Gold consolidation continues

We assess that the gold price will continue its long-term rise. The general case for investing in junior miners remains strong and the stock specific case will only grow in importance.

In this ACF analytical blog we assess the items driving the price of gold, what the implications of the pandemic and longer-term post-pandemic conditions are and why, in our view, the upward trend is set to continue.

In general, we are witnessing an increase in structural, political and economic instability in the global economy. The Covid pandemic has become an additional element driving this instability. The Covid-19 restrictions that forced mining suspensions, meant less exploration, which led to a market perception of lower reserve horizons and less gold for spot delivery.

Markets are still of the general view that inflationary pressures are short term, nevertheless longer-term inflation expectations continue to support or push up the gold price.

Central Banks are increasing their reserves in preparation for another ‘rainy day’.

Technological innovation is leading to increased demand for gold in industry (energy efficiency) and delivering greater supply opportunities – exploration effectiveness and exploitation efficiencies improve margins for producing mines and make more deposits economic.

It is axiomatic that during 2020, the gold market experienced a surge in M&A activity due to the following:

- There has been a gradual depletion of gold reserves over the past five years – 53,000 mt tons in 2020E down from 57,000 mt in 2016E (US Geological Survey, 2021).

- Competition in the gold industry is limited to projects and assets as all players produce and sell the same product, tending to the same price.

- Gold prices continue to gain support from geopolitical and macroeconomic uncertainties, volatility in the markets and an uneven economic outlook as the world navigates the new normal post-covid.

The price of gold – our drivers

The most notable use of gold is jewellery. However, because of gold’s conductivity properties (i.e. it is an efficient conductor), gold is also used in technology, such as cell phones and televisions, as an investment instrument and by Central Banks (part of FX reserves and as a tool for improving international financial stability).

The 2020 gold demand schedule was made up of investment 46.6%, jewellery 36.8%, Central Banks 8.6% and technology 8%.

Demand from investments is the highest contributor to the overall demand schedule, as gold acts as a hedge against interest rates and inflation – the price of the metal responds to changes in these two factors in the following ways:

Interest rates

Low rates make traditional financial instruments less attractive and the market then looks to gold as an optimal asset choice. Demand for gold goes up as does the price, providing potential for upwards revaluation for gold equities.

High rates make government bonds and other investments more attractive as the returns are higher. This shifts the market’s focus away from safe haven assets such as gold, demand falls and the price falls.

Inflation

High inflation increases the price of gold. This is because the price of gold is dollar denominated. As inflation increases, the US dollar depreciates – an indication that the economy is contracting. The demand for gold goes up because it is relatively ‘cheaper’ to buy. The inverse is also true.

