The Internet: risks and rewards of policing

The FCA, following its last AGM, is under pressure to get a handle on Google Ads scams. It seems the regulator has not done enough to appease financial professionals.

- There is an increase in fraudulent online advertising that promotes illegal or unsuitable financial products. For example, offering high RoI investments from made-up trading platforms.

- Due to EU legislation the FCA is unable to intervene as platforms, like Google, are not liable for these types of scams.

- Nevertheless, financial professionals are calling on the FCA to take action. Mark Taber, fixed income investor, has suggested that the FCA “trace scammers using ‘mystery shopping’ tactics”, for example.

- Taber believes that the FCA has enough legal backing to take down websites or even block bank accounts. However, faith in the FCA to that effect is dwindling.

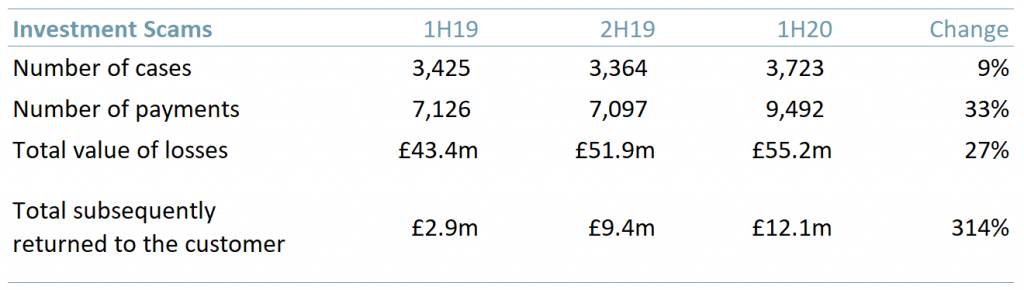

Exhibit 1 – Investment scams in the UK 2019 – 2020

Sources: ACF Equity Research Graphics; UK Finance 2020 Half year fraud update

Sources: ACF Equity Research Graphics; UK Finance 2020 Half year fraud update

Anyway you spin it, it seems the problem lies at the source – posting adds on search engines is relatively low cost and all it takes are a few clicks. What financial professionals want, is an improved due diligence process on both ends – search engines and regulatory authorities.

As of March 2020, Google Ads has implemented its Business Operations Verification Programme (BOVP).

The program requires a business to verify its information within 30-days. If that does not happen then Google Ads can place the ads on restrictions. As of May 2020, the verification time was shortened to 21 days.

The goal of the BOVP is to provide consumers with greater transparency into businesses and give them the opportunity to block ads.

While this is a step in the right direction, Google claims that it will take at least two years before the programme is fully implemented.

Covid-19 and the shift to all things online has created a vulnerability and high level of exposure for companies and individuals. Internet scammers are taking advantage of this.

The estimated cost of digital ad fraud globally was US$ 19bn in 2018, according to Business Wire. Given Covid, in our view, this changed behaviour of everything digital will continue in the medium to long-term. Humans are creatures of habit.

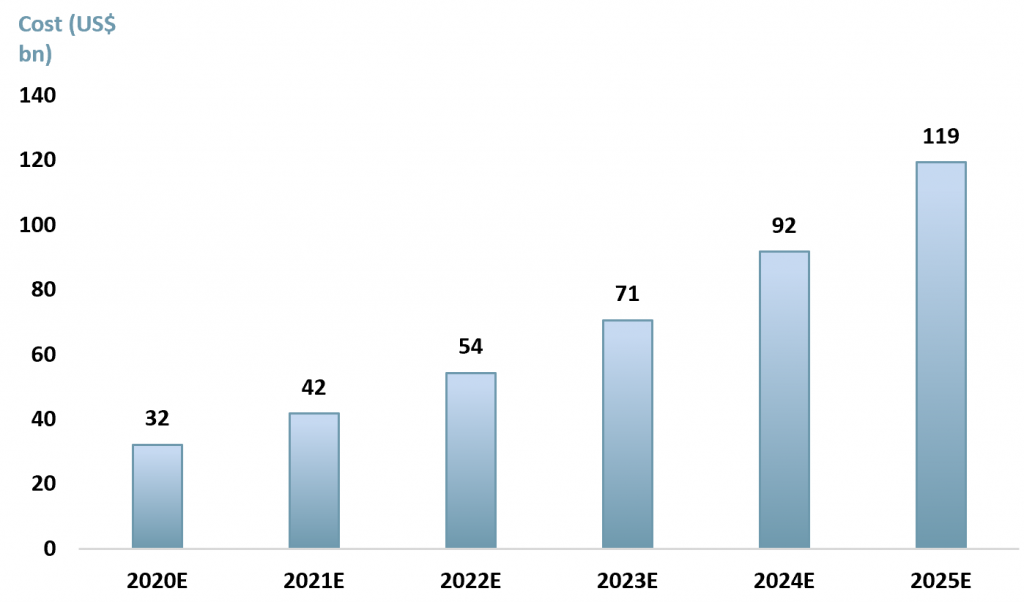

Therefore, we forecast that the global cost of digital ad fraud will increase to US$ 119bn by 2025E, at a 5-yr CAGR of 30%. (See Exhibit 2 below.)

Exhibit 2 – Global cost of digital ad fraud 2020E – 2025E

Sources: ACF Equity Research; Business Wire

Sources: ACF Equity Research; Business Wire

Online investment scams are everywhere, and fraudsters are increasingly clever – from creating shell companies to creating mock online trading platforms with staff that have financial, if not financial services backgrounds.

This is not to say that the responsibility of avoiding such risks falls entirely on the search engine platforms. The internet is a complex web of risks and rewards and consumers step right into it, willingly and knowingly, on a daily basis.

However, protecting consumers, to a certain extent, is the job of businesses if they want repeat clients. Big companies such as Google must protect their consumers as a matter of priority and investing in increased transparency is key.

If the companies do not believe they are at risk of losing enough business to compensate for the costs for increased transparency…then this is a time when local, regional and global regulators should step in.

Transparency and an efficient due diligence process are not only relevant for the corporate giants, but are relevant for all companies.

The UK’s FCA recently condemned DB pension transfers. DB pension transfers are something we have often found iniquitous even when provided under the rules, and yet many providers were offering DB pension transfers outside the rules.

There is hope for the future, at least at the local level. For companies, an element of the incentive is that being whiter than white and fully transparent attracts investors. It is one of the few ways of reducing the risk discount without reducing the returns profile.

Authors: Anne Castagnede and Renas Sidahmed – Anne leads the Sales & Strategy Team at ACF Equity Research. Renas is a Staff Analyst and part of the Sales & Strategy team at ACF Equity Research. See their profiles here