UK energy sector pressure – market signalling

Bulb, the UK’s seventh-biggest energy supplier obtained £1.7bn government support designed to keep it running until Apr 22. The energy supplier was put into “special administration” after insolvency in November 2021.

- Bulb, with 1.6m customers, is the biggest energy supplier to collapse in Britain in nearly 20 years. Bulb was the 23rd UK electricity and gas supplier to go bust since the end of June 2021.

- Since Bulb’s failure, another three UK suppliers have folded (Entice Energy, 5.5k customers, Orbit Energy, 65k customers, Zog Energy, 11.7k customers).

- According to Ofgem data, in the UK market there were 50 energy suppliers in June 2021. However, by the end of winter there are expected to be less than 10 UK electricity and gas market suppliers.

- The leading reason for the demise of UK energy suppliers is surging wholesale prices combined with the UK’s price cap that applies to over 15m households. These two factors together, rising input prices and an inability to raise prices to consumers, forced suppliers to sell hydrocarbon gas generated energy “at a significant loss”.

- Bulb has been put into “special administration” unlike the other 24 firms, because of its larger customer base of 1.6m. No other energy supplier was prepared to absorb this many loss-making customers.

- Bulb’s special administration status will continue until it can be sold, restructured or its customers transferred to an alternative provider.

- Customer transfer to other energy suppliers will likely only occur once current Bulb customer contracts expire, or gas prices fall to long run average levels, so that other providers can either make a margin or charge new higher prices that cover input costs and margin generation.

The crisis in the UK’s energy sector is considered a “systemic failure of regulation”. In our view, the issue can probably be reduced to insufficient capitalisation (e.g. as required of banks) and a failure to require energy price hedging.

Bulb’s situation may also be evidence of a lack of financial markets support for small and mid-cap companies in this sector. Energy suppliers have been encouraged to join public markets with little thought to capital adequacy, much like say, a typical retailer. At the first sign of pressure the secondary markets have essentially stepped away.

The response of the secondary markets suggests to us that institutional investors had no confidence in the quality of the companies that have gone bust and rejected both their operational strategies and their business models.

Smaller companies providing utility services such as energy supply, should perhaps be subject to capital adequacy tests for their ability to weather price shocks.

The ongoing crisis in the energy sector will of course diminish competition, which is what the regulator was attempting to avoid. Nevertheless, if the alternative is no power – it is clear that expediency demands fewer competitors.

Capital adequacy tests and enforced hedging of inputs (e.g. natural gas), despite creating a barrier to entry, would create a smaller number of more reliable competitors, that would, in theory, be better able to innovate.

However, the banking sector, the clearest example of a capital adequacy approach, is barely a paragon of competition and innovation (though that is beginning to change somewhat with the advent of neo-banks). No doubt the regulator will be considering this aspect too – clearly any new approach to create a competitive but more robust sector will require nuanced thought.

Currently, there are six top energy suppliers in UK: British Gas, EDF Energy, E.On ($EOAN:XETRA), Npower, Scottish Power and SSE ($SSE: LSE). EDF and British Gas have already increased standard energy prices by 12% starting 1 Oct 2021. A further 14% price rise is planned from April 2022.

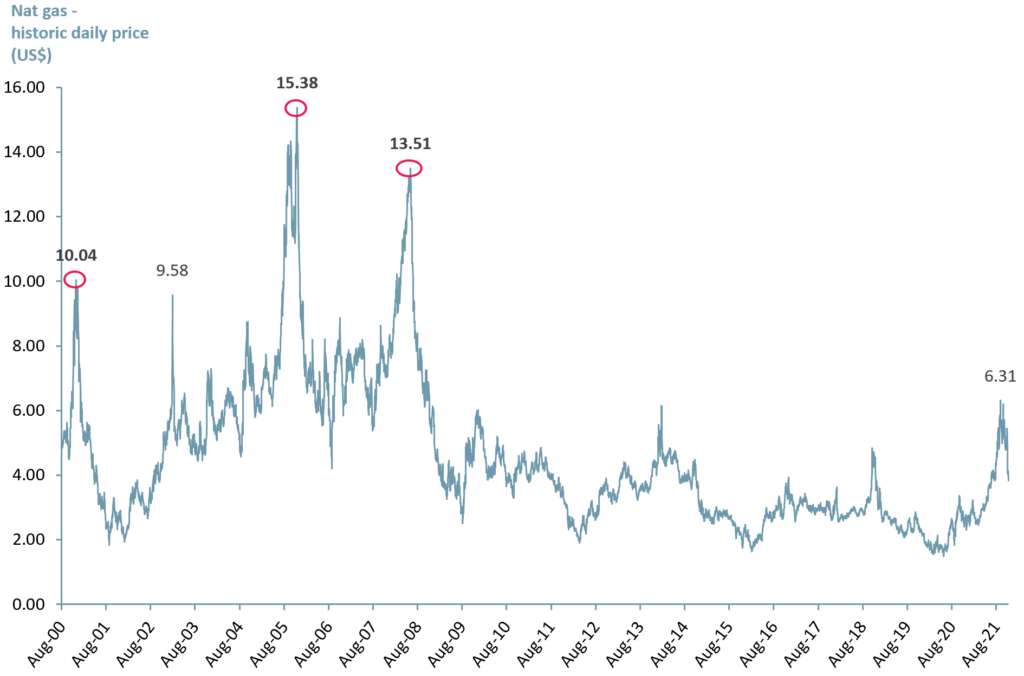

It is also important to retain some perspective on where we are – 2021’s highest gas price ($6.31/MMBtu) is lower than the last 20 years’ peaks.

From 2000 to the present there have been three major spikes: Dec 2000 ($10.04/MMBtu), Dec 2005 ($15.38/MMBtu) and Jun 2008 ($13.51/MMBtu) – as per exhibit 1 below. This makes 6.31 MMBtu, fairly inoffensive.

Therefore, given the effect the current gas price spike has had on the number of players in the UK energy market, this says more about the quality of the companies that were in the sector than it does about an energy crisis.

The more we look at what is happening in the UK energy market, the more the current issues look like they were entirely avoidable and have cost investors losses unnecessarily.

Exhibit 1 – Natural Gas – daily close prices between Aug 2000 – Dec 2021

Sources: ACF Equity Research Graphics; Yahoo Finance

Sources: ACF Equity Research Graphics; Yahoo Finance