Illustrative case study

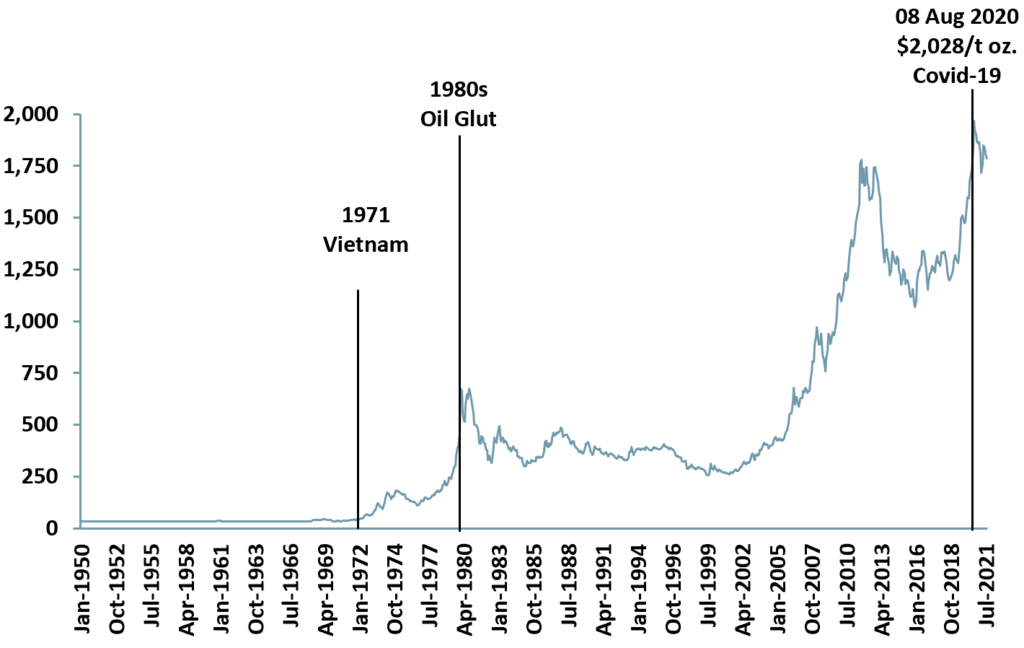

Throughout the pandemic we saw the effects of the above drivers on the price of gold (exhibit 1). The US Federal Reserve kept interest rates at 0.25% and the price of gold has consistently remained above $1,600/ t oz. Once the Federal Reserve hinted that it would begin tapering and potentially increase interest rates, the price of gold began to decline in 1H21, and currently trades around 10% below its pandemic high of ~$2,000 /t oz.

Exhibit 1 – Gold spot price 1950-2021

Sources: ACF Equity Research Graphics; datahub; indexmundi

Sources: ACF Equity Research Graphics; datahub; indexmundi

History supports our long and short run gold price assessment

Up until 1971, the value of gold was tied to the USD at the fixed conversion rate of $35/t oz. President Nixon took the dollar off the gold standard following soaring deficits form the cost of the Vietnam War.

By 1980 the price of gold hit, what was then, an all-time record high of $850/t oz., prompted by high inflation (13.5%) on the back of strong oil prices ($35/bbl). The price dropped to $251.70/t oz. in 1999 as Central Banks looked to decrease their gold reserves and began a steady climb until Mar 2008 when it broke above $1,000/t oz. during the financial crisis.

Since the crisis, the price of gold has remained above the $1,000/t oz. support line until reaching another all-time high of $2,028/t oz. on 8 Aug 2020 – as the US government continued its efforts to support the economy via various stimulus bills.

What is happening to gold now?

During the pandemic, many investors flocked to gold-backed ETFs with a record 877 tonnes added to global holdings – ~$48bn. The low interest rate environment reduced the opportunity cost of holding gold over other financial instruments.

Where investors and markets benefitted during the pandemic, retail businesses did not. Lockdown restrictions and the shutting of the market caused demand for gold to fall by 14% to 3,759.6 tonnes in 2020 from 4,386.4 tonnes in 2019 (World Gold Council).

As economies reopen and recover, retail business re-open their doors as usual and consumers start spending more – not with-standing the accelerated migration to online purchasing, we observe an uptick in gold demand. In 2Q21 global demand for gold was up 9% vs. 1Q21 – albeit at lower levels compared to 2020 (down 1% y/y). Part of the return to near pre-pandemic demand for gold has been driven by Central Banks ramping up their gold reserves.

Rising inflation continues to be a cause for concern for investors but also for Central Banks. In the US, inflation data for Aug 2021 came in at 5.3%, the Euro Area at 3.0% and the UK at 3.2%. The Bank of England (BoE) on 23 Sep 21 indicated that it expects UK inflation to reach up to 4%.

In our view, the UK inflation number is 4% or greater. After 12 years of monetary easing and bond buybacks, significant debt holders are conflicted – the real value of their debt, and so its burden, falls as inflation rises.

Banks acquire gold as a hedge against inflation because it is a ‘finite’ commodity and does not carry any credit or counterparty risk. As of 2Q21, Central Banks held ~31,200 tonnes of gold – ~21% of global holdings (World Gold council).

Central Banks are increasing their reserves and at the same time gold miners reserve horizon development and gold production have been held up by Covid-19 driven shut-downs. This dynamic becomes a significant upwards or supporting price driver for gold.

