PGM Value Drivers – is Norilsk Key?

The Feb 2021 shutdown of two Norilsk Platinum Group Metals (PGM) mines and the continuing structural problems in South African mining led many investors to conclude that PGM supply will remain in deficit thereby pushing PGM prices still higher.

We analyse the underlying factors and the likely outcomes and provide forecasts on the supply demand equilibrium for Pt and Pd with general applicability to other PGM.

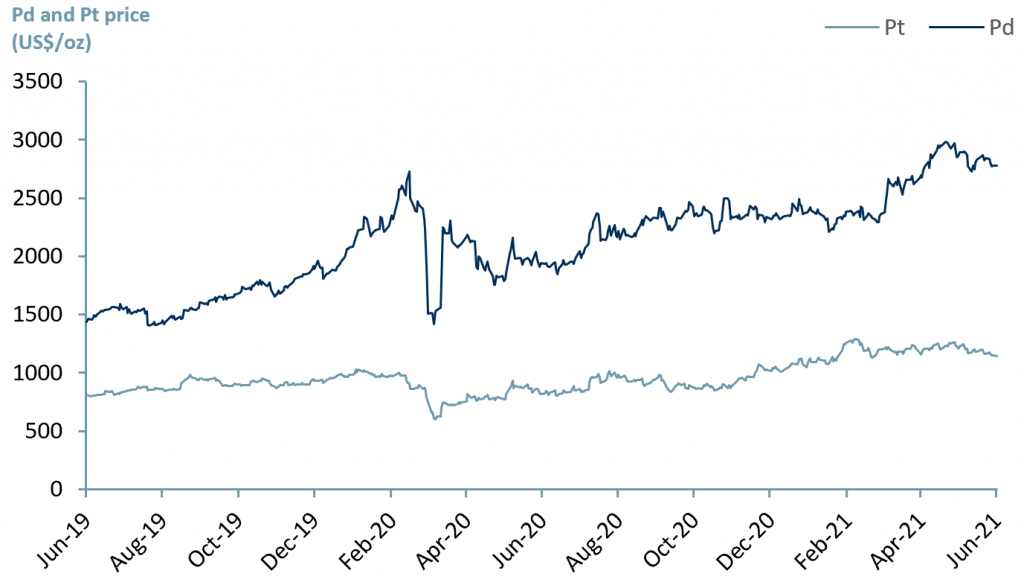

The continued supply deficit of PGM – in particular palladium (Pd) – has been a growing cause for concern or interest, depending on one’s perspective, since 2018. As a result of the Pd deficit and the less than robust supply of Pt, prices for both Pd and Pt have increased rapidly and significantly since 2019.

As of 14 Jun 21, Pd was priced at US$ 2,775/oz, up 829/oz (43%) vs. $1,946/oz y/y and Pt was priced at US$ 1,152/oz, up 329/oz (40%) vs. $823/oz (exhibit 1).

Exhibit 1 – Global Pt and Pd prices June 19 – June 21

Sources: ACF Equity Research Graphics; Macrotrends

Sources: ACF Equity Research Graphics; Macrotrends

The direction of travel of PGM prices is correlated with the PGM deficit, but the supply/demand equilibrium is more complex than it appears at first glance. This complexity means that prolonged or intermittent unpredictable individual mine closures could lead to sustained additional rises in PGM prices, particularly, Pd, Pt and Rh. We assess that this unpredictability of supply is an inherent characteristic of PGM pricing.

