Antimony liquid metal batteries – US challenger for LDES?

Ambri, a US long duration energy storage (LDES) company, has partnered with Xcel Energy (US utility holding company) on a demonstration project. Together, Ambri and Xcel Energy, will install a liquid metal battery in Colorado in a grid-connected scenario to prove the ability of calcium-antimony liquid metal batteries to interact with renewable energy sources.

- The calcium-antimony liquid metal battery will be tested at the Solar Technology Acceleration Center (SolarTAC) in Aurora, Colorado. The aim is to demonstrate the battery works with utility companies’ large-scale, i.e. grid-scale applications.

- The capacity of Ambri’s large-scale battery unit is 250 kW/1,000 kWh and a direct current (DC) efficiency of over 80%. The voltage of the battery is between 550 V to 1,150 V. (pv-magazine, 2022)

- Xcel Energy aims to be net-zero across electricity, heating, and transportation by 2050. Ambri’s technology is well-suited for effective storage and dispatchable power circumstances in any weather conditions.

- The antimony needed to produce Ambri’s liquid metal batteries will be supplied by Perpetua Resources (Nasdaq: PPTA), as per a 2021 agreement. Perpetua’s Stibnite mine is expected to supply ~35% of the US’s domestic antimony as of 2024E. See our Perpetua initiation note

Liquid Metal Batteries (LMBs)

By 2023, liquid metal batteries (LMBs) are likely to be competing with Li-ion, lead-acid and vanadium flow batteries for long duration stationery storage applications. Antimony is used in LMBs because when alloyed with other metals, e.g. lead, it makes the metals harder and stronger.

In batteries this characteristic of antimony is beneficial because it improves resistance to corrosion. Antinomy can therefore improve the life cycle, current density and capacity of grid energy storage. As such, antimony is also a key element in bearings for wind turbines and glass clarification for solar energy.

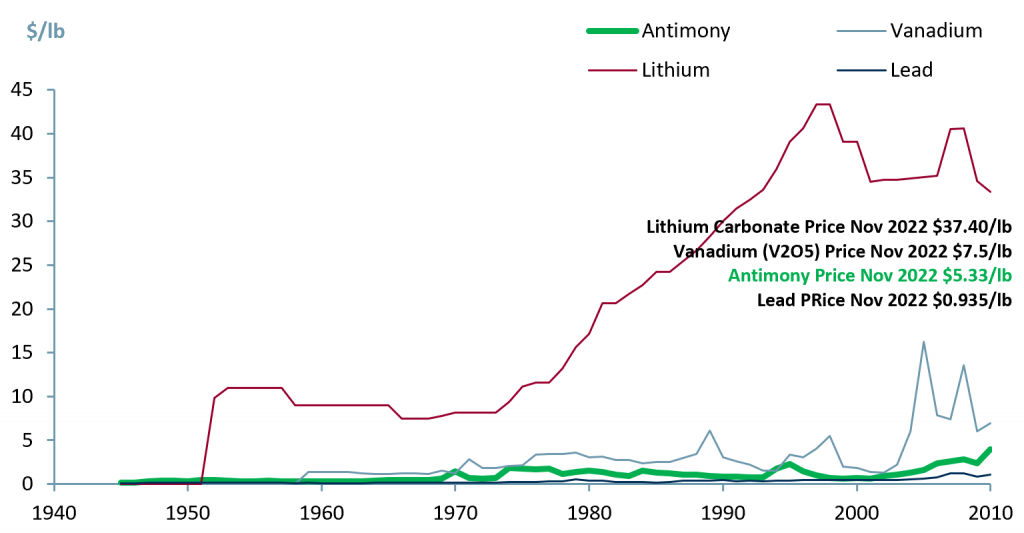

Antimony’s popularity is also driven by its price. In exhibit 1 below, we present the price movements of the main energy storage battery metals vs antimony between 1940 and 2010. In 2010, the price of antimony was 42% less than that of vanadium and 88% less than that of lithium.