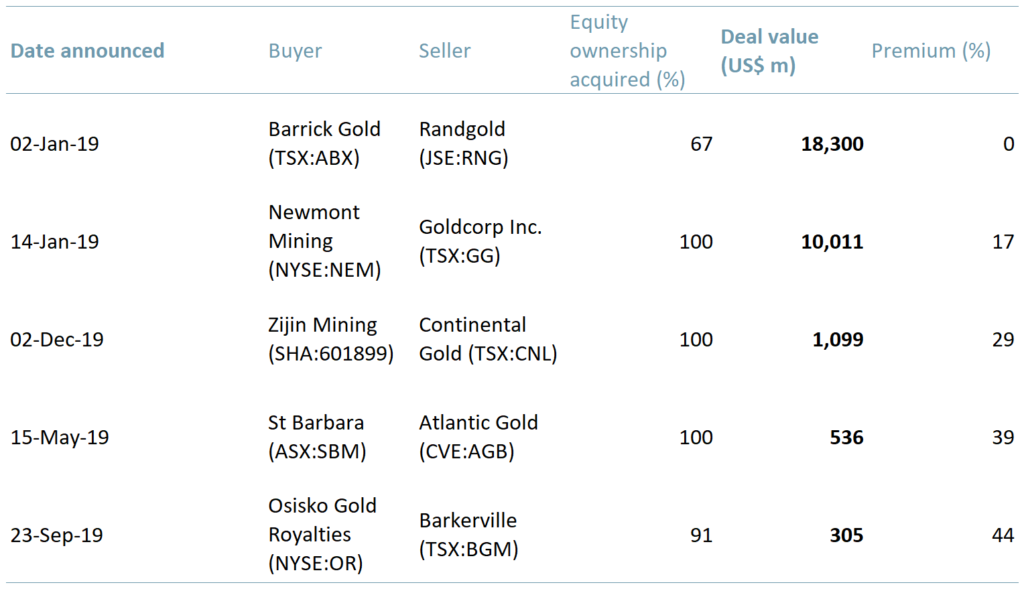

The consolidation continues

In YE19A there were a recorded 39 M&A gold deals worth ~$20.3bn, up from ~$11.7bn in YE18A. In YE20A, there were 50 M&A deals with a total transaction value of $12.9bn, a 36% decline y/y (S&P Global, Jan 2021), even though the number of deals rose 28% according to S&P’s data.

Deal values have fallen significantly y/y. We believe three factors have driven the reduction in M&A values:

- The market has come under the impression that there was a certain amount of hype around YE19A M&A deals, a perception issue that probably requires attention and that is causing investor resistance.

- Sellers during covid are more likely to have been forced sellers in a thinner buyer market.

- Covid held up verification and so a reduction in deals and deal appetite injected an inevitable increase in discount rates.

Exhibit 2 – Top five M&A deals by value 2019A

Sources: ACF Equity Research Graphics; Kitco

Sources: ACF Equity Research Graphics; Kitco

Exhibit 3 – Top five M&A deals by value 2020A

Sources: ACF Equity Research Graphics; S&P Global Market Intelligence

Sources: ACF Equity Research Graphics; S&P Global Market Intelligence

As Covid restrictions ease, allowing for physical asset inspection, M&A will is likely to accelerate. As we have argued here, the gold price is also likely to continue to rise over the next ten years, supporting both longer-run M&A and production and exploration projects.

In the shorter term, drivers for gold production and extension of reserve horizons will persuade investors of the general investment case for junior explorers and producers.

Nevertheless, company specific investment cases will remain front and central to the execution of investment decisions, in part due to 1) the market’s perception of deal pricing in YE19A and 2) a far more intense focus on sustainability (ESG).

Authors: Renas Sidahmed and Christopher Nicholson – Renas is a Staff Analyst and part of the Sales & Strategy team and Christopher is MD and Head of Research at ACF Equity Research. See their profiles here