Esports – playing a new revenue game

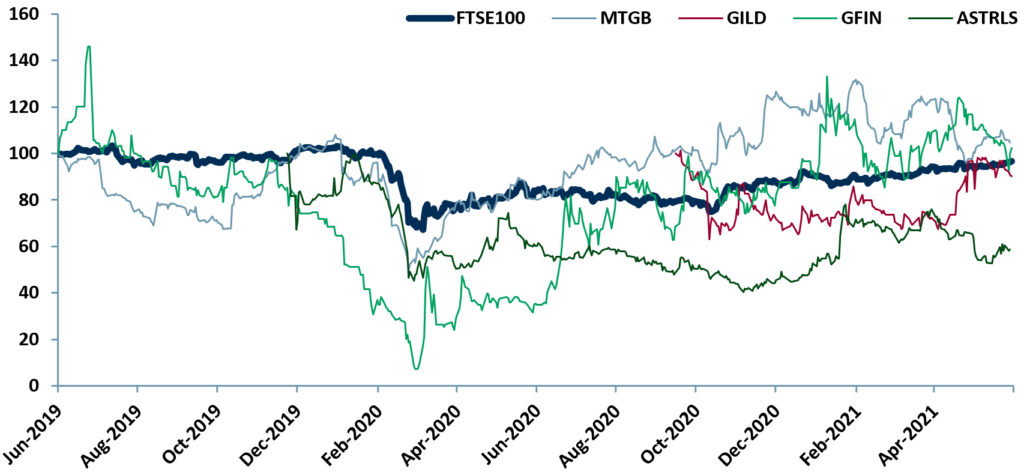

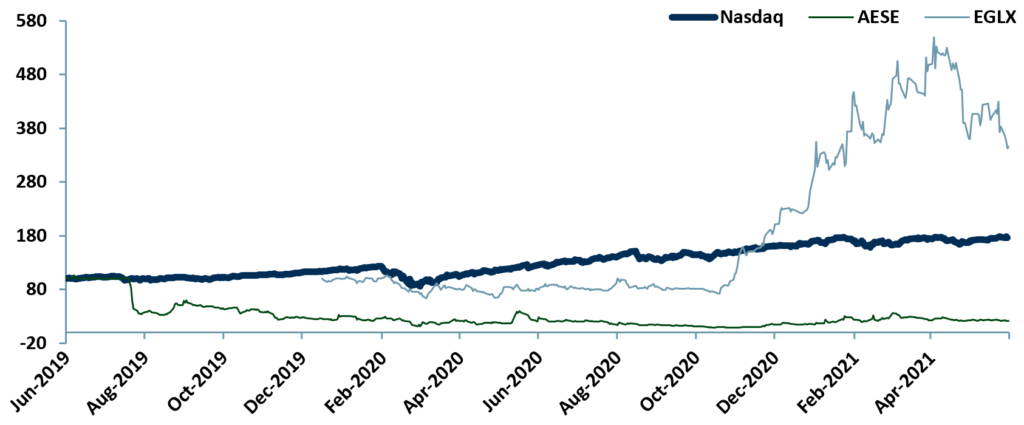

Esports’ investment performance, until recently, has not been as exciting as its growth prospects suggest (see exhibit 1 below). This phase of ‘disappointment’ is to be expected with a young growing sector. We examine some of the evidence and provide some of our own market forecasts and insights below.

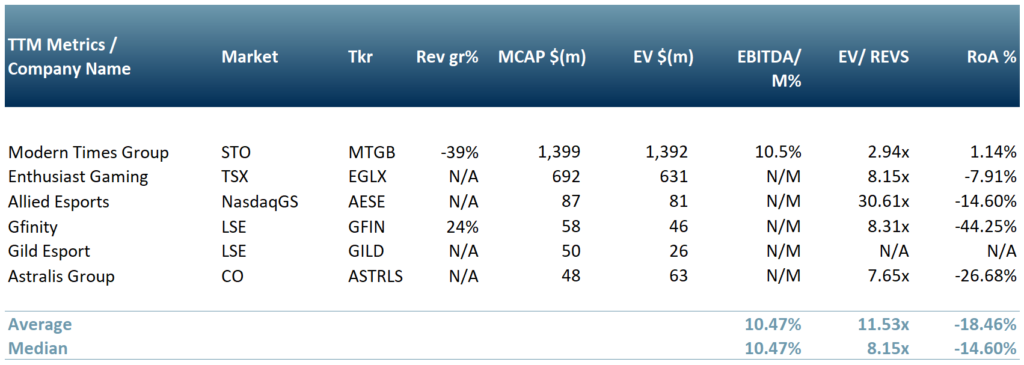

Esports valuations continue to hold significant promise despite fan monetisation lagging behind major sports clubs. Arguably the economics of esports differs from traditional sports, and investors in the secondary market are taking notice. Esports companies will need to consider diversifying revenues as investors demand more transparency on potential profitability.