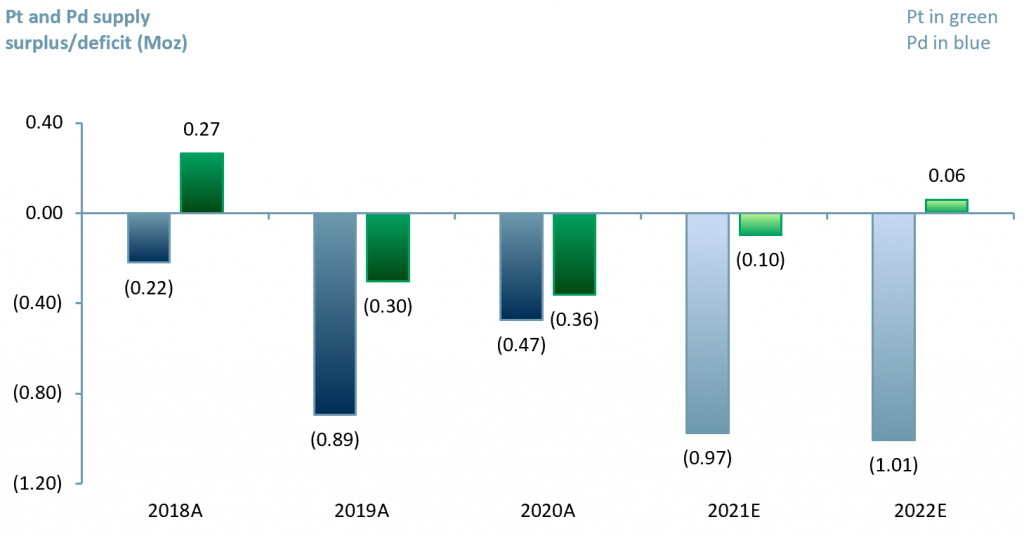

In exhibit 2 we summarise the 2019 and 2020 deficits and drivers after the leading PGM regions’ (South Africa and Russia) supply faltered. We assess that inconsistency of supply leading to possible supply shocks from both South Africa and Russia is a mid-term persistent characteristic of PGM pricing in the face of mid-term rising global demand and in the context of a commodity supercycle.

- South African production of Pt – 72% of global supply (US Geological Survey, 2019)

- Russian production of Pd – 42% of global supply (US Geological Survey, 2019)

Exhibit 2 – Global Pt and Pd supply surplus/deficit changes 2019 and 2020

Sources: ACF Equity Research Graphics; Company reports; US Geological Survey

Sources: ACF Equity Research Graphics; Company reports; US Geological Survey

In South Africa, mine closures occurred as a result of energy and water deficits, strikes and the Covid-19 lockdown restrictions. We don’t expect any of these South Africa issues to change in the near future and Covid remains a short-term threat to supply consistency from this region.

In Russia, supply has fallen due to floods in two Norilsk Nickel (GMKN : MCX) mines and some possible marginal production cutbacks during 2020. Any marginal production cut-backs are likely to have been a response to Covid reduced short run demand for Pt and Pd as consumers purchased fewer cars (global auto sales fell ~20% in 20E – IHS Markit).

A cut in global Pt output is also a cut in global Pd output. The geological and commercial dynamics of PGM mining mean that Pd is generally a by-product of Pt. Both the Pd market deficit and the growth in demand for Pd are greater than the market deficit and demand growth of Pt. This means that Pd prices are supported proportionately more than Pt prices when a mine shuts or cuts Pt production.

In our view, any Pt/Pd demand softening due to Covid will most likely have washed through the supply chain at this point. At the same time, and as part of the overall global response to Covid, Governments and consumers have accelerated their demand for clean energy and sustainable products e.g. green hydrogen (Pt and Pd used in electrolysis), lower petrol and diesel emissions and more EHVs (more auto-catalysis means more Pt and Pd demand).

The increased pressure to reduce emissions is leading governments e.g. China to change emissions policies sooner – these policies increase the amount of Pd used in catalytic converters and accelerate the move away from petrol and diesel cars to HEVs (Hybrid Electric Vehicles) that use Pd and Pt in their catalytic converters.

Similar responses in Europe are also spurring an alternative fuel – green hydrogen production, which requires Pd and Pt in the electrolysis production process. We expect the US, under Biden, to reposition itself as a policy leader in emissions reduction, having been a recent laggard.

Platinum supply concerns out of South Africa

South Africa’s relative supply deficit is expected to continue in the medium-term as it is driven not only by pandemic restrictions but also longer-term structural barriers. For example, inefficient utility infrastructure, power shortfalls and social unrest, which remain PGM production issues.

Energy shortage in South Africa – In Dec 2014, South African electricity utility Eskom began a three-stage load shedding programming in order to preserve limited supply. Load shedding is the interruption of power, ‘removing the load’, in order to protect the generating units at power stations and prevent failure of the entire electricity-distribution system.

Load shedding occurs in four stages. Each stage describes the amount of national electricity load that will be removed from the electricity grid during a 2-4 hour block: Stage 1 <1,000 Megawatts (MW), Stage 2 <2,000 MW, Stage 3 <3,000 MW and Stage 4 <4,000 MW.

1 MW of power can generate enough electricity for 400 – 900 homes/year. South Africa has ~17.2m households (- at the higher end (Stage 4) Eskom only has capacity for ~1.6m-3.6m households (~20% of total households).

The limited supply of power is the cause of nation-wide blackouts as the load is rationed. Blackouts have been a recurring issue and Eskom warns they may continue for another five years as the utility company struggles to meet demand and maintain its power plants.

