A new investment theme for cleantech is taking hold

Cleantech investments in start-ups were very popular among the Venture Capitalists (VC) 10 years ago – the VC community, in particularly in Silicon Valley, was looking for something exciting and new following the aftermath of the Dotcom Bubble.

Unfortunately, given the capital investment scale of renewable technology infrastructure and the nascent nature of the sector at the time (the term “cleantech” was relatively new), these companies were, in the end, unable to deliver the necessary returns for VCs.

During the period of VC funding between 2006 and 2011, investment firms lost over half of the US$ 25bn invested in cleantech start-ups. However, VCs are now taking a different approach. The focus has shifted to ‘more affordable’ cleantech investment opportunities e.g. EVs, lab-grown meat products or solar services.

The VC’s are leaving much larger investors to appraise and manage renewable energy infrastructure build-outs such as grid interconnection and power generation ‘plants’, e.g. wind and solar farms, hydro projects and geothermal projects.

- According to the IEA (International Energy Agency) new patents for core technologies – batteries, hydrogen, smart grids and carbon capture – are outpacing other technologies, including fossil fuel innovations.

- In 2020, investors poured $500bn into ‘energy transition’ – up over 2x vs. 2010. In the US alone, expected investments are ~$60bn in 2021 up from $36bn in 2020.

- VC senior partners are more likely to get on board following the success of Beyond Meat (NASDAQ : $BYND), Impossible Foods and of course Tesla (NASDAQ: $TSLA) whose MCAP has reached ~$700+bn, up from $1.7bn in 2010.

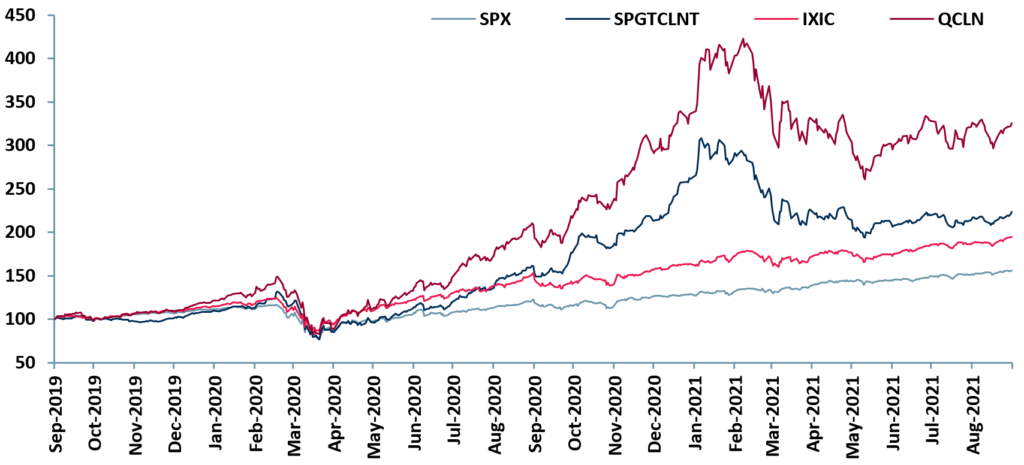

- The S&P Global Clean Energy Index has generated annualised returns of more than 40% over past three years (more than 2x the benchmark S&P 500 Index).

Exhibit 1 price relative chart shows how the clean energy indices have outperformed against the US major global indices – S&P 500 (SPX) vs. S&P Clean Energy (SPGTCLNT) and NASDAQ (IXIC) vs. NASDAQ Clean Edge Green Energy (QCLN).

Exhibit 1 – Clean energy indices vs. major indices over 24-months

Sources: ACF Equity Research Graphics; Refinitiv

Sources: ACF Equity Research Graphics; Refinitiv

Cleantech investment on the rise

Cleantech investment is entering a new era. Gone are the days where investment funds were only available from the VC community. What we are seeing today is support from governments, interest from family offices and retail (millennials cohort), a change in direction of charities and sustainability initiatives from large-caps and Wall Street in general.

