Small Modular Reactors – a new future of nuclear energy

Small modular reactors (SMRs) could help the UK reach its new nuclear capacity goal of 24 GW by 2050. This could increase the UK’s nuclear electricity share to 25%, up from 15% in 2022, and protect domestic energy security.

The UK government plans to achieve its ambitious targets via an international competition to find leading designs for SMRs. The UK will co-fund the development of new technology and plans to replace any existing aging atomic plants.

-

- Four out of the five UK operating atomic plants will retire by 2028. The only new large nuclear plant under construction is Hinkley Point, in Somerset. Hinkley Point has suffered from delays due to scheduling and budget constraints.

-

- The SMR project has the potential to attract industrial groups. Rolls-Royce (LSE: RR) and Newcleo (start-up) aspire to build small reactors in the UK.

-

- The Rolls-Royce-led consortium has secured £210m of government funding for its SMR project and its reactor design is currently being assessed by the Office for Nuclear Regulation (ONR), which is the UK nuclear regulatory agency.

-

- The UK government also plans to invest an additional £20bn over the next 20 years for carbon, capture and storage technologies. This could increase the UK’s storage capacity to 20-30m tonnes of CO2/year by 2030 (enough electricity for ~13-19.5m households/year – in 2021 there were ~28.1m households in the UK, according to the Office for National Statistics (ONS), a non-ministerial government department reporting directly to the UK Parliament.

-

- The US is supercharging its energy transition with $369bn from the Inflation Reduction Act of 2022, advancing energy security and fighting climate change via clean and energy efficient technologies.

The global market for SMRs is projected to reach $18.8bn by 2030E, up from $3.5bn in 2020A (Valuates’ 2022 research report – UK research institute). SMRs’ variety of uses, size and compactness compared to traditional nuclear power plants, makes them a high potential preferred alternative to large scale nuclear power plants.

SMRs also have potential as one of a range of solutions needed to bridge the transition gap from fossil fuels to fully renewable power generation.

Small modular reactors (SMRs)

Smaller – A small modular reactor (SMR) is a nuclear reactor that is smaller in size and power output compared to traditional large-scale nuclear power plants. It typically has a power output of 300 MWe (Megawatts electric – electricity output of the plant) or less, versus the 1,000 MWe in conventional nuclear plants.

Modular – SMRs are designed to be modular – they can be manufactured in a factory and transported to a site where they can be assembled and installed quickly. Because they are modular, they are more cost-effective than traditional nuclear plants (these are typically built on-site and require significant construction time and resources).

Flexible – SMRs can also be used in a variety of applications such as a source of electricity for remote communities or industrial facilities, power generation in developing countries, desalination and hydrogen production.

Cost to construct – Data from EIC suggests that an SMR will cost around $300m to build cf. a large scale ~1,000 Mwe nuclear power plant with an estimated cost of $5.5bn.

Time to construct – EIC data suggests an SMR is an 18m construction project cf. its ~1000MWe large scale equivalent time line of ~5-years (at least in our view).

LCOE – EIC data suggests that the SMR levelised cost of electricity could be ~$36/MWh cf. LCOE $92/MWh for a large scale ~1,000 MWe nuclear power plant.

