Is the IPO market cooling off?

The US IPO appears to be cooling 2Q21 after a boom at the beginning of the year. Investors are becoming more discerning about which Initial Public Offerings they are prepared to support.

We assess four factors which may lie behind a migration to quality over quantity in the 2Q21 IPO market.

IPO pent up demand may be exhausted

- Investors are increasingly cautious about investing in Initial Public Offerings (IPOs) – it is less likely that companies will see their shares price climb above expectations or enjoy the usual “share price pop” on the first day of trading.

- By Mar/Apr of this year the average pop of companies listing on the #NYSE and #NASDAQ fell ~20% from their IPO listing price on the first day of trading vs. Jan/Feb 2021 where shares rose by >~40% (excluding special purpose acquisition companies (SPACs), Dealogic).

- On most occasions, companies that IPO experience a ‘share price pop’ on the first day trading, which eventually tapers off. Be it market excitement or optimism leading up to the day – either way it is a win.

- For 2021, the excitement has already worn off. With one month left to the end of the second quarter, 54 companies have raised US$ 18bn so far – this is a ~43% less than the US$ 42bn raised by 101 IPOs (more than 2x) in 1Q21.

- The average raise size is also down at US$ 0.333bn so far in 2Q21 vs. 0.416bn 1Q21

The nature of capital markets and its impact on IPO decision making

After a booming start to the year, IPOs have fallen noticeably in 2Q21. IPOs are subject to the vagaries of capital markets and as a result some companies have chosen to delay their IPOs. Perhaps a necessary precaution in certain circumstances – such as price competition or inflation pressures.

On the other hand, waiting too long for the ‘perfect’ market condition is not necessarily the optimal solution either.

Capital markets are volatile and market behaviour is unpredictable. In that regard, if companies prepare meticulously for their first ‘coming out’ onto the market and if thorough due diligence is conducted, companies will have more opportunities for a successful raise and leave an exceptional first impression.

For a company that is considering an IPO, its prospectus must be of the highest possible standard. While assessing the value of the company is not an exact science, the prospectus provides insights into the company’s future projections as well as outlines any risks and ideally contains a great deal of third party verification and due diligence.

IPO candidates should also note that the nature and priorities of investors is changing – we [ACF] are seeing a far greater emphasis on sustainability (ESG) considerations. This is partly because investors want to be on the right side of history but also because it makes returns sense. ESG companies generate higher EVA, largely due to the additional internal discipline EGS policies with public metrics create.

Investors want to see that companies, or rather management teams, are taking into account the environmental and social implications of their business operations on the climate and people. For the largest companies at the highest level, investors want to see an ESG policy with metrics that are audited separately from the rest of the financials. At the very least investors increasingly want to see that a company is on the ESG pathway.

IPOs and the ESG (sustainability) effect

Investors’ strategies have evolved over the years and the Covid pandemic has caused further change. The Covid crisis probably has not accelerated sustainability per se amongst institutional investors – that was already happening, but it has broadened awareness within retail, SHNWI and family offices. The Deliveroo ($ROO.L) IPO is a case in point, showing the consequences of ignoring ESG and declining to engage in the fullest disclosure, which in turn has created mistrust and apprehension in the markets.

$ROO.L failed to disclose on the ‘S’ – Social aspect of ESG and its treatments of employees. The markets pushed back and understandably so, especially when regulators (e.g. #SASB and #SEC) are pushing for mandatory reporting on Human Capital Management issues. The UK recently created a body called GTAG, the main purpose of which is prevent greenwashing. We expect GTAG to be granted teeth in due course, effectively making greenwashing a criminal offence in the UK.

A lack of an ESG policy with metrics puts a company on the wrong side of history. Companies may even experience a lower valuation, penalties and or additional fees when seeking capital. All the more reason to come to market prepared with an open commitment to full policy and public metrics, rather than to wait to be forced by legislation.

Although Deliveroo’s IPO disaster was a turning point (failed delivery business IPOs are not only a London event, New York has had a less than stellar record too), there have also been a lot of successful IPOs so far this year.