- Esports companies tend to have three revenue streams: sponsorship, prize money and league fees. These streams are misleading as a good portion of revenues actually get paid out to the players.

- Payment out to top players generally can happen in two ways – first, sponsorship money paid to esports companies by other brands is used by esports companies in part to sponsor top players to enter events, leagues and competitions. Second, there is prize money. This is something like a salary plus bonus arrangement for top players that win.

- Astralis Group ($ASTRLS.CO), for example, reported revenues of DKK 51.5m (~US$ 8.2m) for YE20A – gross of prize money. Of that, 66% (DKK 33.9m / ~$5.4m) was from incoming sponsorships. If the prize money paid out is also deducted (DKK 4.1m / ~$0.7m), that amounts to 72% of total revenues. Astralis YE20A net loss DKK (52.9)m / ~$(8.5)m) and YE20A NCO DKK (33.2)m / ~$(5.3)m.

- Investors have become aware of the issues and have demanded better business models, some of this drive for change may already be reflected in relative share price performance over 2021 (see exhibit 1 below).

- Whilst esports broadcast deals are increasingly popular (i.e. streaming live games), esports companies are examining other ways of growing revenues (not necessarily organically):

-

- M&A activity – The acquisition or merger of businesses that complement the core focus of the primary esports organisation by merging different capabilities, would generate diverse revenue streams. e.g. Holding company US Immortals Gaming Club (IGC) acquired Gamers Club (LatAm) in 2019. As a result IGC has access to Gamers Cub’s subscriptions revenue stream and potential brand activation in LatAm.

-

- Digital platforms – Esports organisations are shifting towards building their own digital platforms. This is becoming more popular as VCs enter the esports arena – 2020’s Gaming Bonanza 2.0 – dedicated gaming funds for new gaming start-ups.

-

- Brick & mortar stores – Esport companies are building physical stores in order to increase brand awareness by selling merchandise and offering access to LAN (Local Area Network).

-

- Gaming camps – Fans are taught by pro players at teaching camps, increasing fan engagement.

Investors can see the potential in an industry that continues to flourish post-pandemic. If anything, Covid has reinforced existing esports demand drivers as the global population moves to a more digitalised new normal.

Our Healthcare team concluded that it is almost inevitable that strains or classes of the Covid virus will emerge that evade current immune responses generated by vaccines – their bear case scenario is that Covid, as a threat, will be with us for a decade – that means a long-term change in social behaviour.

Esports does not need the Covid behaviour driver to thrive but if our healthcare team is correct, we assess that it will accelerate esport adoption, engagement and revenue growth opportunities.

Exhibit 1 – 24m price relative charts for our esports peer group vs. major indices 2019-2021

Source: ACF Equity Research Graphics; Refinitv.

Source: ACF Equity Research Graphics; Refinitv.