Eskom’s infrastructure – coal-fired power stations – is outdated. Eskom CEO André de Ruyter says the risk of load shedding “will abate over time but not disappear” as critical maintenance work is needed. Eskom controls 13 power stations, each with six generators, across the country. The 13 power stations have an average age of 40 years. On average globally, coal power plants are retired after 46 years, though they can continue to operate for 50-60 years, and perhaps longer.

Water shortage in South Africa – South Africa’s water crisis is attributed to climate change and aging infrastructure. In 2018 Cape Town (the country’s legislative capital) almost ran out of water after a series of severe draughts. Climate change has caused an increase in temperatures and a decrease in rainfall.

By mid-2018, water levels in dams in Cape Town were between 15-30% of total capacity. At the time Cape Town implemented significant water restrictions on the city, decreasing daily water usage to ~500m litres/day (less than half of the regular supply).

South Africa’s rainfall concerns are warranted – SA receives only 492 millimetres (mm) of rain annually compared to the average 985 mm the rest of the world receives, ~50% (WaterWise, 2021). Average temperatures in South Africa have increased by ~0.13°C per decade since 1960, and are forecasted to increase by a further 2-3°C by 2050.

Aging infrastructure is also a cause for concern for the country’s water supply – more than ~30% of the water supply is lost due to failing and leaking infrastructure. Without government intervention, SA is at risk of reaching water scarcity by 2025.

Strikes in South Africa – PGM mines in South Africa are some of the world’s deepest mines at 2.3 – 4.0 km (1.5-2.5 miles) deep – the average global mine depth is ~1 km.

The conditions in deeper mines are particularly challenging for workforces on a daily basis, not least of which is heat. Longer term, miners risk noise induced hearing loss (NIHL) and an occupational lung disease – silicosis (silicosis is caused by breathing in small pieces of silica, a mineral commonly found in sand, quartz and other types of rock). These are all factors that raise the probability of work forces laying down tools for periods of time.

South Africa introduced its Mine Health and Safety Act 29 in 1996 to protect the wellbeing of miners, the general consensus of workers is that it is not widely followed. As a result, there have been a series of strikes. In 2007 there was a one-day strike to protest working conditions. In 2012 there was the infamous Marikana massacre where 34 striking miners were killed by the South African Police Service.

As recently as 2019, the Association of Mineworkers and Construction Union (AMCU) requested permission to carry out an industry-wide strike (platinum and gold sectors), which was rejected by the labour court.

Covid-19 in South Africa – As of early June 2021, South Africa had only vaccinated 0.8% of its population and the Government’s target for vaccinating 66% of the population is now Mar 2022 -delayed four months from the previous target of Dec 21. Unless the vaccine roll out is sped up, we forecast that production will not reach pre-pandemic levels (~4.4 Moz) until 2023.

Palladium supply concerns out of Russia

In 2019, Norilsk Nickel ($GMKN: MCX) produced ~40% of the world’s Pd and 20% of the world’s Pt output. Norilsk Nickel (also known as Nornickel),is a Russian nickel and Pd mining company, with its largest operations are located in the Norilsk-Talnakh area close to the Yenisei River (northern Russia) is in the arctic circle, and ~1700 miles northeast of Moscow. Norilsk Nickel produces all of the Pt and Pd resources in the Norilsk region.

Ongoing environmental disasters at the hands of Norilsk Nickel – (i.e. diesel spill and failing infrastructure, and mine floods) will likely continue to exacerbate the current supply deficit of Pd in both the short and mid-term.

Diesel spill – In May 20, due to Norilsk Nickel’s outdated facilities and equipment, a fuel storage tank failed. Local rivers were flooded with ~20,000 tonnes of diesel oil. $GMKN was ordered to pay the Russian government ~US$ 2bn – causing a 39% fall in net profits for YE20A.

Whilst the Russian government imposed fine impacted Norilsk Nickel’s ($GMKN) profits, it was an even more significant hit to the Company’s reputation and environmental accountability.

As most of Norilsk city’s employed population works for $GMKN, there is an expectation from citizens and the Russian government that $GMKN will invest heavily to develop the region. GMKN can only do this if it is generating reliable profits. This suggests that GMKN may itself be subject to labour disputes and political interference that could intermittently affect its ability to supply Pt and Pd.

Mine flood – On 24th Feb 21, $GMKN had to suspend operations at two of its mines – Oktyabrsky and Taimyrsky – as it detected groundwater flowing into the facilities from underground tunnels. The two mines are connected by an underground network. The Oktyabrsky mine returned to normal operations in Apr 21 and as of the beginning of June 21, the Taimyrsky mine had resumed production, with full capacity expected by the end of June 21.