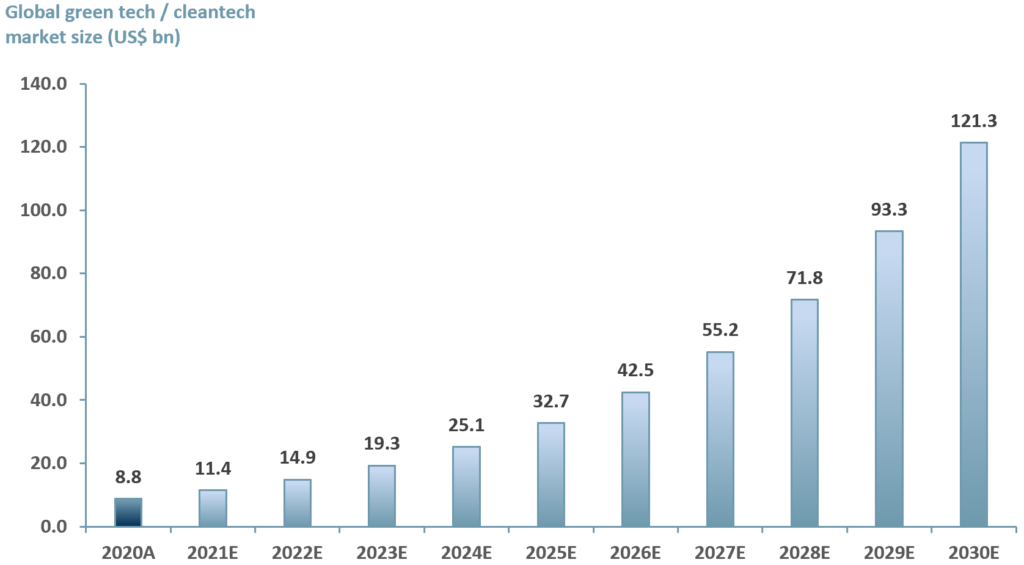

ACF forecasts that the global cleantech / greentech market will reach a value of $121.3bn by 2030E, up from $8.8bn in 2020A – a CAGR of 30% (exhibit 2). Our forecast is less conservative than the market consensus for the following reasons:

- The EU and the US have both set targets to reduce greenhouse gas (GHG) emissions by 2030 by more than ~50% to be in line with the Paris Agreement target of limiting global warming levels to below 2°C. While the US does not look likely to meet its 2025 emissions reduction target of 25%, the Biden administration is determined, hence the aggressive 2030 target. The EU is also re-energised to do a lot more after 2019 data showed GHG emissions only fell by 25%.

- Ahead of the UK hosted COP26 this November 2021, the World Bank Group announced that it will double its current 5-year investments in greentech / cleantech to ~$200bn. The investments will support private sector financing in countries actively working towards climate change, with a focus on climate adaptation (explained in further detail below).

The resources and the drive are all there for countries to meet the Paris Agreements targets by 2030. Where it was once only regulatory authorities or government bodies pushing the sustainability agenda, everyone from the financial sector to charities is getting involved.

Exhibit 2 – Global greentech / cleantech market 2020A-2030E

Sources: ACF Equity Research Graphics; Allied Market Research

Sources: ACF Equity Research Graphics; Allied Market Research

Government support

On 12 Aug 2021, the US’s Department of Energy (DOE) partnered with Breakthrough Energy Catalyst – a Bill Gates financing programme focused on decarbonization. It is a $1.5bn partnership working to develop ‘novel’ technologies for sustainable aviation fuel (SAF), green hydrogen, direct air capture (DAC) and long-term energy storage (LDS).

The partnership is in addition to the existing $40bn+ DOE loan programme for deploying and developing cleantech for offshore wind, green hydrogen, geothermal energy and EVs.

The European Commission (EC) has also partnered with Breakthrough Energy Catalyst to provide $1bn to build large-scale projects for cleantech. The partnership will bring together the private and public sectors to invest in these technologies, which will eventually lower the costs of production and operation and make them more easily accessible to the rest of the investment community.

The UK plans to invest £166.5m (~$230m) in green technologies. This ‘green’ fund will provide investments for UK-based cleantech start-ups with the goal of the UK becoming a net-zero economy by 2050. This is part of the £12bn UK government ’10-Point Plan’ announced in November 2020 to create 250k highly skilled green jobs.

Non-conventional investors

Charities, philanthropically minded firms and non-profits are also taking an interest in cleantech. For example, US non-profit Elemental Excelerator is providing opportunities, through its fund for start-ups committed to solving climate change (as well as other operational stipulations) anywhere in the world, to have access to up to $500k.

Many more clean energy funds that are looking to not just ‘do good’ but to ‘do better’ for our environment. In addition, in the US, corporates and institutional investors, who pay corporate taxes, are able to participate in ‘Tax Credit Investments’. Tax credits redirect the tax liability of projects that fall under the ESG/Sustainability umbrella, i.e. an investor can receive a tax benefit from the US government to cancel out a portion of its liability.

Big fish

It is not surprising that given the US’s ‘Tax Credit Investments’ incentive, large investment banks, such as BNP Paribas ($BNP: Euronext), and large corporations, such as Facebook (NASDAQ: $FB), are embracing tax credits as an investment opportunity. $FB, for example, is investing in the solar Investment Tax Credit (ITC) through its 379MW Prospero Solar project.

According to a white paper, Tax Credit Investments are ESG Investments, by Reuters Events and Foss & Company (US tax credit specialists), more companies should get involved in tax credit investments as a way of achieving ESG goals.

Companies like Microsoft (NASDAQ: $MSFT) and Amazon (NASDAQ: $AMZN) are setting up cleantech funds as part of their business operations. $MSFT has setup a $1bn fund and plans to offset all greenhouse gases it has ever emitted by 2050. $AMZN’s fund is worth $2bn (financed directly from its balance sheet) and focuses on reducing the company’s carbon footprint.