The Esports market

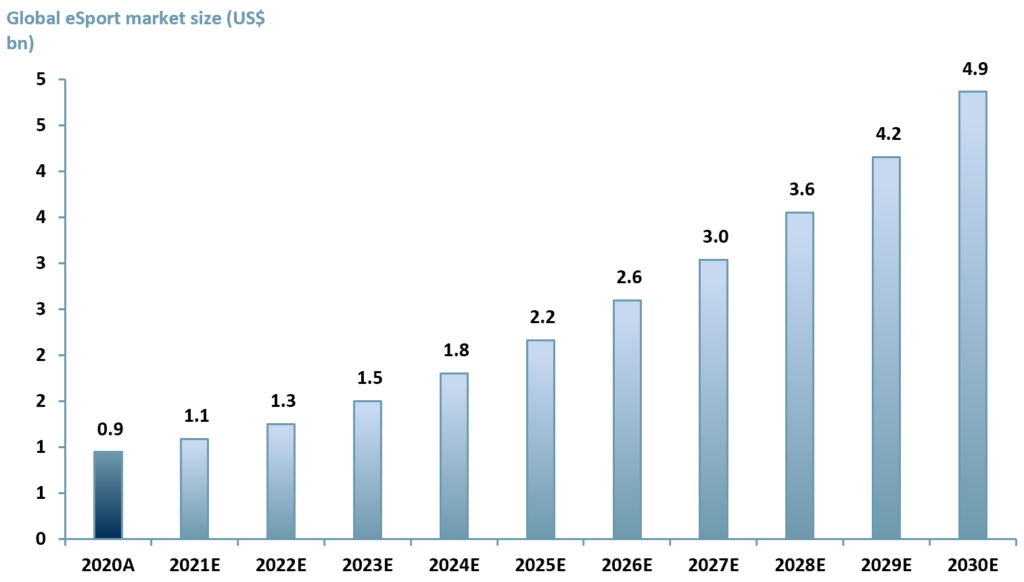

The global esports market is valued at US$ 1.08 bn in 2021E (exhibit 1). ACF forecasts that the market will reach ~US$ 4.9bn by 2030E at a CAGR of 18%. The forecast is based on a three factor growth model:

Phase 1 – 2021E-2022E: Growth rate of 15% – As major economies reopen with increased vaccination rollouts, stadia will open for tournaments. In the short-term stadia will operate at lower capacities than pre-pandemic levels, however we expect revenues from broadcasting sales for home viewing of tournaments to increase along with revenues from sponsorship.

Phase 2 – 2023E-2026E: Growth rate of 20% – As the pandemic eases and uptake in computer games continues, stadium capacity will surpass pre-pandemic levels (we expect new build and more stadia upgrades on a global basis). The growth of online viewers set during the pandemic will continue as the market moves from niche to mainstream and digital accessibility becomes easier and more effective globally.

Phase 3 – 2027E-2030E: Growth rate of 17% – major esports organisations undergo a consolidation phase and take the majority share of the market as penetration begins slow and the oncoming battle for market share rather than market growth appears on the horizon. Growth is slowing though vs. phase 2, but we expect it to be above pandemic recovery levels 2021/22E in our phase 3 forecast.

Exhibit 2 – ACF’s 10-yr forecasts for development of the value on the esports market

Sources: ACF Equity Research Estimates; Grandviewresearch; Markets & Markets; PR Newswire.

Sources: ACF Equity Research Estimates; Grandviewresearch; Markets & Markets; PR Newswire.

Diversifying revenues

Our forecast 9-yr CAGR at 17.8% is conservative compared to market consensus of 19.4%. Our forecasts are also close to the bottom of the range. In spite of current investor concerns over the quality of current revenues, market prospects for esports growth remain positive: audience levels, sponsorships, brand advertising and broadcasting deals are either nascent or growing.

The main share of esports market revenues is currently from sponsorships – ~US$ 641m in 2021E vs. $584m in 2020A (AdAge, 2021), 59% of total global revenues in 2021E.

In addition, global esports audience levels have increased 10% y/y/ to 728m in 2021E vs. 663m in 2020 and are expected to reach ~920m in just three years – 2024E (Newzoo, 2021) – a driver for increasing broadcast deals.

More diversified business models are emerging. For example, Guild esports ($GILD.L) operates as a brand and media & marketing business, i.e. sells audience. In addition, $GILD.L offers an online academy system connecting aspiring professionals with actual professionals all over the world.

Revenue streams in esports may currently seem unexciting but growth does not. The sector is young and growing rapidly. Consider some of esports closest cousins:

-

- Content creation and streaming and its delivery via broadband – many misfires and doubters in the early years but now vast businesses both for content and delivery with huge market capitalisations

-

- F1 -disorganised initially and now a highly successful business model.

-

- Top flight football (soccer) – player salaries may be out of control but the underlying revenue model of gate receipts, sponsorship, advertising, broadcast revenues, merchandising, social engagement and fintech products and entertainment appears solid enough.

Exhibit 3 – Peer group table of esports organisations

Sources: ACF Equity Research Graphics; Refinitiv; Notes: Exchange rates: (Source: XE.com) GBP vs USD 1.38625; CAD vs USD 0.80805; SEK vs USD 0.116172; DKK vs USD 0.15987;

Sources: ACF Equity Research Graphics; Refinitiv; Notes: Exchange rates: (Source: XE.com) GBP vs USD 1.38625; CAD vs USD 0.80805; SEK vs USD 0.116172; DKK vs USD 0.15987;

Authors: Renas Sidahmed and Anne Castagnede – Renas is a Staff Analyst and part of the Sales & Strategy team, Anne leads the Sales & Strategy Team at ACF Equity Research. See their profiles here