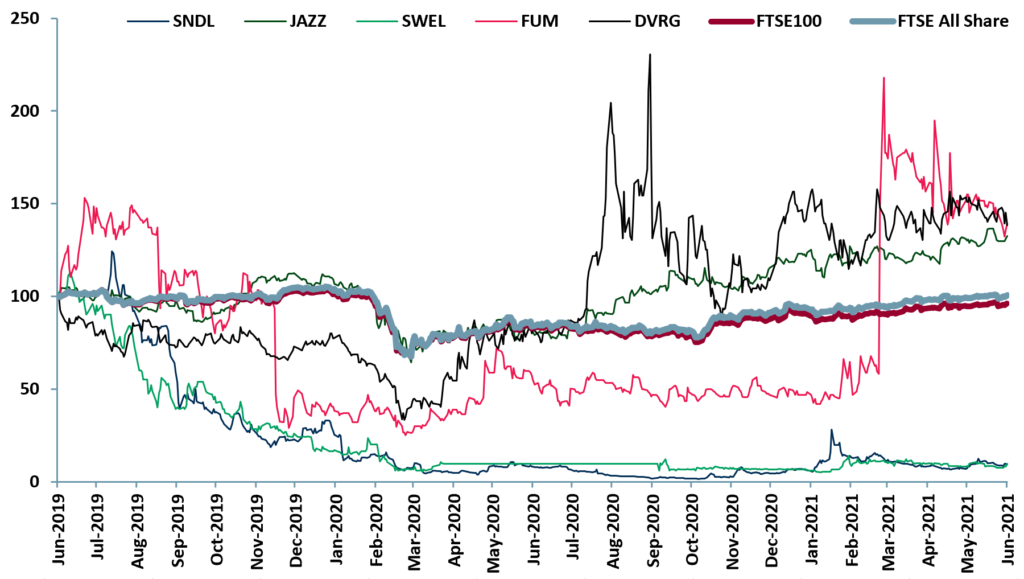

Exhibit 1 – 24m price relative charts for our medicinal cannabis peer group (below) vs. major indices 2019-2021

Sources: ACF Equity Research Graphics; Refinitiv

UK ‘s cannabis IPO boom

Following UK legalisation of medicinal cannabis in 2018, companies were slow to list on UK exchanges as investors were not able to participate in cannabis stocks due to the UK Proceeds of Crime Act 2002 (POCA). The ambiguity and concern arose as the POCA captures ‘criminal conduct’ in the UK and outside of the UK.

For example, if a UK national or business is in a foreign country where the possession and supply of recreational use is legal, if said person/entity is involved in any transactions the generate proceeds (including stocks) that is considered a criminal offense of money laundering.

As a result of the backlash from this act, in Sep 2020 the FCA published its approach for publicly listed companies in the medicinal cannabis industry. While recreational use is still completely illegal, UK-based companies can list as long as they have the required licenses from the Home Office. Overseas-based companies may also list as long POCA does not apply (i.e. strictly medicinal use only).

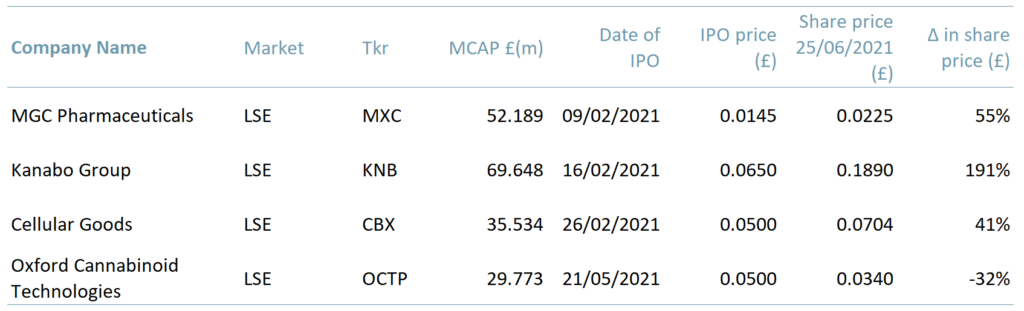

The first London IPO, 09 Feb 21, was an Australia based company MGC Pharmaceuticals ($MXC) – a bio-pharma company that develops CBD-based treatments for epilepsy and Alzheimer’s disease. As of 25 Jun 21 $MXC was priced at £0.0225, up 55% vs its IPO price of £0.0145.

