Gallium and Germanium demand signals

Germanium and gallium are important signalling markets in spite of their low (but rapidly growing) total dollar market value.

Germanium and gallium are subject to a new Chinese system for securing licenses for rare metals administered by the Chinese Ministry of Commerce as of 1 Aug 2023. This system restricts the export of germanium, gallium and several of their compounds from the country.

- Both gallium (Ga) and germanium (Ge) are produced as byproducts of the refineries of other metals. Gallium from the processing of bauxite and zinc ores, and germanium from zinc production.

- China exported 94t of Ga 43.7t and of Ge in 2022. According to Critical Raw Materials Alliance China produces ~ 60% of the world’s germanium and 80% of the world’s gallium. (CRM Alliance, 2023)

- Out of the 94t of Ga exported from China in 2022, the US imported US$ 3m worth of Ga and US$ 200m worth of gallium arsenide (GaAs) wafers (USGS, 2022). Gallium (Ga) global import demand was up 34% YE22 vs.YE21, according to the USGS.

- Out of the 43.7t of Ge exported from China in 2022, the US imported $60m worth of Ge, while the EU bought $130m (S&P Global Market Intelligence, 2022).

Ga and Ge are essential elements for the semiconductor industry, they are also considered critical raw materials with a wide range of applications across various industries.

Gallium is a soft silvery metal used mostly in the compounds gallium arsenide (GaAs) ~95%, and gallium nitride (GaN), ~5%. Both Ga arsenide and nitride compounds have applications in industries including semiconductors, renewable energy, electronics and communications, and healthcare.

The global market for GaAs wafers is expected to reach US$ 3.4bn by 2030E, up from US$ 1.4bn in 2022E, an 11.6% CAGR (Research and Markets, 2023). While the global GaN market is forecasted to reach ~US$ 2.44bn by 2030E, up from US$ 0.32bn in 2021A, a 24.95% CAGR (Research and Markets, 2023).

Overall, the global gallium market is expected to reach US$ 17bn by 2032E, up from US$ 1.9bn in 2022A (Persistence Market Research, 2022). Quite a ramp up in demand over 10 years.

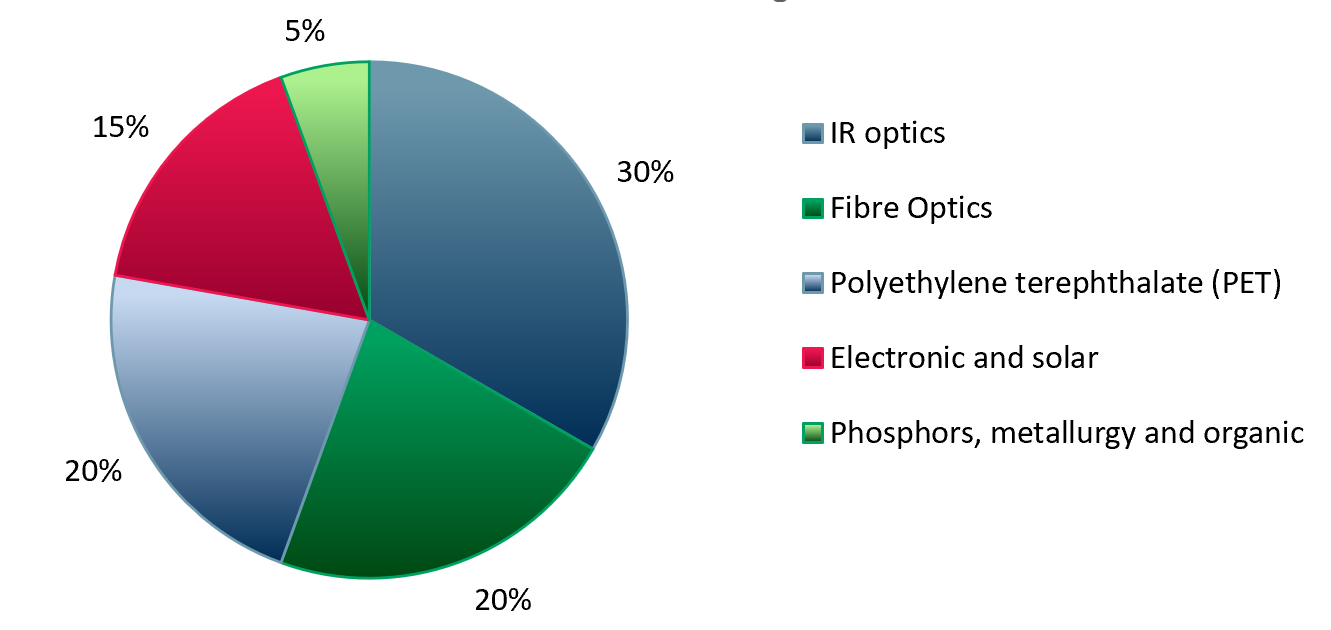

Germanium (Ge) is a semi-metal with high applicability within the semiconductor industry. As per exhibit 1 below, Ge has a variety of other applications compared to Ga.

