Greenwashing sustainability? Investors are watching

A green boom is emerging as green firms outperform major indices in 2019 due to higher EVAs created by greater internal discipline in companies embracing sustainability (ESG with metrics).

However, when checking ‘under the hood’ of companies, we are seeing a problem with greenwashing, so are governments (e.g. UK’s GTAG initiative) and other authorities (e.g. SASB).

Key points:

- Political leaders are giving clear signals about tackling climate change, the green boom is underway.

- 40+ green firms have seen share prices triple since 2019 (in exhibit 1 below we highlight the top five ESG rated companies).

- While renewable energy sector share price momentum has paused over concerns over increased interest rates, other ‘sustainable’ assets are taking off, e.g. copper, lithium – green metals used in electric vehicles.

- The boom reflects soaring demand from investors – ESG funds account for ~24% of global AUMs up from ~11% in 2018 (The Economist). This amounts to, on average, two new ESG funds launched every day. But informal ESG filtering is the part of the iceberg companies cannot see.

- Unfortunately, or perhaps inevitably, the green/sustainability boom is accompanied by rampant ‘greenwashing’ – where companies provide a false or misleading impression of how their operations are sustainable / environmentally friendly.

- We suspect greenwashing is heading towards classification as a criminal offence for directors and those perceived as having executive authority – it is not there yet but the signals we are picking up from governments and lawmakers suggest it is an agenda item.

- Whether or not greenwashing becomes classified as a criminal offence, it is important to be on the right side of history with respect to sustainability (ESG with metrics).

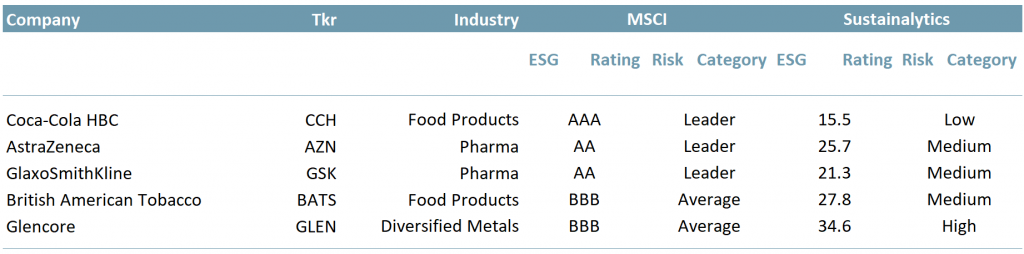

In exhibit 1 below, we tabulate the top five ESG rated companies in the FTSE 100 index – AstraZeneca ($AZN.L), GlaxoSmithKline ($GSK.L), British American Tobacco ($BATS.L), Glencore ($GLEN.L) and Coca-Cola HBC ($CCH.L).

In this exhibit, we compare ESG scoring based on data from Sustainalytics (one of the leading data analytics providers for ESG) with MSCI’s rating system.

The ESG Risk Rating measures what kind of exposure a company has to ESG breeches that can lead to billions in fines and a risk of severe sanction for those in executive roles. Increasingly, it is also an indication of a company’s probability of accessing future capital, and so future growth and total shareholder return (TSR).

The ESG Risk Rating system attempts to assess how well a company is able to mitigate sustainability (ESG) risks by taking into account management’s role.

MSCI’s rating system is self-explanatory, but Sustainalytics deserves some commentary. Sustainalytics determines a company’s ESG rating based upon a scoring system that is then ranked by five categories of risk/exposure – Negligible (0-10), Low (10-20), Medium (20-30), High (30-40) and Severe (40+).

In exhibit 1, we tabulate the ESG Risk Rating scores of the top five ESG Sustainalytics rated corporates in the FTSE 100 index vs. the equivalent MSCI ratings. Note the disparity/difference in impressions the rating systems leave.

Sustainlytics’ ratings appear to suggest to us that even the currently best companies can still make significant improvements. MSCI’s ranking system seems to convey the idea that the best companies do not need to do very much more.