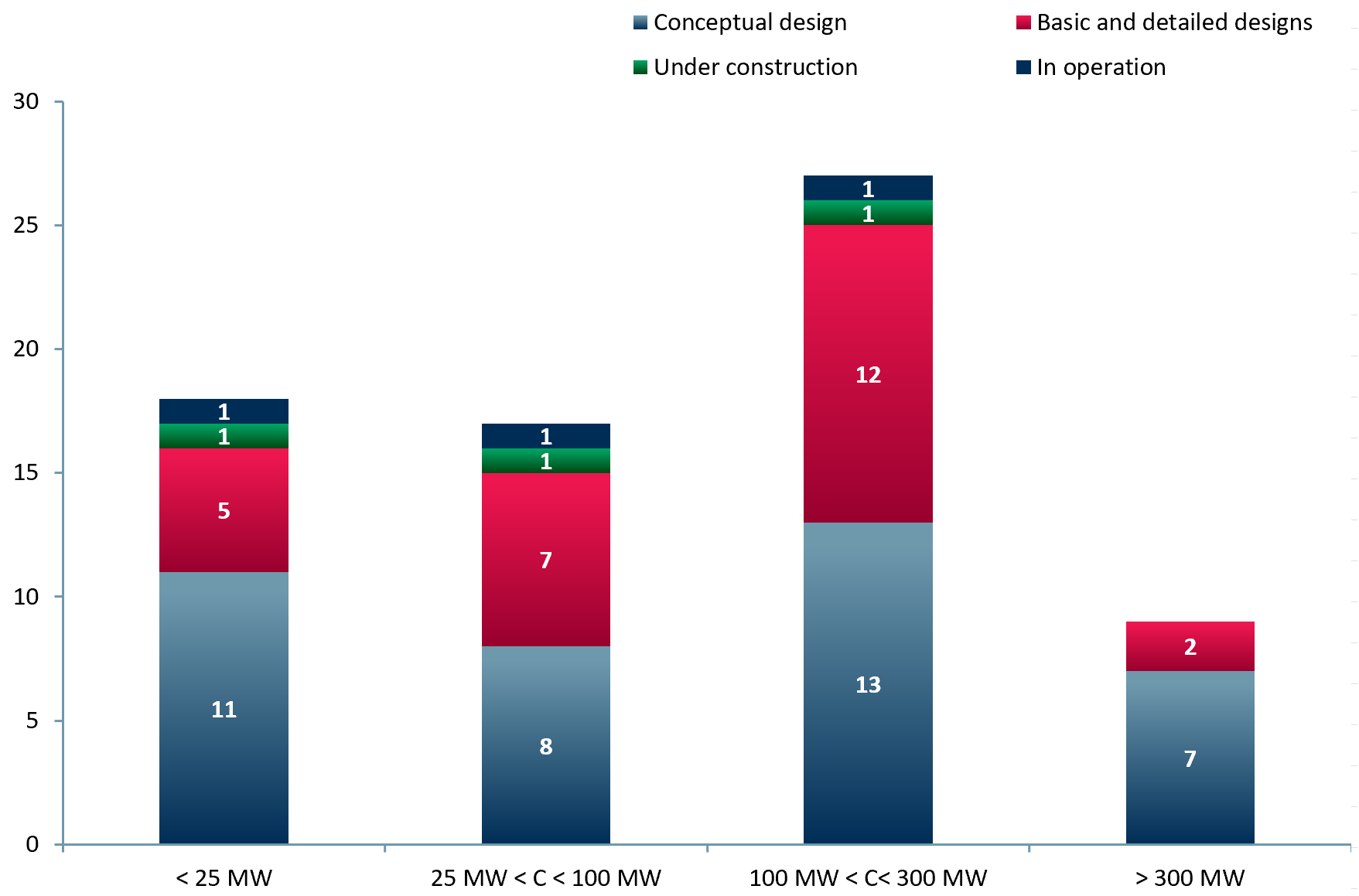

As of 2022 there were only three operational SMRs located in Russia, China and India. Three more were under construction and 65 were still in the design stage, with the majority having a capacity of 100-300 MWe (exhibit 1).

Exhibit 1. Number of global small modular reactor projects, by capacity and status 2022

Sources: ACF Equity Research; Energy Monitor.

Sources: ACF Equity Research; Energy Monitor.

The data suggests that despite a potential positive global impact on the economy, energy security and transition, the implementation of SMRs is lagging. SMR projects require standardization, as the designing and licensing processes are country specific. Therefore, new reactors are not expected to become operative before 2030.

As of 2023, there are 80+ SMR designs and projects in progress. We have presented the top five developer solutions below.

The top five global SMR developers:

-

- NuScale Power Corporation (NYSE: SMR) – Flagship SMR power plant VOYGR will be built in Poland by 2029E with up to 924 MWe of electricity.

-

- TerraPower (private) secured $80m in US Fed funding in 2020 for the development of its next-generation Natrium nuclear reactor (345 MW capacity). One of its advanced reactor demonstration projects is in Kemmerer, Wyoming.

-

- Westinghouse Electric (private) created the transportable eVinci™ micro (high-temperature heat pipe) reactor. This reactor resembles a nuclear battery more than a traditional nuclear reactor and its 15 MWe solid thermal core generates 5 MWe of electricity and up to 13 MWe of heat.

-

- BWX Technologies (NYSE: BWXT) – Selected to manufacture the US’s first full-scale mobile microreactor prototype ready for testing in the Idaho National Laboratory by 2024. Project costs estimated at under $300m.

-

- Kairos Power (private) – Focused on fluoride salt-cooled high temperature reactors (KP-FHR), a novel SMR technology with a near-zero carbon footprint and minimal water consumption. The projects initial demonstration is projected in 2030 (c3newsmag, 2023).