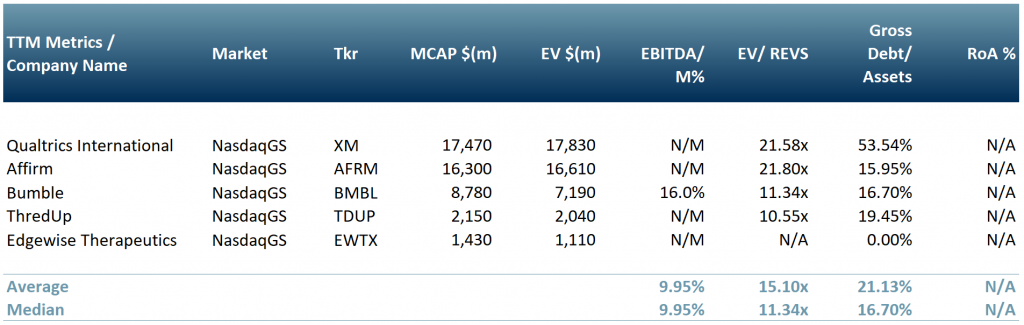

Exhibit 1 below shows five of the most successful IPOs in 1Q21 in relation to the share price pop (difference between IPO price and close price at the end of the first day’s trading).

The IPOs delivering the greatest initial first day successes were all in New York and all on the tech heavy Nasdaq – Qualtrics International (NasdaqGS: $XM) with a 66% pop, Affirm (NasdaqGS: $AFRM) with a 50% pop, Bumble (NasdaqGS: $BMBL) with a 59% pop, ThredUp (NasdaqGS: $TDUP) with a 70% pop and Edgewise Therapeutics (NasdaqGS: $EWTX) with a 53% pop.

Exhibit 1 – Peer group table showing five companies with successful IPOs in 1Q21

Exchange rates: (Source: XE.com) GBP vs USD 1.4135. Sources: ACF Equity Research Graphics; Refinitiv.

Exchange rates: (Source: XE.com) GBP vs USD 1.4135. Sources: ACF Equity Research Graphics; Refinitiv.

The possible Crypto effect

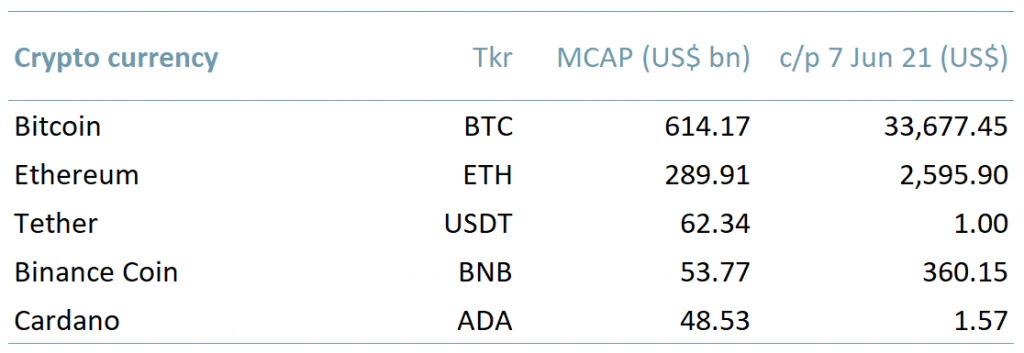

The lack of an ESG policy has become a major concern to investors and their view of IPOs, however it is not the only factor that is dampening IPO uptake. The markets also experienced a surge in Crypto currency interest. Could this have affected the IPO boom? Did investors steer away from IPOs and into the Crypto instead – admittedly definitive evidence is difficult to obtain but it is a factor our team have concluded is worth consideration.

As of 8 Jun 2021 the five top crypto currencies had a combined market cap of US$ 1.07 trillion (exhibit 2). This could imply that in 2Q21 the excitement around crypto sucked out a lot of retail money from equities (including IPOs). While this is a hypothetical argument, it may be a contributory factor that explains some of the pull-back from IPOs so far in 2Q21.

Exhibit 2 – Top five crypto currencies by market capitalisation June 2021

Sources: ACF Equity Research Graphics; CoinMarketCap.

Sources: ACF Equity Research Graphics; CoinMarketCap.

We conclude that a combination of all four factors, investor exhaustion, capital markets volatility, sustainability (ESG) and so EVA concerns, and Crypto are taking the shine off the Initial Public Offering market in 2Q21. This does not mean the market is shutting for IPOs and It does not mean companies should necessarily hesitate.

What it does mean is that the watchword is quality over quantity for investors. It means companies should exceed the basic transparency standards in the prospectus rules, it means companies should have sustainability as part of the heart of their internal disciplines (leading to higher EVA), and it does mean a focus on excellent story-telling to get the investment message across to the markets.

Authors: Anne Castagnede, Renas Sidahmed, Sam Butcher. Anne leads the Sales & Strategy Team, Renas is on the Sales & Strategy Team and is also a Staff Analyst and Sam is a Junior Staff Analyst at ACF Equity Research. See their profiles here