Exhibit 1 – ESG Risk Rating of the top five ESG rated companies on the FTSE 100 Index 2021

Sources: ACF Equity Research Graphics; Sustainalytics; MSCI

Sources: ACF Equity Research Graphics; Sustainalytics; MSCI

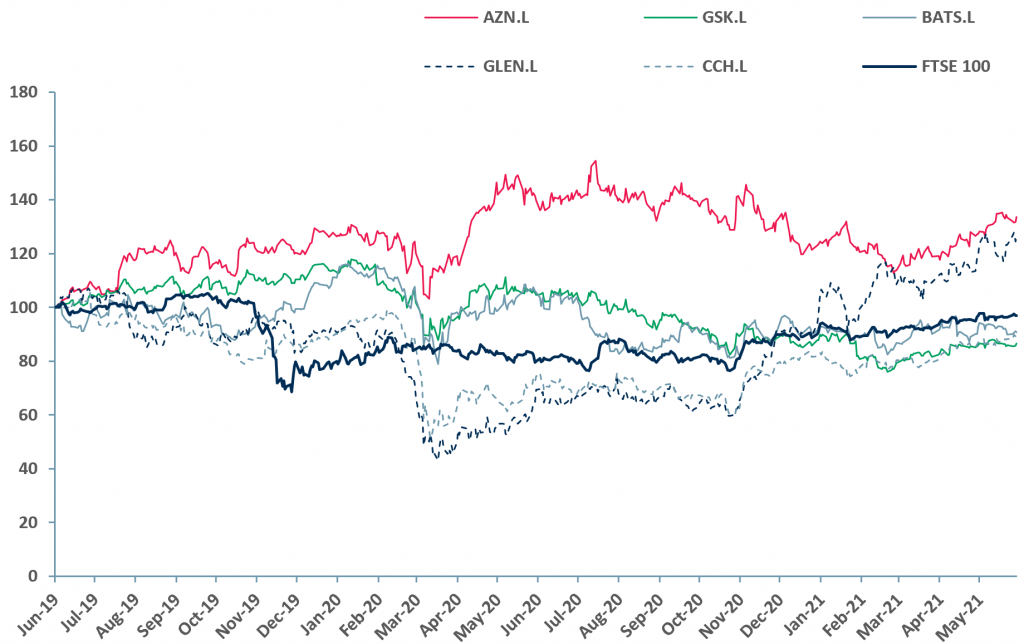

In exhibit 2 we chart the price relatives of the top 5 ESG ranked companies from exhibit 1 versus the FTSE 100 index. The price relative charts indicate that outperformance, at least against the FTSE 100 index, is some way from consistent.

Part of the challenge in making investment decisions based upon ESG ratings and risk categories is how to assess if a) the ESG policies in place are actually appropriate for the operations of the companies in question – are the policies serving to create greater internal disciplines leading to improved margins and better returns on capital that create higher EVA. Or perhaps b) the policies are correct but are not implemented rigorously or consistently enough internally. Or c) it could be that some of the policies of even the largest companies, even when highly ranked, amount to greenwashing – intentionally or otherwise.

Exhibit 2 – Price relative top five ESG rated companies vs. FTSE 100 2019-2021

Sources: ACF Equity Research Graphics; Yahoo Finance

Sources: ACF Equity Research Graphics; Yahoo Finance

Cleaning up greenwashing

Investors are becoming increasingly sensitive about greenwashing. ~44% are concerned that ESG funds are not what they appear to be (International Investment, 2021). The overarching fear is that greenwashing threatens to undo all of the progress made with ESG implementation and sustainable investing.

Sir Nicholas Stern put it bluntly back in 2007 – ‘Climate change is a result of the greatest market failure the world has seen.’ Markets, and the financial sector as whole, play as much of a role as corporates, governments and regulators. All of these entities must work together to overcome these obstacles.

- Governments and regulators can set the scene – providing frameworks and protocol.

- The financial sector must be clearer about what it is looking for in investment opportunities, divest from brown assets (assets involved in carbon emissions, e.g. fossil-fuels that are not carbon neutral) and opt out to engage in anything that could be associated with those corporates that are not able to demonstrate and verify emissions neutrality

- The private and government sectors need to focus on due diligence and transparency – this may be a painful cultural change.

The underlying effect of the changes that have followed admonitions such as those of Sir Nicholas Stern is that increasingly, there is nowhere to hide. Sustainability is on everyone’s minds.

Institutional investors have led the way

According to The Economist, on average, each of the 20 largest ESG funds hold investments in 17 fossil-fuel producers [e.g. ExxonMobil (NYSE: $XOM) and Saudi Aramco), suggesting there is still some way to go in making ESG an unavoidable driver for change. Nevertheless, even with the fossil fuel ‘anomalies’, ESG is already very significant, and is growing rapidly, as an investment filter.