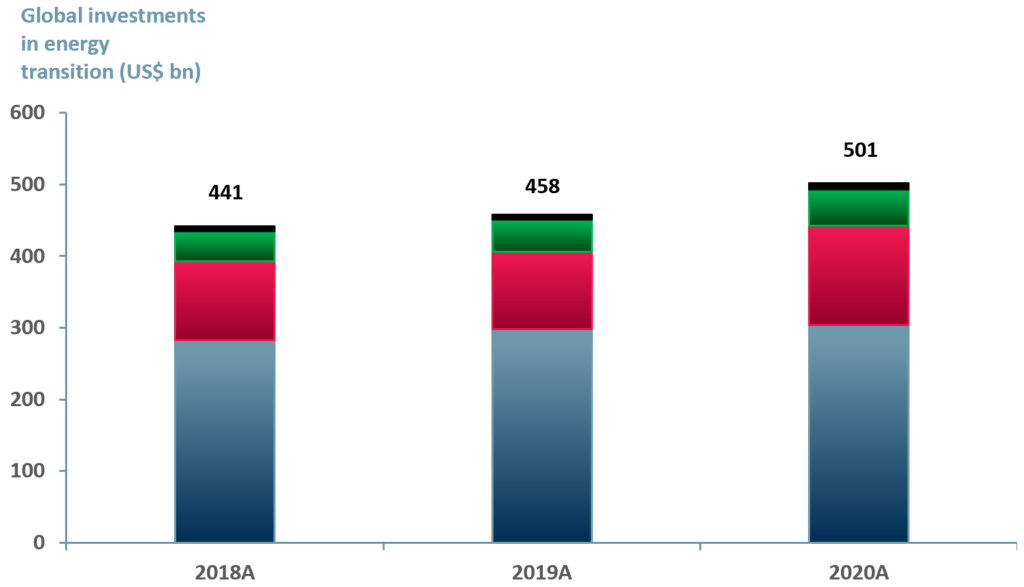

Investing in energy transition (decarbonising everything from energy, transport, industry and farming) which involves the use of cleantech, is not slowing down anytime soon. In exhibit 3 we highlight how global investments in green energy transition have increased over the past three years. By 2020A, global investments reached ~$501bn up from $441bn 2018A – a 14% increase.

Exhibit 3 – Global investments in cleantech 2018A-2020A

Sources: ACF Equity Research Graphics; BloombergNEF

Sources: ACF Equity Research Graphics; BloombergNEF

Global investments in cleantech are on the rise, however the stipulations from the investor community are changing. The sustainable investor wants to see that a company is incorporating sustainable practices into its business operations and deliver public and verifiable metrics. Greenwashing will not be tolerated, indeed there are moves to criminalise greenwashing in the UK.

This is particularly relevant for small and mid-cap companies, who already find it challenging to access or maintain the constant flow of capital they require for growth. By getting ahead of the curve and being pre-emptive in how companies adapt their business operations to incorporate climate change, we see a plethora of opportunities available to deliver or ease the search for funding.

Climate adaptation and pre-emptive investing

Climate adaptation is becoming a necessary box to tick when investors take climate-risk factors into consideration for their portfolios. Climate adaption is adapting a business, in particular the infrastructure of a business, so that it adheres to building codes in regard to safety and environment footprint. Safety – how it can be protected against storms, floods, etc., Environmental footprint – how it operates in reducing, or not emitting, pollutants.

The United Nations Environment Programme (UNEP) suggests that ~US$ 300bn is needed annually in less developed countries for climate adaptation and that private investors will need to get on board. According to Climate Policy Initiative (CPI), private investors only contributed 2% to climate adaptation in 2018.

Private investors may soon change their minds as investing in climate adaption will not just mean a handsome payoff, but also deliver lower costs for companies, at least in the short-term via for example, tax incentives.

BlackRock’s 2019 study of 260 utility companies, suggests that the property industry will be hit worse than other industries not only because of natural disasters, but due to higher insurance premiums and costs of installing backup generators if they do not have climate adaptation measures in place.

Reinsurers (insurance for insurance companies) are also focussing on Blackrock’s findings. Reinsurance is concluding that it is more cost effective to invest in an entity ahead of the disaster, rather than pay for it afterwards.

The increased reinsurance emphasis on prevention rather than cure is probably related to a change of frequency in previously observed 1 in 100-year events.

Companies that invest in climate adaptation could potentially trade at a premium (2019 BlackRock study). Companies that are exposed to climate-related risks are particularly vulnerable to potentially lethal valuation volatility shocks. Those that were more ‘climate-resilient’ were able to withstand initial valuation shocks and recover.

Is there a positive valuation impact soon?

We take the view that it will become mandatory in hyper-developed and developed economies for all companies to disclose climate-related risks. Therefore, showing evidence of climate adaption now would position a company to take advantage of the nascent wave of investor interest in this area of sustainability. Ceteris paribus, climate adaptation will increase a company’s valuation.

Author: Renas Sidahmed – Renas is a Staff Analyst, heading up the ESG / Sustainability valuation team and is also part of the Sales & Strategy team at ACF Equity Research. See Renas’s profile here

![Climate change and the [re]emergence of millet Climate change and the [re]emergence of millet](https://acfequityresearch.com/wp-content/webpc-passthru.php?src=https://acfequityresearch.com/wp-content/uploads/2023/08/ACF_Millet-a-new-sustainable-market-_Twitter-470x320.jpg&nocache=1)