Exhibit 1. Price chart comparison for antimony, vanadium, lithium and lead 1940-2010 (with Nov 2022 prices added for comparison)

Sources: ACF Equity Research graphics; USGS.

Sources: ACF Equity Research graphics; USGS.

LMBs have liquid calcium (Ca) anodes, antimony (Sb) particle cathodes, and molten salt electrolytes. These components hold some cost, operational, and safety advantages in grid storage over Li, lead-acid (LA) and vanadium flow (VFB) based technologies. (Verdict, 2022)

Cost – As indicated above, the metals/minerals used in LMBs are at a lower-cost vs. vanadium and lithium which conveys competitive advantage (though it should be noted that there probable is not enough economically viable metal deposits of any of these types to satisfy global overall demand).

Operational – The life of the battery is longer as evidenced by a DC efficiency of over 80%.

Safety – Metals/minerals used make the batteries non-inflammable and resistant to external temperatures compared to other batteries.

LMBs have the potential to help renewable power generators like wind and solar, increase their roles in power

Grids. (Renewables are expected to increase their share in global electricity generation to 45% by 2040E from 29% in 2020A. (International Energy Agency, 2020))

Levelized Cost of Storage (LCOS)

The Levelized Cost of Storage (LCOS) must be taken into consideration before deciding upon the best type of battery for storing energy. Investors consider the LCOS a useful metric for evaluating the relative economics of battery systems. LCOS is the minimum price ($) that [they/ investors] would require per kWh of electricity stored and subsequently dispatched to break even.” (Science direct, 2022).

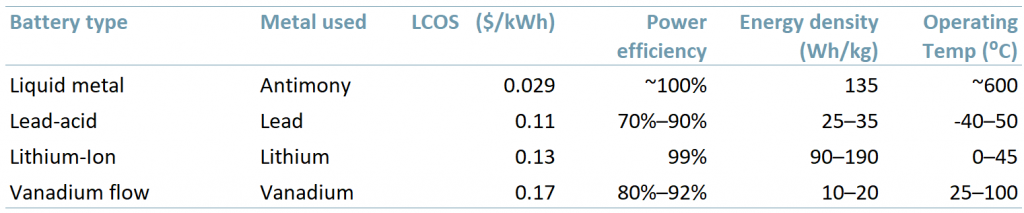

The estimated (LCOS) for the type of batteries above mentioned are as follows:

- Sodium liquid metal batteries (Sb-LMB): 0.029 $/kWh – making them a promising technology for grid-scale energy storage applications.

- Lead-acid batteries: 0.11 $/kWh.

- Lithium-ion batteries: 0.13 $/kWh.

- Vanadium flow batteries: 0.17 $/kWh.

Exhibit 2. Energy storage batteries performance comparison

Sources: ACF Equity Research graphics; Science Direct; Chem Europe; Frontiers In.

Sources: ACF Equity Research graphics; Science Direct; Chem Europe; Frontiers In.

Power efficiency reflects the amount of energy released from a battery vs. the amount of energy that enters it. Therefore, a power efficiency of ~100% indicates that [almost] all of the energy that enters the battery is released for use.

The energy density of a battery is the amount of energy (watt-hour, Wh) a battery contains compared to its weight (kg) or size. The larger the energy density, the more efficient the battery.

The higher the operating temperature of a battery the more performance is increased. However higher operating temperatures can affect the battery life-cycle – higher temperatures can increase water loss and corrosion rates. However, new LMB technology allows LMB batteries to “operate at maximum performance level no matter the external temperature and [they] require no power-hungry air conditioning”. (Ambri, 2020)

In spite of some of the apparent advantages of LMBs with antimony, there are too many long duration energy storage systems around the world for only one solution to prevail. In our view, there is a market for all battery types in long duration energy storage (LDES) and dispatchable power due to limited resources.

What is interesting from an investor point of view is companies that are positioned in the dispatchable electricity vertical. The dispatchable electricity vertical provides renewable energy generation with the ‘capacity’ and characteristics to deliver grid parity and so replace fossil fuel generation across utility scales grids.