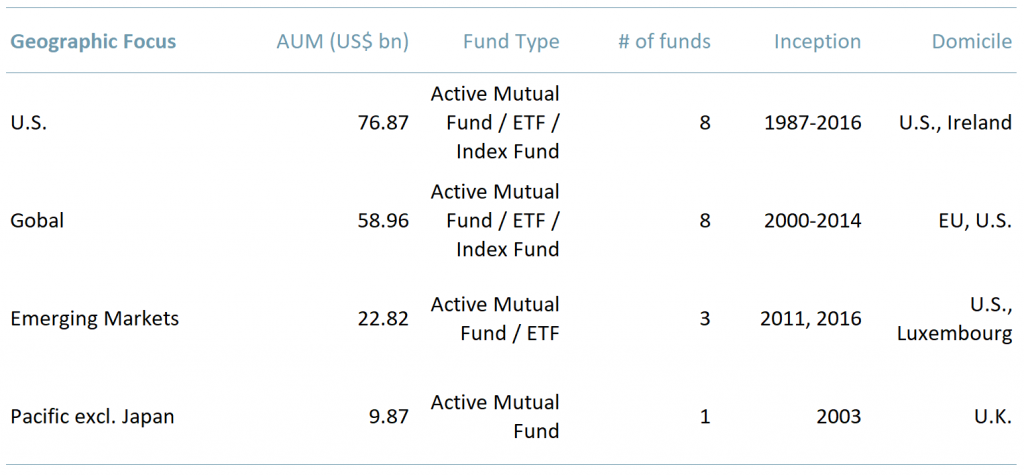

In exhibit 3, we break down the top 20 ESG funds by geographic focus. In total they have AUM of ~US$ 169bn and the geographic focus is divided – 46% U.S., 35% global, 14% Emerging Markets and 6% Pacific (excl. Japan).

Exhibit 3 – 20 largest ESG funds by geographic focus 2020

Sources: ACF Equity Research Graphics; MSCI

Sources: ACF Equity Research Graphics; MSCI

Millennials are investing with intention

It is not just institutional investors that are focussed on ESG. There is a surge in retail investors entering capital markets – in particular millennials (born between 1986-91). ACF forecasts that in 2021E retail investors will make up 31% vs. 69% institutional, up from 25% in 2020E. Furthermore, Cerulli Associates (US research company) forecasts that millennials will inherit ~US$ 22trn by 2042 of investable assets.

Millennials are increasingly environmentally conscious and coming into their own in regards to directing capital toward investment opportunities. Millennial investors expect businesses to be held accountable.

In our view, if only because of the EVA enhancements ESG brings, companies should not wait for the regulatory authorities to make ESG policies mandatory.

All classes of investors increasingly want to see an ESG policy with metrics, even if it only shows that a company has started on an ESG trajectory.

Key actions for nano to mid-caps

For nano to mid-caps, this means starting with low-hanging fruit – metrics that can be produced from information already available in the reporting or management accounts to get started on the trajectory. These metrics do not require auditing early on, especially for nano to smaller mid-caps. They do require third party scrutiny with a view to EVA gains to be effective (Note that ESG companies are only compared with their peers – i.e. in the same sector and with similar market caps).

Key messages:

- Avoid greenwashing at all costs – better to wait than publish a CSR as a substitute for an entry point ESG with metrics;

- Look to convert to a culture that puts primacy on exuding accountability and transparency;

- Get on the ESG-with-metrics pathway and so start enhancing company valuation.

Getting on the ESG pathway is relatively easy, changing culture is not. ESG policies and metrics are perhaps the starting point for achieving cultural change. Investors are demanding the added returns these changes bring.

Author: Renas Sidahmed and Christopher Nicholson Renas is a Staff Analyst and part of the Sales & Strategy team, Christopher is MD and Head of Research, at ACF Equity Research. See their profiles here

![Climate change and the [re]emergence of millet Climate change and the [re]emergence of millet](https://acfequityresearch.com/wp-content/webpc-passthru.php?src=https://acfequityresearch.com/wp-content/uploads/2023/08/ACF_Millet-a-new-sustainable-market-_Twitter-470x320.jpg&nocache=1)