Mine floods are common and relatively quickly fixed in general so that production can return to pre-flood levels in a matter of 2-4 months. However, Norilsk seems accident prone. This in turn means supply shortages could become an unpredictable intermittent occurrence, supporting the price of Pt and Pd over the mid-term (5 years).

Norilsk Nickel has indicated that it is working on a plan to stop the inflow of groundwater, however it is complicated and geological conditions remain part of the challenge in returning to full production. As a result, $GMKN forecasts that Pt output for 2021E will fall short of original estimates of ~3.70 Moz by 0.77 Moz – an annual decline of 21%.

Global Pt and Pd surplus/deficit forecast

Given the ongoing disruptions in South Africa and Russia, ACF forecasts that the Pt and Pd supply deficit will expand through to 2022E (exhibit 3).

Platinum – The supply deficit will continue through to 2021E followed by a gradual recovery in supply and demand, with demand from South Africa recovering to pre-pandemic levels (~4.4 Moz in YE19) by 2023. Supply recovery is slow due to the underlying concerns around infrastructure, climate change, working conditions and the pandemic.

By 2022E we expect a Pt supply surplus of 0.06 Moz vs. a deficit of -0.10 Moz in 2021E. Pt demand will increase by 9% y/y in YE21E and 7% y/y in YE22E and global supply will increase by 12% y/y in YE21E followed by 10% y/y in YE22E. It is for this reason that we forecast the supply deficit to last for only one year.

Palladium – Pd’s deficit is forecasted through to 2022E at -1.1Moz vs. 0.97 Moz in 2021E. This is based on the assumption that overall demand for Pd will increase by 6% in YE21E y/y while supply will remain flat – spearheaded by a resumption of demand growth in auto catalyst components of 27% in 21E vs. a decline of 13% in 20A.

We predict Pd supply will remain roughly the same (decreasing <1%) in YE21E, followed by a 13% increase in YE22E. The 2021E net marginal supply reduction is in part due to two of Russia’s largest PGM mines closing for part of 1H21A.

As we expect supply to decrease (marginally) for 2021E whilst demand continues to grow and we expect demand growth to exceed supply growth in 2022E, we forecast an increase in the global Pd deficit through YE21E and YE22E.

Exhibit 3 – Global Pt and Pd supply deficit/surplus 2018A-2022E

Sources: ACF Equity Research Estimates; Company reports; US Geological Survey

Sources: ACF Equity Research Estimates; Company reports; US Geological Survey

Whilst the pandemic has played a short-term role in the supply deficit from the dominant global producers (South Africa and Russia), structural issues such as, power, water, employment reliability, under-investment in equipment and technology are more important mid-term PGM price drivers.

The relatively small platinum surplus could easily reverse into deficit because of faster than anticipated auto catalyst demand growth driven by Chinese and Western environmental policy and or from increasing demand for new innovative uses for platinum, such as electrolysis for the production of green hydrogen.

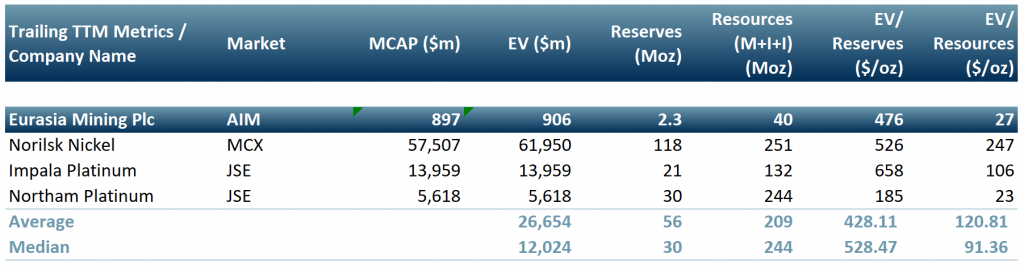

The palladium deficit is unlikely to abate in the foreseeable future, we expect the palladium deficit to grow. We expect Eurasia Mining (EUA.L), Norilsk Nickel (GMKN : MCE) , Impala Platinum (IMP.JO), and Northam (NHM.JO) shareholders to be fundamental beneficiaries of our palladium deficit scenarios.

Exhibit 4 – Beneficiaries of a growing palladium deficit

Sources: ACF Equity Research, Refinitiv.

Sources: ACF Equity Research, Refinitiv.