FCA leads new crypto changes

FCA banned the leading global crypto exchange by volume, Binance Markets, from doing business in the UK in June. Concerns grow over cryptocurrency firms withdrawing 5MLD (anti-money laundering) applications.

On 25th June, Binance was the most liquid crypto market – the group of Binance markets hosted $17.3bn of crypto trades across its exchanges over 24 hours. The next nearest was ZG.com with $10.3bn.

- Since Jan 2020, businesses carrying crypto asset activities in the UK (crypto asset exchange providers, crypto asset ATM, Peer to Peer Providers, Initial Coin Offering (ICO) or Initial Exchange Offerings) are required to comply with legislation within the UK Money Laundering Terrorist Financing and Transfer of Funds Regulations 2017.

- Since Jan 2021 crypto businesses are also required to register with the FCA.

- Binance withdrew an application related to the Fifth Anti-Money Laundering Directive (5MLD) in May.

- Since Binance withdrew its FCA application for its separate legal entity Binance Market, the FCA has become concerned about Binance Market’s potential involvement in money laundering and fraud.

- 5MLD focuses on creating greater transparency and increased levels of due diligence in respect of company registrations.

- The UK is tightening regulations on the cryptocurrency sector.

- According to the FCA, there are a high number of crypto asset businesses which are not meeting the required standards under the money laundering regulations, in addition, more than 90% of these crypto asset firms assessed by the FCA have withdrawn their 5MLD applications, generating red flags within the regulator.

- The FCA banned Binance Markets following Binance Markets’ withdrawal of its 5MLD related application.

The UK regulator is concerned about the alarmingly high numbers of crypto firms withdrawing applications to register with the FCA, which seems only to reinforce the idea that diligent monitoring of crypto companies is a necessity.

Crypto – a booming sector in need of tighter monitoring?

The cryptocurrency sector in the UK has attracted a lot of attention. Bitcoin ($BTC) transactions in the UK grew steadily during 2020. In the real economy, London in 2020 was ranked as the 10th most integrated bitcoin city, though in reality there were only 130 bitcoin ATMs and some 50 London businesses that accepted bitcoin for payment (investopedia).

The UK, in 2020, ranked 5th globally in terms of the most Bitcoin traded behind the US, Russia, Nigeria, the rest of Europe and China (Coin Dance, LocalBitcoins, Paxful, Bisq).

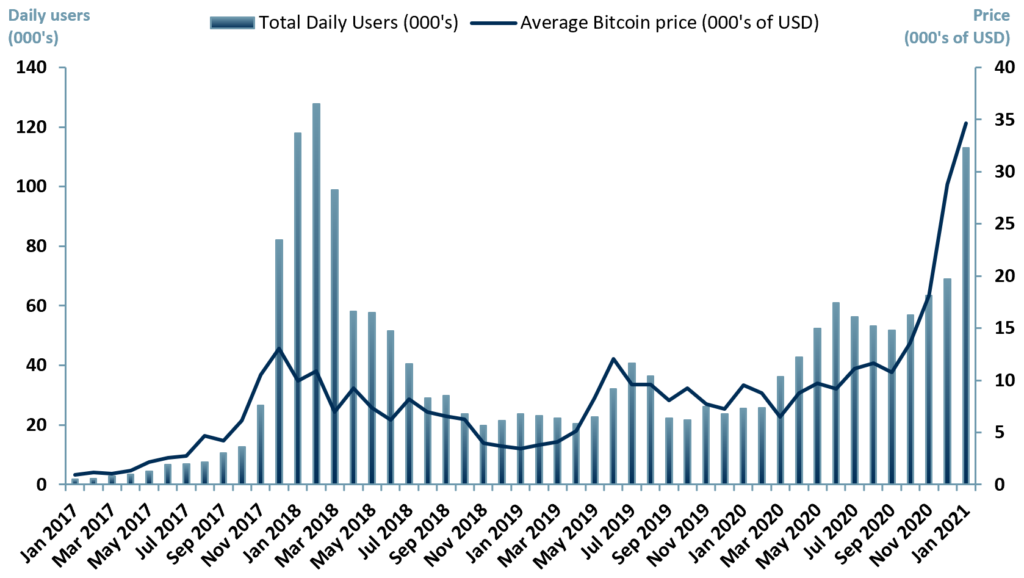

In addition, and as shown in exhibit 1 below, the average daily users of cryptocurrencies exchange platforms: Coinbase Wallet; Blockchain.com; Luno; Coinbase Pro; Exodus; Trust; Bitcoin Wallet by Bitcoin.com; Uphold and BRB has increased to 113,042 in Jan 2021 along with the average Bitcoin price at USD 34,622 as per Jan 2021.

Exhibit 1 – Average number of daily active users in crypto wallets in the UK Jan 2017 to Jan 2021

Sources: ACF Equity Research Graphics; Airnow; Coindesk.com

Sources: ACF Equity Research Graphics; Airnow; Coindesk.com

Since the beginning of the pandemic, a surge in online fraud resulted in increased pressure on the FCA to tackle fraud concerns in financial services offerings, particularly to retail investors.

But concern about fraud and money laundering in the cryptocurrency sector is of particular and renewed concern after 90% of the crypto asset firms assessed by the FCA, withdrew their 5MLD following the FCA interventions.

Many cryptocurrency firms are struggling to meet the FCA anti-money laundering standards and the FCA appears to have a keen focus on monitoring this complex and burgeoning crypto segment.

In addition to the fraud and money laundering concerns, it is generally understood, at least within financial markets, that central banks have significant concerns about cryptocurrencies that are not issued by a respected central bank. ‘Private’ crypto currencies, such as Doge and Bitcoin, if commonly adopted, have the potential to remove the ability of central banks to manage and support our economies via monetary and tax management.

If central banks were able to dominate the cryptocurrency markets with their own issued coin, they could still exercise monetary policies to stimulate or cool down the economy. This is a good thing.

So central banks are not opposed to cryptocurrencies and neither are regulators – they are opposed to economic chaos and vast expansions in fraud and criminality, which in turn undermine ‘property rights’, a concept central to any functioning economy.

We are also not opposed to crypto, it has an undeniable logic and inevitability, but it is clear that like any wild west market in its infancy, it will become regulated more effectively as it matures, probably for the good.

Author: Anne Castagnede – Anne leads the Sales & Strategy Team at ACF Equity Research. See Anne’s profile here