Lithium – Cornwall’s mining and UK electric vehicle revolution

The demand for lithium could revive the Cornish mining industry. British Lithium and Cornish Lithium, private mining companies, are paving the way for the UK’s EV battery industry.

It has been a busy time for both companies over the last year, particularly Cornish Lithium:

- British Lithium made the UK’s first major lithium discovery in 2019, when it drilled the first lithium exploration holes.

- Cornish Lithium (The Company) was created in 2019 in order to specifically produce metal used in batteries for electric vehicles.

- Cornish Lithium has already raised over £2m to fund its pilot plant development. The plant will extract lithium from geothermal waters from the 5,275m deep United Downs well, run by Geothermal Engineering (UK geothermal heat and power company).

- On the 19th January 2021 Cornish Lithium won an exploration licence from the Crown Estate to explore for Lithium in geothermal waters off the north and south coasts of Cornwall.

- In early December 2020 Cornish Lithium confirmed successful production of nominal battery-grade lithium hydroxide at its Trelavour hard rock lithium project. Cornish Lithium will accelerate the Trelavour project on the lithium hydroxide result.

- The majority of the world’s lithium is produced from brines in Chile and Argentina followed by Australia, which produces lithium via hard-rock mining. In 2019, China alone produced 79% of the global supply of lithium hydroxide.

- As domestic demand increases, the demand for sustainably sourced materials is also rising.

- While Cornish Lithium’s use of United Downs will provide energy and heat from the well, it is not enough to compete with the likes of US companies that are currently being funded by America’s elite funds – Warren Buffett’s Berkshire Hathaway (NYSE:BRK-A) and Bill Gates’ Breakthrough Energy Ventures.

- Cornish Lithium will need to provide evidence of low-cost resources in the mines in order to gain access to government funding. The Company will need to convince the government that it has a sizeable resource.

- According to The Faraday Institution (the UK’s independent institute for electrochemical energy storage R&D), demand for lithium domestic batteries is projected to reach 59,000 metric tonnes a year of lithium carbonate equivalent by 2035 – this represents 1/5 of the global demand for lithium.

- Cornish Lithium is yet to disclose its full mining potential. British Lithium, on the other hand, currently estimates it could produce around 28,000 tonnes/year of lithium carbonate equivalent.

ACF view:

If Cornish Lithium’s pilot project proves successful, it will have a positive effect not just for Cornwall but for the whole of the UK. However, as indicated above it is not so much about if it can produce lithium, but will it find support from investors to fund development of its projects.

If successful, more companies like British Lithium and Cornish Lithium could emerge, expanding the domestic lithium supply. A new industry for a UK looking for growth opportunities post Brexit. Of course it is probably better to state that it is the return of an old Cornish industry, but it is none the worse for that.

The reignition of a Cornish mining industry is both good for economically deprived Cornwall and for the UK. If the UK turns out to have a ready resource of Lithium for batteries, this will make the UK more attractive for battery car makers, eventually providing additional jobs in other regions in two sectors that have been souring for decades.

Post Covid we expect an explosion of pent up demand in the UK for lithium-ion battery electric vehicles. Car buyers have been saving money for 12 months, there is probably another 9-12 months to go that will increase savings further.

With the 2035 deadline for the cease of the sale of internal combustion vehicles in the UK and Europe looming, securing the raw materials for EVs will be critical.

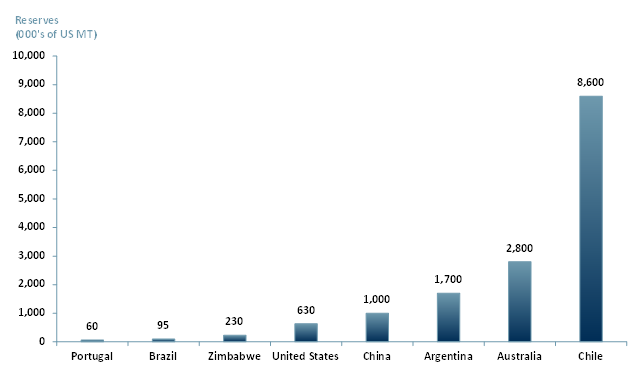

There are 30 critical materials including four newly added ones (bauxite, lithium, strontium and titanium) required for the transport sector electrification. According to 2019 statistics, the countries with the largest lithium reserves are in South America (Chile, Argentina and Brazil), China and the US. (exhibit 1)

Exhibit 1 – The world’s largest lithium reserves by country in 2019

Source: ACF Equity Research, US Geological Survey.