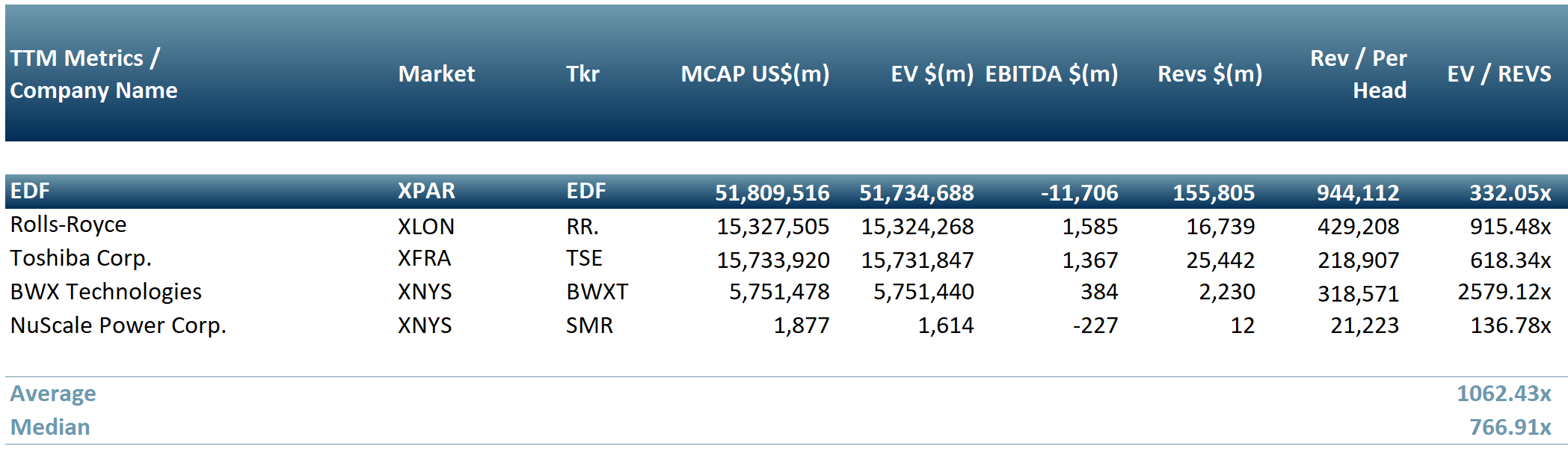

Exhibit 2. Peer group of the top publicly listed SMRs producing companies

Sources: ACF Equity Research; Refinitiv.

Sources: ACF Equity Research; Refinitiv.

How nuclear energy will (still) change the future of electricity and heat

The nuclear power capacity worldwide is growing. In total, there are ~440 nuclear power reactors operating in 32 countries with a capacity of 390 MWe. An additional ~60 reactors are currently under construction in 15 countries (notably China, India and Russia) and 100 reactors are planned with a total capacity of 100,000 MWe. (World Nuclear Association, Apr 2023).

Furthermore, the IEA’s Stated Policies Scenario forecasts installed nuclear capacity to reach 590 GW by 2050E, up 43% from 2020A. The nuclear contribution to global power generation will amount to ~12% by 2050E. (World Nuclear Association, Apr 2023)

Nuclear energy still has the potential to change the future of energy by providing a reliable, efficient and carbon-free source of energy that can reduce GHG emissions and increase energy security, while continuing to improve its technology. Though it does not come risk free, it seems inevitable for now that nuclear power will play a role as a key bridging technology in the global transition to clean energy.

-

- Reliable: Nuclear energy provides a constant based load supply of power compared with the fluctuations that currently occur with renewable energy sources. LTES rollout (batteries) are essential to make renewable energy a true replacement for conventional fossil fuel energy sources.

-

- Efficient: Nuclear power plants have a higher energy output compared to traditional forms of energy generation, i.e. they have the ability to produce more energy with less fuel.

-

- Carbon-free: Nuclear energy does mot emit GHG, therefore it does not contribute to climate change, making it an attractive alternative top fossil fuels (though it has the potential to produce more hazardous emissions than even fossil fuels in the event of catastrophic plan failure).

-

- Energy security: Nuclear energy can reduce a country’s dependence on foreign energy sources, which is critically important for countries that do not have an abundant domestic source of fossil fuels.

-

- Technologically advanced: There have been significant advances in nuclear technology in recent years, which include small modular reactors (SMRs) and advanced nuclear fuel cycles. These advancements improve the safety profile of nuclear energy and promise more cost-effective and versatile plants.

How small modular reactors (SMRs) will change the future of energy

SMRs have the potential to change the future of energy production by providing more flexible, safe and cost-effective alternatives to traditional nuclear power plants that also decrease environmental impact.

-

- Flexible and versatile? SMR designs lend themselves to construction in a variety of locations, including remote areas where large-scale nuclear reactors may not be feasible. They can also be used to power small communities or industrial facilities.

-

- Safe? SMRs claim to use safety features that are designed to shut down the reactor in case of an emergency. They also generate less heat, reducing the risk of a nuclear meltdown.

-

- Cost-effective? SMR data suggests SMRs are less expensive to build and operate than traditional nuclear power plants because of their small size and simple design. This makes SMRs a more attractive investment option for companies and countries looking to increase or begin nuclear power diversification.

-

- Environmental impact? SMRs have a smaller environmental footprint compared to traditional large-scale nuclear power plants, because of their small size and shorter time to construct. SMRs are also able to use spent nuclear fuel (primarily uranium fuel used in a reactor that is no longer efficient in producing electricity) or other nuclear waste as fuel, reducing the amount of stored nuclear waste – which if demonstrated to be consistently the case at volume, could be a compelling selling point.

Nuclear energy currently accounts for ~10% of the global electricity production. Within less than 30 years, it is expected to reach 12%. It seems to us that new low-carbon/carbon-free technologies (e.g. nuclear hydrogen production and SMRs) will be essential transition technologies if we are to achieve the world’s net-zero goal by 2050.

Although nuclear energy is in competition with other forms of energy such as ‘infinite’ renewables (solar, wind, wave), technological advancements (e.g. SMRs) keep nuclear as a strong contender as one of the futures of energy production.

The new low cost SMR alternatives make the nuclear energy sector more appealing to the investment community as an alternative to traditional fossil fuels that are, in any event in decline and that are increasingly subject to phase out pressures.