Exhibit 1 – Ge applications by ~percentage of total consumption 2019

Sources: ACF Equity Research graphics; USGS, ThoughtCo.

Sources: ACF Equity Research graphics; USGS, ThoughtCo.

The global Ge market is estimated to reach US$ 342.93m by 2027E, up from USD 290.14m in 2022E (Research and Market, 2022).

Both Ga and Ge can also be obtained from recycling. Gallium is recovered as high-purity refined Ga. Reclaiming Ga in this way accounts for ~10% of global Ga production. (The higher the purity of the recycled Ga, the better for performance in applications). In 2022E, ~290t of Ga was obtained from new scrap vs zero from old (USGS, 2022, ScienceDirect, 2023).

In contrast only ~3% of global Ge supply is produced from recycled materials. For example, the US’s Defence Logistics Agency Strategic Materials Ge recycling programme expects to produce ~3 t/yr of high-purity Ge ingot to be used for military devices (USGS, 2023).

Besides China, several other countries including Japan, Slovakia, Canada, Germany and US have been recycling Ga and Ge over the years. Prior to 2020 there was a trend for countries to withdraw from Ge recycling, e.g. UK, Hungary, and Ukraine. However since COVID and the Russia/Ukraine war some countries, e.g. Germany, have considered restarting recycling of Ge following commensurate recent price increase (USGS, 2023).

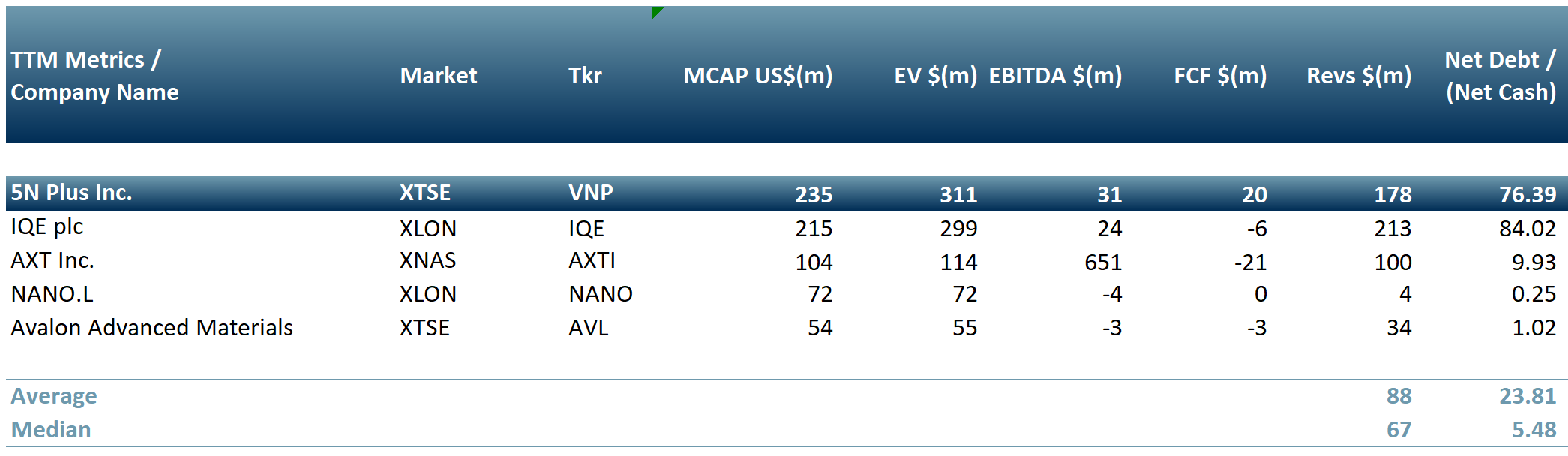

In exhibit 2 below we present a peer group of mid-cap US, Canadian and European companies that focus on producing Ga and or Ge.

Exhibit 2 – Peer group of mid-cap companies that focus on Ga and Ge production

Sources: ACF Equity Research graphics; Refinitiv.

Sources: ACF Equity Research graphics; Refinitiv.

In the ever-evolving technological carbon neutral landscape Ga and Ge are becoming indispensable. Understanding the current global demand dynamics of Ga and Ge (continuous increase in demand vs restricted supply) and ensuring a sustainable robust supply and logistics chain for these elements will be crucial for the continued growth and development of technology-dependent and carbon neutral sectors.

It seems self-evident that in order to meet supply, those countries that used to recycle and produce Ga and Ge will need to re-enter the Ga and Ge recycling markets. What Ga and Ge supply and demand suggests to us extends to other critical metals. Critical metals recycling growth, in our view, seems very likely to be an inescapable and expanding component of the supply equation.