Since MGC there have been three more IPOs (exhibit 2) – Kanabo Group (LSE : $KNB), Cellular Goods (LSE : $CBX) and Oxford Cannabinoid Technologies (LSE : $OCTP). Upcoming IPOs – Northern Leaf successfully closed a pre-IPO funding round at £14m in Apr 21 and Cannaray is targeting a £110m+ IPO.

Exhibit 2 – UK cannabis IPOs 2021

Sources: ACF Equity Research Graphics; Refinitiv; Note: $OCTP IPO’d on 21/05/2021

Sources: ACF Equity Research Graphics; Refinitiv; Note: $OCTP IPO’d on 21/05/2021

These companies are showing strong returns in the first few months of trading besides $OCTP, which is in its first month of trading where volatility is expected as the hype dies down. This data is encouraging because the markets are an indication of the attractiveness to UK/European investors of the growing sativa therapeutic sector – this could give the UK government the nudge it needs to amend cannabis regulations.

The way forward

All UK-based public cannabis companies, or those seeking to list, must be registered with the Home Office – UK’s office for immigration, security, law and order. However, in the most recent report by The Taskforce on Innovation, Growth and Regulatory Reform (TIGRR) released in May 2021, MPs are calling for the following recommendation:

“Regulation of medical cannabinoids and medicinal CBD should move from the Home Office to the DHSC / MHRA (Department of Health and Social Care and Medicines and Healthcare products Regulatory Agency) to create a regulatory pathway for assessment and approval based on patient benefit.”

The licensing transfer from the Home Office to the Department of Health and Social Care would facilitate growth in this sector – creating additional investment opportunities nationally and internationally. By easing up on company listing restrictions, the labour shortage issue could become less challenging as employers become more economically incentivised to hire and train UK nationals.

As a leading global exchange, the LSE will play a significant role in the growth of the cannabis market across Europe and overseas. Companies that are already listed are establishing themselves and in a good position to capture market share, and private companies looking for an opportunity are also well placed to take advantage.

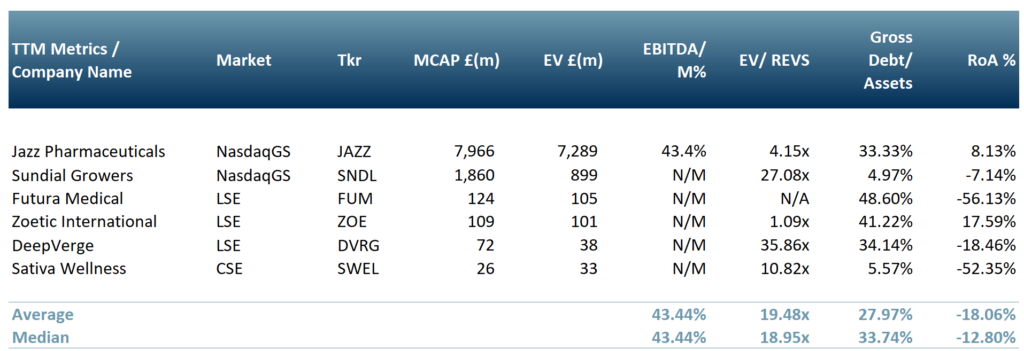

Exhibit 3 – Peer group table of medicinal cannabis companies

Source: ACF Equity Research Graphics; Refinitiv Notes: Exchange rates: (Source: XE.com) USD vs GBP 0.72032397 CAD vs. GBP 0.5857449

Source: ACF Equity Research Graphics; Refinitiv Notes: Exchange rates: (Source: XE.com) USD vs GBP 0.72032397 CAD vs. GBP 0.5857449

Authors: Anne Castagnede and Renas Sidahmed. Anne leads the Sales & Strategy Team and Renas is a Staff Analyst and part of the Sales & Strategy team at ACF Equity Research. See their profiles