Consolidating the Gold Market

A new theme has emerged in the gold (Au) market: an increase in mergers and acquisitions (M&A) business activities. The hope is that this may derail growing structural issues inherent to the sector which include the following:

- The industry is highly fragmented, resulting in small gold mining companies running the risk of becoming irrelevant;

- Companies with mature assets are unable to boost earnings by optimising their existing portfolio (i.e. growing organically);

- Reserves are depleting and companies are struggling to raise debt for new projects;

- Rising gold prices; partially driven by geopolitical uncertainties, Covid-19, market volatility and sluggish growth.

The gold sector is highly fragmented where only a small percentage of global mining output is controlled by top-tier producers. (Other segments of the mining industry such as platinum, uranium, nickel, and copper only have a few large companies that dominate production). In the gold market there are very low barriers to entry and even though there is competition over projects and assets, these companies are selling the same product for the same price.

Large companies are challenged by having to replace reserves in a sustainable manner while competing for a shrinking pool of new discoveries. Small and junior companies are facing limited access to credit and capital amidst increasing volatility in the equity and debt markets and the uncertainty brought by Covid-19. Furthermore, as it is not required for gold miners to operate at the lowest cost in the industry or have a ‘healthy’ balance sheet (assets are greater than liabilities), there is no competition to drive out the weaker players in order to create stronger mining entities.

According to McKinsey, from 2012-2017 gold reserves of the major gold companies declined by 26% from 967Moz to 713Moz while the average life of mine (LoM) dropped from 19 to 16.5 years. Exploration activities are also yielding fewer high-grade world-scale deposits. While technology may make it possible to convert currently uneconomical reserves, there still remains the risk of exhausting (or nearly exhausting) gold reserves. In lieu of this, industry consolidation via M&As may be the only viable solution for companies to grow and replenish existing reserves.

The increasing price of gold has added more than US$500/oz. It has increased from US$1,203/oz in November 2019 to $1,732/oz (at the time of writing).

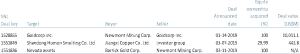

YE19 saw 348 M&A deals worth more than US$30.5bn up from US$10.8bn in YE18. This figure also surpasses the previous high of $25.7bn set in YE10. Please see below for data on the largest deals in 2018 and 2019.

1.Largest Deals in 2018

Source: S&P Global Market Intelligence

2.Largest Deals in 2019

Source: S&P Global Market Intelligence

ACF is of the view that coordination between large companies, and small and junior companies could promote increased investor activity. Not only is it important that mining companies showcase a high degree of environmental credibility (ESG is no longer an option, it is a requirement); merging resources among gold mining companies can reduce the competition for access to shrinking new discoveries, replenish reserves, and attract greater valuations from investors because of greater certainty for future Free Cash Flows (FCF) and economies of scale.

Author

Adeline Bockarie is a Junior Research Analyst working as a staffer for the Head of Research at ACF