Source: ACF Equity Research, US Geological Survey.

Given that the UK’s demand for lithium could easily reach 1/5 of the global demand, it may not be long before it finds itself on the lithium production map.

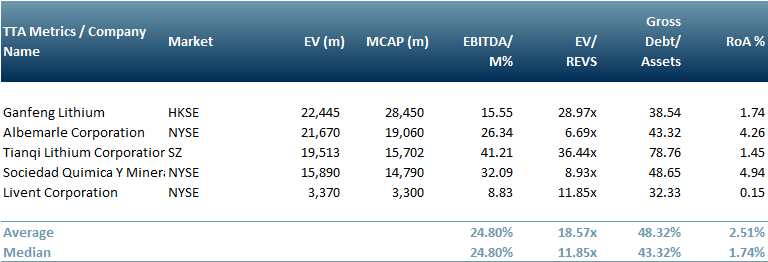

In exhibit 2, we show a peer group of the global leading lithium mining companies – Albemarle Corporation (NYSE:ALB), Ganfeng Lithium (HKSE:1772.HK), Sociedad Quimica Y Minera de Chile (NYSE:SQM), Tianqi Lithium Corporation (SHZ:002466.SZ) and Livent Corporation (NYSE:LTHM).

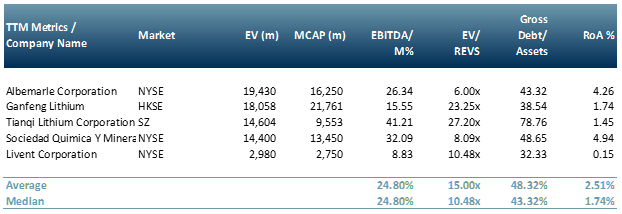

In exhibit 3 we show the peer group using closes from 7th Sep 2020. In a little over four months there have been notable gains for Ganfeng Lithium and Tianqi Lithium Corp. Even in Lithium it is still about picking the winners as a comparison between exhibit 2 and 3 demonstrates.

Exhibit 2 – Peer group table for lithium producing companies 22nd Jan 2021

Source: ACF Equity Research.

Source: ACF Equity Research.

Exhibit 3 – Peer group table for lithium producing companies 7th Sep 2020

Source: ACF Equity Research.

Source: ACF Equity Research.

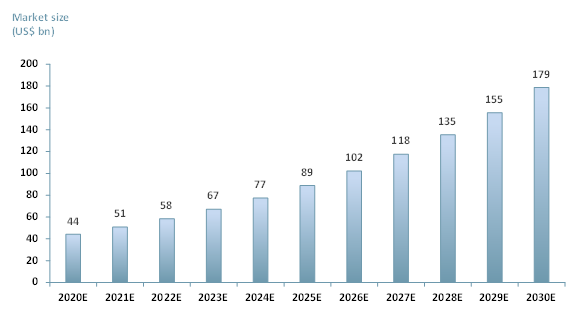

ACF’s forecast suggests that the global lithium-ion battery market is expected to reach US $179bn by 2030E, up from $44bn in 2020E, with a CAGR of 15% as shown in exhibit 3 below. Our CAGR is more conservative than market consensus.

Exhibit 4 – Global lithium-ion battery market 2020E – 2023E

Source: ACF Equity Research Forecast.

Source: ACF Equity Research Forecast.

Our lower CAGR is due in part to the overarching uncertainty of the real impact of Brexit, now it is here, and government / private investor funding / support. In our view the government has little to lose and plenty to gain. It would seem a shame to squander the opportunity to establish a potentially significant global position in a leading and sustainable growth segment.

While undoubtedly the UK is a contender in the lithium market, investors may seem hesitant to act now and will prefer to wait and see how our new Brexit status really manifests itself.

Fortunately perhaps, small companies such as Cornish Lithium are seeking alternative sources of funding such as crowdfunding, at this investment round, crowdfunding may in fact suit Cornish’s growth better than government or public market equity/debt funding.

If UK crowdfund investors are willing to commit resources into sustainable projects such as this one, it is conceivable that politicians might see the risk reward return profile as…above water.

Jobs in two sectors that were once, a long, long time ago, quintessentially ‘British’ industrial success stories (mining and car manufacture), popular support, growth, a leading international position, and the right side of history in terms of sustainability. There is a lot to like in this gambit.