Is Sustainable Investing Phasing Out the Coal Industry?

BHP (BHP:NYSE), an Anglo-Australian oil and gas company, confirmed on Tuesday 18 August 2020 that it will begin scaling back on its thermal coal business and that it will start selling its older oil and gas assets in an attempt to respond to investor pressures around climate change initiatives.

Thermal coal is used for energy generation and coking (‘metallurgical’ coal) and iron are used in steelmaking.

BHP plans to sell off 80% of its share in a JV with Mitsui (8031.T:TYO), a Japanese oil exploration company, that owns two coking coal mines in Queensland.

Furthermore, BHP is planning to sell its oil and gas field assets in Bass Strait that made up approximately two-thirds of BHP’s oil and gas revenues in 2019.

To make up for these losses Mike Henry, BHP CEO, says the company will expand its industrial metal commodities businesses such as copper (Cu) and nickel (Ni) that are currently used in low carbon power generation. The divestment and reinvestment could take at least two years.

While BHP’s actions may be considered commendable, they could be a little too late. Given the increased concerns around CO2 assets as we move into an increased sustainable investing approach, finding buyers for coal operations will prove to be difficult.

Institutional and retail investor interest in renewables has revived and accelerate in recent months.

As one of the high profile and main causes of global warming, the coal industry has become a, if not the, main target for divestment campaigns over the last five years.

Increasingly, investors of all classes are rebalancing their portfolios away from carbon-intensive companies and their industries. For example, BlackRock Inc (BLK: NYSE), a major asset management firm, recently announced its plan to stop investing in companies that derive more than 25% of revenues from thermal coal production.

Like BHP, other large cap international companies operating in the carbon energy sector have moved to divest coal assets over the last two years – Mitsubishi Corp (8058: TYO), Glencore (GLEN: LON) and South 32 (S32: LON) Rio Tinto (RIO: ASX) and Anglo American (AAL: LON).

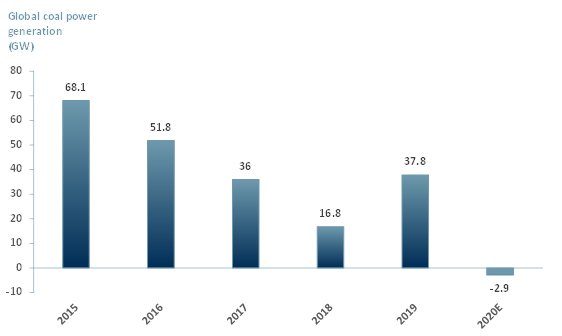

Recent data shows that coal powered electricity generation fell approximately 2.9 gigawatts during the first 6 months of 2020. (Global Energy Monitor, 2020)

While this electricity output drop can largely be attributed to Covid-19 containment measures, (which also saw production cuts across the entire energy ecosystem) we have seen a declining trend in coal powered electricity production for many years. We do not expect a significant reversal in this trend, though we accept there is data that on face value can be used to challenge our assessment.

Exhibit 1: Global Coal Power Generation, 2015 – 2020

For example, information from GlobalData, suggests that global coal production is expected to grow marginally this year, reaching 8.17 bn tons vs. 8.13bn tons in 2019, a 0.5% yoy growth. During this period, demand growth is ascribed mainly to China and India, both rapidly developing economies in need of vast energy resources to continue their growth and Africa has not yet really even come on stream by the standards of India and China.

Sustainable investing, although not a new concept, is showing signs that it will become the new normal in capital markets. The environmental benefits experienced during Covid-I lockdown will only accelerate this trend.

It is our view that as sustainable investing continues to scale and become mainstream, funding as well as demand for coal will eventually dry up entirely. We accept it might take a while and we acknowledge and have identified interim specialist investment opportunities in the coal powered sector, such as Ncondezi Energy (NCCL.L).